We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Rich babyboomers behaving like the nobility in the peasants revolt...

Comments

-

Partly that and the fact that food was cheaper in 2008 than the '70's

Which begs the question - why do we need so much more welfare now than we did then?

Even for working people, tax credits didn't even exist then and the idea would be unheard of. Now, people are relying on them to get by and people have much higher personal debts...which when you look at the price of staples, doesn't make any sense.

Maybe the price of staples have gone down slightly, but the price of other things gone up?

Things like petrol may cost the same per litre (roughly), but were all having to use more to travel further to work? Have to use more to travel to get the food etc. Maybe it's a case that now things may be around the same price or sometimes cheaper, just they are used in different ways making them feel a lot more expensive.0 -

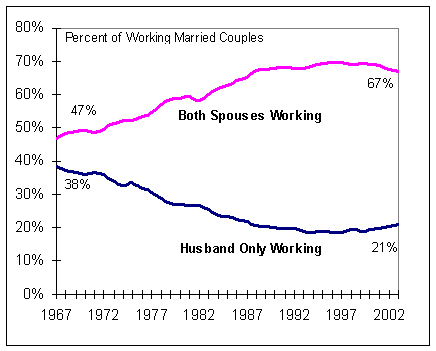

Graham_Devon wrote: »Isn't this more to do with the fact many more families in 2008 would have 2 incomes (out of necessity in many cases) as apposed to one in 1970?

No

it's because if food prices had increased with earnings milk would be £1.20 a pint bread would be £1.90 a loaf and a bunch of bananas £3.61.

If wages had just kept up with RPI the average wage would now be £15k instead of £26k

0 -

The generational divide is a diversionary tactic. Its just a component of the "divide and rule" agenda that Governments follow. What matters is whether people are prepared to stand up for themselves in protesting against all forms of unfairness. My experience is that many are simply too busy looking after their own interests to protest about anything.Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are incapable of forming such opinions.0

-

Graham_Devon wrote: »Which begs the question - why do we need so much more welfare now than we did then?

Even for working people, tax credits didn't even exist then and the idea would be unheard of. Now, people are relying on them to get by and people have much higher personal debts...which when you look at the price of staples, doesn't make any sense.

Maybe the price of staples have gone down slightly, but the price of other things gone up?

Things like petrol may cost the same per litre (roughly), but were all having to use more to travel further to work? Have to use more to travel to get the food etc. Maybe it's a case that now things may be around the same price or sometimes cheaper, just they are used in different ways making them feel a lot more expensive.

Why do you always look for reasons to show how bad thing are for you and how easy they were in the 70s. I have one advantage over you I was living in 70s and am living now and I can tell you life wasn't the bed of roses you seem to think it was. Out of interest how far do you drive to work.0 -

No

it's because if food prices had increased with earnings milk would be £1.20 a pint bread would be £1.90 a loaf and a bunch of bananas £3.61.

Really?

You have quoted household income and food taking 21% in the 70's.

In the 70's, far fewer households had 2 incomes compared to now.

Household spending on food is now 9%, but far more households have 2 people working for that household income.

Anyway, just did a search on this, and it's all relative. You have picked out 3 food items. Pick out fish for example and you;ll likely find its higher today.

However, when everything is looked at, instead of individual items... (this is American, but serves to prove the example...)It is tempting to assume that the 70s generation were more frugal. Don't people eat out more now? Dress more expensively? And so on. Not so, the kind of spending that seems to be typical 2013 conspicuous consumption - home electronics, clothes, eating out - are, in inflation adjusted spending terms, actually lower than in 1970. In any case, these expenses are optional, if you run into difficulties you can postpone them. But what has risen, as the analysis in the lecture shows, are the much higher fixed costs of mortgages.

In prices adjusted for inflation, present day, middle class Americans are paying way more for their houses than in 1970. The fact that nowadays mom, as well as dad, is often bringing home a significant salary is not helping. The extra cash coming is going straight out again to service the debt, mainly on a much higher mortgage.

Back in the 70s most families managed with one car. But these dual income families have higher fixed costs, they need two newish cars so both partners can get to work. Taken on their own car running costs are lower, cars are relatively cheaper, more reliable and service costs are lower.

Other things being equal, even houses should cost less, mortgage rates are lower. But those mortgages are much higher, house prices have risen much more than the rate of inflation.

Sure, one item (food) may cost less, but as I reference above, petrol may cost about the same, but if families today are using more of it (which they are), food is having to be bought from a smaller proportion of the left over money.

“On several occasions, I have glibly referred to how it now takes two spouses working to equal the wages of a one-income family of 40 years ago. Unfortunately, that is now an understatement. In fact, Western wages have plummeted so low that a two-income family is now (on average) 15% poorer than a one-income family of 40 years ago.” — Jim Nielson | The Street 0

0 -

Why do you always look for reasons to show how bad thing are for you and how easy they were in the 70s. I have one advantage over you I was living in 70s and am living now and I can tell you life wasn't the bed of roses you seem to think it was. Out of interest how far do you drive to work.

I think my points are valid. I'm not trying to show how "bad things are", just questioning how you are using your figures.

It's difficult to measure food prices against household income, in my view, as the household income, and the way it is earnt and spent has changed dramatically. That's all I'm saying. If you don't take that into account, you will of course be able to make things look better or worse.

Your point may well still stand, all I'm asking is you take this into account instead of suggesting food is cheaper as bananas (which were in shorter supply in the 70's) haven't risen in line with inflation (mainly due to the increased supply).0 -

Graham_Devon wrote: »I think my points are valid. I'm not trying to show how "bad things are", just questioning how you are using your figures.

It's difficult to measure food prices against household income, in my view, as the household income, and the way it is earnt and spent has changed dramatically. That's all I'm saying. If you don't take that into account, you will of course be able to make things look better or worse.

Your point may well still stand, all I'm asking is you take this into account instead of suggesting food is cheaper as bananas (which were in shorter supply in the 70's) haven't risen in line with inflation (mainly due to the increased supply).

The RPI to earnings figures are available and they show that someone earning £1700 a month now would be earning £1000 if earnings had kept up with inflation instead of surging ahead.0 -

Graham_Devon wrote: »Really?

..)

Sure, one item (food) may cost less, but as I reference above, petrol may cost about the same, but if families today are using more of it (which they are), food is having to be bought from a smaller proportion of the left over money.

In the 70s I travelled 20 miles to work in a car which was less efficient than cars are now and my wife commuted the same distance by train so what makes you assume people used less petrol.0 -

The RPI to earnings figures are available and they show that someone earning £1700 a month now would be earning £1000 if earnings had kept up with inflation instead of surging ahead.

Yes, I understand this. But you are taking isolated items.

I did a 2 minute search on google for the two separate items of research I found. Both of them found families are worse off today compared to the 1970's, when they look at "all things being equal".

One has calculated families are 15% worse of today compared to 1970.

Granted, it's American research, and given the enthusiasm, I could likely find UK based research.

I'm not trying to make things look bad, I was just stating to you you have to look at how the household income is composed and look at how spending and income has changed. I found research that's done all that on my behalf and calculated that all things being equal, were 15% worse off today than 1970.

Of course, perception is key here. Even if things are 20% worse 40 years from now, I probably won't think that are, as I'd remember building my life back then and then compare it to my relative comfort (hopefully) after a life of working and earning and think back to how bad things were when I was trying to build everything up.

The research is the research though. It's not my research. I'm not trying to do anything, just looking at what the research has concluded, and what I found, concluded, even though were earning more, were 15% poorer relative to 1970.0 -

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards