We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

UK employment pension, but living abroad

Comments

-

bostonerimus wrote: »

Apologies to the OP for hijacking his thread, it’s just that it’s very unusual to get useful advice on this subject on this forum.

The linked article would suggest that Christmas has come early for expats.

In contrast Article 18 para 2B

However, such pensions and other similar remuneration shall be taxable only in the other Contracting State if the individual is a resident of, and a national of that State.

Seems to stipulate that you have to be a UAE national to benefit from the exemption from UK tax?0 -

I’m currently drawing down from a SIP I transferred to from a company pension at the UK personal tax allowance of £11500 tax free per year.

I’ll soon transfer 10% of the wife’s allowance to me to increase the tax free withdrawal rate.

I’m assuming the OP is a UK passport holder and this may be of some use to him.0 -

That clause, and all of Article 18 of the treaty, applies only to Government pensions. Private and personal pension -- SIPPs, stakeholders, GPPs and so on -- are not covered by it, so they get the Article 17 treatment.Seems to stipulate that you have to be a UAE national to benefit from the exemption from UK tax?0 -

That clause, and all of Article 18 of the treaty, applies only to Government pensions. Private and personal pension -- SIPPs, stakeholders, GPPs and so on -- are not covered by it, so they get the Article 17 treatment.

Yes, the distinction between private and Government pensions is crucial. Article 17 applies to the OP's situation and without a" savings clause" (as in all US tax treaties) the domestic tax law is modified by the treaty.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

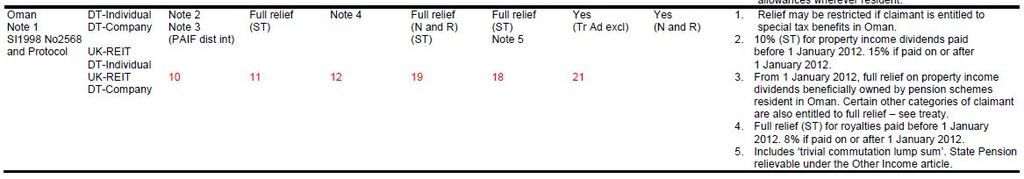

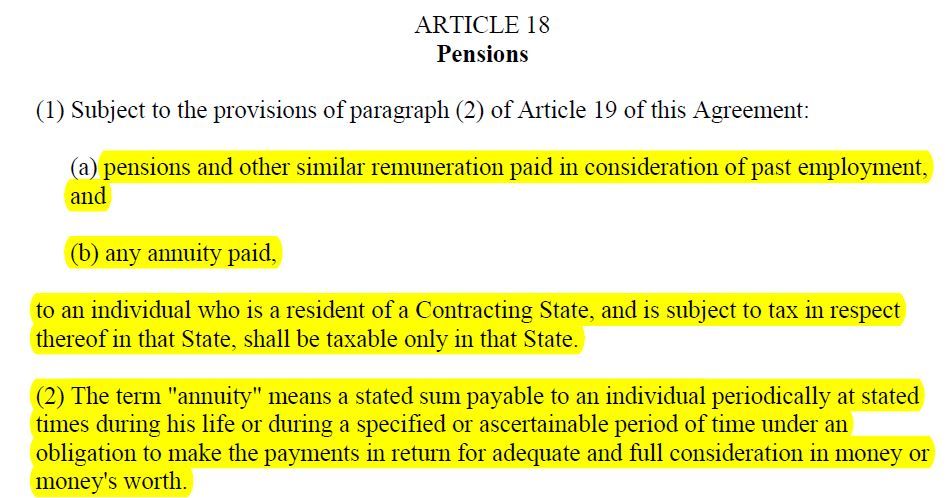

With regards to UK/OMAN, pensions are covered under article 18 of the document above, page 24 which says

Article 19 mentioned in the above quote applies to government service. I would say therefore that UK SIPP derived pension income drawn while tax resident in OMAN should be covered under the UK/OMAN DTA, subject to the overseas residency tests. If anyone can confirm this for me, I would be very grateful indeed. Thank you.(1) Subject to the provisions of paragraph (2) of Article 19 of this Agreement:

(a) pensions and other similar remuneration paid in consideration of past employment, and (b) any annuity paid,

to an individual who is a resident of a Contracting State, and is subject to tax in respect thereof in that State, shall be taxable only in that State. (2) The term "annuity" means a stated sum payable to an individual periodically at stated times during his life or during a specified or ascertainable period of time under an obligation to make the payments in return for adequate and full consideration in money or money's worth.0 -

This would appear to cancel an early Christmas for expats in Oman no mention of UAE but chances are the situation would be the same.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/538047/Digest_of_Double_Taxation_Treaties.pdf

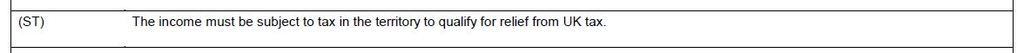

There appears to be a requirement (ST) that The income must be subject to tax in the territory to qualify for relief from UK tax.

So back to original plan of drawing money out under UK personal tax allowance.0 -

Indeed, however the rate of tax is 0%. so, what exactly do you see as the problem?This would appear to cancel an early Christmas for expats in Oman no mention of UAE but chances are the situation would be the same.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/538047/Digest_of_Double_Taxation_Treaties.pdf

There appears to be a requirement (ST) that The income must be subject to tax in the territory to qualify for relief from UK tax.

So back to original plan of drawing money out under UK personal tax allowance.

The document you quote says -

And on page 5 it says -

The pension is subject to tax in Oman. The tax rate is presently 0%. What is the problem?

Meanwhile the ACTUAL dual tax treaty, Article 18 says -

Pretty clear to me? (By the way Article 19 is mentioned, but it only applies to Government Service, not private individuals).0 -

OK, a bit more on this with respect to claiming tax relief for UK pension income under a dual taxation treaty.

1 Fill in Form SA109 for the relevant tax year.

2 Fill in Form HS304

Follow the HMRC guide notes for those two documents. Send them both off with your self assessment form.

Note - Assuming you are already qualified in the previous tax year as non-UK resident by passing the automatic overseas residency test. Unless anyone can tell me to the contrary, I think this works for both UAE and Oman. Helpfully, the countries where this does NOT work are listed in the HMRC forms.0 -

The problem as far as I can see is that to the best of my knowledge there is no income tax in Oman. Therefore the income would not be subject to tax, game over.0

-

I beg to differ. However, I'll let you know in a couple of years when I have filed my 17/18 tax return along with SA109 and HS304.The problem as far as I can see is that to the best of my knowledge there is no income tax in Oman. Therefore the income would not be subject to tax, game over.

Biggest problem to me, seems to be getting the UAE/Omani tax office (yes there is one) to stamp the form. They love their rubber stamps, but finding the right person with the right rubber stamp on the right day will be a challenge in my experience.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards