We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FTB trying to understand bank mortgage estimates.

Options

Nine_Lives

Posts: 3,031 Forumite

Trying to understand this but the wife is in the ear tonight & i can't wrap my head around it all.

Basically we'll be looking at fixed term for sure, and probably for 5 years. There are so many options though & i don't really understand the difference between them tbh.

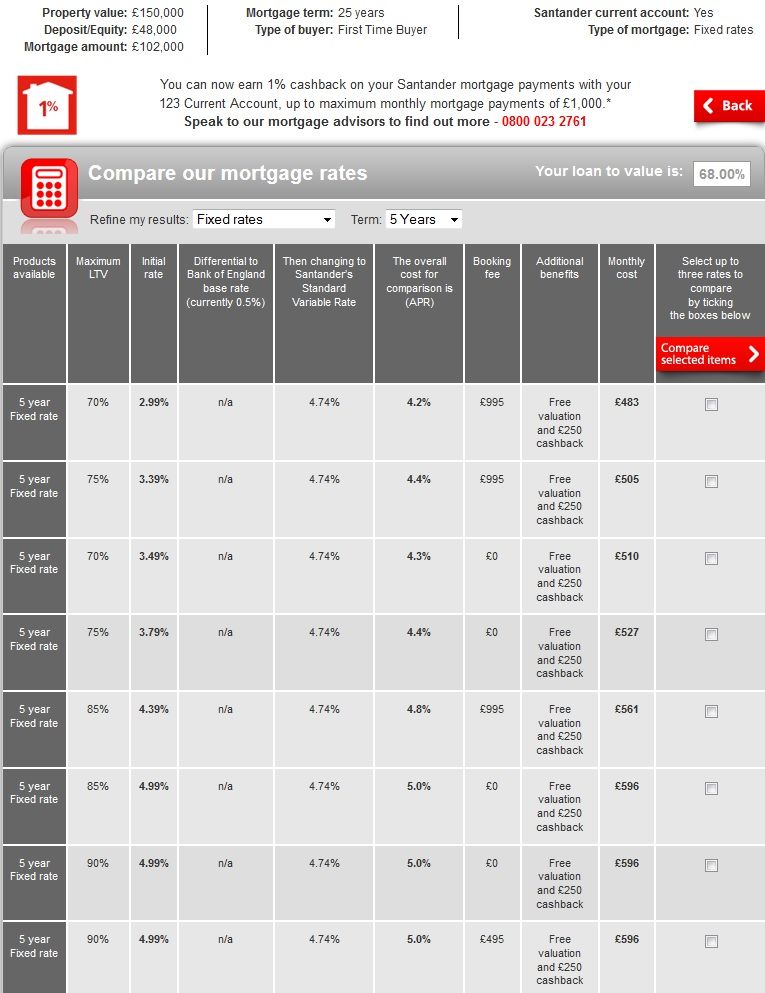

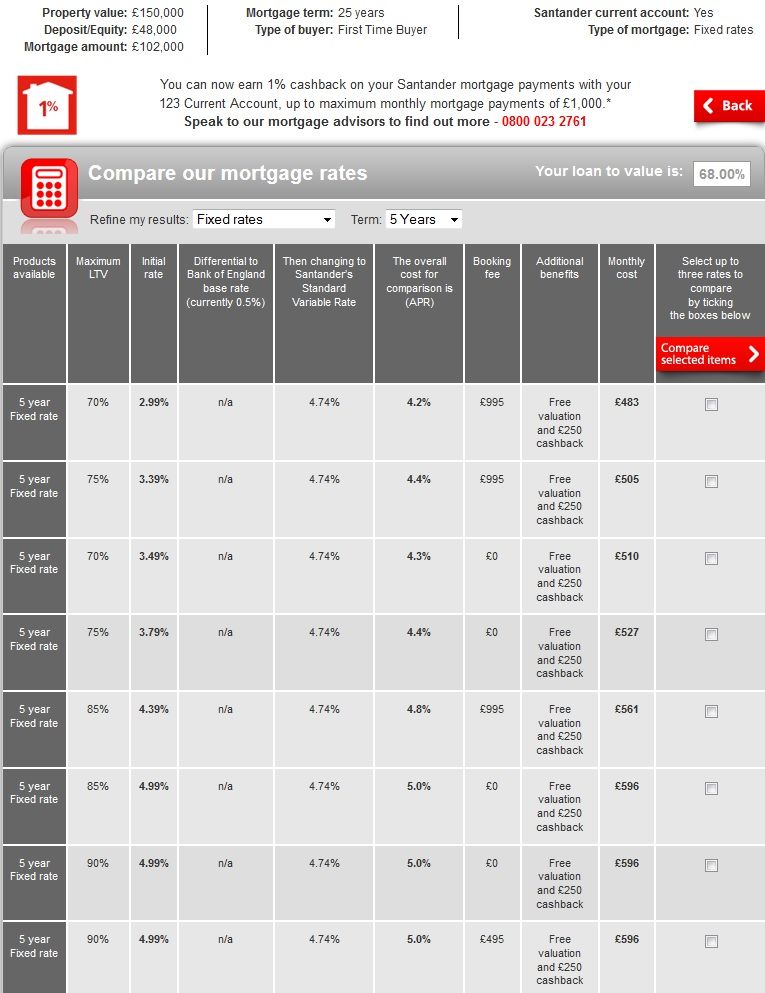

Not sure if photobucket is going to be annoying & resize my screencap so small, but here goes...

There's 8 different options. As we're just stepping into this, it boggles my mind.

What i do understand however is the final column - the monthly fee. Is this the only one that really matters? As if so, then i'd obviously be opting for the top one as it's cheapest.

EDIT: I was reading a book today on buying your first house by that Phil Spencer (is it?) bloke.

Do you only see your bank/BS for your mortgage? There's nobody else you'd bother to see? (so we're talking Nationwide, Santander, FD, Halifax etc etc etc, but only those?) If the answer is yes, do you have to be an account holder with them, or does it help to be an account holder with them?

Basically we'll be looking at fixed term for sure, and probably for 5 years. There are so many options though & i don't really understand the difference between them tbh.

Not sure if photobucket is going to be annoying & resize my screencap so small, but here goes...

There's 8 different options. As we're just stepping into this, it boggles my mind.

What i do understand however is the final column - the monthly fee. Is this the only one that really matters? As if so, then i'd obviously be opting for the top one as it's cheapest.

EDIT: I was reading a book today on buying your first house by that Phil Spencer (is it?) bloke.

Do you only see your bank/BS for your mortgage? There's nobody else you'd bother to see? (so we're talking Nationwide, Santander, FD, Halifax etc etc etc, but only those?) If the answer is yes, do you have to be an account holder with them, or does it help to be an account holder with them?

0

Comments

-

A broker would be worth a chat if you are unsure on mortgages.

If the figures you have are correct then you only need to worry about the 70% mortgage deals.

The arrangement fees will need to be paid up front or added to the loan. You need to work out if the fee will be saved over the chosen period to make it worthwhile paying.

A broker could search all options for you and get the best deal for your needs and preferences.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

You need to look at the first column to ensure you fit into the criteria for it.

There are any number of things that would be important and its down to the individual. Some people want the cheapest, some people want the security of a long term fixed rate, others want some of the options (overpaying/underpaying etc).

Im not trying to confuse you or make it seem more difficult than it is, but to say the repayments is the most important is just wrong.

Its probably a good idea to speak to a broker, the reason being is there is more than just your bank. They may be able to find something more suitable to your needs and if your baffled by just one lender - then imagine checking all the banks. They can help narrow down whats important to you and then go and do the research.

Sticking to your own bank isnt always best - they have access to your whole banking history, if you have been ovedrawn for a day or so recently then it can go against you sticking to your bank.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

All the stats given are correct, so it says our LTV would be 68%, so this is true. If anything, as time goes on, our deposit is only increasing, albeit slowly as we're not on megabucks.

Regards being overdrawn etc - this isn't a problem. I've never been overdrawn in my life. Never made any late payments, always paid on time etc. The wife is a bit different as she was 'another statistic' before she met me. The last time she was living on her overdraft though would've been getting on 10 years ago though. We've been stoozing for the past few years (have paid off & closed all credit cards now) & we've both always paid on time.

Are these brokers expensive? What do they do that you can't do yourself? If they just look at what all the banks offer & put in the information that you see at the top of that screengrab, then why couldn't the individual do that? Yes a bit time consuming entering in the info to all the banks websites, but still?

If they don't charge a great deal though then it's a bit different.

GMS - your sig says you're a MA. Sorry for being a bit green here, but i've never had to look into it so don't know & am about to sound stupid ......... but what advice do you (MAs) actually give? I'm talking about in person, not on MSE. Is it just telling people what they can & can't afford? Is it in place of a broker or alongside? Just wondering what sort of advice a MA gives. Basically i'm trying to work out whether we actually need to pay to see one or whether it's not necessary.

ACG - sorry, i see you're an MA too. I missed that (your sig isn't as bright as GMS lol)0 -

There is nothing stopping you doing your own mortgage research at all.

The difference really is that we gather the information we need then find a mortgage with the lowest rate that meets your criteria.

We do the application, send it over to the lender and just basically try to package it all up to make the process go smoother.

You and anyone else is able to do all of this by yourself, we just try to take away the stress and work from you and let you worry about it. We also ensure you have thought about the potential problems that can arise and ensure your property is protected (this doesnt mean we just flog any old thing to you - far from it, as its one of the most regulated industries going).

Imagine your fitting a bathroom, you can do it all yourself from plumbing to tiling - but do you?

We're effectively a professional that ensures the job is done properly.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

I spent the weekend doing the same thing Nine. I reckon it all boggles the mind for the first couple of hours, then starts to become clear in the next couple, then briefly boggles you again as you get overloaded, and finally (after about 5-6 hours) starts to make sense!

Here are a couple of things I worked out:

- It isn't JUST the monthly payment that matters (final column). You need to factor in the fees, too. Basically, borrowing £100K, a fee of around a grand is like an extra percent on your first year's mortgage. Some fees are even higher than that. There's no point getting a low/discounted 'deal' if the fees add up to even more than the discount.

- Some mortgages tie you in, so there's a big penalty charge if you move or pay back early. Most of the fixed deals tie you in for the period of the deal - i.e. fixed at 2.9% for 2 years, but you'll have to pay a big penalty (often £2-3K!) if you leave/repay before those 2 years are up. If you're not intending to sell up within this time, that's probably not a problem; but if you are, then it might be, and you need to factor in that extra cost too.

- Some of the best fixed deals (i.e. with low rates at the beginning) have higher rates than average after that, making them not such good value. So for instance 2.9% for two years sounds better than 3.5%... But if the first deal then jumps to 4.9%, while the second one only rises to 4%, then the second one might be a better deal.

- Some of the best deals have special conditions that might rule you out. For instance, they might only be available to people who earn over a certain amount, or who are in a certain age range, or who only need a loan for 60% of the property's value... It's worth checking out the details before you get excited!

I also reckon talking to a broker (or two or three) is a good idea. I spoke to 4 of them in the end I think, and learned/understood something new each time... (It also meant that I'd asked my stupidest questions before I spoke to the broker I've actually chosen to use, which saved me a bit of embarrassment! )

)

Good luck!0 -

Broker/adviser are the same thing.

A broker would search for the best mortgage for you. Match your needs and preferences to a lender. Deal with the lender to take away any interaction and provide advice so as to give you something to rely upon.

Broker fees vary. Most wouldn't charge for an initial consultation. From there make sure you agree the terms up front.

Whether you NEED a broker is your choice. You could spend hours or days speaking to lenders to see if you fit. Your own bank may be best for you. A broker could compare the market for you so take away the leg work so to speak.

Why not do both? Research your own lenders and see if a broker can beat it?I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

An individual could do it - for example moneysupermarket lets you compare many deals at once - but a broker may have access to deals that are 'broker only'.

They will also be able to explain the various options if you are unsure of whats involved.

From the screen capture above you need to take the fees into account over the term as a higher rate but a lower fee may be cheaper overall than a lower rate with a higher fee.

You also need to decide if you want to pay the fee up front or add it to the loan.0 -

Thanks guys. Very helpful!!

When we move it'll be for long term to permanent. That's why we've taken so long to actually move & for us to get the deposit we have.- Some of the best fixed deals (i.e. with low rates at the beginning) have higher rates than average after that, making them not such good value. So for instance 2.9% for two years sounds better than 3.5%... But if the first deal then jumps to 4.9%, while the second one only rises to 4%, then the second one might be a better deal.

However the above quote made me wonder...

Take my mums gas for example. She fixed in for however long & got an email recently saying the term is about to be up. It'll switch to some default setting British Gas have in place, but she also has the option to fix in with BG, or switch altogether. Suppose it's like the ISAs situation too when your term is up.

Maybe i'm showing how green i am again, but i imagined that when you lock in for 5 years, that once those 5 years is up, you can then lock in for another 5, or even switch & go with someone else (although i suppose switching may cost a bit? But certainly have the option to lock in again for another 5).

Or does it not work like this? Can you only lock in for 5, but then you're variable with the lender every year after that?

I know you may pay more being fixed, but i like the security of it so would ideally like to just keep locking in every time the term is up.

EDIT: And what's the best way to find a decent broker? To be honest, we don't have many friends we can ask. In fact i only know of one who's just bought & i'm sure they didn't use one.0 -

When your deal finishes, there are usually a few options available:

1) Revert to the lenders standard variable rate (This vaires from bank to bank).

2) Take up a new deal with your current lender (Depending on what they have available)

3) Move to a new lender.

As for finding an advisor, i would just go to google. I use that for everything else.

Try and find either Whole of Market or independent. Tied or Multi tied arnt really worth the time or effort in my opinion. You might find some who dont charge a fee, but my opinion is you get what you pay for.

Edit: - Having said my last comment. If your situation isnt too difficult and it doesnt seem to be going off what you have said then you will probably fine with almost any broker.I am a Mortgage AdviserYou should note that this site doesn't check my status as a mortgage adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

Yes, you can switch after your fixed term... But bear in mind there are fees to pay - both to the company you're with for leaving them, and the company you move to for starting a new mortgage! (Hmmm!)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599.2K Mortgages, Homes & Bills

- 177K Life & Family

- 257.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards