We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Only increased building can solve prices....

HAMISH_MCTAVISH

Posts: 28,592 Forumite

http://www.ftadviser.com/2014/07/24/mortgages/mortgage-data/only-increased-housebuilding-will-solve-prices-says-david-brown-e3gIps8OpfcsNjiN5DdFgL/article.htmlIncreasing the supply of homes rather than just restricting mortgage lending is the key to solving runaway house price inflation, David Brown has said.

The commercial director of LSL Property Services spoke out following the publication of the Office for National Statistics’s monthly House Price Index, which showed a rise in prices yet again in May.

According to the ONS, UK house prices rose 10.5 per cent in the year ending May 2014, with London seeing the largest annual increase of 20.1 per cent.

Earlier this month, Paul Smee, director general of the Council of Mortgage Lenders, stated that unless policy makers got themselves “up a ladder” with a trowel and some cement and started to build the houses themselves, then all their policy measures would not have any effect.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

0

Comments

-

This should be turned into a sticky we can refer to when the usual suspect comes waffling once more about Carney's inaction or scrapping HTB to cool the market or similar tripe.Don't blame me, I voted Remain.0

-

We know this Hamish but high prices are an issue as well without the return to loose lending.

You give your argument all the time that builders won't build what they can't sell, yet as we all know there is massive demand for housing in the UK, so what are building companies really concerned about?

The mortgage problem exists because house prices are too expensive in relation to earnings and many experts now realise that the debt levels are real potential problem in the future. In essence the state of the housing market is having a real bearing on interest rates for the UK whether they like to admit it or not.

Lets build more, relieve the price pressure, houses can become more affordable for all and reduce the investment/speculation interest in the housing market. Unfortunately there are too many vested interests out there preventing this from happening.0 -

I'm sure LSL and their clients would love to snap up more houses and keep current lending practices to make it easier for them to do so.

Just have to read their strap line to see the vested interest here Hamish....just incase it had passed you by!

"LSL - building a market leading position in the residential property services market."

Their BTL clients suffer tougher lending....they suffer.

Tougher lending = fewer buying and prices falling = their Estate Agencies suffer.

But hey, it must be true. Possibly the biggest vested interest in having more homes to sell, to all and sundry, says so.

More homes are very much welcome. But to say its the "only" solution is pure nonsense. It's part of the solution.0 -

shortchanged wrote: »We know this Hamish but high prices are an issue as well without the return to loose lending.

You give your argument all the time that builders won't build what they can't sell, yet as we all know there is massive demand for housing in the UK, so what are building companies really concerned about?

The mortgage problem exists because house prices are too expensive in relation to earnings and many experts now realise that the debt levels are real potential problem in the future. In essence the state of the housing market is having a real bearing on interest rates for the UK whether they like to admit it or not.

Lets build more, relieve the price pressure, houses can become more affordable for all and reduce the investment/speculation interest in the housing market, unfortunately there are too many vested interests out there preventing this from happening.

Builders will not build to the extent that it may cause lower prices. It is not in their interest, they would rather just sit on the land they own and keep the shortage going.

Why build 100 houses to make £xx when you can make more money by building 50?0 -

Builders will not build to the extent that it may cause lower prices. It is not in their interest, they would rather just sit on the land they own and keep the shortage going.

Why build 100 houses to make £xx when you can make more money by building 50?

Exactly, it's a rigged market. It's basically price fixing.0 -

Builders will not build to the extent that it may cause lower prices. It is not in their interest, they would rather just sit on the land they own and keep the shortage going.

Why build 100 houses to make £xx when you can make more money by building 50?

fortunately the state controls the planning process so can ensure that sufficient land be made available for

-self builders

-small community based builders

etc0 -

I think it is Costain that has announced that their strategy is to build fewer houses but with higher margins over the next few years.0

-

I think it is Costain that has announced that their strategy is to build fewer houses but with higher margins over the next few years.

They're all doing it focusing on higher end housing. Obviously these houses are targeted at present home owners who will have equity. They're doing very little to assist the FTB'ers, unless a backhander in the form of HTB is involved.0 -

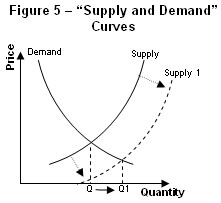

OK so back to GCSE economics for a moment.

(1) The first rule of economics is that demand goes up as price goes down. It's common sense. People are able & willing [both are important] buy more of stuff as it gets cheaper.

(2) The second rule of economics is that supply goes up as price goes up. It's common sense. Companies are more able & willing to make and/or sell more as it becomes more expensive [relative to opportunity cost].

(3) From the above you get the classic supply-demand curves that we're all familiar with.

Now let's talk about what increase demand & increased supply mean.

Increased demand

See Figure 1.

The demand for something is said to be increased [i.e. the demand curve shifts] if, for any given price, people are able & willing to buy more of it than used to be the case. The demand for something increases because, broadly, the following three things: (i) increased population; (ii) increased income [increased credit has the same effect]; (iii) increased popularity [e.g. because of fashion, advertising, whatever]:

Have a look at Figure 1. Notice that, following an increase in demand, both price and the amount bought/sold go up. Both effects happen because the supply curve is upward sloping.

Increased supply

See Figure 2.

'Increased supply' means that, for a given price (important - we're not just talking about the supply curve being upward sloping), firms are willing to supply more. This could happen because of, oh, firms becoming more productive [i.e. their costs giong down], firms being given subsidies that make selling more attractive, their taxes being reduced, the weather getting better, whatever.

What is HTB in a supply/demand sense?

HTB increases demand. It pushes up prices & as a byproduct the amount of houses built & sold.

You cannot reduce prices by increasing demand. You cannot cannot cannot cannot. The very idea of this makes less zero sense.

Figure 1

Figure 2 FACT.0

FACT.0 -

shortchanged wrote: »We know this Hamish but high prices are an issue as well without the return to loose lending. .

Nobody is asking for a return to 'loose lending', just to historically normal, prudent and sensible lending.

High prices are being caused by the shortage, which has been worsened by the overly tight lending, so even though lending now remains heavily restricted prices are shooting up anyway.

There is no other solution than to build more houses.

And we won't build anywhere near enough new houses when the number of mortgages being issued per month is half the long term average, and a third of the number required to keep up with demand.

Banks continue to ration the limited pool of funds through overly tight credit scoring and deposit requirements, so as to shrink the pool of borrowers to match.

Millions of creditworthy renters can afford to pay rent equal to or greater than a mortgage payment, but banks would rather lend to landlords than to FTB-s, largely as a result of the new regulations around bank capitalisation requirements....

It's a bonkers situation and completely politically and socially unsustainable....

Hence why government has had to implement HTB to try and overcome the worst effects of the ongoing mortgage famine.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards