We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

I've just switched to a 5 year fix, 2.48% £999 fee heres why...

pault123

Posts: 1,111 Forumite

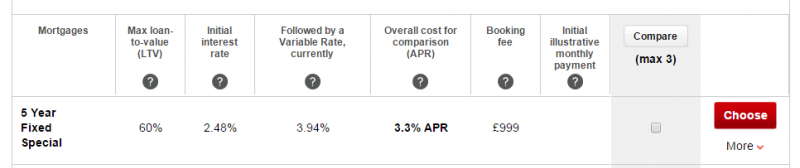

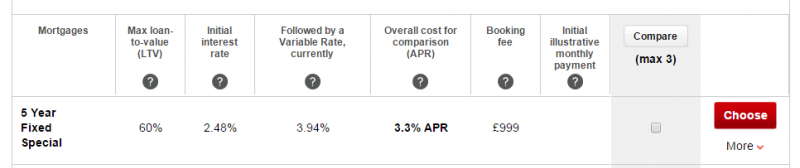

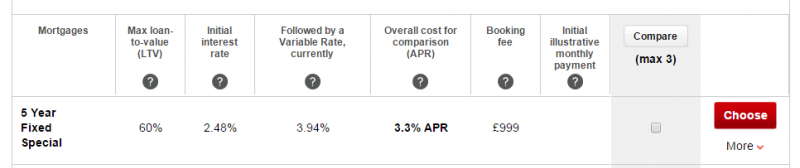

I've been on a 2.39% lifetime tracker for a while, +1.89% above base. The recent new batch of 5 years fixes which appeared in January look very attractive...

( http://www.thisismoney.co.uk/money/mortgageshome/article-1687576/What-mortgage-rates.html )

...albeit with high fee's, £999-£1500.

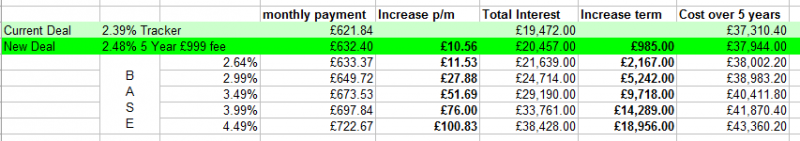

I used the fantastic Karls Mortgage calculator to put some figures into a spreadsheet, as many advised the large fee makes the new 5 year fixes not worthwhile. I beg to differ...

Tonight i've phoned up HSBC and just switched to the 2.48% 5 year tracker with £999 fee,

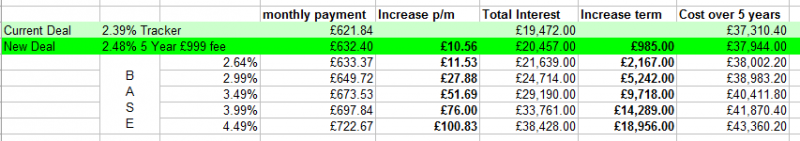

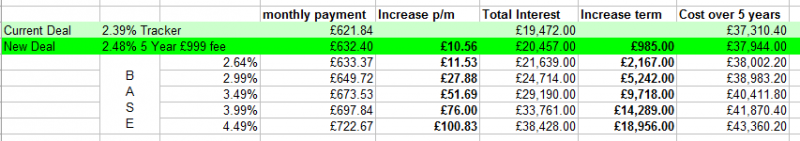

Thinking behind it. Monthly increase in payments from £621.84 to £632.40 = £10.56. This includes putting the £999 fee on the mortgage as I don't have the spare cash at the moment. An increase in interest over the remaining term of £985. An increase in interest over the 5 year term £633.

The base rate will go up in the next 5 years i'm sure no one disagrees with that? and once it starts moving IMHO it will do so a few times before peaking. Look at the base rate column and pick even the minimal increase of 0.25 base, this gives me a £2167 interest increase over the term, already higher than my five year fix.

Where it gets more sobering is should it go up 0.5%, 1% or 1.5% look at those interest figures!

Obviously this doesn't look at the fact after the five year fix its then SVR, but based on even a minimal base rise of just 0.25%, this would instantly put my current tracker on the backfoot. I can even overpay 20% a month so clear the £999 fee off the capital if I so wish. Its clear to see a 5 year fix has everything going for it at the moment :T

Fantastic mortgage calc to have a go yourself, use the summary box for overall interest and payment figures.

https://www.drcalculator.com/mortgage/uk/

( http://www.thisismoney.co.uk/money/mortgageshome/article-1687576/What-mortgage-rates.html )

...albeit with high fee's, £999-£1500.

I used the fantastic Karls Mortgage calculator to put some figures into a spreadsheet, as many advised the large fee makes the new 5 year fixes not worthwhile. I beg to differ...

Tonight i've phoned up HSBC and just switched to the 2.48% 5 year tracker with £999 fee,

Thinking behind it. Monthly increase in payments from £621.84 to £632.40 = £10.56. This includes putting the £999 fee on the mortgage as I don't have the spare cash at the moment. An increase in interest over the remaining term of £985. An increase in interest over the 5 year term £633.

The base rate will go up in the next 5 years i'm sure no one disagrees with that? and once it starts moving IMHO it will do so a few times before peaking. Look at the base rate column and pick even the minimal increase of 0.25 base, this gives me a £2167 interest increase over the term, already higher than my five year fix.

Where it gets more sobering is should it go up 0.5%, 1% or 1.5% look at those interest figures!

Obviously this doesn't look at the fact after the five year fix its then SVR, but based on even a minimal base rise of just 0.25%, this would instantly put my current tracker on the backfoot. I can even overpay 20% a month so clear the £999 fee off the capital if I so wish. Its clear to see a 5 year fix has everything going for it at the moment :T

Fantastic mortgage calc to have a go yourself, use the summary box for overall interest and payment figures.

https://www.drcalculator.com/mortgage/uk/

0

Comments

-

Really interesting to see the options out there and an analysis behind the decision. Will check out that calculator tomorrow.0

-

I've been on a 2.39% lifetime tracker for a while, +1.89% above base. The recent new batch of 5 years fixes which appeared in January look very attractive...

( http://www.thisismoney.co.uk/money/mortgageshome/article-1687576/What-mortgage-rates.html )

...albeit with high fee's, £999-£1500.

I used the fantastic Karls Mortgage calculator to put some figures into a spreadsheet, as many advised the large fee makes the new 5 year fixes not worthwhile. I beg to differ...

Tonight i've phoned up HSBC and just switched to the 2.48% 5 year tracker with £999 fee,

Thinking behind it. Monthly increase in payments from £621.84 to £632.40 = £10.56. This includes putting the £999 fee on the mortgage as I don't have the spare cash at the moment. An increase in interest over the remaining term of £985. An increase in interest over the 5 year term £633.

The base rate will go up in the next 5 years i'm sure no one disagrees with that? and once it starts moving IMHO it will do so a few times before peaking. Look at the base rate column and pick even the minimal increase of 0.25 base, this gives me a £2167 interest increase over the term, already higher than my five year fix.

Where it gets more sobering is should it go up 0.5%, 1% or 1.5% look at those interest figures!

Obviously this doesn't look at the fact after the five year fix its then SVR, but based on even a minimal base rise of just 0.25%, this would instantly put my current tracker on the backfoot. I can even overpay 20% a month so clear the £999 fee off the capital if I so wish. Its clear to see a 5 year fix has everything going for it at the moment :T

Fantastic mortgage calc to have a go yourself, use the summary box for overall interest and payment figures.

https://www.drcalculator.com/mortgage/uk/

only problem I see with the calculation is the increase in interest rates starts today, I can't see rates rising in the next 12 months if the economy remains the same.0 -

viously this doesn't look at the fact after the five year fix its then SVR, but based on even a minimal base rise of just 0.25%, this would instantly put my current tracker on the backfoot. I can even overpay 20% a month so clear the £999 fee off the capital if I so wish. Its clear to see a 5 year fix has everything going for it at the moment

You don't appear to have given enough attention to the fact that you will go onto the SVR, which is the most important aspect of it all.

Did you run any comparisons against using your £999 fee to instead switch to First Directs 1.79% lifetime tracker? If base rates rise by 0.75%, you'd be on a rate roughly the same as your 5-year fix. We all expect rates to rise more than this but not for quite some time.

For example, if rates rose 0.5% at the end of this year, followed by 0.25% in the middle of next year, you will have enjoyed reductions of interest of 0.75% for a year and 0.25% for another half year. You'll then be on a similar rate to the 5-year fix and the savings made will allow you to absorb most, if not all, of the impact of future rises.

Finally, you'd remain on 1.29% + BOE as opposed to going into SVR, which would likely be higher than current rates at that time. Of course, you could pay another £999 fee to move to a good rate - but this £999 could have been used to pay down capital had you stuck with a lifetime tracker and, I suspect, would leave you better off in the long term.0 -

Talk of "rates will rise soon" has been going on for over 5 years already and had you done it back then you would now be reverting to an SVR much poorer than the Tracker deal. I personally don't think there will be any rate rise till at least Q3 of 2015 at earliest, though it could well get pushed but further - e.g. if Greece defaults, election outcome is a stalemate, deflation etc.

The best option as ever depends on your specific circumstances.

If you have less than £50K left on mortgage then the fee will be more than any "saving" should the rate go up even by quite a few %.

However, if you have static earnings and know you can afford monthly fixed payments, but are worried that it could be tight with a small rise, then the £10 extra per month is essentially an insurance policy for 5 years.

These factors are individual, but if the 5 year fix is best for you then congratulations.

MCInitial mortgage (Dec 2012) £108,000 3.84%APR MF date Jan 2038

Mortgage remaining £68285

Daily interest £4.28

2017 MFW #14 £3746.90/£10,0000 -

I have to renew my current fixed deal on march 1st. I was going to fix again for 2 yrs but wondering what you think about fixing for 3 years?

don't have a lot of spare income and the mortgage will be for about £88000 over 12/13 yrs.£1000 Emergency fund challenge #225 - £1000.00.00/£1000- End of Baby Step 3 (A work in progress)0 -

Thinking behind it. Monthly increase in payments from £621.84 to £632.40 = £10.56. This includes putting the £999 fee on the mortgage as I don't have the spare cash at the moment.

Rather than increasing you mortgage debt by a £1k and increasing your monthly outgoings in the process. Why not simply overpay your existing mortgage by £10.56p.0 -

Jack_Johnson_the_acorn wrote: »only problem I see with the calculation is the increase in interest rates starts today, I can't see rates rising in the next 12 months if the economy remains the same.

Thats true, I guess the base comparisons would need a staggered year added to them if the base rate holds low.0 -

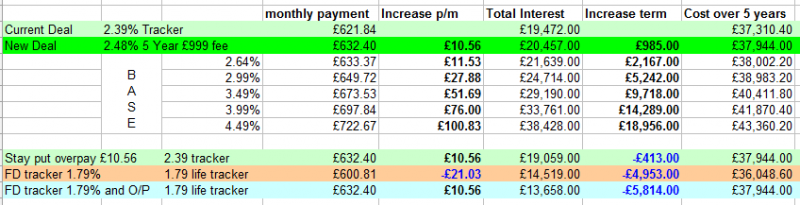

@marathonic, @midnightchild @thrugelmir you gave me something to think about so I ran some more figures in...

a) don't return new 5 year fix paperwork/cancel 5 year fix I signed up for. Stay on 2.39 tracker, overpay by £10.56 to equal what I would pay on 5 year fix. £413 saving in interest over the term.

b) switch to First Direct 1.79%. £4953 saving in interest over the term and £21.03 less monthly outgoing.

c) switch to First Direct 1.79% and overpay £31.59 to equal the 5 year fix monthly outgoing. £5814 saving over the term.

Considering the interest left on my mortgage staying put, is around £20k, £5k saving is a rather large percentage of this.

I guess what the spreadsheet doesn't reflect is how this all pans out with BOE raises. I'm certainly having a good think about option C now though :eek:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards