We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Green, ethical, energy issues in the news

Comments

-

Swan_Valley said:

River Weaver hydroelectric plant planned for Dutton Sluice

PLANS for a hydroelectric plant along the River Weaver near Dutton Lock have been submitted to Cheshire West and Chester Council.

Adjacent to Dutton Sluice, a Grade II-listed property, the proposed Archimedean screw could generate up to 900MWh of renewable energy each year, saving 514 tonnes of CO2. The scheme has an anticipated 60 year-plus lifespan.

The plans explain how water will pass through an Archimedean screw adjacent to the sluice gate on the southern bank of the river, with flow controlled by an automatic sluice gate.More info herePS. Only just seen this. However, it was from 2018! Will try to find out if it got approval & is now installed.PSS. Appears that construction has started https://canalrivertrust.org.uk/notices/19713-dutton-hep-scheme-river-weaver

I was surprised to find there is an Archimedean screw generator in the heart of Exeter, installed in a former mill building on The Quay.

4 -

Chris Goodall's Carbon Commentary newsletter:

[Quick note on 9 + 10, which is something I've mentioned before, and I think others have chatted about, where H2 can be used as a form of excess RE storage, with the existing gas generation fleet then being used to demand follow, much as it is today, but burning green H2 rather than FF gas.]Things I noticed and thought were interesting

Week ending 20th February 2022

1, Bank lending to oil. Nordea, the biggest bank in the Nordic region, said it would cease all lending to offshore oil and gas. (Of course other banks continue to pump money in). It currently has a €1bn portfolio of assets in this sector, although it has cut back new lending in recent years. Nordea also said it expected to devote more of its financing to the energy transition, writing that it foresees a near fourfold increase in lending needs between now and 2025. The bank also indicated that the percentage of its personal customers expressing an interest in sustainability in their investment preferences had nearly doubled between 2019 and 2021.

2, Electric cars. With a 3% share in 2021, EVs still represent a small portion of US automobile sales. This is a much lower figure than European markets where pure battery cars took over 10% of sales last year and plug-in hybrids achieved a similar percentage of the market. But, in a sign of the future direction of US sales, EVs were featured in most of the car advertisements carried on the TV during the SuperBowl. A car comparison site noted that of the seven automakers which produced advertisements for the game, six featured EVs. And a recent study showed that there were four times as many ads for EVs on US television in 2021 as there were in 2019.

3, Waste to fuels. A proposed plant near Porto in Portugal will take the CO2 arising from the rotting of organic waste and combine it with hydrogen to make 100,000 tonnes of aviation fuel a year. This is one of a number of such possible refineries in Europe and is approximately the same size as the Engie/Infinium plant in Dunkerque mentioned in a recent newsletter. The rapid growth in interest in synthetic fuels is encouraging but our enthusiasm should be limited. One of the backers of the Portugal plant said that it ‘provides a unique solution for the simultaneous decarbonization of waste management and air travel.’ Nonsense. It decarbonises one activity, not two. The carbon dioxide still ends up in the atmosphere after being burnt in the jet engine. (Thanks to Afonso Vieira)

4, Heavy trucks. A study forecasts that heavy goods vehicles powered by batteries will see a 40% decrease in costs by 2030. Almost all of this reduction will come from lower battery prices. Fuel cell trucks will see a smaller decline of approximately 23%. Large battery trucks in 2030 will be comparable in cost to diesel trucks today and the daily operating costs will be very much lower. Sales of heavy duty electric trucks are still low but growing rapidly with Volvo controlling a large share. 746 electric vehicles of more than 16 tonnes were sold in Europe in 2021, almost triple the level of the previous year.

5, Solar over water. Solar PV benefits from being installed on water or just above. In hot countries temperatures are cooler there because of evaporation, raising the productivity of PV panels. California has about 6,850 kilometres of irrigation canal. Research recently suggested that profitability of solar would be higher over these canals than on adjacent land because of lower temperatures, despite the higher installation costs. PV will also reduce costly evaporation in a water-short region. The study estimated water savings sufficient to irrigate 20,000 hectares, about half a percent of California’s total farmland. Covering all the state’s irrigation canals could produce as much as 13 GW of solar PV, about equivalent to all the panels now installed in the UK. And air pollution would be significantly reduced by using the electricity instead of the diesel generators that now pump the water onto farmland. The first panels will now be installed over canals to test these research results, funded by $20m from California. Good to see academic work so quickly translated into action. (Thanks to Mark Oliver).

6, Synthetic materials. Rubi Labs in California is an early-stage company that makes a replacement for cellulose, a key material for use in clothing. The business says it will use captured CO2 and pass it through an enzyme to make long chain molecules. Although high concentrations of carbon dioxide are preferred, such as those derived from cement processing, we’re told that very low densities will work. Conventional routes to making cellulose require extensive chemical processing of wood pulp. Rubi Labs raised a small round of less than $5m but expects to be able to demonstrate its first products in the next weeks. If the idea works, this business could be an important part of the huge changes needed in the fashion industry.

7, Hydrogen hub in Spain. The country’s ambitions to lead Europe in green hydrogen took a step forward with the announcement of a plan to install 9.5 GW of solar power and 7.4 GW of electrolysers in a region of northern Spain. For comparison, Spain has about 15 GW of solar PV today and the world’s electrolyser capacity is less than 1 GW. The H2 will be used at industrial sites making steel, fertilisers, ammonia and other energy-intensive products. The substantial consortium backing the project says its scheme will reduce Spain’s emissions by 4%. The hydrogen produced -around 350,000 tonnes a year - will provide about 0.5% of current world needs.

8, ‘Urban mining’. A property developer in London bought second-hand steel from the demolition of an office block. It will reuse this material for the refurbishment of a nearby 19th century warehouse and its conversion into offices. Although much steel is recycled, I think this is one of the first attempts to use existing metal without melting it down. The quantity is small – only 139 tonnes – but this seems an important step. The magazine writing about the scheme said that this was an example of ‘urban mining’ and the developer was ‘reclaiming materials from existing developments in order to reduce the embodied carbon in its schemes.’ The new building will also be one of the first in the UK to have a small ‘forest’ on its roof.

9, Hydrogen distribution. SoCalGas, the largest US natural gas distribution company with nearly 22 million consumers, announced a proposal to build the country’s largest hydrogen network. The details were sketchy, and no date was promised, but the plan involves new pipelines taking hydrogen from production sites to large customers in the Los Angeles region. The company says it envisages substituting hydrogen for 25% of its natural gas, a strikingly large percentage. It will use ‘25-35 GW’ of wind and solar power, including capacity curtailed from delivering into the electricity grid and ‘10-20 GW’ of electrolysers. It promises that the proposed network would allow 4 gas fired power stations to be converted to hydrogen combustion. As in note 7, the scale of these ambitions compared to the level of current renewables and hydrogen installations is impressive.

10, Hydrogen for handling variability in electricity supply. I wrote an article on why the UK and other wind-rich countries need to plan to use hydrogen as a storage medium for electricity. The last months have seen huge variations in the supply of wind power with a long period of low speeds followed recently by unprecedentedly high production from turbines. I suggest that hydrogen is the best way of providing an energy source that can precisely complement renewable power, particularly in high latitude countries with profound seasonal differences in the supply and demand for electricity. I briefly discuss the main obstacles to building a 100% renewables plus hydrogen energy economy: electrolyser shortages, the capacity of salt caverns to store seasonal power surpluses in the form of H2 and whether turbines can run on hydrogen rather than natural gas. In my view hydrogen isn’t going to get much used for road transport, but it is enormously important as the complement to intermittent renewables (as SoCalGas implicitly suggests in note 9).

Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.3 -

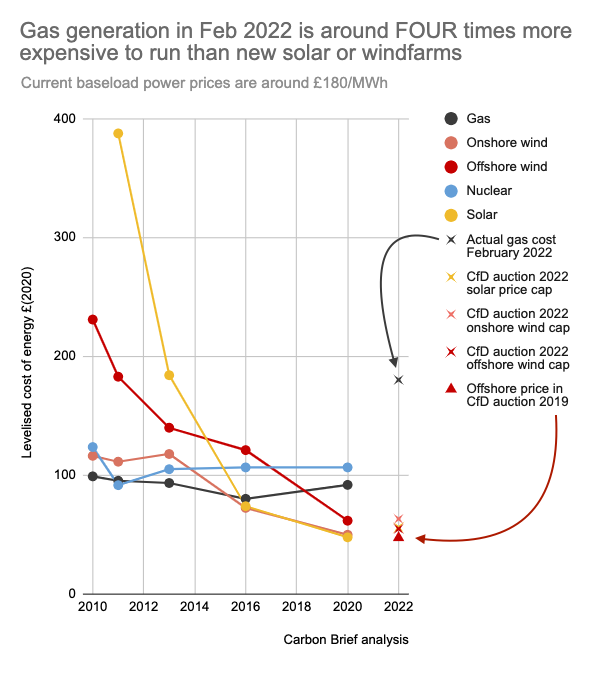

Strange post, but bear with me, saw this twitter post being referred to on some international RE news sites, and thought it was worth a quick post as it not only shows the direction of travel for UK leccy RE generation costs, but also the eye-opening comparison to current gas costs.

I'll give a link to the twitter thread, and also the Carbon Brief article, which I seem to recall has been posted on here some time back.

Dr. Simon Evans - TwitterPssst! Solar is now 88% cheaper than thought a decade ago, UK govt says – half its estimated cost of new gas power Just running a gas plant in Feb 2022 is costing around FOUR times as much as we'd pay for new solar or windAnalysis: Cutting the ‘green crap’ has added £2.5bn to UK energy bills

Energy bills in the UK are nearly £2.5bn higher than they would have been if climate policies had not been scrapped over the past decade, Carbon Brief analysis shows.

The changes included gutting energy-efficiency subsidies, effectively banning onshore wind in England and scrapping the zero-carbon homes standard. They were introduced after a November 2013 Sun frontpage reported that then-prime minister David Cameron’s answer to rising energy bills was to “get rid of the green crap”, meaning to cut climate policies.

With UK energy bills set to rise by around 50% from current levels in April, the government is once again scrambling to find ways to mitigate the impact on struggling households.

Mart. Cardiff. 8.72 kWp PV systems (2.12 SSW 4.6 ESE & 2.0 WNW). 28kWh battery storage. Two A2A units for cleaner heating. Two BEV's for cleaner driving.

For general PV advice please see the PV FAQ thread on the Green & Ethical Board.5 -

Thanks. To me, that graph debunks the need for more gas and oil exploration/exploitation, that is currently being pushed.

It is difficult to argue it would even be useful as a short term fix as renewables (and storage) are likely to be quicker to deploy.3 -

Thanks, Martin, that thread encapsulates so much about where things are going right and wrong.Medium term storage semms to be a major missing pice from the puzzle. Periods of anticyclonic gloom, stalling both wind and solar, for potentially weeks at a time, in the highest demand season, is what needs to be tackled urgently, to mitigate the Achilles heel of RE.3

-

At the moment we are burning gas even when the wind is blowing a gale and the sun is out. In the medium term, I foresee that renewables would be used for the vast majority of time directly (i.e. a doubling of capacity). In this scenario, gas would be preserved for periods of stagnent gloom, which would significantly stretch out current reserves.Verdigris said:Thanks, Martin, that thread encapsulates so much about where things are going right and wrong.Medium term storage semms to be a major missing pice from the puzzle. Periods of anticyclonic gloom, stalling both wind and solar, for potentially weeks at a time, in the highest demand season, is what needs to be tackled urgently, to mitigate the Achilles heel of RE.

Biomass is often seen as the ugly sister of RE. Currently biomass energy is produced continuously. There is scope for the production of biomass energy to be co-incided with lean wind and solar periods by increasing biomass storage (either pre or post processed) and generation capacity. This only becomes viable when we have periods of excess RE.

... then there are also interconnects

All these things will become naturally more relevent as RE share increases.2 -

At the moment we are burning gas even when the wind is blowing a gale and the sun is outIt's worse than that, at the moment; a lot of the time they are burning coal, even when gas generation is down to less than 5 GW. I'm guessing that coal is temporarily cheaper than gas.

2 -

Verdigris said:At the moment we are burning gas even when the wind is blowing a gale and the sun is outIt's worse than that, at the moment; a lot of the time they are burning coal, even when gas generation is down to less than 5 GW. I'm guessing that coal is temporarily cheaper than gas.I think Drax co-fires coal with biomass, up to a certain maximum amount of coal per year.The map on page 9 of this DUKES document makes it look like we only have three coal-burning plants left operational?N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.4 -

Fascinating document. I'm much obliged to m'learned friend.Some interesting little trends like the traffic on the French interconnector not being a one-way import any more. I gather the Gallic Great Idea of going majority nuclear is going a bit runny, of late.3

-

I think the argument for UK produced gas is not the impact on prices (these are set internationally) but on the balance of payments and also on the amount of tax that could be raised to offset the impact of the high international price on consumers. IN theory as it wouldn't impact on the price we would still have the same strong price signal not to use gas if possible but would be better off in terms of UK PLC if there were more domestic gas produced.2nd_time_buyer said:Thanks. To me, that graph debunks the need for more gas and oil exploration/exploitation, that is currently being pushed.

It is difficult to argue it would even be useful as a short term fix as renewables (and storage) are likely to be quicker to deploy.I think....2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards