We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Travel Costs on Mortgage

Jimmy9012

Posts: 46 Forumite

Hi folks,

I am looking to try to get a mortgage later in the year. The online calculators vary quite drastically when estimating what I could potentially loan, and I am worried that my travel costs mean its not going to be possible.

I will see an mortgage advisor in April, but would like to know if I should be expecting to be disappointed beforehand...

I earn £50k pa before tax. My student loan is almost paid. My monthly travel expenses (train to London from Kent) is now £6048 per year. Whenever I put my salary and expenses in to the estimation tools, I look to be able to get a mortgage around £200k - £225k. However, as soon as I add the £504 monthly season ticket loan to the calculator, that sum significantly drops to around £120k -£140k, which wont cut it for a mortgage...

When I see the advisor should I expect they would only be able to get similar sums?

Once my student loan is finished, (August 2019), I have around £1,900 (after all bills and travel costs) disposable income so I am pretty sure I could afford a mortgage...

Any advise?

Best,

Jim

I am looking to try to get a mortgage later in the year. The online calculators vary quite drastically when estimating what I could potentially loan, and I am worried that my travel costs mean its not going to be possible.

I will see an mortgage advisor in April, but would like to know if I should be expecting to be disappointed beforehand...

I earn £50k pa before tax. My student loan is almost paid. My monthly travel expenses (train to London from Kent) is now £6048 per year. Whenever I put my salary and expenses in to the estimation tools, I look to be able to get a mortgage around £200k - £225k. However, as soon as I add the £504 monthly season ticket loan to the calculator, that sum significantly drops to around £120k -£140k, which wont cut it for a mortgage...

When I see the advisor should I expect they would only be able to get similar sums?

Once my student loan is finished, (August 2019), I have around £1,900 (after all bills and travel costs) disposable income so I am pretty sure I could afford a mortgage...

Any advise?

Best,

Jim

0

Comments

-

You can ignore your payments to the student loan as it only has around 6 months to run. That should help.

There are other things we can do to get the loan amount up, but obviously £500 a month is a lot - will that carry on when you move or will it drop/increase?

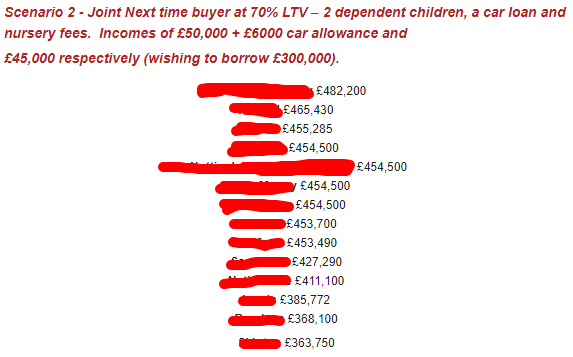

Every month, we get some example affordability calculations from one of the companies we work with. This shows how much lenders will lend for the exact same case - so you can see there is a big difference. Speak to a broker and see what they say. I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0

I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

I can think of a couple of lenders that can discount travel costs in the right situations which could boost your affordability upI am a Mortgage AdviserYou should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0

-

The outcome here is going to vary lender to lender.

Some use ONS figures and won't ask for your individual costs. They also don't ask for bank statements.

Others will want to know every penny.

You should find a lender which will ignore this as long as it isn't visible on your payslips as a loan.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0 -

Thanks ACG. If anything when I move its probably going to go up cost wise. I'll be going from £504 PCM to £524 PCM (If i'm in the area I would expect).

I think its going to be a case of applying and seeing. I just don't know what to expect.

If I budget, cancel things like my cinema subscription, Netflix, NowTV etc, all the 'nice things' I could afford about 2050 PCM whilst still spending the basics. Im hoping that would be enough.

Always paid loans, credit etc on time, nothing bad.0 -

kingstreet wrote: »The outcome here is going to vary lender to lender.

Some use ONS figures and won't ask for your individual costs. They also don't ask for bank statements.

Others will want to know every penny.

You should find a lender which will ignore this as long as it isn't visible on your payslips as a loan.

It is visible. each 1/12 payment is taken through the payslip after tax.0 -

I think its going to be a case of applying and seeing. I just don't know what to expect.

If any of my brokers submitted and application to see if it would be accepted I would literally castrate them. There is absolutely no reason to submit an application like this on a wing and a prayer. It is a waste of time, a wasted credit check and possibly a waste of money.

It might take time to research and the outcome may be less than you had hoped (it may not) but you should spend time doing the ground work whilst time is on your side or get a broker to do it on your behalf.

I can not put in to words how bad of an idea that is. I was just having a read about Manchester' finest and your idea makes this idea look fairly normal - https://www.manchestereveningnews.co.uk/news/greater-manchester-news/yobs-setting-fire-wheelie-bins-15852982I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

kingstreet wrote: »The outcome here is going to vary lender to lender.

Some use ONS figures and won't ask for your individual costs. They also don't ask for bank statements.

Others will want to know every penny.

You should find a lender which will ignore this as long as it isn't visible on your payslips as a loan.If any of my brokers submitted and application to see if it would be accepted I would literally castrate them. There is absolutely no reason to submit an application like this on a wing and a prayer. It is a waste of time, a wasted credit check and possibly a waste of money.

It might take time to research and the outcome may be less than you had hoped (it may not) but you should spend time doing the ground work whilst time is on your side or get a broker to do it on your behalf.

I can not put in to words how bad of an idea that is. I was just having a read about Manchester' finest and your idea makes this idea look fairly normal - https://www.manchestereveningnews.co.uk/news/greater-manchester-news/yobs-setting-fire-wheelie-bins-15852982

Misunderstanding... I was meaning 'apply and see' as to go to the advisor face-to-face and see what they say 0

0 -

So, basically - if a good history there is a chance that I could get 200 - 225k with that situation with the company provided season ticket loan? Or, should I expect 0% chance with that in trying to get 200/225k?0

-

If it's showing as a loan on your payslips I can't think of a lender who won't tax your mortgage affordability (off the top of my head).I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.0

-

Once my student loan is finished, (August 2019), I have around £1,900 (after all bills and travel costs) disposable income so I am pretty sure I could afford a mortgage...

Little point in deceiving yourself. Affordability is a major consideration for lenders as borrowers become complacent. Years of low interest rates may appear normal. But these aren't normal times. Interest rates will ultimately rise. Might not be significant for some years. However could be painfull to service the debt owed at that time.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards