We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Check your State Pension error

Comments

-

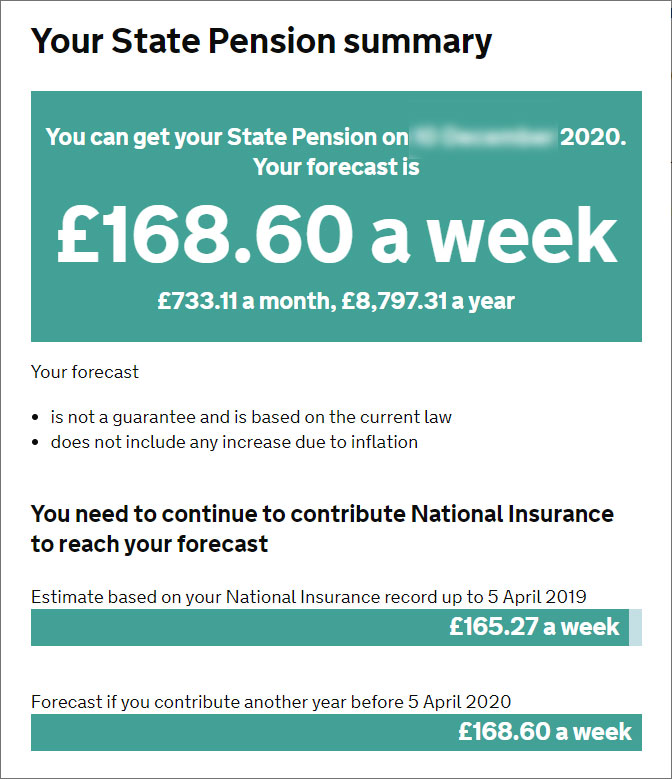

Did you save a copy of this forecast you will get £168.60pw?Peter_Kendrick wrote: »For several years I have monitored my State Pension forecast on the government website. I last checked on 24 June 2019 and took a screenshot. It said that I could get my State Pension on 6 September 2019 and my forecast was £168.60 per week. It clearly stated that if I was working I may still need to pay NI contributions until 6 September. I am not working and it made no mention of what to do in these circumstances.

I have just received a letter from DWP stating I will get a pension of £134.76 per week. I have checked the forecast online and it has been changed. I am devastated as it is £33.84p per week less than what I have been advised for the last few years, around 20% less.

Is it a mistake or is the Government forecast website not fit for purpose? What can I do?

You can appeal if you still think there is an error in the pension you have now been offered.0 -

I suspect that many of these errors have to come to light as a result of the massive GMP reconciliation exercise, which has now just about finished.

A simple keying in error when the pension details were input - ie, showing contracted in instead of contracted out - would have done it.0 -

No. It means 168.60 state pension and on top of that, about 17.94 a week of the estimated works pension income is due to that scheme taking over responsibility for the earnings-related part of the state pension while you worked there.on the top, in large letters that my forecast is £168.60 per week (the full state pension). After reading this thread and checking my Contracted Out Pension Equivalent (COPE) my cope estimate is £17.94 a week.

Does this mean that state pension which is due next year will now be £150.66? and the £17.94 is then paid by my private works pension?

It'll make no difference to the cope. If you'll be anywhere close to state pension age buying an annuity with 26k is normally a bad mistake that halves the income you could get by deferring claiming your state pension instead.The pension pot of the private works pension is valued around £26K and I have recently been looking into transferring this pot to another company to withdraw 25% and to use the rest for purchasing an annuity. If I carry on with this how will this affect my COPE payment?

The state pension forecast also gives an amount for "Estimate based on your National Insurance record up to 5 April 2018" or 2019 if you made no more contributions. What is that amount?0 -

My experience suggests that it is equally possible that if a COPE value is stated on the SP forecast then it may be wrong.You misunderstand how the system works, COPE is not deducted from the top line figure, it was only ever used in the 2016 starting amount calculation. If there is a COPE amount quoted you should get the figure on the top line provided you make any further contributions which will be specified.

It does seem that OP's original forecast is suffering, as are many others as shown in xylophone's link, from a missing contracted out element in the 2016 calculation which only came to light when the final calculation was done

As Silvertabby has mentioned, DWP has recently completed a massive reconciliation (to records held by employers) of the data it holds on the state second pension (SERPs/S2P). This has been necessary as there were numerous opportunities for employers to incorrectly report information to HMRC over an individual's working life. In addition, sometimes information held by HMRC is not transferred to DWP.

As molerat mentions, the COPE amount is only used to (re)calculate the 2016 starting amount. If revised SERPS/S2P/NI data is applied by DWP to an individual's NI record then the starting amount could change. Any change to the COPE will trigger a recalculation of the starting amount. NI accrued since the 2016 nSP start date will then be applied to the new starting amount and a different SP forecast could be the outcome.

For those of us who will receive the nSP, and have also accrued a NI history prior to 2016, the SP we receive will depend on the accuracy of the starting amount, and that will depend on the accuracy of the COPE value.

I reconciled my NI history with both HMRC and DWP. This included checking my SERPS/S2P records and contracted-in/out periods with DWP, with HMRC, and with the individual pension schemes (link provided by xylophone upthread). I discovered several errors. Once corrected, my COPE figure reduced, and my starting amount increased by the equivalent of four NI years.

An individual's SP forecast may be too high if:

- s/he has benefits under a DB scheme but there is no COPE value on the forecast

- s/he knows that one or more of his/her pension schemes contain contracted-out benefits but no COPE value appears on the forecast.

An individual's SP forecast may be too low if:

- s/he has exited a DB scheme in the past and contributions were refunded (and no deferred benefits retained under the scheme).

This typically happened when an employee left an organisation within x years of joining (5 or 2 depending on when employed). In such instances the pension scheme should have paid an additional NI payment to HMRC in order to 'contract back in' a formerly contracted out employee.

This happened to me on several occasions. Not a single instance was recorded on DWP's records. Some organisations did not pay the o/s NI. Others paid (and payments were recorded by HMRC) but DWP's records were missing this information. I was therefore recorded by DWP as being contracted-out for each of these periods of employment. My COPE amount was too high and my starting amount too low.

Other errors I discovered:

- One employer had reported me as a concurrent member of two of their pension schemes (erroneously increasing my COPE amount for that period)

- HMRC had no record of any employee NI payments deducted by another organisation. This despite paying tax under PAYE (which HMRC had recorded) and being a 40% taxpayer.

Most of these errors were made by employers. Individually, each error wouldn't impact my SP that much but, collectively, they amounted to a substantial decrease in my SP.

I can't help but wonder how many people retire, including those under the old system, with an incorrect SP. It had never occurred to me to check until the rules changed and a basic (incorrect) NI history was made available to me.

Many of the issues affecting me would have remained unidentified had I retired under the old system and had assumed, as do the majority, that DWP's figures are accurate.

I suspect that, primarily due to employer mistakes, SP is incorrectly calculated for a substantial percentage of the population, and always has been. :eek:0 -

There is no easy way of checking the DWP figures for your pension estimate. The only thing that you can access is a record of whether NI contributions were made for a full year. There is no record online of when you were contracted out or what your SERPS amounts to. Just before you are eligible to receive your state pension you get a letter with a figure for the Contracted Out Pension Equivalent but no explanation of how that number was arrived at. You are also given a figure for your state pension but again no workings or explanation as to how the sum is arrived at.

My employment history is pretty straightforward with just three main employers & a period working overseas. I have spoken several times to DWP on the phone & they assure me that for the four year period 1978-1982 when I was contracted out but subsequently left the employer & had my contributions returned that I was contracted back in but I have no written proof. How much would my SERPS have been for those four years? I don't know & see no way of finding out.

The figure for COPE might as well have been plucked out of the air as it's not possible to confirm that the calculation is correct. Does £70 for fifteen years contracted out seem correct? I don't know & see no way of finding out.0 -

DairyQueen wrote: »My experience suggests that it is equally possible that if a COPE value is stated on the SP forecast then it may be wrong.

Having been contracted out for my entire working life so far I've had a pretty large (over £90) COPE quoted in my pension forecast.

However I had 30 years NI credited to me at the point the nSP was introduced - therefore, whatever the COPE, under the old rules I can be confident that I'm entitled to at least the full old style 'basic' pension (which I think it was about £119 in 2016) and an additonal £4+ a week for each post-2016 year I can add, so I believe that I can reach the full nSP amount by the time I hit state pension age.0 -

There is no way to determine the algorithm for calculating the COPE (AFAIK). However, it is possible to check one of the primary inputs to the calculation - i.e. periods of contracting-out held by both DWP and HMRC. HMRC is likely to be more accurate but DWP performs the calculation. In theory, DWP's records should mirror those held by HMRC as HMRC is the source of DWP's data. This is not necessarily so.There is no easy way of checking the DWP figures for your pension estimate. The only thing that you can access is a record of whether NI contributions were made for a full year. There is no record online of when you were contracted out or what your SERPS amounts to. Just before you are eligible to receive your state pension you get a letter with a figure for the Contracted Out Pension Equivalent but no explanation of how that number was arrived at. You are also given a figure for your state pension but again no workings or explanation as to how the sum is arrived at.

My employment history is pretty straightforward with just three main employers & a period working overseas. I have spoken several times to DWP on the phone & they assure me that for the four year period 1978-1982 when I was contracted out but subsequently left the employer & had my contributions returned that I was contracted back in but I have no written proof. How much would SERPS have been for those four years. I don't know & see no way of finding out.

The figure for COPE might as well have been plucked out of the air as it's not possible to confirm that the calculation is correct. Does £70 for fifteen years contract out seem correct? I don't know & see no way of finding out.

There is no easy way to reconcile your periods of contracting out with DWP - and also with HMRC if necessary. However, it is possible to do so. If you refer to post 23 on [URL="https://forums.moneysavingexpert.com/discussion/6009662link already posted by xylophone[/URL] then you will find the process I went through.

It is time-consuming but, in my case at least, well worth the effort.

The info I have posted on this thread is for the benefit of the forum. I agree with others that, unfortunately, it would appear that you (OP) have been on the sharp end of an update to your contracting-out data. I recall that I had no COPE figure shown on my forecast for about a year following the intro of the nSP. Turns out this was because it was deliberately withheld as DWP were aware of inconsistencies.

To reiterate (for others) some warning signs of an incorrect forecast:

a) No COPE figure when you have benefits under a DB

b) No COPE figure when you know you have been contracted-out

c) Errors on your NI contributions yearly record (available online)

d) You have exited a DB scheme without retaining any deferred benefits. If DWP confirms that you have been contracted back in for these periods then you need investigate no further.0 -

I appealed against my figure. The appeal judgement ran to about 50 pages of explanation and calculations with the end result being their figure was right all along and previous estimates are just that an estimate which may have errors.0

-

Problem is that the forecast is assumed to be an accurate value. Given that it is issued by DWP that's hardly surprising.I... and previous estimates are just that an estimate which may have errors.

I have sympathy for those (like OP) who were relying on accuracy only to have his expectations dashed on the eve of retirement.0 -

The state pension forecast also gives an amount for "Estimate based on your National Insurance record up to 5 April 2018" or 2019 if you made no more contributions. What is that amount?

Not sure why this amount is lower than the pension forecast because I have 41 years of confirmed full years on NIC? There will also be an extra year on NIC before I reach state pension age, April 2019-April 2020.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards