We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

5 months at new job - not paid tax?

silva1999

Posts: 1 Newbie

I was self-employed for a couple of years after University and had a very small income from this (less than £5k - was still living with parents etc). In mid-October of 2016 I got a job which pays 32k, and my payslip shows I haven't been paying any tax (my tax code is 1100L). I mentioned this to payroll who explained I've built up an allowance, and that I wont pay tax until this allowance is used up - but when will this be?

If someone could give me an idea of when my tax will kick in, that would be very helpful - I've asked payroll, but they were somewhat vague and I'm still none the wiser!

If someone could give me an idea of when my tax will kick in, that would be very helpful - I've asked payroll, but they were somewhat vague and I'm still none the wiser!

0

Comments

-

When do you get paid? What is your taxable pay to date?0

-

Well you have an 'allowance' of £916' a month, but it's an annual allowance of £11,000, so

Basically they should work it out so you have the same income every month, the way they do it now means you income will drop sharply0 -

Allowance is £916/month. It starts anew in April, so now you've got April, May, June, July, August, September, October, November, December, January = 10 months.

At the end of February there'll be another allowance added on, taking it to "£10k can be earnt by this date without tax being paid".

To the end of January you could've earnt up to about £9000 before paying any tax.

At £32k, your basic is £2600/month.

½ October is £1300.

Nov/Dec/Jan is £2600x3 = £7800.

Earnings to end of January are about £9100

Earnings to end of February will be about £11,700

£11,700 > £10k allowance by the end of February - so you should see tax deductions starting in this month's paypacket.

You'll have to work out the minutae/details, but that's how it works.0 -

Well you have an 'allowance' of £916' a month, but it's an annual allowance of £11,000, so

Basically they should work it out so you have the same income every month, the way they do it now means you income will drop sharply

The employer has no choice on how it's worked out, they have to follow the HMRC rules (back in my day referring to the tax tables for each month) and in the OP's situation it seems inevitable that there will be a drop from an artificially high take home pay to the correct lower level at some point - I'd guess it'll kick in this month but the full drop may not be until next month.0 -

Fair enough, I know in the past when switching roles, the salary was the same every month, but I guess I hadn't built up an allowanceThe employer has no choice on how it's worked out, they have to follow the HMRC rules (back in my day referring to the tax tables for each month) and in the OP's situation it seems inevitable that there will be a drop from an artificially high take home pay to the correct lower level at some point - I'd guess it'll kick in this month but the full drop may not be until next month.0 -

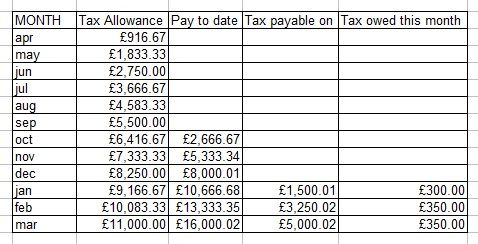

Let's assume that you started on 1st Oct (yes, I know you didn't, but it's to show you the worst case scenario) and that you earned £5k before starting the job.

It looks to me as if they haven't taken your previous earnings into account (and why would they, as you were SE.) You will have to fill out a tax return for your SE earnings, but if your turnover was £5k, you should be able to claim expenses against this before any tax is liable. As you are using up all your tax allowance on your main job, any profit you made from SE will be taxable at 20%, so you should put aside up to £1000 to pay this, which will be due in Jan 2019.

Apart from that, I think your tax position looks like this. Tax seems to peak at £350 a month from Feb onwards, but it does look to me as if you should have been taxed in your Jan payroll...(assuming, that is, that you earned more than £1166 in October, when you started.) Ex board guide. Signature now changed (if you know, you know).0

Ex board guide. Signature now changed (if you know, you know).0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards