We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Sipp - To use or not to use an IFA

Comments

-

It depends on whether you believe the IFA can cover their fees through improved performance and value for money services, versus whatever portfolio and strategy you cobble together.

There are a lot of people here that think that all an IFA does is choose investments. Most would be able to add value through a variety of means and may be able to save you money compared to DIY investing.

If you don’t think an experienced IFA can cover 0.5% per annum then you must also believe that everyone on this forum is achieving the same return as each other as it’s impossible to outperform the market.0 -

I decided to DIY based on the fact that my financial situation is not at all complicated. If I was earning a lot of money, had several pensions and other savings / investments and a wife and children then I would definitely seek the advice of an IFA. I don't personally think they would be able to increase my money through choosing different funds without increasing my risk, and I can do that myself if I wish to, so I would instead employ their services to find the most tax efficient way of using my money and leaving as much tax free to my family in the event that I should go first.Think first of your goal, then make it happen!0

-

So you have managed to pick the best performing funds globally for your risk strategy?!0

-

How much do you intend to invest?

If it is not much, i'd DIY ito a Global Tracker or Multi asset fund along the lines of Vanguard series. Until your pot is north of 20K, not much reason to pay for an iFA.

Stay away from all UK funds and singe shares until you learn about investing.

Do you mean £20k or have you missed a zero off?0 -

[FONT="]Is there any real benefit (financial or otherwise) in using a regulated Independent Financial Advisor or Financial Planner for the purposes of setting up and running a Sipp investment portfolio?[/FONT]

[FONT="]What are your views on going down the DIY route (if you have the confidence to do so) and use a number of passive diversified tracker funds and managing the Sipp yourself?

[/FONT]

[FONT="]What are your reasons for:-[/FONT]

[FONT="]1/ Not using an Independent Financial Advisor or Financial Planner for the purpose of choosing a Sipp funds portfolio.[/FONT]

[FONT="]2/ Using an Independent Financial Advisor or Financial Planner to choose the Sipp funds portfolio.

[/FONT]

2) My IFA has experience of the platform and gets me institutional rates. They advise me quarterly on the asset allocation/investmwnt funds. They have access to a much greater pool of knowledge than me on assets, investment funds, even fund managers, how to globally diversify. For this they charge me 0.5%. Oh and also keeping up to date on any pension legislation changes.

If individuals think they have that level of skill then that is up to them, but there’s quite a lot there and it’s not my hobby.

I think most people are taking a risk trying to replicate the work of a professional IfA who in turn would be relying on other departments.0 -

I am due to retire next year and plan on using an IFA who has a number of portfolios

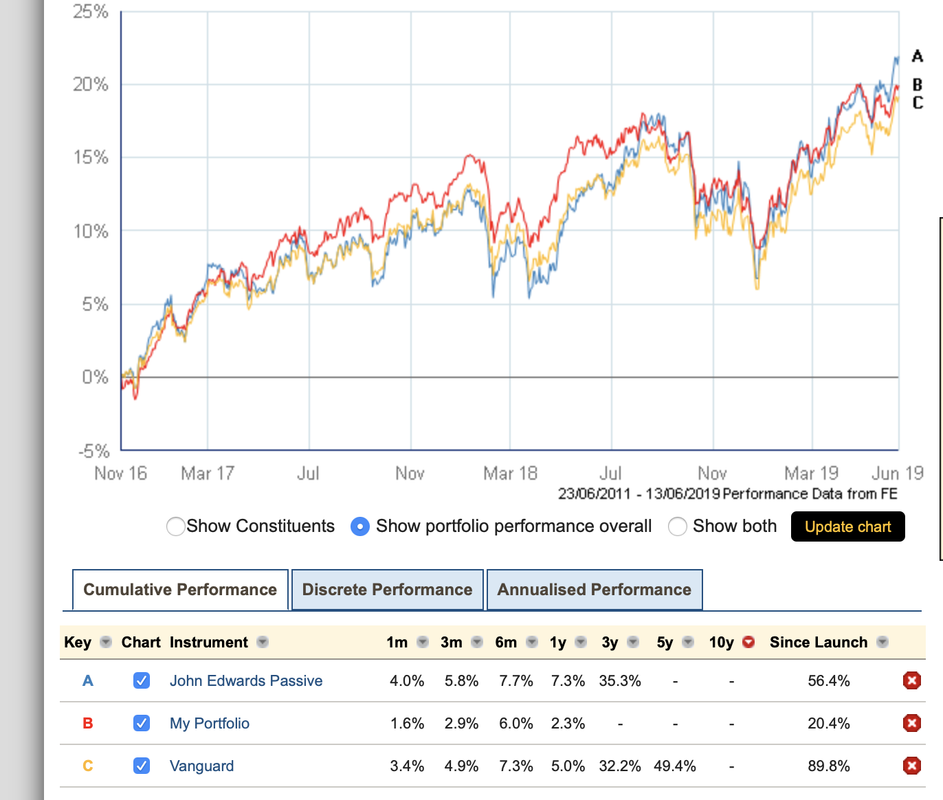

I have been tracking one of the balanced portfolios this year, the chart shows it against the example in John Edwards book as well as the Vanguard Lifestrategy 60:40

I like the smoothness of the IFA portfolio - this doesn't really show the fact that the IFA balanced portfolio can change maybe twice a year (this portfolio started to be used in Jan 2019 so history doesnt really make any sense - but its good for reference)0 -

Deleted_User wrote: »I have been tracking one of the balanced portfolios this year, the chart shows it against the example in John Edwards book as well as the Vanguard Lifestrategy 60:40

Those 3 portfolios are tracking really closely.

If you went with Vanguard on a cheap SIPP platform, with a e.g. £500k portfolio you should be paying <0.4% in fees/charges in total

With your IFA portfolio, what is total % in charges? (IFA+Platform+fund+dealing)?

If you plot out the effect of that difference in charges over e.g. 30 years (or whatever period suits you) what is the overall cost to you?0 -

It depends on whether you believe the IFA can cover their fees through improved performance and value for money services, versus whatever portfolio and strategy you cobble together.

It’s also about making it less risky I.e. covering their fees (and some) in a dip/crash.

I’d expect my globally diversified portfolio to be cushioned from say a fall in the FTSE or the £.

Yes sure you can do that yourself (if you know all the risks of all the regions of the world) but can you do it as well as an individual with recourse to much wider resources,

So for me it’s not just can it increase by more than 0.5% but will I be sustanstially better off in negative territory.There are a lot of people here that think that all an IFA does is choose investments. Most would be able to add value through a variety of means and may be able to save you money compared to DIY investing.

One example is institutional rates.

A second example is a access to cheaper platforms. My IFA uses Novia and I don’t think that’s one that is available to indivduals.

The self investment platforms are more expensive.0 -

With your IFA portfolio, what is total % in charges? (IFA+Platform+fund+dealing)?

Mine is approx 1.44% but that includes all ongoing advice required about anything.

I say approx because funds have different %s so each switch could alter the figure slightly.

How much time would you expect to spend as an individual managing a self invested portfolio? Including researching funds, assets etc.

How much time in spent gaining the initial knowledge.

This isn’t my bag, I don’t want to take the risk and I don’t want to spend my time doing it but it would be interesting to see the numbers.

And what happens if you are otherwise engaged (I’ll, v.busy, dealing with death etc) and things happen in the market? Is this a risk?0 -

How much time would you expect to spend as an individual managing a self invested portfolio? Including researching funds, assets etc.

And what happens if you are otherwise engaged (I’ll, v.busy, dealing with death etc) and things happen in the market? Is this a risk?

Zero, a single fund covering the global market means I need to do no further research (other than mayyyyybe a quick check every 6 months to make sure the fees are still competitive.)

What happens to the market doesn't matter at all, unless there's a big drop and I'd try to find some extra cash to buy more units of the single fund while it's cheap.

This is why passive investing is so appealing to me and others, it takes all of that stress and effort out of the equation.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards