We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Rental half mortgage costs in Sydney ?

Comments

-

#4 is the biggie for me.

The RBA have said that the investor loan book can't grow by > 10% pa for a bank. As a result the Big 4 banks have announced rate increases for investor (BTL) loans and AMP, the number 5 bank, has stopped lending to investors altogether. Presumably AMP has already increased their book by 10% this year.

You can bet that the Big 4 are also tightening up loan criteria. Presumably there has to come a point where the Sydney market is so bubbly that the mere act of wanting to buy into it disqualifies you from getting a loan! Goodness only knows where that point is though.0 -

really insanely low [e.g. rental yields being half the level of mortgage interest rates would certainly qualify as insane] rental yields are always, always a sign of a bubble.

but I don't think that there's any suggestion that Sydney yields are nearly as bad as all this - they've nudged down to about 3%, right, frothy for sure but hardly another tulipmania, not by a long chalk?

the only sense in which "half mortgage costs" is true is presumably if you compare rents with a repayment mortgage that includes an interest rate fix? like I said, decidedly frothy but not insane.FACT.0 -

houses now act as index linked perpetual bonds (after management costs)

why should an investor lend to osborn at 1.5% nominal for 10 years when he can buy a house and get 4% post cost index linked for 10 years

there is some additional political risk but there is also some possible political gain (eg councils giving out too few stamps for new builds, lots of immigration etc)

so its no surprise that houses are being valued effectively on its coupon.

Prices in London are ~3x higher than Birmingham because rents are ~3x as high0 -

the_flying_pig wrote: »but I don't think that there's any suggestion that Sydney yields are nearly as bad as all this - they've nudged down to about 3%, right, frothy for sure but hardly another tulipmania, not by a long chalk?

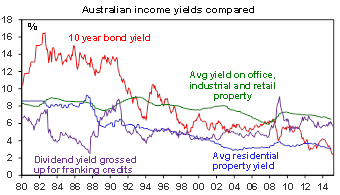

Yields in Sydney are pretty bad... hmmm getting worse.

There are also a lot of vacant homes... Melbourne has now a huge problem with those!

Though when you start to see things like this:

It's a bit of a worry! The house is earning more than the occupants!!!0 -

Another thing dragging the prices up in Australia is the obsession with 'Auctions'. Keep selling like that and the price will keep going up and up!0

-

I think investors haven't quite figured it out here yet.

I can't really figure out why anyone would buy a house in Australia when renting is far cheaper but the buyers are there ready to pay over the odds for a property then rent it out for half of what they are paying in interest on a mortgage. It really doesn't make sense to me. Average house price in the Sydney region now exceeds £1,000,000. Crazy prices....and there's insufficient skilled work available in country towns so you have to work in a city and if you have to work there you've got to live there and pay the high prices.

AU$1,000,000 not £1,000,000.

There is a big difference.0 -

remorseless wrote: »Yields in Sydney are pretty bad... hmmm getting worse.

So your graph shows that following a long period when residential property yields were lower than 10 year govt bond yields suggesting property was overvalued, now the situation is reversed suggesting property is no longer overvalued.....

Presumably the only reason in the past that people were willing to accept such low yields on property compared to gilts was the expectation of capital gains. Now it is reasonable to invest in property purely on yield.

(Although of course it probably makes most sense to compare property with an undated bond rather than just a 10 year as whilst the asset can be sold it never actually gets a principal payment)I think....0 -

So you graph shows that following a long period when residential property yields were lower than 10 year govt bond yields suggesting property was overvalued, now the situation is reversed suggesting property is no loger overvalued.....

wow, I got to say I did not read it that way at all :rotfl: I was just looking at the pretty chart!

Some research were saying that Australian Properties are still 30% undervalued so no chance that there is a bubble yet!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards