We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

BOE MPC raises interest rates by 0.25% to 0.50%

worldtraveller

Posts: 14,013 Forumite

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 1 November 2017, the MPC voted by a majority of 7-2 to increase Bank Rate by 0.25 percentage points, to 0.5%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

Bank of England

Shocker!

Bank of England

Shocker!

There is a pleasure in the pathless woods, There is a rapture on the lonely shore, There is society, where none intrudes, By the deep sea, and music in its roar: I love not man the less, but Nature more...

0

Comments

-

Forward guidance a bit more dovish than the markets seemed to be expecting though based on Sterling selling off a bit.0

-

-

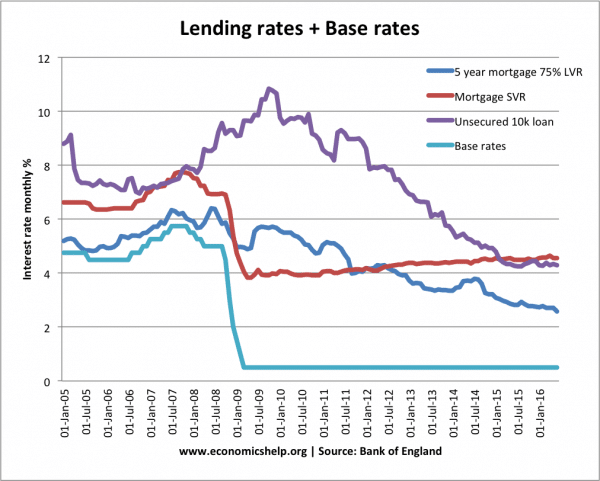

When rates came down mortgage lenders stopped passing on the decrease to SVRs at a base rate of about 2.5% so the gap between base rate and svr that had historically been 2% has jumped to 4%.

What will happen on the way up? Will the current historically large gap between the base rate and the average SVR be maintained or will this gap also 'return to normal' levels? I think....0

I think....0 -

Are they going to stop QE?[STRIKE]1/12/16 - £152,599.00 [/STRIKE]

[STRIKE]11/11/17 - £145,990.00 [/STRIKE] <> Overpaid £3916.

11/11/18 - £142,074.00

Barclays Car (5.99%)£0/£8,832.370 -

Nope, no new qe for a while but no plans to reduce current stocks of £10bn corporate bonds and £435bn govt bonds

Yes. The APF is still at £435 bn. The BoE has been topping it up, as the gilts in the existing portfolio mature, but otherwise no change.since the extra £60 bn in August 2016.0 -

-

What will happen on the way up? Will the current historically large gap between the base rate and the average SVR be maintained or will this gap also 'return to normal' levels?

Large gap simply gives lenders flexibity. Should base rates jump up rather than be incremental increases. Still in uncharted monetary policy waters.0 -

In theory the 2020-2030 period should be a decade of low price inflation as the near AI software revolution kicks in making goods and services a good deal cheaper.0

-

But can't we draw an exact analogy with energy suppliers standard variable tariffs - ie higher prices for those who can't or won't swap around. Given this is politically unacceptable for utilities I can't see it will be long before the same happens with mortgages.I think....0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards