Question on SMART (salary sacrifice)

maxthepolarbear

Posts: 52 Forumite

Hi, I've been playing with the salary sacrifice calculator in the legal and general website. https://www.legalandgeneral.com/workplacebenefits/employees/plan-for-your-future/salary-sacrifice/

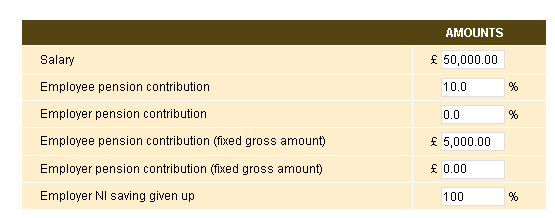

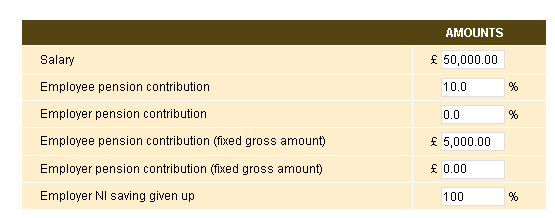

I've put in some dummy inputs:

This is the output:

I'm happy with how the before and after simple salary sacrifice columns are calculated but I'm a bit unsure how the salary (£44,654.41) and total pension contribution (£6,083.28) figures are derived. Could someone please enlighten me?

I've put in some dummy inputs:

This is the output:

I'm happy with how the before and after simple salary sacrifice columns are calculated but I'm a bit unsure how the salary (£44,654.41) and total pension contribution (£6,083.28) figures are derived. Could someone please enlighten me?

0

Comments

-

Have you looked at your post (on a mobile?)0

-

Dazed_and_confused wrote: »Have you looked at your post (on a mobile?)

Sorry images didn't get embedded - now fixed. Thanks for spotting it!0 -

I'm more interested in why the Employee Income Tax isn't changing between the first two columns when the gross wage is £5,000 different.Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

Are cols 1 and 2 comparing sal sac with avc? Basically it works out what level of sal sac would give you the same net income as a certain amount of avc.

Calculator seems to know nothing about AA or NMW I think....0

I think....0

This discussion has been closed.

Categories

- All Categories

- 343.1K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.2K Work, Benefits & Business

- 607.9K Mortgages, Homes & Bills

- 173K Life & Family

- 247.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards