We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Is personal tax optional ?

Comments

-

chucknorris wrote: »My wife owns more property than I do (in value), she owns 3 houses in Hackney, I own 4 flats in Battersea and we both jointly own a house in Tottenham Hale. Glad to hear any suggestions but we can't see a way out of paying it, it would take about 190 years to mitigate the CGT by selling shares to each other. My CGT bill will be slightly mitigated by having lived in 3 of them and some losses being carried forward. We could move into them, but we really don't want to move back into London, that might change of course, but I can't see it happening.

Perhaps I'm misunderstanding but I'm pretty sure you can't offload CGT in that way to a spouse https://www.gov.uk/capital-gains-tax/gifts though I'm not sure either way.

If it is legit it sounds like it should be possible to remove £22k of capital gains each year, so I'm surprised it'd take 190 years to remove your liability (wouldn't that be something like £4.3 million in capital gains)Having a signature removed for mentioning the removal of a previous signature. Blackwhite bellyfeel double plus good...0 -

I don't think VAT is very regressive as charged in the UK. If you have a link to research that shows otherwise I'd happily revisit my opinion.

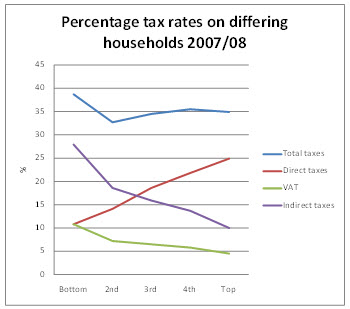

This is the UK governments own figures on VAT. Obviously from a few years ago, explained purely by my laziness rather than any expectation that it will have changed. These figures aren't contested, even by the people who have challenged the governments conclusion that VAT is regressive.

I don't know enough about the website taxresearch.org.uk to vouch for the validity of their claims but there analysis of the governments figures, the IFS case against them, and the issues with the IFS claims seems to match with my recollection of this from back then.

Given that you understand full well what progressive means it's disappointing that you continue to use poor proxies to define it here; though the second attempt is a considerable improvement.Having a signature removed for mentioning the removal of a previous signature. Blackwhite bellyfeel double plus good...0 -

Perhaps I'm misunderstanding but I'm pretty sure you can't offload CGT in that way to a spouse https://www.gov.uk/capital-gains-tax/gifts though I'm not sure either way.

If it is legit it sounds like it should be possible to remove £22k of capital gains each year, so I'm surprised it'd take 190 years to remove your liability (wouldn't that be something like £4.3 million in capital gains)

No you are not misunderstanding, I knew that it isn't a legit method, but I couldn't remember the exact rules, so to keep the post simple, I rejected the method because it would take too long.

It was a typo it would actually take about 120 years, and it isn't a legit method in any case, which is why I just quickly rejected the idea based on the duration.Chuck Norris can kill two stones with one birdThe only time Chuck Norris was wrong was when he thought he had made a mistakeChuck Norris puts the "laughter" in "manslaughter".I've started running again, after several injuries had forced me to stop0 -

I think it's pretty interesting that this thread has been around for some time now, in a forum fill of (arguably) switched-on people, and actually there has been remarkably little practical information about how to avoid tax.

It just goes to show that between the standard schemes, and being a half-corporate, half-individual jet setter, there isn't much avoidance to be done.0 -

This is the UK governments own figures on VAT. Obviously from a few years ago, explained purely by my laziness rather than any expectation that it will have changed. These figures aren't contested, even by the people who have challenged the governments conclusion that VAT is regressive.

I don't know enough about the website taxresearch.org.uk to vouch for the validity of their claims but there analysis of the governments figures, the IFS case against them, and the issues with the IFS claims seems to match with my recollection of this from back then.

Given that you understand full well what progressive means it's disappointing that you continue to use poor proxies to define it here; though the second attempt is a considerable improvement.

Cheers, I'll have a dig to see what I can find out.

There are several grey areas in things like this, most notably are tax credits a tax reduction or a benefit...?

I am very surprised to see the poor paying a higher tax rate than the rich as that is in direct contravention of what I've read. I'm not saying it's incorrect and certainly not trying to imply bad faith on your part but it is very surprising.

I guess it could be true if you take wages before benefits but after tax. I struggle to see how the bottom quintile pay so much income tax even then. The bottom quintile earn very little, almost nothing before benefits.0 -

princeofpounds wrote: »I think it's pretty interesting that this thread has been around for some time now, in a forum fill of (arguably) switched-on people, and actually there has been remarkably little practical information about how to avoid tax.

It just goes to show that between the standard schemes, and being a half-corporate, half-individual jet setter, there isn't much avoidance to be done.

Indeed.

Despite the frequent protestations of some to the contrary it's actually pretty hard to avoid paying tax.

You can do a bit with structuring disposals to maximise allowances, or distributing assets/income amongst family members, but that's about it.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I am very surprised to see the poor paying a higher tax rate than the rich as that is in direct contravention of what I've read. I'm not saying it's incorrect and certainly not trying to imply bad faith on your part but it is very surprising..

The key component is indirect taxes.

Does this includes all the taxes deliberately designed to make things extortionately expensive in the hope of changing behaviours, such as cigarettes, alcohol, fuel duty, etc?

If so then it's little surprise they make up such a large component of low income earners budgets?“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »The key component is indirect taxes.

Does this includes all the taxes deliberately designed to make things extortionately expensive in the hope of changing behaviours, such as cigarettes, alcohol, fuel duty, etc?

If so then it's little surprise they make up such a large component of low income earners budgets?

Yes, exactly. I also don't think it's an incredibly meaningful view on taxes to chart them as a percentage of income, but then also not chart the percentage of tax take as a whole.0 -

HAMISH_MCTAVISH wrote: »The key component is indirect taxes.

Does this includes all the taxes deliberately designed to make things extortionately expensive in the hope of changing behaviours, such as cigarettes, alcohol, fuel duty, etc?

If so then it's little surprise they make up such a large component of low income earners budgets?

In a lot of ways the picture is more complex than one picture can demonstrate. Clearly it is based on the correct definition of taxation (and thus ignores benefits). However even if that assumption was contentious it's irrelevant to my point: VAT is regressive.

Hamish has nicely summarised a major reason why the graph looks that way (duty designed as a disincentive to consume).

I'm inclined to the view that our overall tax/benefit system is broadly progressive even if I'm less sure at the higher levels; but again, this doesn't mean that we should make changes to make it less progressive.Having a signature removed for mentioning the removal of a previous signature. Blackwhite bellyfeel double plus good...0 -

Yes, exactly. I also don't think it's an incredibly meaningful view on taxes to chart them as a percentage of income, but then also not chart the percentage of tax take as a whole.

If you're talking about whether a tax system is progressive or not then it's only meaningful to talk about it as a proportion of income as that's exactly what the terms progressive/regressive are talking about.

I doubt anyone seriously contests that most tax is paid by the small proportion of the population who have the highest incomes.Having a signature removed for mentioning the removal of a previous signature. Blackwhite bellyfeel double plus good...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards