We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

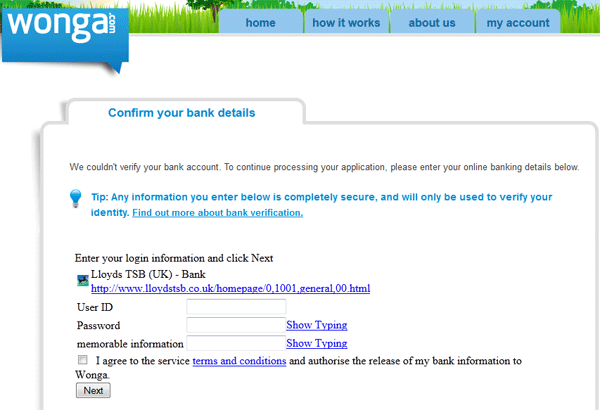

Wonga are now asking for online banking login details "to verify" applications

Comments

-

very iffy. even if wonga were asking for it dont do it. who in there right mind would give control of their money over to loan sharks whoops ethical friendly loans company that really does not charge massive amounts of interest.

email wonga and warn them. who knows they may send the old folks round to sort the fruadsters out.0 -

Paul_the_Painter wrote: »Can't be legit, a Lloyds only ask for 3 characters from your memorable word, looks like a phishing scam to me, or Wonga have reached the absolute bottom and started to dig.

This is asking for the whole thing so that they can access your account. If you give them the entire thing, they can then enter whichever characters Lloyds asks for.What will your verse be?

R.I.P Robin Williams.0 -

The last time I read the terms and conditions for my bank account, it said you can pass your details to a third party ("account management services") but doing so would offset liability to the bank for fraudulent activity, etc. So if you pass these details over, and £1,000 goes missing, the bank won't cover it even if it's unrelated.0

-

Good_Goose wrote: »Playing devils advocate, this measure would stop virtually all fraudulent applications overnight.

It would. It's also really, really stupid.

I'm all for stopping fraud, but this is insane. I came to this thread thinking it was a phishing scam caused by a virus, but... nope.

EDIT: Actually, it would make fraud WORSE, because it provides a precedent where people have to enter full, unredacted online banking details to access products and services, leading to a scenario where they think "well, if Wonga asked for it, maybe this [weight loss product/security scam/other dodgy phishing site] is legit too?"

Shameful. Contact the media - the Guardian would absolutely sh*t themselves over this.urs sinserly,

~~joosy jeezus~~0 -

Nobody seems to have verified if this is true or not.

Worried48, a Payday Loan Veteran, has logged in for another loan but didn't face the same questions, but then Worried48 is a previous borrower.

We need someone with a disposable phone number to apply and receive the PIN number (unless they don't mind being hounded afterward once the phone number is revealed to them).0 -

Nobody seems to have verified if this is true or not.

Worried48, a Payday Loan Veteran, has logged in for another loan but didn't face the same questions, but then Worried48 is a previous borrower.

We need someone with a disposable phone number to apply and receive the PIN number (unless they don't mind being hounded afterward once the phone number is revealed to them).

I'm tempted to think it's fake, as the other website referred to in the OP and this site are the only mentions of this I can find on Google.

However, this, http://www.decisionlogic.com/ServiceInfo.aspx, says it provides access of up to 90 days of the borrower's account transaction history. Is there any way of obtaining this information other than logging into the user's internet banking? I'd be annoyed if my bank gave that information away willy nilly!

Edit:

http://www.decisionlogic.com/Security.aspx

"How does DecisionLogic work?

When a borrower selects a financial institution and enters their credentials, DecisionLogic securely transmits them to secure aggregation servers allowing them to retrieve account information in “read-only” mode.

Do you store my bank login information on the DecisionLogic servers?

Your login information is passed securely to the data provider which establishes the connection. DecisionLogic does not retain your login information and your login information is never displayed anywhere.

What should I do if I am concerned about the security of my login information?

If you go to your financial institution and change your login information then DecisionLogic and our data provider cannot access your information from that institution unless you come back to DecisionLogic and provide the new information."

Seems real! - only question is whether Wonga is using it or not.What will your verse be?

R.I.P Robin Williams.0 -

but isn't the PIN number the last stage before the money is deposited?0

-

but isn't the PIN number the last stage before the money is deposited?

In the example in the first page for Lloyds;

UserID is a Constant - It doesn't change

Password is a Constant - It doesn't change

Memorable Information is also a Constant but slightly different. At the login screen for Lloyds it will ask you for the first two constants (UserID & Password) then ask for three random characters from the Memorable Information (e.g First, Fourth and Sixth characters). Once you have done that, you have complete access.

If you fill out those boxes, anyone who sees it can repeatedly log into a Lloyds account and move money willy nilly, wherever they decide to.

They could even request an increase of an Overdraft and simply move the money to a different account.

If you mean the Wonga PIN.

I tried making a dummy application, I filled out name, address etc with random keyboard slapping but the second page requested my mobile number.

Once completed Wonga send a PIN number to that mobile which you use to fill out a box and continue to the next screen where I think, if anywhere, this Bank detail nonsense is.0 -

but isn't the PIN number the last stage before the money is deposited?

The impression I got from patanne's posts is that this is an extra step after that if Wonga are unable to otherwise verify the account the money is to be paid into? i.e. a lot of people wouldn't get it, but some might?Still rolling rolling rolling...... <

<

SIGNATURE - Not part of post0 -

So it sounds like you'd need to enter the Wonga PIN, then enter some fake bank details, to get to the interesting part?What will your verse be?

R.I.P Robin Williams.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards