We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

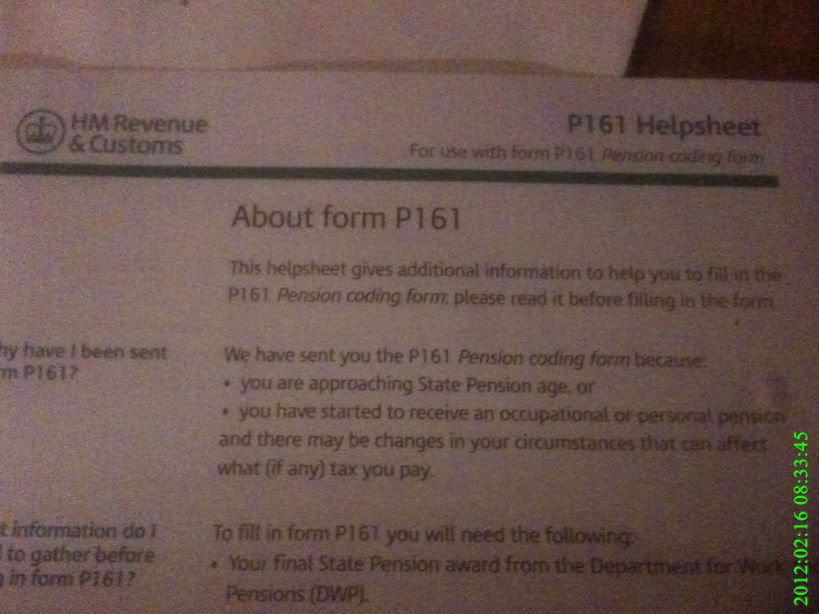

P161 & declaring interest

Nine_Lives

Posts: 3,031 Forumite

in Cutting tax

My sister has had a P161 through the post today & the section that asks about interest....

Halifax's reward account (£5 per month for £1000 deposited), is this considered interest?

TSB's vantage offer an actual % for your £1000, as do Santander. Halifax just say they'll give you £5.

I know it's not going to be major money, but just wondering if it should be included on the form.

Thanks.

Halifax's reward account (£5 per month for £1000 deposited), is this considered interest?

TSB's vantage offer an actual % for your £1000, as do Santander. Halifax just say they'll give you £5.

I know it's not going to be major money, but just wondering if it should be included on the form.

Thanks.

0

Comments

-

I presume this is the P161(W) Bereavement Benefit version? As the standard P161 is for use when someone is approaching State Pension age.

However - yes, the £5 reward is considered interest for this purpose. The £5 is the net figure. The gross is £6.25 per monthIf you want to test the depth of the water .........don't use both feet !0 -

And if your sister is not a taxpayer, ensure she reclaims that £1.25 per month after the end of the tax year. She should use form R40.

She cannot register it for gross interest, so a reclaim is the only way.0 -

My sister has had a P161 through the post today & the section that asks about interest....

Assuming it's the P161(W) as Mike says, are you sure your sister should receive this? What Bereavement benefit is she going to receive?

You have only ever mentioned your sister receiving your Dad's dependant pension which wouldn't see a P161(W) being issued I wouldn't have thought.

My sons certainly didn't receive one.0 -

Hmm i think i need to re-check the form. I could've sworn it said P161.

It's the exact same form my mother was given after my dad died, to do with his pension & such to determine her tax code.

She paid tax in the previous tax year, even though she only earned £465 for the year, so she fired off her P60 (which she asked for the tax orrifice to return ... and they didn't!) & a request to be repaid the tax that she had paid.

A cheque was sent out & this form was attached, which she has to fill out to help them determine her tax code.

jennifernil - thanks for that. I wasn't aware she could claim the money back from the Halifax reward.

Question - can this be done from the previous tax year? I think she joined mid 2010, so she'll have received a few £5s (i cycle my own £1000 through her account to enable her to bag £5/month).

OR as we're in a new tax year, is she out of luck for claiming for 2010-11?0 -

Nope, i was right it seems.

She's started receiving my dads pension due to still being at college.0 -

Question - can this be done from the previous tax year? I think she joined mid 2010, so she'll have received a few £5s (i cycle my own £1000 through her account to enable her to bag £5/month).

OR as we're in a new tax year, is she out of luck for claiming for 2010-11?

Yes she can reclaim for a previous year. Form R40.

The P161 doesn't appear to fully fit - hence my asking which one. But I'm working on the assumption it's probably the best that HMRC had for the circumstances - one such as the P810 is even more confusing. It's probably easier to send it in and then check the resultant Code - than question it?If you want to test the depth of the water .........don't use both feet !0 -

Yeah the form is pretty straight forward. Will see what comes back. She's still paying tax on the pension, which she shouldn't be.

I wish they were as quick to give money back!!0 -

With a joint halifax reward account, what about if one account holder is a tax payer & the other is not ... when it comes to the R40?

Do you just half the £60 (£5/month * 12 months=£60)? So the non tax payer is receiving £30? As my sister now has a joint reward account too, but with a tax payer.0 -

-

With a joint halifax reward account, what about if one account holder is a tax payer & the other is not ... when it comes to the R40?

.

On a joint account the interest is implied as 50 : 50 for HMRC purposes. So - yes - you halve it.If you want to test the depth of the water .........don't use both feet !0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards