We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

London property market bubble?

Comments

-

Thanks for the helpful responses.

HouseBuyer77 - I think you have summed up my thoughts very well. It is very important to consider the drivers behind the current high demand and if they might change in the near future. Also how cheap that credit currently is and where that might go. Negative equity is my big fear so the thoughts on buying a place that you're prepared to live in long term are very useful.

Pants999 - You make a good point. I have been commuting into London (about an hour each way) for quite a while now and ideally I want to move into the City. But I don't spend a great deal of time at home and I was trying to assess this almost purely from a financial perspective. It is so difficult to get your head around what is effectively a gamble on tens of thousands of pounds.

Thanks0 -

If you have already bought, even with a mortgage, the fall in house prices can really IMO only affect you when you come to sell, maybe putting you into negative equity.

Are you meaning that you would take a lodger to boost your savings/reduce you mortgage to the value of the property or do you mean something else?

The issue is when you come to remortgage. The headline rates you see are all time-limited deals both variables and fixed rates. For example I have a 2-year fix. After that it reverts to the lender's standard variable rate, which I think is 4.5% currently. So a large increase in mortgage payments. Not a problem if you can remortgage but if you're in negative equity that's not going to happen (greater than 100% LTV).

So for me a 20% drop (compared to purchase price, current market value is already a couple percent above at least) means I'm in negative equity (85% LTV mortgage). However I've got some savings and I've already paid off a small amount of the mortgage. So I could probably claw my way back to 95% LTV quickly if not instantly by giving up a large chunk of savings. At which point a remortgage may be possible.

At more like 30/40% I can't buy my way out of negative equity so I'll have to deal with larger morgage payments longer term. So that + say a 2% base rate increase and the mortgage payment is starting to become unaffordable. Taking a lodger would be one option to deal with this.0 -

No need to remortge at the end of the fix, just to do a product switch with the same lender. Matters not what the LTV is at the time.0

-

Typhoon2000 wrote: »Matters not what the LTV is at the time.

This is not true (or at least not generally true). The LTV shortly before the end of the product you are on will determine which of your current lender's products you are eligible to switch to. This will typically be calculated using a house price index (e.g. those published by Nationwide and Halifax), although you can probably ask for a survey (at your own expense) to re-evaluate the LTV.Let's settle this like gentlemen: armed with heavy sticks

On a rotating plate, with spikes like Flash Gordon

And you're Peter Duncan; I gave you fair warning0 -

LTV matters even if switch to a different mortgage under same lender.

@OP: Whether to buy in London or not, only you can answer this. If you can afford the price then better to buy. However, ask yourself how you will feel if price goes down in near future.

Remember, everything is possible. Nobody predicted Lehman Brothers fail and nobody thought we'd have 0.5% interest rate forever (almost) even though it didn't happen in last 400 years.Happiness is buying an item and then not checking its price after a month to discover it was reduced further.0 -

legoanakin wrote: »Hi All,

I've never posted on the forum before so apologies if this has already been discussed recently.

I am a first time buyer looking to buy a flat in London. One thing that has been worrying me for a while are reports that the London property market might be a bubble about to burst. I have read many articles on the subject with many arguments from 'experts', some saying it is going to happen, others saying no chance.

I appreciate that there are many different drivers and variables to consider but the only thing my research has led me to be sure of is that nobody has a clue. Can this really be the case?

Thoughts?

Thank you

http://truepublica.org.uk/united-kingdom/britains-house-price-crash-2016-predictions-mount/

My son sent this to me last week, asking what I thought. He is looking to buy a flat in or near London which is where he works. He is now indecisive, and I am reluctant to offer any sort of advice as my thoughts were, like many others expressed on here, that prices can go either way. Negative equity is no laughing matter, but neither is spiralling property prices which are beginning to be out of reach for most FTB.0 -

Nah, nothing to see here :lipsrseal

In all seriousness, no-one knows... if you can afford to buy and you see somewhere you like I would say go for it.0 -

legoanakin wrote: »Thanks for the helpful responses.

HouseBuyer77 - I think you have summed up my thoughts very well. It is very important to consider the drivers behind the current high demand and if they might change in the near future. Also how cheap that credit currently is and where that might go. Negative equity is my big fear so the thoughts on buying a place that you're prepared to live in long term are very useful.

Pants999 - You make a good point. I have been commuting into London (about an hour each way) for quite a while now and ideally I want to move into the City. But I don't spend a great deal of time at home and I was trying to assess this almost purely from a financial perspective. It is so difficult to get your head around what is effectively a gamble on tens of thousands of pounds.

Thanks

Do you really mean The City of London? If so, I hope you have deep pockets.

If not, and you actually mean within, say, the M25, it's a question of what's important to you. Personally, I'd commute because I enjoy the quality of life where I live. Some, though, prefer the convenience of living close to work.0 -

HouseBuyer77 wrote: »So perhaps there's a bubble, no-one can really say for sure.

That's not true. When there is a speculative bubble in any market it shows.0 -

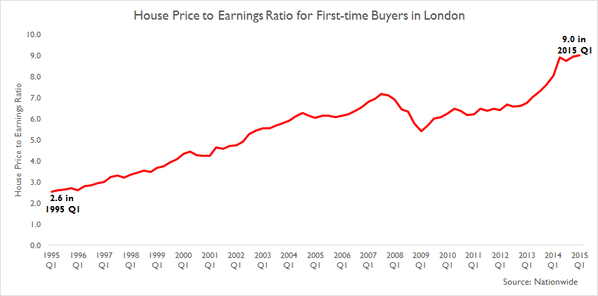

London property (with the exception of PCL) doesn't appear to be a bubble. There are a lot of buyers who have paid with large deposits. price to earnings ratio is pretty meaningless (mean or median) in determining of the property market is overpriced or not.

I would say buy but be careful what and where you buy. I think going forward location within London will be crucial. you could get areas in London falling a lot whilst other areas staying flat or even rising. I think areas to avoid are heavily BTL areas, areas where no one wants to live in and which are not going to improve and areas generally with a lot of supply of property such as lots of new developments.

try to stick to areas that are established with limited supply, that should hold its value well in any downturn.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards