We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mortgage Debt Arrears improving markedly

Comments

-

Graham_Devon wrote: »There will be a mad rush to fix....that will be the problem. Lenders won't be able to supply the demand.

A massive rush for people to pay them arrangement fees, I'm pretty sure they'll find a way of covering it. Moving from SVR to a fix won't require a re-application in most cases, when I did it 3 years ago it took a 5 minute call.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

Graham_Devon wrote: »I have a feeling I've pulled some down to the ground with a bit of reality and it's offended. I'm sorry for doing that, but to suggest you will all just fix when rates start going up is fantasy.

You know how it works Graham.

You're the only one that understands reality. The rest of us are getting aroused by Daily Express headlines and the picture of Kirsty Allsop we carry in our wallets.0 -

A massive rush for people to pay them arrangement fees, I'm pretty sure they'll find a way of covering it. Moving from SVR to a fix won't require a re-application in most cases, when I did it 3 years ago it took a 5 minute call.

Oh yeah....like the way they did when interest rates fell and everyone got super new shiny low rates? of course.

I give up with this place. It's complete nonsense now.0 -

RenovationMan wrote: »When rates go up, super low fixed rates will be withdrawn to be replaced by not-so super low fixes.

The balance to counter not getting the absolute best rate is the amount saved by years at the lowest rate.

The risk is if you fix now, although safe, you are infact paying more on the mortgage than you would on SVR / Tracker.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

Graham_Devon wrote: »Oh yeah....like the way they did when interest rates fell and everyone got super new shiny low rates? of course.

I give up with this place. It's complete nonsense now.

Eh? People on SVRs got shiny new rates yes.This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

You know how it works Graham.

You're the only one that understands reality. The rest of us are getting aroused by Daily Express headlines and the picture of Kirsty Allsop we carry in our wallets.

How someone can be so convinced he is right, when he has been so wrong all other times amazes me. Remember all that moaning about the BoE should raise rates and that the Europeans had it right when they raised the ECB rate (and how quiet he became when they quickly lowered it again!). There have been numerous occasions when Devon has taken the extreme 'bear belief' view and been wrong, yet he is still unshakable in believing that in the next prediction he will be right.

The 'bear belief' is as rigid and immovable as any religious beliefs held by people. This is why they sit and wait for events to go their way (wating for a crash for decades) rather than adapt their thinking and financial plans and taking advantage of what is actually happening and likely to happen rather than having 'faith' in what they 'believe' will happen.

Bonkers, but there you go.0 -

Graham_Devon wrote: »No, I have no statistics, so it's safe for you to put your blinkers on and ignore everything I say.

It's all those who have higher LTV requirements though, for info.

Context Graham, context.

I am not closing my eyes and they are not blinkered. Indeed I'm highlighting that you are the one who has shut his mind to the information.

If you start considering facts I'm sure you'll make your points far better.

The fact you don't have anything to back up what you are saying will point to the lack of merit in your post.

How can I look if the data is not there?Graham_Devon wrote: »You only have to look at the people now, stuck on SVR, who had all intentions of switching to see how cumbersome it is making airy fairy plans.

To be honest though, there really is no point in discussing it is there. You simply do not want to know and want only to listen to the other airy fairy views.

Maybe I'm not the one who is blind.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

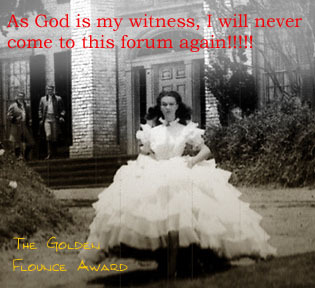

Graham_Devon wrote: »I give up with this place. It's complete nonsense now.

Oh dear someone has realised they are wrong!

Get ready everyone......

"He cannae hold it Captain, he's gonna flounce!" 0

0 -

Graham_Devon wrote: »Oh yeah....like the way they did when interest rates fell and everyone got super new shiny low rates? of course.

I give up with this place. It's complete nonsense now.

I bought a holiday place and arranging the mortgage took less than half an hour of my time and that was with a lender that I'd never previously had any dealings with.

I popped into my existing lender one lunchtime on the off-chance that I could talk to someone there. Subject to a signature from my wife they would have transferred the equity in my house up to 80% LTV into my current account the next working day - no questions asked.

My BIL has just remortgaged - one phone call - paperwork arrived 3 days later for signing - job done.

Out of interest - have you ever remortgaged?0 -

Graham_Devon wrote: »It's all those who have higher LTV requirements though, for info.

Higher LTV's does not mean they are 'stuck on SVR'.

I'm guessing you mean those that do not meet the current mortgage requirements and have finished any mortgage term they might have initially been on?

In otherwords, those with less than 10% equity and savings.

It would still be interesting to know how many of them there are and unless we are able to, we'll never be able to put them in context or understand their weighting on the market.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards