We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

DMP mutual support thread part 13 !!

Comments

-

And also, is it possible creditor starts legal action just after default notice and before account is marked as default?0

-

@AgentBigBoss Yes to all.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

-

Good afternoon all, I have received an email from antelope loans in june stating If your arrears are outstanding for more than 180 days, we may issue you with a Termination Notice and transfer your account to a debt collection agency. A default would be registered to your credit file at this time.Then in September I had Your account has been passed to us from our collections department due to your account terminating and a default being registered on your credit file from antelope loans too. I can't see a default as this account doesn't show on my credit file anywhere and for some reason never did. Shall I assume its defaulted and make contact? Cheers0

-

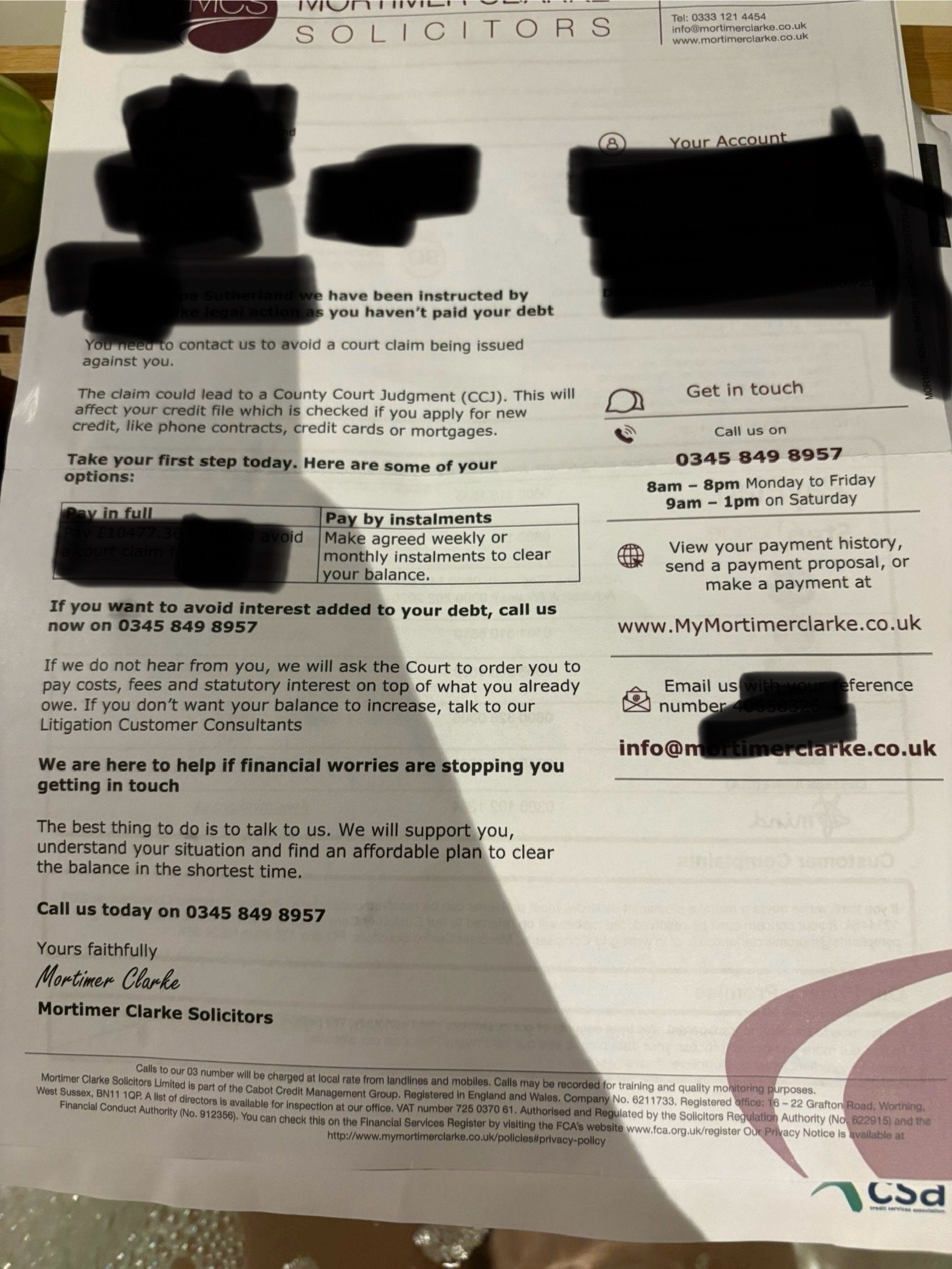

I’ve received the attached letter from a solicitor about a Cabot debt. It relates to a credit card that they responded to a CCA request on. Questions I had were:

1. Is this a letter before action?

2. If it is, what’s my best course of action in terms of making contact? I’m also curious to know if I might have grounds to raise irresponsible lending for this credit card. It was given to me “as a freebie” when I opened a current account way back in 2012 and the credit limit was increased over time by the lender under no request from me. Tilly Tidy 2024 = £88.99 / £2000

Tilly Tidy 2024 = £88.99 / £2000 -

@DebtFreeWannabe27

Just a threat of court action, not an LBA, but that may come next, what is your strategy here if any?I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Have you checked all 3 CRA`s?Jonnychang87 said:Good afternoon all, I have received an email from antelope loans in june stating If your arrears are outstanding for more than 180 days, we may issue you with a Termination Notice and transfer your account to a debt collection agency. A default would be registered to your credit file at this time.Then in September I had Your account has been passed to us from our collections department due to your account terminating and a default being registered on your credit file from antelope loans too. I can't see a default as this account doesn't show on my credit file anywhere and for some reason never did. Shall I assume its defaulted and make contact? Cheers

If its not showing anywhere, no harm in engaging if that is your strategy.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

In truth, I want to pay as little as possible. This lender had responded to a CCA request with what looked like the right docs but I hadn’t acknowledged the debt, so the clock was running from when I defaulted in march 2024. I don’t think I’ll be seeing this one out until its statute barred so sounds like next step is to make contact to pay something. If I’m choosing to acknowledge the debt as mine, I want to challenge the total amount owed based on irresponsible lending because I do think that happened here. There was no need for my credit card limit to increase when I hadn’t requested it, and it ultimately tempted fate. Who would I raise something like this with?sourcrates said:@DebtFreeWannabe27

Just a threat of court action, not an LBA, but that may come next, what is your strategy here if any?

Whilst it’s reassuring to hear this isn’t an LBA, I’m worried about this becoming a CCJ so would rather be cautious here.

Tilly Tidy 2024 = £88.99 / £2000 -

Hi,

I don’t know if this is the correct forum to post but I will give it a go.

I received this decision from the Financial Ombudsman.

To give a bit of context. I took out a personal loan on behalf of a company but found out I’m not eligible because only company directors could avail of the loan. I’m just a shareholder

I asked the Ombudsman to point me to the correct government agency to raise this complaint but they haven’t provided any

I stopped paying the monthly dues for close to 2 years but the loan provider hasn’t defaulted me.

Hope someone can assist.

Ombudsman final decision.“ I am sorry to further disappoint Mr XXX but there is nothing that I can add to what our investigator has already said. She was right to say that this is not a complaint we can consider. Mr XXX is not a consumer in relation to this complaint, and nor does he fall within any of the other categories of eligible complainant. That means his complaint does not fall within my jurisdiction, and I do not have the legal power to consider it.

I should stress that I have not made any findings here as to whether GC Business Finance has acted fairly. The point is that I cannot make such findings, because Mr XXX’s complaint falls outside of my jurisdiction. This is a complaint I cannot consider rather than one I have chosen not to consider.”

0 -

You have a thread on this subject running already, please post it on there.tksnota said:Hi,

I don’t know if this is the correct forum to post but I will give it a go.

I received this decision from the Financial Ombudsman.

To give a bit of context. I took out a personal loan on behalf of a company but found out I’m not eligible because only company directors could avail of the loan. I’m just a shareholder

I asked the Ombudsman to point me to the correct government agency to raise this complaint but they haven’t provided any

I stopped paying the monthly dues for close to 2 years but the loan provider hasn’t defaulted me.

Hope someone can assist.

Ombudsman final decision.“ I am sorry to further disappoint Mr XXX but there is nothing that I can add to what our investigator has already said. She was right to say that this is not a complaint we can consider. Mr XXX is not a consumer in relation to this complaint, and nor does he fall within any of the other categories of eligible complainant. That means his complaint does not fall within my jurisdiction, and I do not have the legal power to consider it.

I should stress that I have not made any findings here as to whether GC Business Finance has acted fairly. The point is that I cannot make such findings, because Mr XXX’s complaint falls outside of my jurisdiction. This is a complaint I cannot consider rather than one I have chosen not to consider.”

ThanksI’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Hi.So I’m getting the usual letters from Wescot (2f) and moorcroft. What’s the usual process? Do you wait until the debts are sold on before setting up payments. Or just wait until defaults and then set up payments with these companies who are handling the debts?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards