We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Savings ratio down to pre-2008 crash levels

tara747

Posts: 10,238 Forumite

http://www.independent.co.uk/news/uk/politics/uk-economy-kept-afloat-spending-binge-obr-treasury-watchdog-warning-a7619351.html

Any thoughts??

Anecdotally, I know several people who brought forward 'big ticket' purchases before Christmas because of predicted price rises. Those people are now paying off said purchases and tightening the purse strings.

Others are still borrowing merrily away.

The Government is still borrowing at record low interest rates.

But for how long...?

Any thoughts??

Anecdotally, I know several people who brought forward 'big ticket' purchases before Christmas because of predicted price rises. Those people are now paying off said purchases and tightening the purse strings.

Others are still borrowing merrily away.

The Government is still borrowing at record low interest rates.

But for how long...?

Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.73

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.73

0

Comments

-

The size of the state's debt has since 2008 been the best indicator of the trajectory of interest rates. I've been saying for a couple of years that we aren't even halfway through the era of ultra low rates.

Imagine how colossally deflationary a rate rise would be. The cost of state debt would rise, the cost of a lot of private debt would rise and taxes would have to rise too to fund the costlier state debt.

I don't see base rates going over 1% for another 10 years, if then.0 -

westernpromise wrote: »The size of the state's debt has since 2008 been the best indicator of the trajectory of interest rates. I've been saying for a couple of years that we aren't even halfway through the era of ultra low rates.

Imagine how colossally deflationary a rate rise would be. The cost of state debt would rise, the cost of a lot of private debt would rise and taxes would have to rise too to fund the costlier state debt.

I don't see base rates going over 1% for another 10 years, if then.

Depressingly, I think you may be right.

What happens if the pound falls further, though? Or if inflation accelerates?

Also, if there is another financial crisis, there's no ammunition left iro interest rates.Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.730 -

If inflation accelerates the MPC would have to raise rates, but we're at 1.8% and the range is 1 to 3% so that seems some way off.0

-

Good news as far as I'm concerned.

The key to a decent retirement is a high savings rate and, ideally, to be richer than your peers who will be chasing the same goods and services.

It warms my heart to hear of people keeping the economy ticking over whilst making efforts to be poorer than me in retirement.0 -

Consumer debt is a far bigger concern. Once people stop spending the economy may stall. So heavily dependent upon the service sector for growth.0

-

Thrugelmir wrote: »Consumer debt is a far bigger concern. Once people stop spending the economy may stall. So heavily dependent upon the service sector for growth.

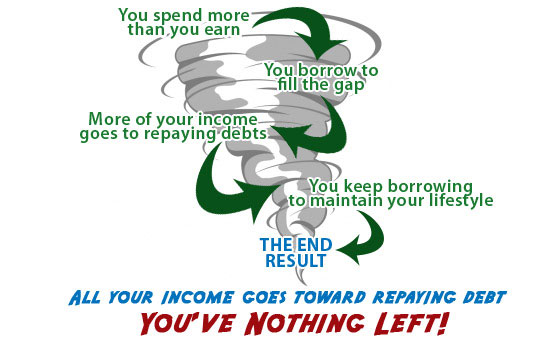

True. Mind you, consumer debt and the savings ratio are linked. High debt = low savings ratio.

What happens when people reach the limit of personal debt they can carry? As Martin says... Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.730 -

What happens if the pound falls further, though? Or if inflation accelerates?

If the pound falls further (which more likely will) it will get the economy to look domestically to produce what it buys from abroad. It may make the country a magnet for foreign purchases.

Or people will need to tighten the belt even further.EU expat working in London0 -

The savings rate needs to fall to zero, with women having fewer than 2 children there is no need to save (aka create capital) as each generation will just inherit all the capital they need and then some0

-

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards