We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Hargreaves Lansdown & buying additiona/extra/other funds?

Nine_Lives

Posts: 3,031 Forumite

Right then ... so my brother has begun putting some (£50/month at moment) away as a start with a view to increase when wages allow.

He understands this whole thing (pensions/ISAs/retirement planning) less than i do, and when i say less than i, i mean he doesn't understand anything beyond "you put money away for a long time, you hope to get more back when you draw on it, but may get less" so on the back of this, he's happy for me to look up the information (i don't mind), tell him what i've found, what i think & then he makes a decision.

On the back of this, his first £50 was put here: http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/j/jupiter-merlin-balanced-portfolio-accumulation/ (Jupiter Merlin Balanced Acc).

An email came through the other day, subject: "Could cheap valuations spur Asian markets?" Giving a link to: http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/a/aberdeen-asia-pacific-accumulation

I had a look at this, and bearing in mind he'll be investing for the long haul (i.e. 40years+), to me it seems not too shabby. Some of you may remember me - and also how little i know ... which is why i'm making this thread.

Does this sound bad news to any of you? I understand it can be volatile, but you take your chances - i'm asking if it sounds bad news. To me it may sound more volatile than the Jupiter Merlin, but the potential gains seem much higher (but on the flipside i understand potential loss is also increased).

Not knowing the ins and outs of how HL works, can you lump your next (or any) payment (so his next £50 in his case) into another fund (such as the one i've just linked up)? Or does it have to be with the first fund you selected?

Feedback very welcome & appreciated.

He understands this whole thing (pensions/ISAs/retirement planning) less than i do, and when i say less than i, i mean he doesn't understand anything beyond "you put money away for a long time, you hope to get more back when you draw on it, but may get less" so on the back of this, he's happy for me to look up the information (i don't mind), tell him what i've found, what i think & then he makes a decision.

On the back of this, his first £50 was put here: http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/j/jupiter-merlin-balanced-portfolio-accumulation/ (Jupiter Merlin Balanced Acc).

An email came through the other day, subject: "Could cheap valuations spur Asian markets?" Giving a link to: http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/a/aberdeen-asia-pacific-accumulation

I had a look at this, and bearing in mind he'll be investing for the long haul (i.e. 40years+), to me it seems not too shabby. Some of you may remember me - and also how little i know ... which is why i'm making this thread.

Does this sound bad news to any of you? I understand it can be volatile, but you take your chances - i'm asking if it sounds bad news. To me it may sound more volatile than the Jupiter Merlin, but the potential gains seem much higher (but on the flipside i understand potential loss is also increased).

Not knowing the ins and outs of how HL works, can you lump your next (or any) payment (so his next £50 in his case) into another fund (such as the one i've just linked up)? Or does it have to be with the first fund you selected?

Feedback very welcome & appreciated.

0

Comments

-

You can change your funds whenever you want but you have to do it within a certain time. I think it's something like the 24th.

So the funds I invest my £50 in in March will have to be decided by end of next week. It's pretty obvious when you log in and go to the regular investment page.0 -

You can put future contributions into a different fund.

As you say, emerging market funds can be volatile, but as you also point out that doesn't matter too much if you're in for the long term.

Who knows which of those two funds will do better over the next decade or two. But having a balance of UK/Europe/USA and emerging markets seems a good idea to me.0 -

Thanks for the feedback.

I'm new to this myself & helping him in a way is also helping myself - for when/if i manage my own (currently being run by my IFA). Funnily (a bit off topic)... I invested £100 for month 1 & my value is sitting at £67 in month 2, a few days shy of the second £100 deposit. My brother invested £50 for month 1, going solo-managed (no IFA) & he's sitting at £50.10.

Makes me think that going solo may not have been such a bad idea after all. HE had no time to go see an IFA so managing it solo was his only option.

So as i say - due to me being new to this, i didn't know if there was something terrible about this that i couldn't figure out.

We'll look around the account & see how you place the next investment with another fund.0 -

What are you invested in that's lost 33% in the last month?0

-

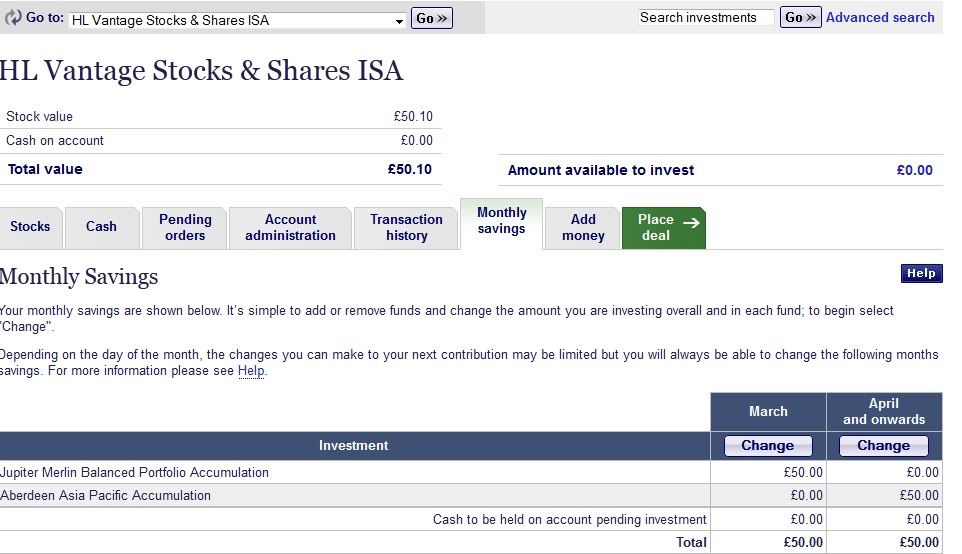

Is this how you add funds in HL:

We tried going £25 Aberdeen & £25 Jupiter, but it said £50 minimum.

Hopefully that has been set out right. Then for the months following this, he'll want to be splitting his £50 per month (if possible) between the 2 funds. If this isn't possible then he wants to go £50 into one one month, & £50 into the other the nextIlya_Ilyich wrote: »What are you invested in that's lost 33% in the last month?

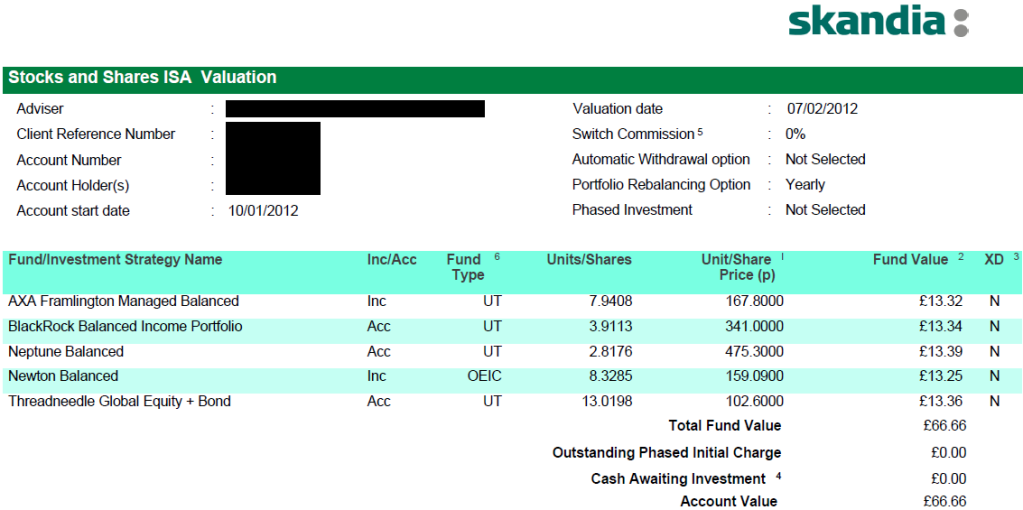

This is an old(ish) screenshot. It dipped below this but then i think it was at £67 on Friday. I'm not sure if the yearly charge has already been taken or not, or a percentage of it. I'd have to check paperwork.

That's what the IFA selected for me based on my risk approach. My gf who was lower risk has different funds. She's investing the same per month, but hers is now worth about £1 less than mine.0 -

OK, here's what I think. I am absolutely no expert, you must understand that from the beginning.

To me, it looks as if you are putting in tiddly amounts but spreading it all much too widely. If you want to put in £50 a month that's absolutely fine, but concentrate on fewer funds. Choose where you want to concentrate first, build that up then diversify from there.

For me, I wanted a good basis in UK equities, a strategic bond, and an ethical fund. I read what HL say on their site and I also read the magazine they send out. I must have done something right, because I started with £199 in the April 2006 statement and I now have a little over £10K.

People do it in different ways. My DH, for instance, has only Artemis Strategic Assets Retail Accumulation. He doesn't bother with any other fund, but from £1600 he now has about £3600, over a few years.

HTH[FONT=Times New Roman, serif]Æ[/FONT]r ic wisdom funde, [FONT=Times New Roman, serif]æ[/FONT]r wear[FONT=Times New Roman, serif]ð[/FONT] ic eald.

Before I found wisdom, I became old.0 -

Margaret - first off i want to say thanks for your reply. Also, i want to say that what i'm about to reply to will look like i'm picking your post apart. I'm not "picking" at all. There's just some parts of what you said that made me think the following...

Agreed, they are tiddly, but currently that's all he can afford. When his pay changes, he's hoping that his contributions will be able to change. He's sticking what he can in now rather than doing nothing & starting later.margaretclare wrote: »To me, it looks as if you are putting in tiddly amounts.

but concentrate on fewer funds.

As for the fewer funds - you can't really get much fewer than 2.

Congratulations (& i don't mean in the sarcastic sense - really well done).I started with £199 in the April 2006 statement and I now have a little over £10K.

However what i wonder after reading that is almost 6 years has passed. You begun with £199 as you said. How much have you contributed between then & now? Which would turn your £199 into £abcd. Then that would give a more accurate picture of your growth.

Reading that on face value makes it sound like you lumped in £199 in Apr 2006 & in just under 6 years, with nothing else done, it's morphed into over £10k. If that's actually the case then even more well done.

Again, please don't think i'm being sarcastic - i'm not.

I've seen that a bit on MSE lately. What's DH mean?My DH

I've seen DD mentioned too. DD to me is Direct Debit, but clearly this doesn't apply in some of these cases when obviously describing a person.

Thanks again for your reply. As ever i always welcome a range of views.0 -

Agreed, they are tiddly, but currently that's all he can afford. When his pay changes, he's hoping that his contributions will be able to change. He's sticking what he can in now rather than doing nothing & starting later.

As for the fewer funds - you can't really get much fewer than 2.

I think margaretclare was talking about your contributions - not your brother's.

DH = dear husband / DD = dear daughter etc - seems to be a popular abbreviation amongst many forum posters - I think it's just a little weird!Old dog but always delighted to learn new tricks!0 -

Oh right. The wildest i get is OH for other half. Usually i just say gf (obvious) or when she becomes the wife, it'll be wife.

I have no kids, so let's say sister or brother - i just type it. Doesn't take long (am not criticising btw).

Ah right, i thought margaret was talking about my brothers approach. As for mine - that's just what the IFA selected for me. I took that they would know more than me & went with it, although as percentages go, we're actually doing better solo managing my brothers.0 -

Your drop of 33% isnt due to the performance of your funds - they have risen by about 3% in the past month. So there must be some other factor at work.

Its difficult to work out definitively as your funds are held with Skandia which is an IFA-only platform and the charges arent obvious to me from the website. The only possibility I can think of is that Skandia have a annual charge, and I guess that could have been taken out of your first investment.

Two other comments:

1) I am bemused by the choice of funds. All the funds are very similar and so I dont see any point in investing in that many. It is considered good practice to invest in a range of funds that invest in diffierent areas so that problems in one area dont have a large effect on your total portfolio.

2) Fund investments are for the long term, checking them too frequently and over enthusiastically will end in madness as the euphoria of a rise is continually followed by suicidal depression from a subsequent fall.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards