We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Annuity Cartel?

deepoo

Posts: 40 Forumite

I am hunting around for an annuity. Saga gave a slightly better quote than L&G for a L&G annuity AND they are taking a £3.5k charge for doing it. L&G said that this is because they get a preferential rate that I can't have. This sounds like a cartel to me and should be illegal. We should all have access to the same special rates.

0

Comments

-

Yes, but £3.5k for a bit of form filling - no advise or anything !!!0

-

I am hunting around for an annuity.

An IFA might help? http://www.unbiased.co.uk/

Are you sure that you want to go down the annuity route?

http://www.hmrc.gov.uk/pensionschemes/pensionflexibility.htm0 -

L&G said that this is because they get a preferential rate that I can't have. This sounds like a cartel to me and should be illegal.

A cartel is where prices are the same. Tescos sell beans at a different price to Morrisons, Waitrose, Asda etc. Are you saying that should be illegal?We should all have access to the same special rates.

Economies of scale exists in all retail markets. For annuities, IFAs get the best rates. So, they are probably better than SAGA.Yes, but £3.5k for a bit of form filling - no advise or anything !!!

Such is the nature of a commission based service. Use an IFA who will do it on fee basis.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Thanks for those links. I will try some IFA to see if they can do better rates. I don't mind paying for their time if they get a better rate for me, but not a percentage of my pension pot.

I have savings so don't need to draw down money. I know the rates are not good at the moment but who can say when they will go up? I'm thinking that it is better to get and annuity now rather than wait for interest rates to go up in a few years. If they do go up to say 3%, what rate of return might I get? (take an example of a 60 year old in good health - currently getting around 5.3%)0 -

I have savings so don't need to draw down money.

So why are you?I know the rates are not good at the moment but who can say when they will go up?

They have been slowly zig zagging up but they will start to improve when interest rates start to rise or markets believe they will rise.I'm thinking that it is better to get and annuity now rather than wait for interest rates to go up in a few years.

With the budget changes, that point of view is largely obsolete now. Also, remember that your pension pot will be higher and your annuity rate would be higher due to age (and possibly health).I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

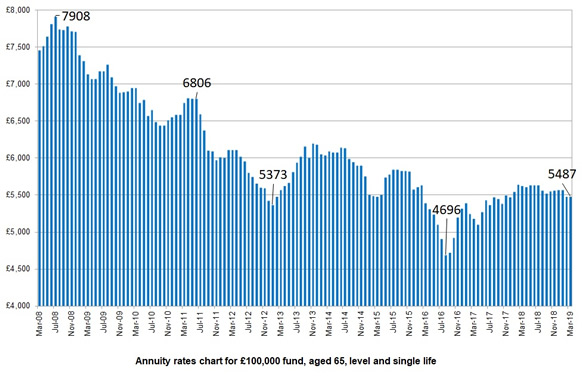

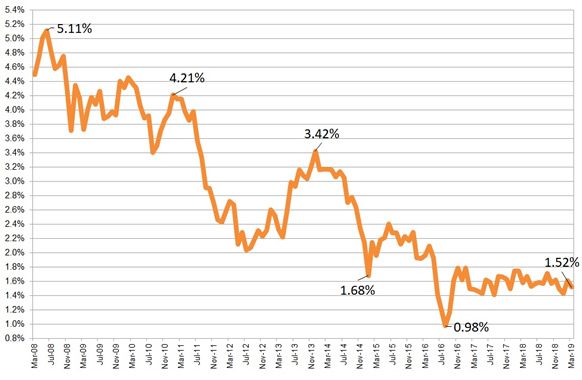

The annuity rates more or less follow 15year gilt rates..

Charts from https://www.sharingpensions.co.uk

Annuity Rates

15 yr Gilts 0

0 -

These charts, and a lot of discussion around annuities, focus on rates for level annuities. These strike me as very risky - a few years of 10% inflation could lead to many years of an unexpectedly low income.

Does anybody know of similar charts for index linked annuities?0 -

Economies of scale exists in all retail markets. For annuities, IFAs get the best rates. So, they are probably better than SAGA.

Slightly contradictory. If we are looking at large scale intermediaries such as non-advised annuity companies, then they are likely to get better rates from a provider than lets say an FI that submits 3 annuity cases a year.

You need to consider whether an annuity and not another product, wholy meets your needs towards part or all of your lifetime income.

If your not sure then yes definatley seek a whole of market FI's advice.0 -

Slightly contradictory. If we are looking at large scale intermediaries such as non-advised annuity companies, then they are likely to get better rates from a provider than lets say an FI that submits 3 annuity cases a year.

Most advisers are networked or use compliance company services that give them bulk buying powers. Plus, IFAs still dominate overall distribution in this area. Over 70%. This is one of the reasons why IFAs can still beat the online services.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards