We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mortgage Overpayments

Horizon81

Posts: 1,594 Forumite

My mortgage provider states the following, regarding overpayments:

Overpayments of up to £499.99 will be applied to your mortgage account on the day of receipt. This will reduce your balance and we will recalculate your interest in line with your account terms and conditions, your monthly repayments will remain the same. If you overpay by more than £500 your monthly repayment will be recalculated, however you will also have the option to have your mortgage term recalculated.

I'm struggling to understand the bit in bold which applies if you make a sub £500 payment. It says the monthly repayments will remain the same but at the same time the interest will reduce which means you're paying more per month off the capital. So... why doesn't it say that the term will reduce?

It only talks about the term reducing if you overpay by over £500.

Overpayments of up to £499.99 will be applied to your mortgage account on the day of receipt. This will reduce your balance and we will recalculate your interest in line with your account terms and conditions, your monthly repayments will remain the same. If you overpay by more than £500 your monthly repayment will be recalculated, however you will also have the option to have your mortgage term recalculated.

I'm struggling to understand the bit in bold which applies if you make a sub £500 payment. It says the monthly repayments will remain the same but at the same time the interest will reduce which means you're paying more per month off the capital. So... why doesn't it say that the term will reduce?

It only talks about the term reducing if you overpay by over £500.

0

Comments

-

So... why doesn't it say that the term will reduce?

It only talks about the term reducing if you overpay by over £500.

Mine is similar (Nationwide) it says that any payment below £500 basically they don't really do anything about it, so your regular payments stay the same, but you are reducing the capital by more than you would have been so the term of the mortgage will be being reduced as you'll pay it off sooner.

I think yours probably works exactly the same as that they're just phrasing it in a weird way. They just mean that they will recalculate the interest based on the new reduced balance rather than on the basis that you're just making the regular payment. As in if you would have paid £100 of interest that month, you may have reduce it with your overpayment to £98 or whatever. That's what they mean by recalculating interest. (I assume)

If you pay over £500 then they would then lower your regular payment, unless you have told them, through your internet banking if you have the option to set it there, or by contacting them some other way to let them know that you want the TERM to reduce not your regular payment.

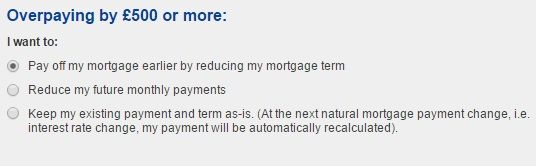

This is what the options look like on my internet bank page when you click on overpaymentsMortgage remaining: £42,260 of £77,000 (2.59% til 03/18 - 2.09% til 03/23)

Savings target June 18 - £22,281.99 / £25,0000 -

It will effectively reduce the term if you continued to pay the £499.99 every month you'd finish your mortgage much sooner. It just doesn't contractually reduce the term.

If you pay more than £500 they'll recalculate your regular monthly payments (lower) but really it makes no difference.

If you have the ability to overpay more than the £499.99 per month I suggest paying the £499.99 and putting any additional into a savings account. Then when you come to the end of your current fixed rate, overpay off a lump sum before remortgaging or changing deals.

Either way, overpaying is going to reduce the time it takes to pay off the mortgage whether the contractual term is changed or not.0 -

Freddie, I assume you have both a bank account and mortgage with Nationwide? My provider doesn't seem to offer online accounts for mortgage holders.

I seem to remember Martin saying it's best to pay off the capital, and keep the monthly repayment the same, but also keep the term the same, so that you can switch to paying lower monthly repayments if need be. To me this is probably a bit over cautious, I think I'll go down the route of overpaying and recalculating the term, providing of course that this does not hit any overpayment thresholds.0 -

If you have the ability to overpay more than the £499.99 per month I suggest paying the £499.99 and putting any additional into a savings account.

Surely if the OP has the ability to overpay by more than £499.99 then they should in fact overpay by as much as they can afford as early as they can.

If it's an issue with the bank then it's just a case of contacting them and saying "From now on I want any overpayments I make over £500 to reduce the term of my mortgage, keep my regular payment the same please".

Unless the OP is on an amazingly low rate then it is unlikely that they will get a better return by putting money into savings rather than overpaying on their mortgage.

So long as they have enough left over to cover all outgoings and have enough money remaining to act as a cushion (as well as having a decent emergency fund in the bank) and are otherwise financially secure, then they should overpay by as much as they can as soon as they can.

Need to check overpayment limit obviously.

But if the OP, say, pays £499.99 a month, and saves £300 a month on top of that in a savings account to pay off as a lump sum at the end as you suggest, then they will have paid more in interest to their mortgage provider then if they'd just paid £799.99 a month.

If you're planning on overpaying your mortgage then do the max you can as soon as you can. I for instance have scrapped my monthly standing charge overpayment to my mortgage account and instead paid all of my remaining overpayment allowance in one go. I will now save up (since im not overpaying again until April) and do the same at the start of the next year.Mortgage remaining: £42,260 of £77,000 (2.59% til 03/18 - 2.09% til 03/23)

Savings target June 18 - £22,281.99 / £25,0000 -

Freddie, I assume you have both a bank account and mortgage with Nationwide? My provider doesn't seem to offer online accounts for mortgage holders.

I seem to remember Martin saying it's best to pay off the capital, and keep the monthly repayment the same, but also keep the term the same, so that you can switch to paying lower monthly repayments if need be. To me this is probably a bit over cautious, I think I'll go down the route of overpaying and recalculating the term, providing of course that this does not hit any overpayment thresholds.

Sounds good to me.

Yes I do have an account as well, it was actually a requirement for getting the mortgage we wanted, 4 year fix at 2.59%. Which was good at the time although I now see they've gone down as low as 2% for 4 years! I hope rates are still low when we come out of our fix.

I'm hoping our next fix might last until the end of our mortgage if we're able to keep overpaying

I think we could still negotiate lower payments if we wanted to. Our term is still down as the same online at least anyway.Mortgage remaining: £42,260 of £77,000 (2.59% til 03/18 - 2.09% til 03/23)

Savings target June 18 - £22,281.99 / £25,0000 -

FreddieFrugal wrote: »Surely if the OP has the ability to overpay by more than £499.99 then they should in fact overpay by as much as they can afford as early as they can.

If it's an issue with the bank then it's just a case of contacting them and saying "From now on I want any overpayments I make over £500 to reduce the term of my mortgage, keep my regular payment the same please".

Unless the OP is on an amazingly low rate then it is unlikely that they will get a better return by putting money into savings rather than overpaying on their mortgage.

So long as they have enough left over to cover all outgoings and have enough money remaining to act as a cushion (as well as having a decent emergency fund in the bank) and are otherwise financially secure, then they should overpay by as much as they can as soon as they can.

Need to check overpayment limit obviously.

But if the OP, say, pays £499.99 a month, and saves £300 a month on top of that in a savings account to pay off as a lump sum at the end as you suggest, then they will have paid more in interest to their mortgage provider then if they'd just paid £799.99 a month.

If you're planning on overpaying your mortgage then do the max you can as soon as you can. I for instance have scrapped my monthly standing charge overpayment to my mortgage account and instead paid all of my remaining overpayment allowance in one go. I will now save up (since im not overpaying again until April) and do the same at the start of the next year.

For example, my mortgage interest rate is 2.19%. I can get 6% on £300 per month with first direct, 5% on £2000 with TSB and 3% on up to £20k with Santander.

The additional benefit of not overpaying it all of the mortgage ensures I have a nice pot set aside should anything happen.0 -

For example, my mortgage interest rate is 2.19%. I can get 6% on £300 per month with first direct, 5% on £2000 with TSB and 3% on up to £20k with Santander.

The additional benefit of not overpaying it all of the mortgage ensures I have a nice pot set aside should anything happen.

If you've got high interest accounts great, however I'd still rather reduce the debt to the lowest level possible before our fix ends in case the interest rates go up. If they do mortgages will rise a lot faster than interest rates on accounts will.

We also have a reasonable pot, if we didn't I wouldn't be overpaying.

But we filled all of our decent return accounts months ago, so rather than filling up the rubbish 1%-1.5% ones, we're piping it all into the mortgage, since we can only overpay by £7,700 a year anyway.

Since our mortgage rate is 2.59% and Santander 3% (-tax) is 2.4%, we're better off doing that rather than opening another account.

But I'm not saying that's the right thing for everyone. Since everyone is in a completely different financial position and even if paying off the mortgage may save money in the long term, you need long term financial stability, so yes fill up the pot to level suitable for your needs before thinking of overpayingMortgage remaining: £42,260 of £77,000 (2.59% til 03/18 - 2.09% til 03/23)

Savings target June 18 - £22,281.99 / £25,0000 -

FreddieFrugal wrote: »If you've got high interest accounts great, however I'd still rather reduce the debt to the lowest level possible before our fix ends in case the interest rates go up. If they do mortgages will rise a lot faster than interest rates on accounts will.

We've filled all of our decent return accounts, so rather than filling up the rubbish 1%-1.5% ones, we've piping it all into the mortgage.

I agree but if you have the money available to make the overpayment when the term ends to reduce your overall loan/LTV then you're no worse off. However you have the benefit of having that extra money available should one of you fall ill or lose your job.

Horses for courses 0

0 -

I agree but if you have the money available to make the overpayment when the term ends to reduce your overall loan/LTV then you're no worse off. However you have the benefit of having that extra money available should one of you fall ill or lose your job.

Horses for courses

Indeed,

Say you have a £100,000 mortgage on 3% fixed for 4 years. If you pay off £10,000 at the start of each year (max overpayment) and then just pay the regular payment each month, then at the end of the 4 years your mortgage balance would be

£41,259.79 (Overpaying max annually)

If instead you paid off £10,000 but split over 12 monthly payments, then at the end of the 4 years the balance would be:

£41,846.53 (overpaying max monthly)

So you save an additional £586.74 in interest by paying off in one big chunk at the start, rather than paying monthly.

If you save up the same amount (I based it on putting £300 into a 6% and 588 into a 3% based on your suggestions) then by the end of the 4 years the balance would be:

£73,293.40 (not overpaying)

However your savings would be £42,453.64 - pay that into mortgage and your balance would be:

£30,839.76 (EDIT please see post no 12 below as I spotted something wrong with the comparison)

SO indeed you could be better off saving. But only if your savings rate is higher than your mortgage rate. Of course banks can change interest rates on their accounts whenever they like. We got the Lloyds accounts that paid 3% on £5000 but only 3 months after getting them they changed to just being 1.5% or something stupid making them basically useless as we already had a normal savings account with that rate.

Since I spent so long doing figures on spreadsheets I thought I might as well share them:rotfl:Mortgage remaining: £42,260 of £77,000 (2.59% til 03/18 - 2.09% til 03/23)

Savings target June 18 - £22,281.99 / £25,0000 -

The term is decided by how much you pay not the contractual term.

All that having a shorter contractual term does is commit you to a higher payment.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards