We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

So-called Debt Crisis

HAMISH_MCTAVISH

Posts: 28,592 Forumite

UK debt has rarely been lower....

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

0

Comments

-

HAMISH_MCTAVISH wrote: »

UK debt has rarely been lower....

As reassured as I would like to be, you are of course well aware that much of our debt is off the balance sheet thanks to PFI and unfunded pension promises for public sector employees.0 -

Hold up.

We both know that in actual terms UK debt has never been higher.

What you're talking about is in real terms.

But that doesn't make sense, because only a couple of days ago you were saying how real terms are meaningless.

It was here in fact:

http://forums.moneysavingexpert.com/showpost.php?p=58763641&postcount=9HAMISH_MCTAVISH wrote: »I don't much agree with the terminology of "real terms", whether it be falls or rises.

Oh dear.0 -

What you're talking about is in real terms.

Nope.

What I'm talking about is a ratio of debt to GDP.

The house price equivalent would be mortgage to income, not real terms versus nominal.Oh dear.

Indeed.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

unfunded pension promises for public sector employees.

Has always been off balance sheet.

It's comparing like with like.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Has always been off balance sheet.

It's comparing like with like.

For half your graph there were no public sector pensions and liabilities have been rising fast due to people living longer, Government largesse and greater public sector employment.

To ignore £5,000,000,000,000 (five trillion pounds) of off balance sheet debt is to miss the point really. It's a bit like someone approaching bankruptcy saying, "My finances are fine if we ignore the mortgage".0 -

To ignore £5,000,000,000,000 (five trillion pounds) of off balance sheet debt is to miss the point really

No, it's really not.

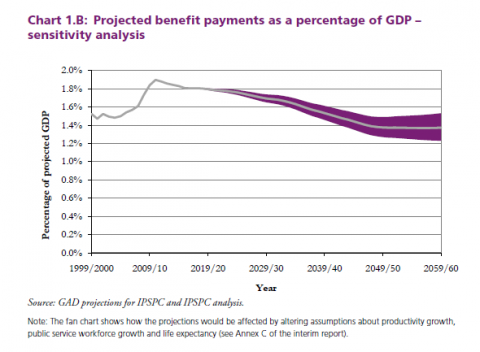

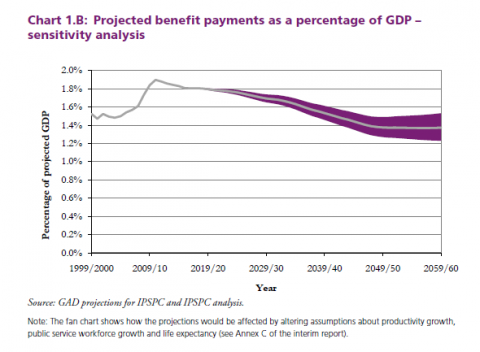

Public sector pension liabilities are projected to decrease as a percentage of GDP.

£5 trillion is a big number.

It's a lot less when spread over many decades.;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »No, it's really not.

Public sector pension liabilities are projected to decrease as a percentage of GDP.

£5 trillion is a big number.

It's a lot less when spread over many decades.;)

£5 trillion, even when spread over 5 decades is a hundred billion a year;)

The assumptions in the small print below your graph assume that real GDP grows at 2.5% a year. Growth has averaged about 1.4% over the past decade according to my rather rough and ready calculation so that's a big ask.

As an aside I find it very interesting that despite an aging population that is living longer and has huge pensions promised to it, the Hutton Report manages to show annual pension costs (as a proportion of GDP) falling pretty much year-on-year from a few years time. That's good if it can be done but I have my doubts0 -

Public sector workers are facing increased contributions for their pensions.

For average paid Civil service workers. This rising by 1% from this April. So wipes out any grading pay increase. (Pay itself remains frozen).0 -

That chart shows what would have happened to PS pensions without reform. And they've been cut very substantially.£5 trillion, even when spread over 5 decades is a hundred billion a year;)

The assumptions in the small print below your graph assume that real GDP grows at 2.5% a year. Growth has averaged about 1.4% over the past decade according to my rather rough and ready calculation so that's a big ask.

As an aside I find it very interesting that despite an aging population that is living longer and has huge pensions promised to it, the Hutton Report manages to show annual pension costs (as a proportion of GDP) falling pretty much year-on-year from a few years time. That's good if it can be done but I have my doubtsFACT.0 -

the_flying_pig wrote: »That chart shows what would have happened to PS pensions without reform. And they've been cut very substantially.

No, the chart shows what might have happened from a particular point in time given a set of assumptions some of which were quite optimistic.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards