We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Motivation Required

autumn2012_2

Posts: 223 Forumite

I have been getting a hold on my debt since April (LBM £24k) and it currently stands at just above 22k. I have cut back alot and increased my income which has allowed me to get a hold on it (it was starting to spiral) however now I find myself slipping back into old habits (buying takeaways, booking holidays) I have a spreadsheet which I update every month. All of our CC debt (5500) is 0% and everything else is fixed repayments. I just need some motivation as I do not want to start adding to my debt again. Iv done alot of hard work to get here and dont want that to be undone.

0

Comments

-

Hi,

I am exactly the same, I find it very hard to stick to a plan long term.

I find that two main things keep me on track and full of determination.

1) - Debt Free Diary.

I update daily my Debt Free Diary here on MSE.

Being accountable to posting on the diary everyday is amazing, if I am having a wobble or thinking of buying something I really cannot afford I post it on my diary and the lovely folk here will give me their advice and sometimes a well deserved kick up the bum

2). Dave Ramsey

I have downloaded the Dave Ramsey app on my Iphone and I listen to his podcast every day.

Each day he has three hours of financial debt busting chat from callers. Admittedly a percentage of it isn't that relevant, mostly the savings parts as he is based in America, but the debt busting advice is relevant and he also has families coming on air to do "Debt free screams" which are totally inspiring and keep me on the straight and narrow.

As a last comment, I also use YNAB (You need a Budget) as my software budget programme. I used Excel spreadsheets for years and never got anywhere with my debt. Using YNAB, keeping a diary on MSE and listening to Dave Ramsey are the key things that keep me going.

Not going to work for everyone I agree but worth considering. xxxx

Keep going, and remember if you fall off, just climb back on again. You will get there xx0 -

Thank you! I try to keep diaries but I can never religiously stick to it. Im now starting to think of christmas and trying to tell myself that my children are only very small and do not go overboard but I just cant help it! Ill feel awful if I dont as other parents will be buying loads but I say ''no its too expensive, they will be happy with just a few toys etc'' but then Ill buy anyway. Iv cancelled 4 CC since april so Im doing well but I cant feel myself going back to my old ways0

-

Autumn- the most worrying thing you just said is 'I can't help it' if you can't, who can? YOU have the power to address this situation and YOU have to belive that.

If having a big Christmas is important to you then start planning now. Make a list of what you want to buy your children and get comparison shopping now. If Christmas is so important then where can you cut back to the bone to make it the event you want it to be?

Also, don't compare your situation to others. Please! As Dave Ramsey says 'don't try to keep up with the Joneses, they are broke!'

Sorry for the tough love but you need it!" Your vibe attracts your tribe":D

Debt neutral 27/03/17 from £40k:eek: in the hole 2012.

27/03/17 from £40k:eek: in the hole 2012.

Roadkill 17 £56.58 2016-£62.28 2015- £84.20)

RYSAW17 £1900 2016 £2,535.16 2015 £1027.200 -

I know you're right! Christmas isnt important to be honest but I do try to keep up with the Jones's ! Im terrible for it. I have cut back alot on things IE buying my clothes online and second hand etc instead of going out and buying new, same with the kids. I need to be strict with myself. I leave cards at home etc. I really want to be debt free!! I went for a meal the other night which was £53 and when I was driving home I felt awful about spending it when I could of cooked a meal for four for £5. I wish my husband was more strict with me0

-

As you can see from my signature I had quite a lot of debt and am nearly at the end, the only thing I can say is that nothing feels as amazing as being able to pay cash for something I need (notice need NOT want! that was a lesson learnt lol). Also having cash at the end of the month rather than being in my O/D, and having the choices that you just dont have when you are in debt. You need to find your own motivation but I found it was easier once the balances started to go down and I could close accounts.

Good luck with your journeyAugust 2010 debt amount £41596

August 2015 debt £2598

Target DFD [STRIKE]October 2015 [/STRIKE] Amended this to May 2016 :j

Mortgage free date: January 2015 :j

Savings goal. £3400 / £13372 :T0 -

One other thing I have done is to make a list of the things I can't do at the moment because of my debt, things I have had to say no to because I am too broke and then stick that somewhere where you will see it often.

Fridge, wardrobe door...I have mine in the front page of my diary.

Here's what mine say:-

REASONS NOT TO SPEND

I NEED TO BE DEBT FREE :-

1) Free up £1000 per month

2) We can have family holidays

3) Finish House Renovations

4) Replace our old car

5) Financial security

6) No more sleepless nights

7) Stop being afraid of the phone / Postman

8) Be able to say yes to invitations for meals, nights out, short breaks away.

10) Be able to have a fully funded Emergency fund so not more MOT panics etc.

If I am having a wobble this is what reminds me of the pain and stress I was in 18 months ago and why I need to stay on track and NEVER go back there again.

xxxx0 -

Thanks guys :-) - Im glad this forum is here! I totalled up July food bill (my months start 15th as hubby pay day) and im disgusted to say 220 was on shopping and 260 was on takeaways and meals out! Iv set myself a challenge for August to be takeaway and meal out free as this 260 could go straight off a CC!0

-

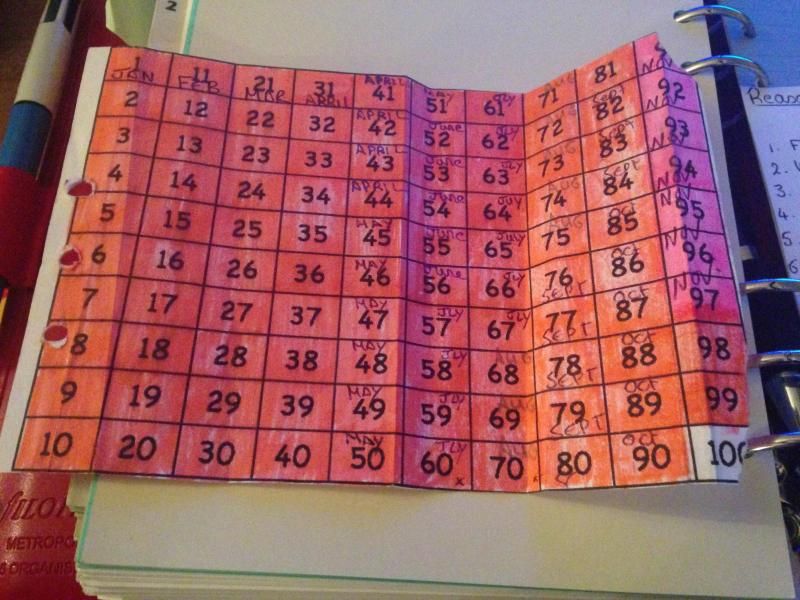

You are going to be fed up of me, but here is another thing I use to keep me on track

Its the 100 chart.

My debt target for last year was to pay off 10k, so everytime I paid off £100 I coloured in a box. This is hard proof that you are making headway and achieving your goal.

I am a real geek but I had so much fun colouring in those squares.

I am working on another one this year to pay off my final 10k. 60% (60 squares are currently coloured in

0

0 -

What a great visual aid StressedSteph! Wish I had thought of that when I started, I could probably wallpaper most of my house with the filled out ones !!August 2010 debt amount £41596

August 2015 debt £2598

Target DFD [STRIKE]October 2015 [/STRIKE] Amended this to May 2016 :j

Mortgage free date: January 2015 :j

Savings goal. £3400 / £13372 :T0 -

autumn2012 wrote: »Thanks guys :-) - Im glad this forum is here! I totalled up July food bill (my months start 15th as hubby pay day) and im disgusted to say 220 was on shopping and 260 was on takeaways and meals out! Iv set myself a challenge for August to be takeaway and meal out free as this 260 could go straight off a CC!

Rather than going completely cold turkey, why not budget for an occasional takeaway or meal out as a treat? That way you have something to look forward to without feeling guilty and are still chucking money at the debt. My occasional meals out tend to come courtesy of groupon or with money off vouchers.

When you say you wish your husband would be stricter, is the debt a joint one or just yours? Are you in the debt busting together?All shall be well, and all shall be well, and all manner of things shall be well.

Pedant alert - it's could have, not could of.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards