We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

House Price Crash Discussion Thread

Comments

-

I had a £100k deposit, not £50k - am always a bit slow on a Monday morning!0

-

Nenen @ #1490: Mrs C and I have moved home over a dozen times during our married life and one principle we always followed was this:

We have never, ever, been a house buyer.

As soon as you start being "a buyer" you're prone to all the emotional traps that goes with it: dreams / idealisations / and sometimes, self deception.

Instead. . . Every house we've ever owned, the first time an EA took us round it, we viewed it as if we were the house seller.

In other words: what would we say about this place when we come to sell?

Obviously, anything which included the words "oh, that traffic noise? Nah, it's only a hum, you get used to it" would never figure. . .

I know not everyone thinks the same way we do. Fair enough. But I still remember a neighbour of ours who, at a time we were looking to buy a secondhand Ford Escort, told us that for the same amount of money he was going to get an Alfa. More style, he said. More pedigree. Not mass-produced carp from Dagenham.

We said, but wasn't it the case that Alfas broke down? Were prone to rust? Had expensive parts?

No, he said. That's just a myth.

We got our Escort. He got his Alfa. Years later, we learned that long after we'd sold our Escort privately on the same day our little ad appeared in the local paper, he'd spent weeks repeatedly trying to sell his Alfa after growing weary of its unreliability, maintenance costs, and, yes, rust perforation. He kept cutting and cutting the price until finally he had to admit defeat and go to the only dealership prepared to offer him a PX. . . for exactly the car he didn't want but was the only option available: another Alfa Romeo.

Moral: houses are like motor cars. Acquire one as a buyer without ever thinking about what'll happen when you become the seller and you could be leading yourself into a very expensive trap indeed. 0

0 -

Very wise words, Codger.

:beer:0 -

PasturesNew wrote: »Back then there wasn't the credit you get these days either. Most "normal people" didn't have credit cards, just slightly posher people. So somebody with a mortgage didn't have the "other debt" and if they did, it was probably only about £2k.

Back then there was shame in owing money on credit cards. Fear and shame.

During the last crash we didn't have access to information like today. Peple didn't speak out like today.

We'd only recently stopped having the TV shut down at 11pm. We had newish Channel 4. No Internet. No email. No forums. The whole thing happened quite quietly, individually. Now it will be all open. People will be able to converse on boards like this. There are websites where you can get information, house prices. You can get opinions and advice from people that aren't your mum.

This time it will be different ... for many reasons.

Indeed. I think a particular difference is the attitude to debt and the incredibly easy availability of credit over the last decade.

People are just used to having access to money whenever they want/need it. Society and the economy has evolved around this situation. It has meant that people don't budget properly, hold large debts and have no idea how to cope without an endless dripfeed of credit.

Once the market crash really starts and we get the recession it is going to be pretty deveastating for many.--

Every pound less borrowed (to buy a house) is more than two pounds less to repay and more than three pounds less to earn, over the course of a typical mortgage.0 -

"Once the market crash really starts and we get the recession "

I thought the thrust of this thread was about whether there will be a crash or not. You seem to have assumed that there will be one.

You do have a point about availability of credit. At one time the government, via the Bank Of England, controlled the amount of credit banks could offer - that element of control was removed by Thatcher in the early 80s for, no doubt, good free-market reasons. Eventually we went from a position where one had to go on hands and knees to get credit, to where it became easy to get, to where credit is thrust at us whether we want it or not. This is, of course, not unique to the UK though we seem to have a particularly bad case, due mainly (in my opinion) to property prices being higher and thus offering more scope for re-mortgaging.0 -

It's been covered probably on previous pages (this is now page 76 and I am not going to go through them all to check), but it's worth remembering the effect of moving the goalposts. No more 100% mortgages and salary multiples being reduced.

Before: £200k to borrow. 100% mortgage. 5x joint salary. Achievable by a couple both on £20k or a single on £40k

Now: £200k to borrow. 10% down. 4x salary. Now you have to save up £20k and can only borrow £180k. So still can't afford it. £200k with 10% down on 4x salary you would now need to have a household income of £45k to afford it.

Small differences, large impact.

Right now, for starters, all those FTBs who were after 100% mortgages are now having to take a year out to save the deposit.0 -

Prices aren't falling fast enough for my liking.) half a percent a month if it's true, is just storing up problems, leading to a worse scenario later.

I've had my fill of hearing of middlemanagement types splashing some magnolia about, and arranging some pebbles and candles to make 15K.

people forget, making money is one thing, but there are a hell of a lot of hardworking people out there who can't afford to buy their own home.Its becoming a tiered society, through greed.Most people overlook opportunity as it comes dressed in overalls, and looks like hard work.0 -

I thought the thrust of this thread was about whether there will be a crash or not. You seem to have assumed that there will be one.

This thread was made to stop people posting lots of threads about prices falling, so in my head this thread is for people who think they are falling - people who think they are rising are free to start multiple new threads Hurrah, now I have more thankings than postings, cheers everyone!0

Hurrah, now I have more thankings than postings, cheers everyone!0 -

I have just posted this article on my blog and would love to hear your constructive criticism, debate of why I am wrong or indeed why you agree.Halifax released it's latest monthly survey on house prices today which showed prices across the UK falling by 0.3% in February, taking the annual rate of inflation down to 4.2%. This now means the average home in the UK costs £196,649 (or at least it does according to the Halifax, other surveys have different findings). What it clearly shows is that the housing market has slowed over the past couple of months but they believe that house prices can remain flat if the economy and employment levels continue to grow. Now that is a big "if" and not one I would personally like to have my house staked on.

The statistics show that economic growth is holding up at 0.6% in Q3 & Q4 last year but the problem with statistics like these are that they are backward looking. Indeed the technical definition of a recession is flawed as it requires consecutive quarters of economic decline before the criteria are met so you only know once you are in a recession, which is not very helpful.

Whilst there is no easy way of predicting the future you only have to take one look at the stock market to see that investor confidence is weak at the moment with fears of a possible recession just around the corner. Of course all those investors could be wrong, and they have indeed been wrong about things in the past. But it's not just investors that are worried, Governments have been desperately trying to avert a global slowdown too and have been cutting interest rates to boost consumer confidence (some more than others).

Ok, so it looks like the economic outlook is not great but what about employment levels? On the face of it there is reason to be optimistic as the number of people in employment has risen by 296,000 in the last year, although unemployment has only fallen by 86,000 over the same period (Source:ONS). Which sounds great but the total number of hours worked has actually fallen by 2.3 million over the last quarter to 935.6 million which either suggests that as a nation we are getting lazy or more likely this is a result of more flexible working options reducing the number of hours people on average work, and thus increasing the total number of jobs to compensate. The number of people claiming incapacity benefit also continues to rise and the so called economic inactive population has remained flat making it difficult, if not impossible to draw any conclusions on the true state of the employment market.

So with little statistical evidence or confidence in the economy and employments levels there is a very real threat that both could suffer downturns in the near future. So back to Halifax's view on house prices, if the economy no longer continues to grow then house prices could start to fall, and if this happens then the question is how far will they fall? I believe the answer to this question can be found by identifying the point where the housing market bubble began (it's worth noting that it's just my opinion that we have experienced a bubble and there is no conclusive proof).

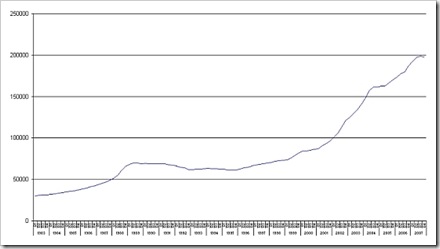

Looking at the statistical evidence of house prices according to the Halifax house price index (see graph below) it is clear that house prices rose during the mid 80s before remaining fairly stagnant during the early 90s. During the late 90s prices grew at a steady rate before really taking off from early 2001. Therefore it looks like the average house price was £87,000 pre-bubble at the start of 2001. In the next 7 years house prices rocketed to a high point of £198,664 before dropping off slightly in the last quarter. This could potentially mean the bubble has inflated prices by over £111,000 although it is more likely that there is an element of real growth buried within this figure. UK House prices in £GBP (Halifax house price survey)

UK House prices in £GBP (Halifax house price survey)

If we were to assume house prices had continued to grow at the rate they were during the late 90s then you could argue that the average house price should be closer to £125,000, but this would still suggest house prices are almost £75,000 over-valued.

In reality nobody can accurately predict what house prices will do over the coming years, and indeed a counter argument could be made to this article that what we have actually experienced is a prolonged slump in the housing market and that we are now back on the steady growth path that was established in the mid 80s.0 -

Good graph and post above.

Are you sure about that? Yes ok electrical goods etc were more then. But petrol is about £4.50 a gallon now and motoring related taxes are far higher. In the last crash, there was no car insurance premium tax, no congestion charge, cheaper MOT's. Lots of other things have increased since those days eg Passports, driving test fees, Prescriptions and general taxation has increased under Labour. We have airport passenger duty, council tax has doubled and that been just since 1997. In 1989 the rates were far less. And don't forget there was still MIRAS then, we don't have that now. So although rates were 10% - people were compensated by MIRAS.PasturesNew wrote: »cost of living was higher then......the cost of petrol was higher in real terms.

I think this time it will be worse. Because the house price bubble is bigger, credit card and consumer debt is 1.4 trillion (there was virtually none last time), and the Buy to Let people who make up 10% of the total market will make losses and offload. A lot of the amateur BTL people will suffer and contribute to the crash. Yes, interest rates are lower now but when you factor in that house prices have tripled now and that MIRAS then brought peoples repayments down it equated to a crash with a lower 'real' rate than 10%. These two times are more similar than the banks would like to admit.

But all your other points I agree with and its a good post Pastures New. What do you think is going to happen?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards