We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

On my way!

Comments

-

I love a good graph too!0

-

Hi all

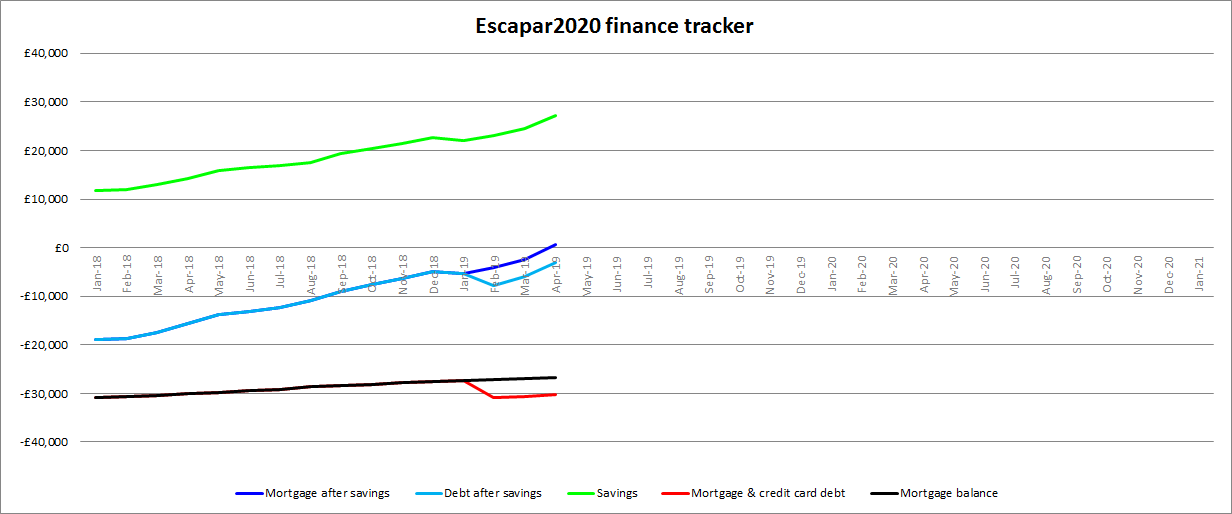

It’s almost a year since I started this diary, and 9 months since I started tracking things on a chart (which I hope you can see above) I've been popping in to catch-up on other diaries fairly regularly but haven't updated my own for a while. Everything is running fairly smoothly now I've set up several standing orders, and manually pay any spare cash into savings.

I've opened 2 nationwide flex direct current accounts and put the max £2500 in each to receive 5% interest, both paying just over £10 per month. I've also opened an instant access savings account that's forecasting to pay out around £150 in November. I’ve also opened a dormant current account ready to take advantage of a future switching offer. It's not very scientific, but I reckon this helps cover the slightly higher mortgage interest rate I pay now I’m saving to offset the mortgage rather than over pay it.

When the base rate increased recently, I paid off £500 of mortgage to help keep my monthly payments about the same. I'd forgotten that the monthly payment would have gone down anyway when the rate changed, simply as a result of paying the mortgage since the previous rate change last November. So, my payment went from £288 to £268 per month, so I put the £20 difference into the offset savings.

At the end of August then:

Official mortgage balance is £28326

Offset mortgage balance is £23112 and I'm on track to be neutral in 2020

If I add normal savings and offset savings together, the mortgage balance would be £9019 and I could be mortgage neutral some time in 2019. While this feels good, I’m not relying on it as there is planned spend coming and can always be some unplanned spend, but it is nice to think I could be technically mortgage neutral sooner than when I planned in September 2020.

Although I had originally planned to actually pay of the mortgage early, I've moved to becoming mortgage neutral in the same timescale. I'm on the SVR, and had been put off switching because of the fees, but have seen a 2 or 5 year fixed rate with my current lender with no fees, and a slightly lower rate than the SVR, which is tempting. What do you think?

Escapar20200 -

If it is any help I have just swiched to a new fix with my existing lender with no fee to avoid going onto the SVR next month.

So I think good idea.I am a Forum Ambassador and I support the Forum Team on Mortgage Free Wannabe & Local Money Saving Scotland & Disability Money Matters. If you need any help on those boards, do let me know.Please note that Ambassadors are not moderators. Any post you spot in breach of the Forum Rules should be reported via the report button , or by emailing forumteam@moneysavingexpert.com. All views are my own & not the official line of Money Saving Expert.

Lou~ Debt free Wanabe No 55 DF 03/14.**Credit card debt free 30/06/10~** MFW. Finally mortgage free O2/ 2021****

"A large income is the best recipe for happiness I ever heard of" Jane Austen in Mansfield Park.

***Fall down seven times,stand up eight*** ~~Japanese proverb. ***Keep plodding*** Out of debt, out of danger.

One debt remaining. Home improvement loan. 21 months left.0 -

As you're fairly confident about becoming mortgage neutral in two years I'd go for the two year fix for security. All looking good! Did you get your increased pension contributions sorted out? Time to turn your attention to retiring early and sorting out pensions is a key consideration

.

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

.

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

Thanks Gallygirl

I haven't made a decision about extra pension contributions yet. I can make extra payments into my lgps but not sure if I want to lock my money away for so long or invest in something else. My lgps people have been fairly useless at explaining how much extra I would need to pay in to bring back down from the higher tax rate.

Sorting the mortgage is fairly straightforward, not sure if my brain can cope with the complexity of pensions and investments though!

Thanks for the nudge, I'll give it some more thought!

ESCAPAR20200 -

Well you could carry on paying 40% tax, open a personal pension and get 20% tax relief immediately paid into it then do self-assessment and get the other 20% back which you could use to pay into your pension etc etc :T. I'm sure there must be something online to calculate all this?Escapar2020 wrote: »Thanks Gallygirl

I haven't made a decision about extra pension contributions yet. I can make extra payments into my lgps but not sure if I want to lock my money away for so long or invest in something else. My lgps people have been fairly useless at explaining how much extra I would need to pay in to bring back down from the higher tax rate.

Sorting the mortgage is fairly straightforward, not sure if my brain can cope with the complexity of pensions and investments though!A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

Hi all

It’s been a while since I posted, seems like Christmas was just five minutes ago!

It’s time to celebrate a milestone, but there is a ‘but’ coming…

Following payday this month, my savings balance exceeded my mortgage balance, so I’m technically mortgage neutral (small woo hoo!), nine years before the mortgage is scheduled to end.

My plan was to be neutral by November 2020, but good to be early! Not quite sure how I managed to be so early, I have noticed I’ve been wasting less and putting away any extra left over at the end of the month. Not over-stressing about it has been the key for me, I think.

And now for the but….

I have taken on some credit card debt to replace all the windows in the house, which should keep it warmer and reduce bills in future. It’s 0% debt for two years, so I’ll just use savings to pay it off in full at the end of the term. I’m also looking at a new kitchen and maybe a used convertible this year which will also go on the card, so I might become mortgage un-neutral again, but aim to be mortgage and debt neutral by my original target of November 2020.

For those that might have read my earlier posts, work has been tolerable over the last few months, so I really need to decide what I’m going to do with the surplus income once I am debt free. I’ll be 55 in nine years’ time, so additional pension contributions and early retirement is one plan, and/or investing in another property is another possible plan.

And best of all, it's Spring!

Escapar20200 -

Well you could carry on paying 40% tax, open a personal pension and get 20% tax relief immediately paid into it then do self-assessment and get the other 20% back which you could use to pay into your pension etc etc :T. I'm sure there must be something online to calculate all this?

Hi Gallygirl

I missed this back in September! If anyone knows of an online calculator, point me in the right direction! I don't know anything about slef assessment, thought it was for self employed, but I'm PAYE?

Escapar20200 -

I don't know of any calculators I'm afraid.

Anyone can/should register for self assessment if they have extra income to declare, extra tax to pay on interest (as a higher tax payer ou only get £500 tax free) and to claim tax relief on contributions outside the PAYE system.

Maybe post a few questions on pensions board, e.g. can you/should you pay extra into LG scheme instead.

Well done on mortgage neutrality , even if only temporary!!!! A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

, even if only temporary!!!! A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards