We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Why not annuitise now?

Comments

-

chucknorris wrote: »That's what I thought, I know my approach might be far too simplistic, but I thought drawing down would be better value. We don't have a problem with running out of money, in fact, we have the opposite problem, we'll probably die before it is all spent (we don't have children).

well, if you have comfortably more capital than you will need to support your retirement, then there either drawdown or annuitization will work fine. i.e. if an index-linked annuity would give you enough income, then probably so will drawdown using a low % withdrawal rate.

it is when someone has barely enough for their intended spending that using drawdown can be dangerous. though the danger can be mitigated if

a) a cash buffer is used to allow a pause in drawing from investments when they're down;

b) there is a sensible mix of investments - that means a significant % in bonds - all equities is asking for trouble, at least unless the withdrawal rate is very low;

c) spending is flexible, i.e. there is nice-to-have expenditure which could be cut if investments do badly.

incidentally, if your aim is to spend it before you go, then buying an annuity at some stage is a great way to do this. though you could start using drawdown, and only annuitize when you're well into your 70s.0 -

Annuity rates aren't exactly generous at the moment.

Nor are investment returns and cash interest rates. However, annuity rate of say 6% guaranteed for life is better than a 3% drawdown.

I am wary of being seen to push the annuity option and I am not. However, it is important that people do not lose sight of the risks of drawdown if they take unsustainable amounts.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Nor are investment returns and cash interest rates. However, annuity rate of say 6% guaranteed for life is better than a 3% drawdown.

I am wary of being seen to push the annuity option and I am not. However, it is important that people do not lose sight of the risks of drawdown if they take unsustainable amounts.

6%? Is that from around 70? Less if you want a surviving spouses pension?

All adds to the drawdown then annuity idea (if you can).0 -

chucknorris wrote: »Can you please elaborate? What problems can you foresee?

The assumption that other investments are safe, i.e. buy a company share and it will be paying increasing dividends for the next 30 years. Risk covers a wide spectrum. Political, technological, financial, loss of key management, loss of key customers/contracts , the list goes on. In essence people are over confident in their own ability.

Pooled risk was created for good reason. Every man to himself will merely cause more volatility.0 -

As discussed here several times - shop around as well - look at annuity discount brokers too and get quotes from several places, including IFA's, and go with the best deal. It's one of the biggest purchases of your life - don't just get one quote.BoothBarber wrote: »Thanks DunstonH, great answers.

Yes, I planned to buy through an IFA rather than H-L.

Where are you based?0 -

I like the idea of an annuity as reverse death insurance with pooled risk. As with all insurance the question is how much would I pay to prevent the impact of an event, where here the event is running out of money before death or being constrained on drawdown. Personally, maybe 5%. But from what I've read, mostly US based, you only get out 70-90% back, so are paying 10-30% for protection against an approx 5% eventuality. Not too different from the rest of the insurance industry. Maybe by the time I retire there will be very low fee (ie overhead) options. Not holding my breath - I hold very little non compulsory insurance for the same reason.0

-

An advantage of buying index-linked annuities rather than continuing drawdown is that as you get older, and potentially prone to muddle (aka "cognitive decline"), the annuities need no management.

Probably a minor point, but if you go into drawdown (and don't !!!! it up the wall) you are quite at liberty to buy an annuity at age 80 or 85 or whenever you start to feel you can't be bothered any more. You'll get a much higher rate at this age.

Inflation-linked annuities are generally very poor value as it takes years before the increases make up for the lower income initially. And most people get more value out of income earlier in life, when they are younger and more active.

Plus the risk of being left in poverty by inflation is much lower than you'd think, because most people will have a State Pension which is index-linked (better, at the moment). For most low and middle earners, inflation on basic essentials will be covered by increases in the State Pension, and inflation on discretionary and luxury spending will be counteracted by taking fewer holidays etc as they get older.0 -

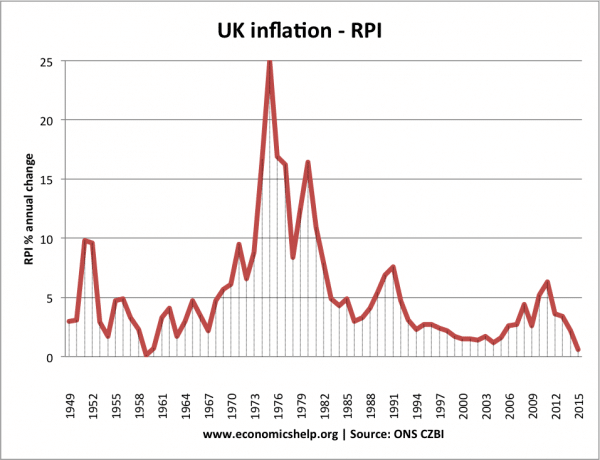

In times of low inflation that is true but who can guarantee that we wont return to the high inflation rates of the not that long ago.the risk of being left in poverty by inflation is much lower than you'd think,

Remember this:-

It doesnt take many years of double digit inflation to totally derail future plans. Lots of DB schemes (private sector schemes) cap their inflation proofing at 5% or 2.5% as well.0 -

Malthusian wrote: ».......

Inflation-linked annuities are generally very poor value as it takes years before the increases make up for the lower income initially. And most people get more value out of income earlier in life, when they are younger and more active.

Plus the risk of being left in poverty by inflation is much lower than you'd think, because most people will have a State Pension which is index-linked (better, at the moment). For most low and middle earners, inflation on basic essentials will be covered by increases in the State Pension, and inflation on discretionary and luxury spending will be counteracted by taking fewer holidays etc as they get older.

Inflation linked annuities are poor value at current very low inflation rates. What if inflation rates return to the 15% of 35 years ago? Perhaps an initially small annuity with a large fixed annual increase could be worth looking into as it could be very useful insurance should you reach extreme old age and would benefit from extra or better care.

It seems dangerous to me to plan on the assumption that costs will significantly decrease as you get older.0 -

Is it possible to buy an impaired life purchased life annuity?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards