We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Help! I don't understand Tax Credits at all!

Evil_Olive

Posts: 324 Forumite

Hello there,

I became unemployed back in March last year and have been finding it very difficult to secure new permanent employment since. My husband had to change jobs just over a year ago for medical reasons and his yearly salary before tax has almost halved

At present we are both living off his salary plus partial housing/council tax benefit so we applied for Tax Credits for the first time ever in December last year.

I'm usually quite good at this sort of thing but it's really got me stumped - I don't understand it at all.

I'm a bit stressed at the moment and it's highly likely that I've mis-read something, not fully read something or made some classic schoolboy error - please be kind - I think I need someone to just explain it all to me in words of one syllable :-/

I'm going to phone them myself but, as we don't have a landline in our flat it costs a fortune so I was hoping for a bit of enlightenment from you lot before I do, so that I can be a bit more efficient with the questions I ask.

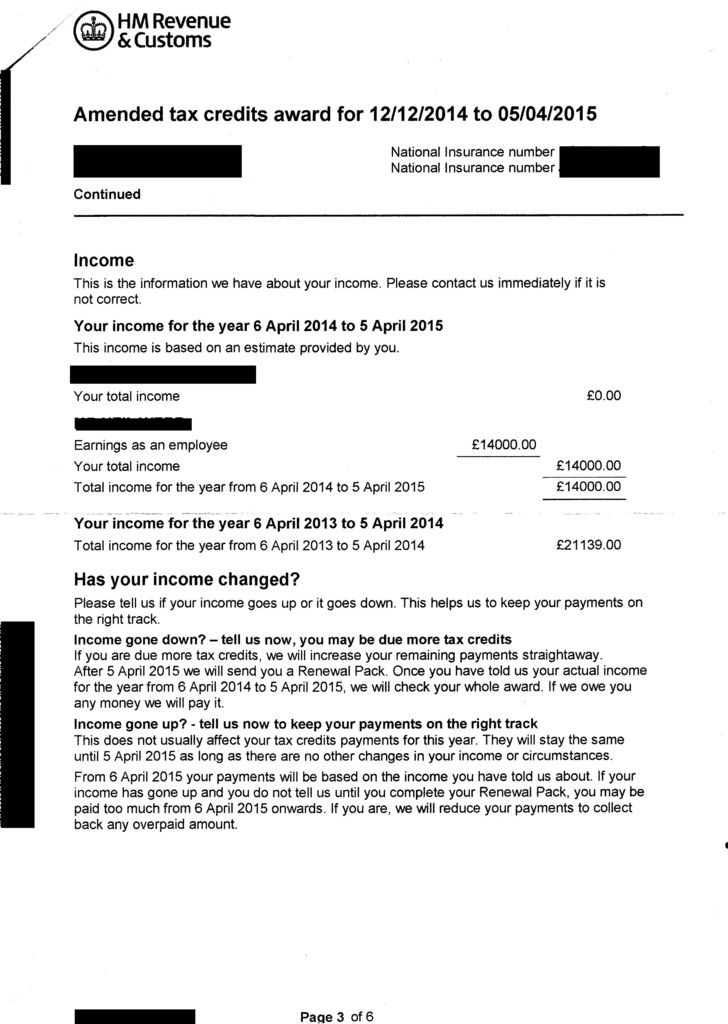

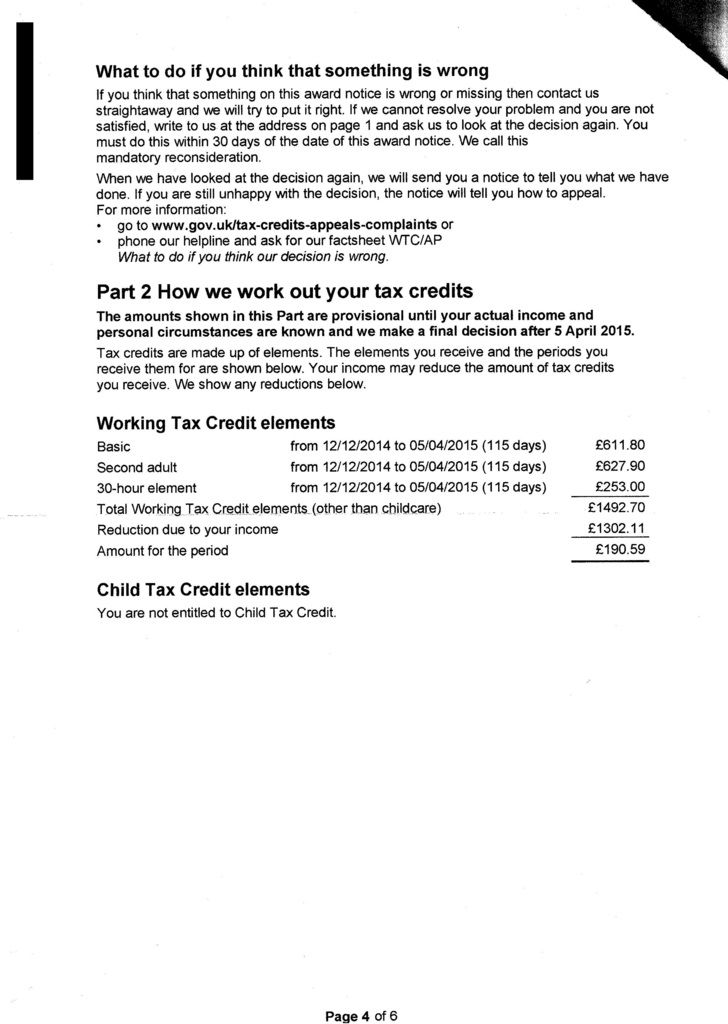

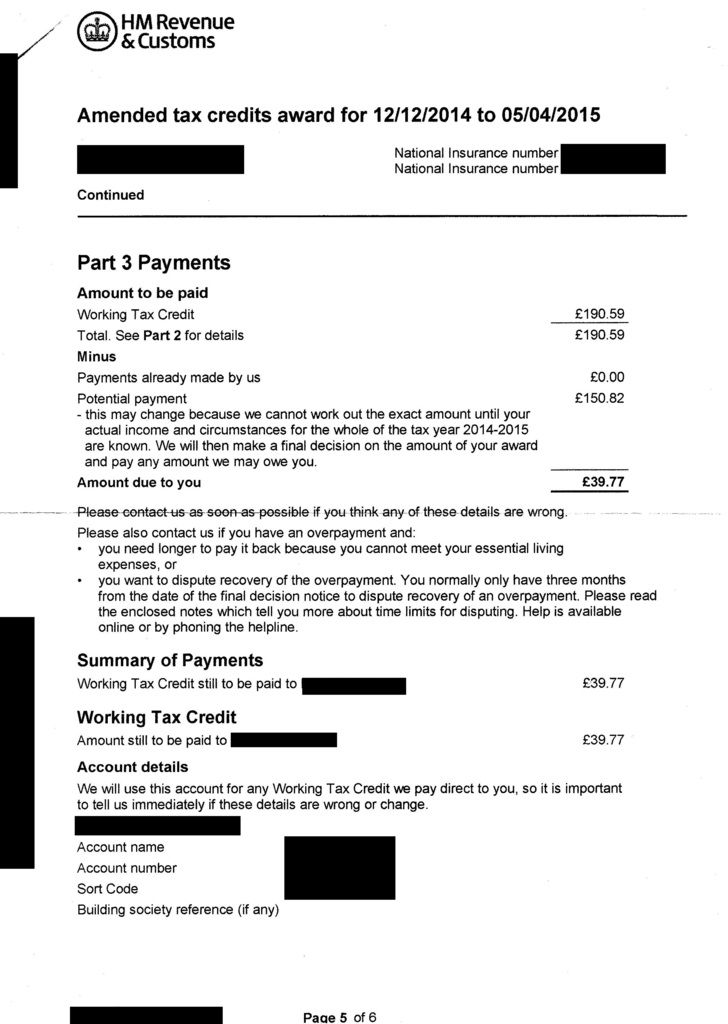

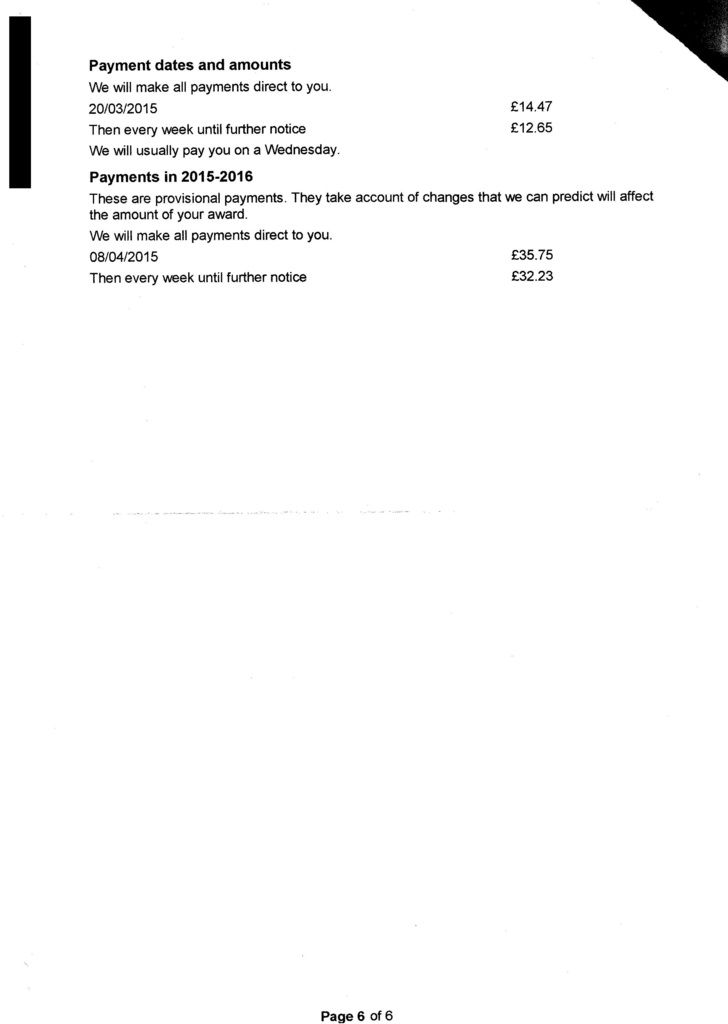

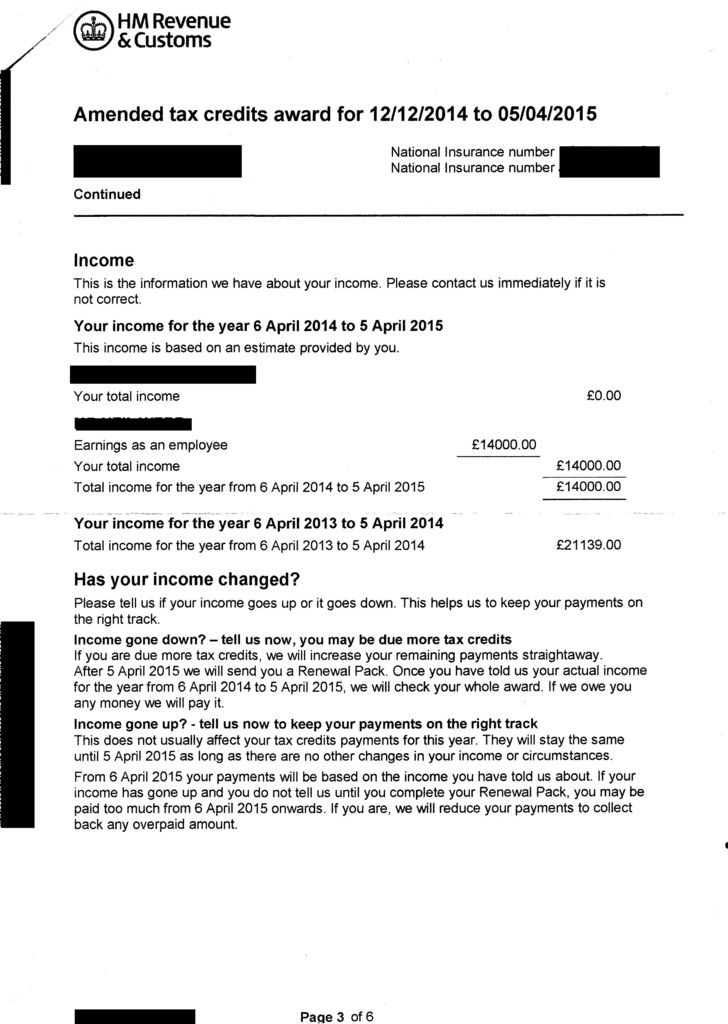

I've posted scans below of the latest award letter from the Tax Credits people and also the relevant letter from Housing Benefit (personal details blacked out) - can anyone help me make sense of it - especially with regards to how much actual money is likely to be paid into our account at what intervals going forward, what happened to the backdating, and will we be paid anything more than the £14.47 we have already received for the 14 (or possibly 19 with backdating) weeks since the start of the claim?

Also - does the amounts our housing/council tax benefit has been reduced by for the next couple of weeks sound right as it seems to be the same or more than we have received in Tax Credits???

According to the various benefit calculation websites, Tax Credits should have meant that we were around £42 per month better off after the housing/council tax benefit claw-back had been taken into account than with housing/council tax benefit alone.

We posted the form on 9th December and from the letters we have received it seems that they started our claim from 12th December which seems about right. The instructions we were given specifically said that if you wanted the application to be backdated for up to one month or if you wanted this years income to be used instead of last years income we had to put a separate letter/piece of paper in with the completed form asking for this and giving the relevant details, which we did. However they seem to have ignored it.

We got the initial award letter in the middle of January which was zero (expected, as our income would have been too high in 2013/14) but were expecting a further letter with an amended award for this years income as it's approx £8000 less (expected to be around the £14,000 mark)

We waited and waited with no new letter and in the end I phoned them. The lady on the phone said that they usually ignore any extra letters/bits of paper put in with the form (!?) but that she would alter our claim to reflect our income for 2014/15 and told us that it had already been backdated for the 1 month allowed automatically.

We have just now got an amended award letter but I don't understand it at all.

Firstly it still only covers from 12th December - if it had been backdated for a month, surely it should now be from 12th November?

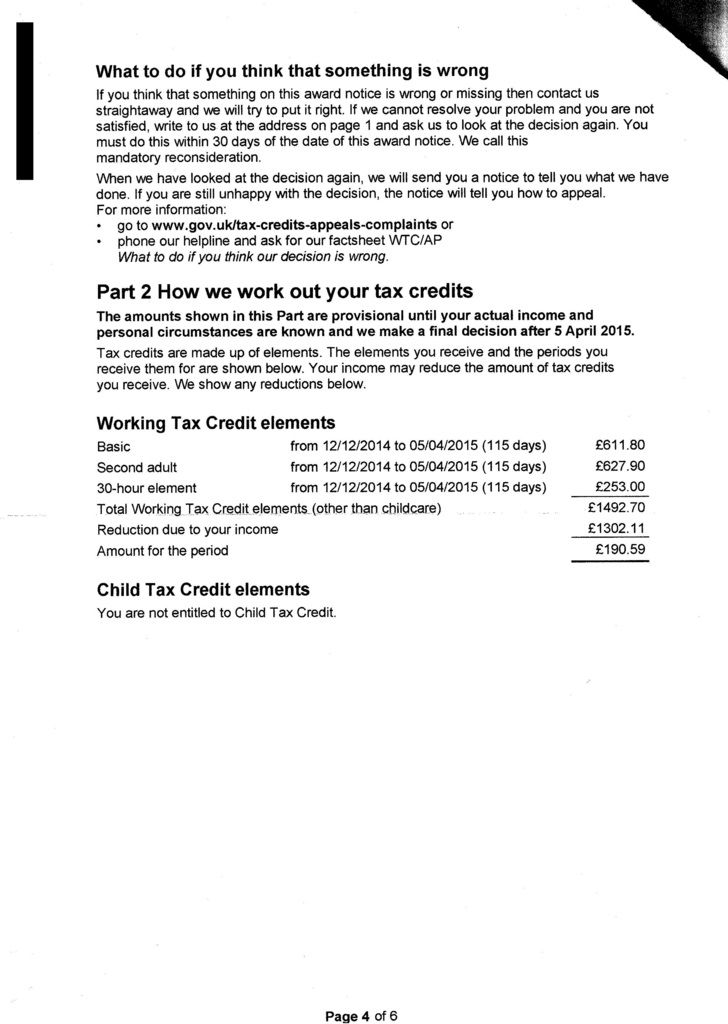

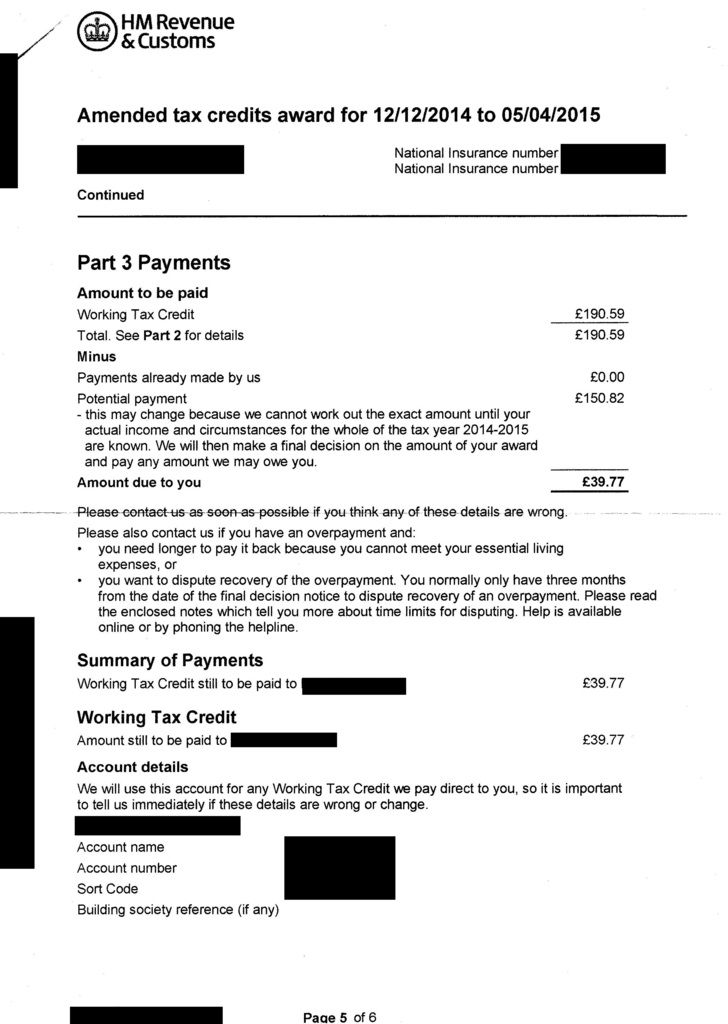

Secondly it has several different figures and I can't tell which one is what they are saying we're actually entitled to and whether that's per week or per month or for the whole year. The only amount we have actually had paid into our bank account (a few days ago) is different again - £14.47

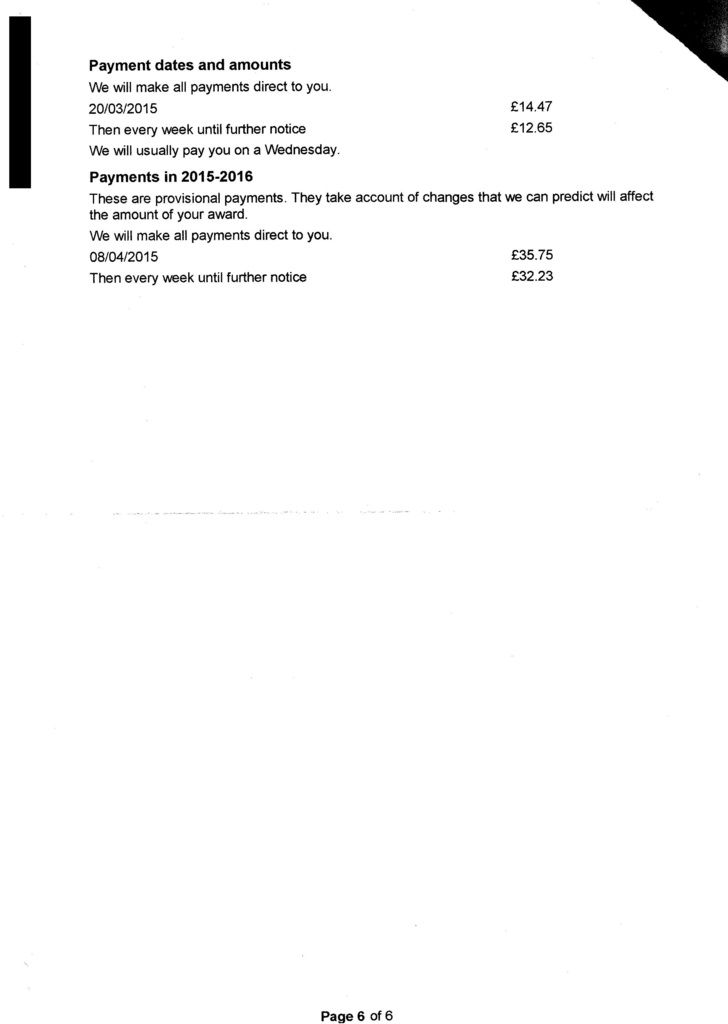

Also it seems to be saying that we are entitled to £12.65 a week until April and then we are mysteriously suddenly entitled to £32.23 a week even though our circumstances will be exactly the same???

Worried about getting an overpayment......

The letter seems to be saying that it will be paid weekly.

On the form we asked for 4-weekly payments and the only other choice was 2-weekly......?

Meanwhile, we expected a portion of the amount we received in Tax credits to be clawed back from our housing benefit but the council seem to be under the impression that we have received a lot more than £14.47. They have cut our housing benefit by various different amounts which seem to be more than we are getting in TCs for the next few weeks and removed our entitlement to council tax benefit completely (we were getting £72.62 per week housing benefit and £2.15 a week council tax benefit).

Adding to the panic is the fact that our tenancy is up for renewal on the 27th March, the rent will be going up by £50 a month from that date and it will probably be at least a couple of months before the housing benefit people (who were so quick to make a reduction) process any increase.

I am really panicking - this has completely messed up my already incredibly tight budget and from how I understand it, there is no way we will be able to pay the rent next month!

I cannot budget at all because I haven't a clue what our monthly income will be or whether we will receive anything for the last 14/19 weeks.

Very confused here

REALLY wishing I hadn't applied for Tax Credits now - a big mess and I'm wondering if we might actually end up with less than before

page 2

page 3

page 4

page 5

page 6

hb letter

I became unemployed back in March last year and have been finding it very difficult to secure new permanent employment since. My husband had to change jobs just over a year ago for medical reasons and his yearly salary before tax has almost halved

At present we are both living off his salary plus partial housing/council tax benefit so we applied for Tax Credits for the first time ever in December last year.

I'm usually quite good at this sort of thing but it's really got me stumped - I don't understand it at all.

I'm a bit stressed at the moment and it's highly likely that I've mis-read something, not fully read something or made some classic schoolboy error - please be kind - I think I need someone to just explain it all to me in words of one syllable :-/

I'm going to phone them myself but, as we don't have a landline in our flat it costs a fortune so I was hoping for a bit of enlightenment from you lot before I do, so that I can be a bit more efficient with the questions I ask.

I've posted scans below of the latest award letter from the Tax Credits people and also the relevant letter from Housing Benefit (personal details blacked out) - can anyone help me make sense of it - especially with regards to how much actual money is likely to be paid into our account at what intervals going forward, what happened to the backdating, and will we be paid anything more than the £14.47 we have already received for the 14 (or possibly 19 with backdating) weeks since the start of the claim?

Also - does the amounts our housing/council tax benefit has been reduced by for the next couple of weeks sound right as it seems to be the same or more than we have received in Tax Credits???

According to the various benefit calculation websites, Tax Credits should have meant that we were around £42 per month better off after the housing/council tax benefit claw-back had been taken into account than with housing/council tax benefit alone.

We posted the form on 9th December and from the letters we have received it seems that they started our claim from 12th December which seems about right. The instructions we were given specifically said that if you wanted the application to be backdated for up to one month or if you wanted this years income to be used instead of last years income we had to put a separate letter/piece of paper in with the completed form asking for this and giving the relevant details, which we did. However they seem to have ignored it.

We got the initial award letter in the middle of January which was zero (expected, as our income would have been too high in 2013/14) but were expecting a further letter with an amended award for this years income as it's approx £8000 less (expected to be around the £14,000 mark)

We waited and waited with no new letter and in the end I phoned them. The lady on the phone said that they usually ignore any extra letters/bits of paper put in with the form (!?) but that she would alter our claim to reflect our income for 2014/15 and told us that it had already been backdated for the 1 month allowed automatically.

We have just now got an amended award letter but I don't understand it at all.

Firstly it still only covers from 12th December - if it had been backdated for a month, surely it should now be from 12th November?

Secondly it has several different figures and I can't tell which one is what they are saying we're actually entitled to and whether that's per week or per month or for the whole year. The only amount we have actually had paid into our bank account (a few days ago) is different again - £14.47

Also it seems to be saying that we are entitled to £12.65 a week until April and then we are mysteriously suddenly entitled to £32.23 a week even though our circumstances will be exactly the same???

Worried about getting an overpayment......

The letter seems to be saying that it will be paid weekly.

On the form we asked for 4-weekly payments and the only other choice was 2-weekly......?

Meanwhile, we expected a portion of the amount we received in Tax credits to be clawed back from our housing benefit but the council seem to be under the impression that we have received a lot more than £14.47. They have cut our housing benefit by various different amounts which seem to be more than we are getting in TCs for the next few weeks and removed our entitlement to council tax benefit completely (we were getting £72.62 per week housing benefit and £2.15 a week council tax benefit).

Adding to the panic is the fact that our tenancy is up for renewal on the 27th March, the rent will be going up by £50 a month from that date and it will probably be at least a couple of months before the housing benefit people (who were so quick to make a reduction) process any increase.

I am really panicking - this has completely messed up my already incredibly tight budget and from how I understand it, there is no way we will be able to pay the rent next month!

I cannot budget at all because I haven't a clue what our monthly income will be or whether we will receive anything for the last 14/19 weeks.

Very confused here

REALLY wishing I hadn't applied for Tax Credits now - a big mess and I'm wondering if we might actually end up with less than before

page 2

page 3

page 4

page 5

page 6

hb letter

Don’t try to keep up with the Jones’s. They are broke!

0

Comments

-

The reason is going up next year is because of the income disregard. When your income falls, they ignore the first 2,500 of the fall. So they are actually basing your claim o 16,500 and not 14,000. However next year, it will be based on 14,000 (unless you expect your 15/16 income to be 5000+ more or more than 2,500 less)

IQ0 -

Thanks for replies - that clears up some of it at least in my messy brain. The income disregard and the potential payment seems a bit of a messy way of doing things - you can have the money - but not until a year after you actually need it

I think that's what I don't understand - I'm looking at it from the perspective of housing benefit which changes in direct relation to your income but I'm guessing that tax credits work differently?

Sorry if I sound a bit thick

So, are Housing Benefit assuming that We've already received the 'potential payment' and we'll have to somehow cover the shortfall in rent until the renewal forms have been processed?

Anyone know when they send these out and how long it is til they are processed?

The 'estimate' of this years income I gave them will be accurate to within a few pounds as husband's on a fixed monthly salary and it's unlikely I will get any more temp work between now and 5th April......

I'm pretty sure the claim should have started on 12th December as we posted the form 1st class on 9th December so 12th December seems a reasonable date to expect they would have received it?

When I phoned to ask why we hadn't received an amendment based on this years income, the lady said it had already been backdated, yet the amendment letter we got as a result of that phone call still says 12th December? The request for backdating was in the same letter as the request for this years income to be used and she said they would have ignored that letter, even though the instructions said to put it in....

Is it possible that they wouldn't have started the claim until 12th January, even though they must have received the form around a month before that?Don’t try to keep up with the Jones’s. They are broke!0 -

For WTC recipients only, it won't automatically backdate the claim, so do ring up again and check what date they received it. It may be that the advisor tried to backdate it manually on system and it didn't complete properly.

In relation to releasing the potential payment, I have seen cases where it has been released; usually after an MP has been involved as part of a complaint. But, it is there to prevent overpayments so bear that in mind if you do decide to go down that route. There is also the fact that by the time your complaint, if you decide to go down that route, is dealt with, it would be released anyway such is the backlog!0 -

Thank you everyone, I think part of the reason it seems messy to me is that it's so near the end of the tax year and has happened to come at the same time as my rent going up/having to apply for increased Housing Benefit. I will go back through the paperwork carefully in the light of the info I've been given here and then phone them.

RE: the backdating - I will definitely doublecheck about the backdating as I would have thought the official start of claim date would be the date they receive the form rather than the date they finally manage to process it and get it on the system as that would be different for everyone.....

Thanks all, and any further help welcome, will update when I've phoned.Don’t try to keep up with the Jones’s. They are broke!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards