We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

How interest rates affect property values

Comments

-

Can you explain to me why we can't examine London as a case?

Knock yourself out - I'm just saying it's a special case.Can you please explain to me why people in Stoke aren't borrowing when prices are well within acceptable bank lending restrictions?

My suspicion is mortgages are being rationed. I can't provide stats and therefore it couldn't possibly be true but logically..

..if you live somewhere where you are committed to by employment and family ties and buying is obviously cheaper than buying then why wouldn't you buy?

Maybe they're all HPC'ers.0 -

You'll have to ask the people of Stoke why they don't want to buy houses. According to your own stats the prices are well within lending multiples vs average salaries and mortgage costs are less than rent. Why do you make the assumption that the people in Stoke are special cases that the banks don't want to lend to at much safer levels but in neighbouring booming towns with higher prices, banks are fine with those people. How does that argument make sense? Maybe people just don't want to pay higher prices in Stoke and so credit costs are irrelevant.

The good people of stoke (and the same applies to over half the country where prices are about 2x joint full time wage) do buy homes with and without mortgages.

We are only talking about some 10% of the population who have no access to a mortgage thanks to excessive regulations to 'save them from themselves'

So you keep crying that there is no mortgage rationing most people can get a mortgage at 2% its never been cheaper. I keep trying to point out to you that some 10% of households can't get a mortgage at any price because computer says no. This 10% is a very important 3 million households and it explains why there has been a boom in rentals from 2008-now. Before you cry that rentals have boomed due to higher prices remember prices are much lower in a lot of the country (about 40% lower in real term mortgage payments in a lot of places) so that is not the answer.

I also gave you a real world example of a households I know. They moved to a cheap town to set up a businesses they have about £60k in savings and would need £50-60k mortgage. If self cert existed they would buy with a 50% LTV mortgage (totally risk free lending) and pay only some £100 per month in interest in the mortgage. Instead they pay £650 in rent and get close to nothing on their savings in a bank. You keep crying there is no mortgage rationing maybe you can explain it to them?0 -

No, I agree with the maths but I don't agree people can or will borrow more to buy a house because interest rates fall.

You don't need stats - just a mortgage calculator and logic. I can help with the mortgage calculator...

http://www.nationwide.co.uk/products/mortgages/our-mortgages/mortgage-calculators/mortgage-affordability-calculator

I can't borrow more by choosing a cheaper mortgage if that takes me beyond the earnings multiple collar.

You believe house prices are some intrinsic fundamental value, unrelated to supply and cost of credit. Therefore from that fact, your position makes sense, people won't borrow more. But if this was true, we should have seen a very notable reduction in mortgage payments as a percentage of income. From what I know, this is just not the case.

On the other hand, I believe that cost and supply of credit isn't just correlated with cost of housing, it is a cause of high cost (*) because it makes up a big part of effective demand. People are bidding in a market, prices aren't just set at X and that's that. People bid prices up. We have 20 buyers per day looking at houses in London, so of course they're going to bid up. But they can only bid up to what they can afford and if they can afford more because credit is cheaper, they will bid higher.

You state that people can't bid more than lending restrictions but this implies that we always operate at the limit of lending restrictions over the years. This isn't true, as ukcarper says (I'd need to see his source), median multiples are still below 4.5. And even 4.5 isn't a hard limit, banks can still lending over this to 15% of their mortgages.

And according to cml, the percentage of people going over this has been increasing:

https://www.cml.org.uk/news/news-and-views/affordability-bites/

Also note the quote:While this would square with a pick-up in the proportion of lending at or above 4.5 times income, there has, in fact, been a much broader increase in higher income multiples over recent months. Several metrics suggest that borrowers are now stretching their incomes more than in mid-2014.

All of this agrees very well with the theory that monthly mortgage payments are roughly linear, and track rents, but borrowing multiples increase as cost of credit comes down, so prices move higher.

Also note that I expect if MMR stays in place, we will reach a soft ceiling within a few years where people are more and more constrained by lending multiples and so I don't expect such high HPI to continue for more than a few years, unless other economic conditions change (big wage growth for one).

(*) When demand > supply. If people don't want to buy, throwing more credit at them won't push up prices.0 -

Can you explain to me why we can't examine London as a case?

Can you please explain to me why people in Stoke aren't borrowing when prices are well within acceptable bank lending restrictions?

You can examine London but you can't come up with a theory that breaks down in most places and seems to apply only in London because that suggests the theory is BS

People in stoke and elsewhere are buying. Just that a percentage can no longer get mortgages so renting has increased. If 10% of households can only get a mortgage with self cert that means a shift of 10% if you abolished self cert.

If you want ownership to increase We need a return of self cert. Return of interest only. Return of 100% mortgages (or maybe 98%) at competitive prices.0 -

if this was true, we should have seen a very notable reduction in mortgage payments as a percentage of income. From what I know, this is just not the case.

I was hoping you'd go there.....;)

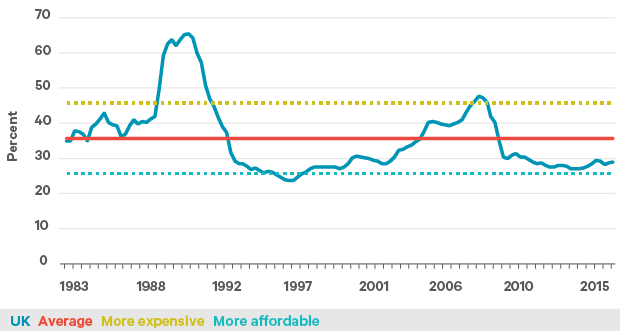

So as it happens, there has been a very notable reduction in mortgage payments, and in fact they're near all time record lows.

Which does rather demolish the argument that people have keep mortgage payments at previous high levels and used low rates to bid up capital values instead of reducing mortgage payments as a % of income.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

You believe house prices are some intrinsic fundamental value, unrelated to supply and cost of credit. Therefore from that fact, your position makes sense, people won't borrow more. But if this was true, we should have seen a very notable reduction in mortgage payments as a percentage of income. From what I know, this is just not the case.

On the other hand, I believe that cost and supply of credit isn't just correlated with cost of housing, it is a cause of high cost (*) because it makes up a big part of effective demand. People are bidding in a market, prices aren't just set at X and that's that. People bid prices up. We have 20 buyers per day looking at houses in London, so of course they're going to bid up. But they can only bid up to what they can afford and if they can afford more because credit is cheaper, they will bid higher.

You state that people can't bid more than lending restrictions but this implies that we always operate at the limit of lending restrictions over the years. This isn't true, as ukcarper says (I'd need to see his source), median multiples are still below 4.5. And even 4.5 isn't a hard limit, banks can still lending over this to 15% of their mortgages.

And according to cml, the percentage of people going over this has been increasing:

https://www.cml.org.uk/news/news-and-views/affordability-bites/

Also note the quote:

All of this agrees very well with the theory that monthly mortgage payments are roughly linear, and track rents, but borrowing multiples increase as cost of credit comes down, so prices move higher.

Also note that I expect if MMR stays in place, we will reach a soft ceiling within a few years where people are more and more constrained by lending multiples and so I don't expect such high HPI to continue for more than a few years, unless other economic conditions change (big wage growth for one).

(*) When demand > supply. If people don't want to buy, throwing more credit at them won't push up prices.

All that effort to argue a strawman...:o0 -

All that effort to argue a strawman...:o

Well, you're excluding credit from the cost of housing. That is what I meant. But please feel free to ignore that line and comment on the rest of my post.

EDIT: No, apologies, the figures were not just London. I thought they were, and I'd expect London to be a lot worse. Feel free to comment on the rest of the points.0 -

HAMISH_MCTAVISH wrote: »I was rather hoping you'd go there.....;)

So as it happens, there has been a very notable reduction in mortgage payments, and in fact they're near all time record lows.

I was commenting on London and my stats were from London. UK wider figures are fairly meaningless when you have completely different markets in the make up. Can you post the same graph for London?0 -

I was commenting on London and my stats were from London. UK wider figures are fairly meaningless when you have completely different markets in the make up. Can you post the same graph for London?

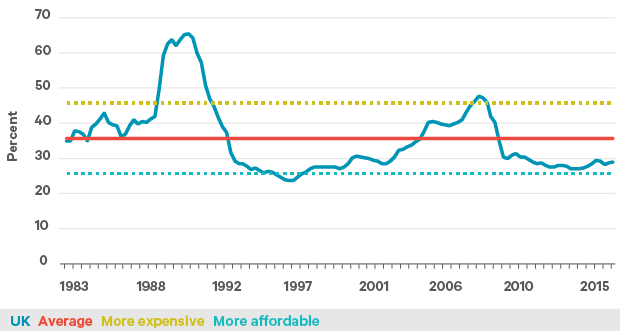

Only up until 2014, but sure.

It shows only minor variances to what is pretty much a national trend.

The fact is that people haven't been bidding up prices to the max thanks to taking larger loans with low interest rates.

Mortgage payments as a % of income, even for London, remain markedly lower than they were in 2007.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Only up until 2014, but sure.

It shows only minor variances to what is pretty much a national trend.

The fact is that people haven't been bidding up prices to the max thanks to taking larger loans with low interest rates.

Mortgage payments as a % of income, even for London, remain markedly lower than they were in 2007.

Thanks. So 2016 to 2006. It appears that in 2006, mortgage affordability was just over 40% and today it is just under 40%, a difference of a few percentage points. While prices are more than double. Low interest rates allow this situation to exist.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards