We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Do you HAVE to use endowments to pay off M'gage?

Comments

-

What choice do the bank have?The only one thing I could not help them with was why, if the mortgage term ends in a few weeks, would the bank then be willing to wait until November for the final endowment to mature? Will they definitely do this?

Repossess and sell the house?

That would take months and cost everyone in terms of money and time. And make the bank look bad.

So the bank may as well wait a few months for the money.0 -

Hi Bob,

Sorry, forgot this was for a friends parents ... so you're off the hook

Ok, well a written letter of request from friends parents was sent Monday, re a term extension - good.

The bank may only converse with you on behalf of the account holders, if they have given their express request and permission to do so, so you'll find any reply will go back directly to them (and really I would keep myself out the loop if possible).

A short term temporary extension (ie due to a late maturing repayment vehicle), tends to be treated completely different to a term extension of a few years (as essentially it requires further underwriting).

Ideally when the mge term was originally selected on this account, it obviously should have been for a yr longer (criteria permitting of course), to allow the maturity of all repayment vehicles to occur pre scheduled redemption.

But it wasn't (for whatever reason), so we are where we are ... its not the end of the world, and the lender will try and be as flexible as possible. The fact however that the policies may also leave a residual shortfall, that the individuals can't immediately repay from their own finances, is obv a major issue of concern for all.

Anyhoo, there really isn't much more I can say at this point, your friends parents now need to see what solutions the lender comes back with, of course pop back as and when ... always here to help.

Hope this helps

Holly x0 -

All sensible comments on immediate advice

The other thing I would consider is about the £15k maturity. Setting aside any ethics discussion, your friend's parents are likley to be financially better off to repay this as a lump sum and reduce their payments. Credit interest rates are very low and are rarely better than the savings they'll gain through reducing the mortgage repayment.

They will also free up the cash which used to go to the endowment firm, as well as reducing the payment. This may be enough to convince their lender to extend the term on the £6k shortfall, particularly if they are willing to repay extra out of savings.So many glitches, so little time...0 -

Dave_the_Ginger_Cat wrote: »All sensible comments on immediate advice

The other thing I would consider is about the £15k maturity. Setting aside any ethics discussion, your friend's parents are likley to be financially better off to repay this as a lump sum and reduce their payments. Credit interest rates are very low and are rarely better than the savings they'll gain through reducing the mortgage repayment.

Not if benefits are still paying the interest!

They will also free up the cash which used to go to the endowment firm, Which is freed as soon as the endowment matures, irrespective of what is done with the funds.as well as reducing the payment. This may be enough to convince their lender to extend the term on the £6k shortfall, particularly if they are willing to repay extra out of savings.

You really are in a relatively unique position with a maturing endowment that doesn't produce enough of a savings pot to effect the payment of SMI benefit. Therefore any interest gained on the endowment payout is a contribution to the shortfall.I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

Thank you all (as usual!), you have been tremendous help.

Holly Hobby, your posts are wonderful. I want to just point out, though, that I did write/type the letter for my friend's parents as my friends parents so the request should be acknowledged, at least.

Regarding my earlier post about will the fact that they will own their own house (hopefully, that is) impact on their pension credit, I just read this and to a layperson such as myself it looks as if it suggests that having 'capital' does make a difference?

For Pension Credit, there is no upper limit of capital above which you cannot claim the benefit. Savings or capital up to £10,000, and any income generated by those savings, are ignored. You will be treated as having ‘assumed income’ of £1 for every £500 (or part of £500) of capital you have above £10,000. If you have a partner, you will be assessed as a couple and the first £10,000 of your joint capital will be ignored.0 -

Apologies, just read this:

'Some types of capital are ignored. This includes the value of the property you live in, if you own any, and any lump sum payments you received after deferring your State Pension.'0 -

Hi Bob,

Your own property is excluded from any means test assessment.

In respect of PC, (and at the risk of repeating what you have said !), you are correct for every £500 savings above the pivotal sum, they are assessed as having a £1 extra income. This will obviously increases their income for assessment, and MAY result in them losing some or all of their pension credit ... and no pension credit = no SMI qualification.

!), you are correct for every £500 savings above the pivotal sum, they are assessed as having a £1 extra income. This will obviously increases their income for assessment, and MAY result in them losing some or all of their pension credit ... and no pension credit = no SMI qualification.

And thats apart from the lender having to agree to defer the whole mge amount for how many yrs ? And given that it will require new underwriting as discussed, this may well not be agreed in any event.

So the suggestion to try and hold onto the endowment proceeds, whilst continuing to claim SMI (if they remained eligible), until whenever, is simply not a viable option IMHO.

Benefits are there for those in need, obv if parents will have 15k sitting in a bank from their mge endowments which were designed to repay their interst only mge, whilst they instead choose not to use them for this purpose (if not assigned and whether temporarily or not), but instead continue to allow DWP and the taxpayer pay their mge interest for them, when there is no need of this, is another facet to the suggestion.

Hope this helps

Holly0 -

holly_hobby wrote: »Hi Bob,

Your own property is excluded from any means test assessment.

In respect of PC, (and at the risk of repeating what you have said !), you are correct for every £500 savings above the pivotal sum, they are assessed as having a £1 extra income. This will obviously increases their income for assessment, and MAY result in them losing some or all of their pension credit ... and no pension credit = no SMI qualification.

!), you are correct for every £500 savings above the pivotal sum, they are assessed as having a £1 extra income. This will obviously increases their income for assessment, and MAY result in them losing some or all of their pension credit ... and no pension credit = no SMI qualification.

And thats apart from the lender having to agree to defer the whole mge amount for how many yrs ? And given that it will require new underwriting as discussed, this may well not be agreed in any event.

So the suggestion to try and hold onto the endowment proceeds, whilst continuing to claim SMI (if they remained eligible), until whenever, is simply not a viable option IMHO.

Benefits are there for those in need, obv if parents will have 15k sitting in a bank from their mge endowments which were designed to repay their interst only mge, whilst they instead choose not to use them for this purpose (if not assigned and whether temporarily or not), but instead continue to allow DWP and the taxpayer pay their mge interest for them, when there is no need of this, is another facet to the suggestion.

Hope this helps

Holly

It ALWAYS help, Holly!! 0

0 -

Fair pointYou really are in a relatively unique position with a maturing endowment that doesn't produce enough of a savings pot to effect the payment of SMI benefit. Therefore any interest gained on the endowment payout is a contribution to the shortfall.

For clarity, I'm a lender. I would insist on the lump sum paid off, even if the policy is not assigned and I might consider the extension but would go through a means test.So many glitches, so little time...0 -

Hi again.

Ok, my friend's parents have now sent two letters to their mortgage provider asking for an extension. As yet they have not replied. In the meantime they are doing what they can to raise the £6k as they are now aware that they will probably fail with any application as they have very little income.

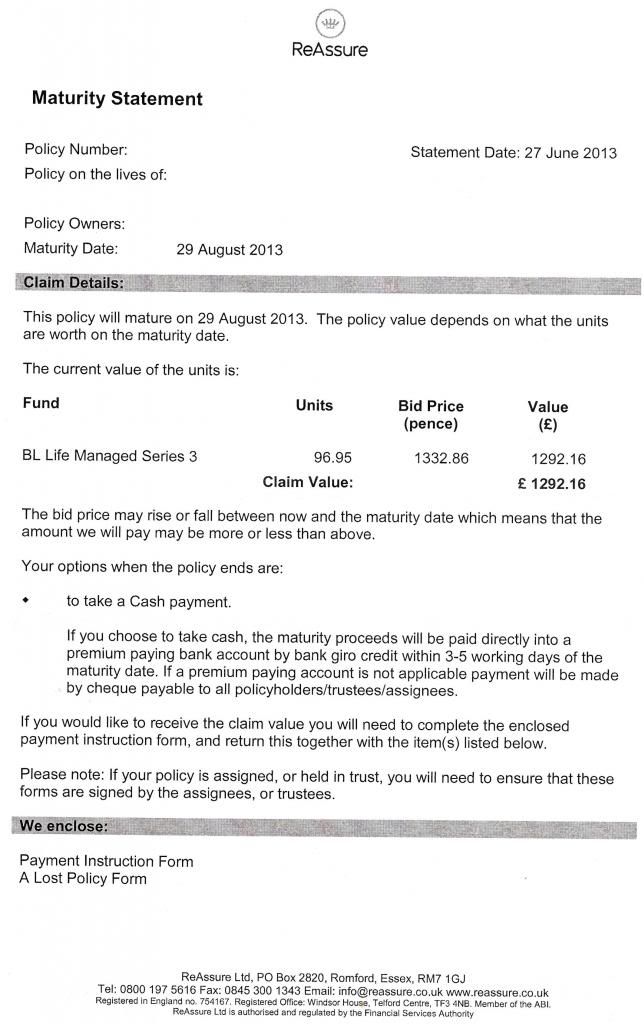

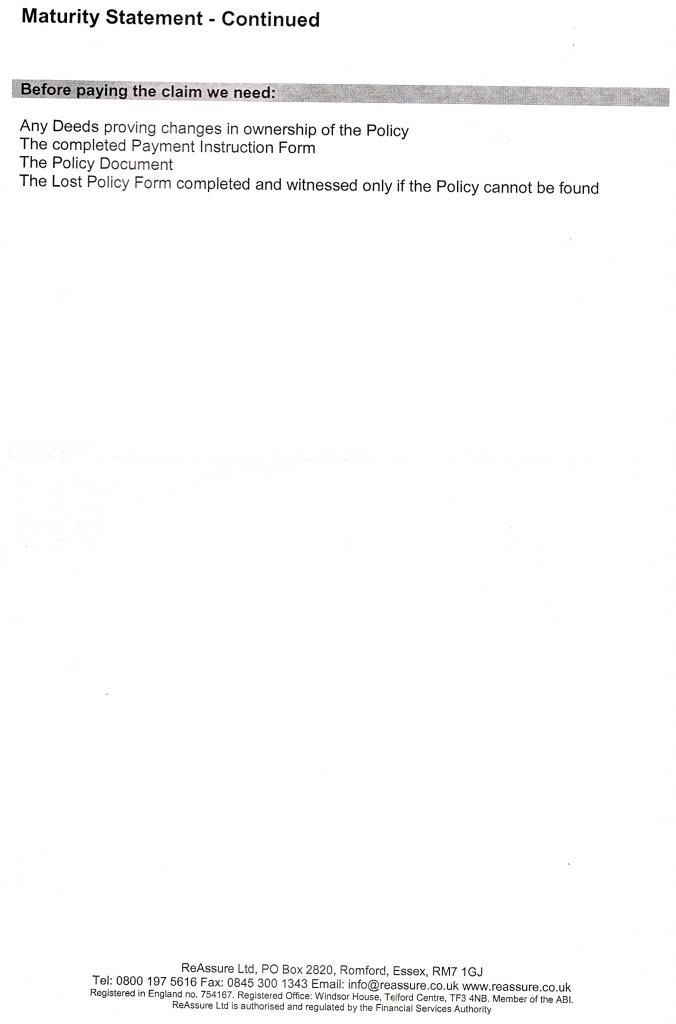

Today they receieved these from their endowment provider:

They do not have the documents but before filling in the lost policy form, please can I ask would the bank have these policies or is it something that they should have?

Also, are they 'allowed' to keep the funds in an ISA until the final endowment is due on 19th November?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.3K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards