We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Late payments and credit score

KingHenryVIII

Posts: 42 Forumite

in Loans

Hi,

I have a loan with Smile and the payment date on the agreement was 30th of each month, standing order.

I unwittingly changed this to 1st of each month with my bank, which is ok when the 30th lands on a weekend or bank holiday.

My question is will a 1-2 day late payment show on credit score? Do banks etc. have a timescale for reporting late payments? I read somewhere a while ago (i think on Experian website) that these are usually only reported when a full payment cycle has gone without a payment, example 30 days.

I have had no correspondence from Smile (or late payment fees) to say if the payments are late or not, would they contact me?

Thanks,

The King

I have a loan with Smile and the payment date on the agreement was 30th of each month, standing order.

I unwittingly changed this to 1st of each month with my bank, which is ok when the 30th lands on a weekend or bank holiday.

My question is will a 1-2 day late payment show on credit score? Do banks etc. have a timescale for reporting late payments? I read somewhere a while ago (i think on Experian website) that these are usually only reported when a full payment cycle has gone without a payment, example 30 days.

I have had no correspondence from Smile (or late payment fees) to say if the payments are late or not, would they contact me?

Thanks,

The King

0

Comments

-

There is a subtle difference between a late payment and a missed payment.

You can be up to 4 weeks late, your credit file normally states how many weeks late you are with each payment.

Neither is a good thing as far as a credit file goes, some lenders will pounce, others will do nothing, others will do nothing but report it to the CRA in any case.

Best not to assume, shifting payments right is not a good thing and brings many risks. You have extended the term of your loan without agreement and broken the very agreement by not paying when you promised.

Give Smile a call and make them aware, there may be a small adjustment in one payment to balance the books.0 -

What is the difference between late and missed? I assumed a late payment (like mine) is a missed payment.

This has now been rectified but was going on for a few months though haven't checked credit score yet to see if it shows, will do once I receive my PIN from Experian. Will also contact Smile though it seems strange that if it does show as a late payment why they haven't contacted me??0 -

Late is when you make your payment before the next one is due, missed is when the next payment arrives and you haven't made it up yet.KingHenryVIII wrote: »What is the difference between late and missed? I assumed a late payment (like mine) is a missed payment.

This has now been rectified but was going on for a few months though haven't checked credit score yet to see if it shows, will do once I receive my PIN from Experian. Will also contact Smile though it seems strange that if it does show as a late payment why they haven't contacted me??

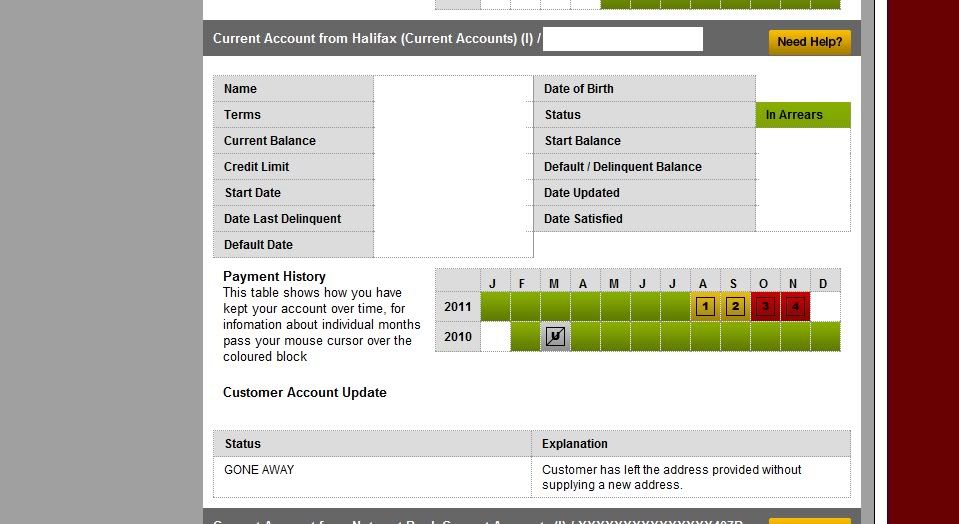

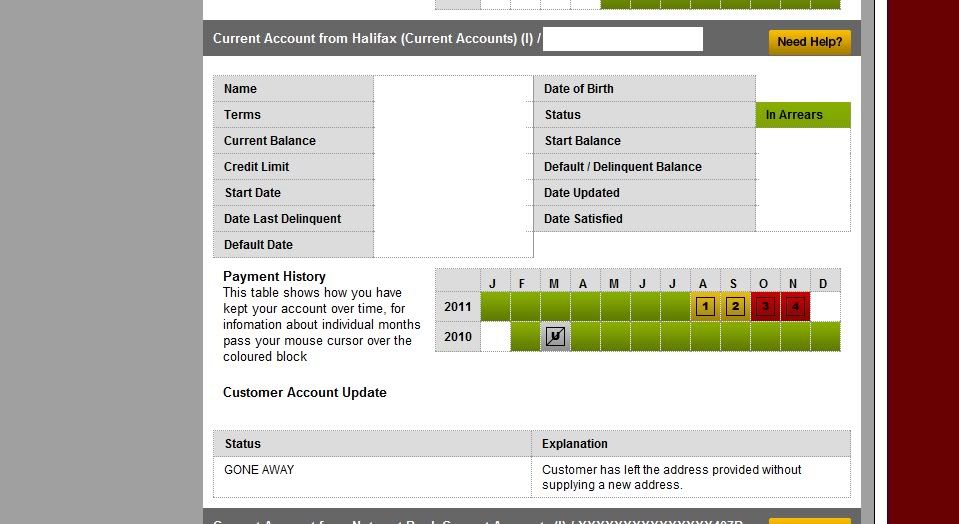

Here's an example of a Credit File (after a quick google). You can see the yellow box with the number inside, this number shows how late the payment was. Missed payments go red. Anything not green is bad so should be avoided.

"Some" unscrupulous lenders won't bother informing you as they can pile on loads of additional charges, the longer you are unaware, the more charges they can apply.... or am I an old sceptic? 0

0 -

Thanks, what do the numbers mean, number of days late? So a missed payment would be if I hadn't paid before the next payment is due. Does a late payment of a couple of days even show up on a credit score?

Surely a company would have to notify you if a late payment charge was being incurred?0 -

KingHenryVIII wrote: »Thanks, what do the numbers mean, number of days late? So a missed payment would be if I hadn't paid before the next payment is due. Does a late payment of a couple of days even show up on a credit score?

Surely a company would have to notify you if a late payment charge was being incurred?

they probably have in your original terms and conditions of the loan0 -

Just an update.

Checked on Equifax and my payments regarding this are all green and up to date, maybe they just don't notice if payments are 1-2 days late or they have a number of days before reporting it.

Is it worth checking Experian or do credit agencies use the same information?0 -

your credit file normally states how many weeks late you are with each payment

This isn't quite right.

You can't just "be upto four weeks late" - it depends on the date of the month on which the lender update the credit reference agencies. If you pay prior to this date, the account appears as up to date on your credit file. If you miss this date, it appears as a month behind.

Credit reference agencies also don't record how many weeks late a payment was nor do they differentiate between a "late" or "missed" payment.

If a payment is paid prior to the date on which the lender updates the credit reference agency, it show up to date, if it is paid subsequent to this date, it will show as one month in arrears.

"Arrears" is a universal term used by lenders to refer to missed or late payments, they don't differentiate.

ADDENDUM: The lender might report an account as up to date if the payment due date is missed by a few days, but marking the account as up to date and paid on time on ones credit file doesn't mean they aren't allowed to charge you a late payment fee. They're entitled to do this if your payment is just one day late.Cashback Earned ¦ Nectar Points £68 ¦ Natoinwide Select £62 ¦ Aqua Reward £100 ¦ Amex Platinum £48

0 -

ya this is very simple friend. it's all depend your lender and their rules and policies...........also.0

-

Late is when you make your payment before the next one is due, missed is when the next payment arrives and you haven't made it up yet.

Here's an example of a Credit File (after a quick google). You can see the yellow box with the number inside, this number shows how late the payment was. Missed payments go red. Anything not green is bad so should be avoided.

"Some" unscrupulous lenders won't bother informing you as they can pile on loads of additional charges, the longer you are unaware, the more charges they can apply.... or am I an old sceptic?

A status '1' can be put on your file (in relation to current accounts) if you breach your agreement as well as pay late, you could even end up with a '1' if you are ONE day late although most lenders don't normally report this up to a some point between the payment failure and the next billing date.I have numerous qualifications in Business and Finance, Accountancy, Health and Safety and am now studying Law.

Don't rely on anything I write as it may be wrong!!!0 -

Thanks, do the credit agencies use the same info? Could it be marked as late/missed with Experian even though it isn't with Equifax?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards