We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Neptune Russia fund

Surreyboy

Posts: 67 Forumite

I have a holding the Neptune Russia fund. It has decreased by over 50% in the last year or two (from £6,500 to £3,100). This is a relatively small (and ever decreasing!) part of my portfolio.

Normally, I am not one to sell out when shares tumble, as that is a sure way to lose money; I have already lost a lot, and this loss would only be crystallised if I sold out now.

However, I am starting to wonder whether I will get my money back, even in the longer term. There have been isolated examples of funds 'going under' completely (eg the 'Heart of Africa' fund in about 2009). Does any one else out there have a holding in this fund and, if so, what are you planning?

Thanks!

Matt

Normally, I am not one to sell out when shares tumble, as that is a sure way to lose money; I have already lost a lot, and this loss would only be crystallised if I sold out now.

However, I am starting to wonder whether I will get my money back, even in the longer term. There have been isolated examples of funds 'going under' completely (eg the 'Heart of Africa' fund in about 2009). Does any one else out there have a holding in this fund and, if so, what are you planning?

Thanks!

Matt

0

Comments

-

I had this fund in my portfolio. It was not part of any strategy really but more of a gamble in my case.

I did not have as much as you invested but the value of my investment fell by 40%.

With oil price likely to be volatile for the next six months before it stabilizes and probable sanctions from the America and Europe for Russia, I decided to bail with a loss.0 -

I invested in a small caps Asia fund last year, right before it hit it's peak.

I lost around 20% but I invested more when it went low and have almost broken even.

If you think Russia will do well long term then now is a good time to invest.0 -

You're lucky to only be down 50%, the Ruble alone has lost 50% of its value against GBP, so if your fund is trading in GBP that will be the main cause of the fall.

I have some exposure to Ukraine whose currency has also plummeted but I'm hoping that sanctions aren't for the long term. This is an extreme situation and tbh it's pretty hard to see how it could get worse. Everyone expects oil to fall further and Russia to basically implode, but well usually market's fear is overdone and in 5-10 years no one will remember it.

Anyone remember the natural gas carnage in the US in 2011/12? Well everything turned out fine.Faith, hope, charity, these three; but the greatest of these is charity.0 -

My 2c: hold or increase your position

I could always be wrong (so totally subjective), but the big Russian energy firms are up 18% already today - I'm regretting not buying yesterday

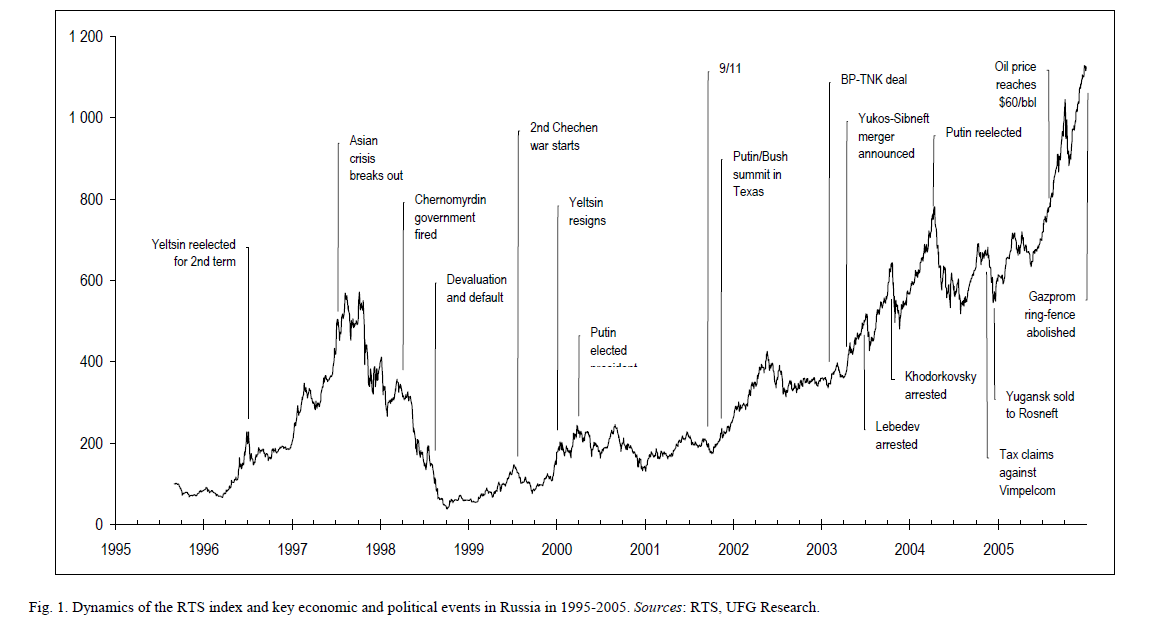

Last time this happened (oil down 40%, russian stocks down 90%) was in 1999, and the next year Russian stocks were up 150%

Either way, it's generally best not to let short-term bad news influence your decisions over a long-term investment

People got rich investing in Argentina when everyone else was running a mile - it's a real test, these conditions, but history favours the bold in these cases (*not a guarantee)0 -

Bloomberg has the MICEX index at a P/E of 7.2 and RTS index at P/E of 4.

Everyone says be greedy when others are fearful, so here it is, the fear. Can you be greedy? Faith, hope, charity, these three; but the greatest of these is charity.0

Faith, hope, charity, these three; but the greatest of these is charity.0 -

A conservative approach might be: if you've normally got 3% allocated to Russia, you'll probably rebalance this month and top that up

So that's why a lot of people say: Don't try and time it, just be disciplined

It's astonishing how negative all the news turns at these times - really makes you think it's asset apocalypse, and that's why everyone does the wrong thing over and over0 -

Thanks for your comments guys. I had heard about the Russian crash in 1998/1999, but not the sharp recovery afterwards, so there's a crumb of comfort!

Ironically, I topped up 18 months ago , when I thought prices couldn't go much lower! That turned out to be pretty wrong, but at least I bought when the fund was relatively cheap.0 -

Yeah, if it's a comfort, this is what Russia was predicted to return over 10 years annually (just on valuation and history) before this drop

http://www.researchaffiliates.com/AssetAllocation/Pages/Equities.aspx

It's one of the risks of buying under value - things can always get cheaper first ... "How do you lose half your investment? You wait till the market's dropped 90% before you buy, then it drops another 5%"

This afternoon Russia said it wouldn't consider seizing assets (the big risk looming over this) as it perhaps would've done in the past if things got much worse, and whether that's true or not, I think that's already seeing investment pick up

I'd see sticking with Russia as a bet against WW3, because most other outcomes should see things normalise over the next few years (and oil's already up almost 4% - surprisingly) ... * not a guarantee0 -

I've lost 30% in this fund too. Its a very small % of my ISA so im not overly concerned and may well increase my holding once I see some positive signs.

I read the US is considering more sanctions so the short term doesn't look great. The oil price is having a much greater effect than sanctions though.0 -

Look at this though - *if* this is a repeat of 1998

These things will always be risky, but this is how you get rich 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards