We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

IFA meeting next week. Will my IFA do this for me...?

Comments

-

Skip down to the so then bit if you're looking to skim read

So i loaned a book from the library to try & better understand pensions: http://www.amazon.co.uk/Pensions-Explained-Complete-Retirement-Essential/dp/1844901106/ref=sr_1_1?s=books&ie=UTF8&qid=1324163160&sr=1-1

It told me a few things, but tbh, nothing considerable that i haven't picked up on MSE these past few weeks.

For anyone not familiar with my previous threads, i'm 28, male & looking to begin investing (not necessarily pensions - perhaps S&S ISAs if that's what the IFA advises - what i'm saying is, my mind is open). My annual income is approx £18k & i'll be looking to begin with investing £100 (plus tax relief=£125pm) a month with a view to perhaps increase this if i can afford.

Having already met with 1 IFA (2hour meeting) i now have a brief idea of what to expect. Speaking of brief, this 2nd IFA has stated our meeting will be 30 minutes.

The 1st IFA gave me some pre-set questions to fill out which based on my answers, he said will get fed into a computer & churn out my approach to risk. So i'm expecting similar from the 2nd IFA. When he asked me about my risk approach, i didn't/don't really have an answer.

If we took on a scale of 1-10 on approach to risk with 1 being scared & 10 being insane, i'd guess i'm at about 7.5.

I also imagine with starting later at 28, that i'd perhaps be best taking a bit of risk. I don't know whether my "7.5" is what would be called appropriate for my age & pension situation.

SO THEN...

Based on how i see my approach to risk & my contribution of £100pm, i'd like:

* to say to my IFA, here's my attitude to risk. Here's my £100 each month, now go & invest it. I read in the book & on MSE that "eggs in 1 basket" is a bad thing - so a spread on (book says "Asset Class" and/or "Type of Fund") ... what would you ask for, what's the correct way to say it - would you ask for a spread on asset classes or a spread of funds? Or is this approach a bad idea? From reading up i thought this the best thing to do.

* I'd like to be able to vary my payments! Not every month i should add, but as said - i'm new to this. I'd like to start out with £100pm, but i'd like the flexibility to be able to increase/decrease (more likely increase) these payments. Any increase isn't likely to be seen as a "lump sum" is it? As the IFA has already said they take 3% of any lump sum investment.

That's basically it. Personally i don't think i'm asking for a lot.

If i've got to choose myself on where to invest my money then i'm not going to have a clue & i simply wont be able to make an educated decision - that's what i'm wanting the IFA to do for me ... to go away with my £100 & spread it based on my risk.

SO, first off thanks for reading through all that, secondly - am i expecting too much? Should my IFA be able to do this for me, or am i likely to be expected to choose WHERE my money is going to be invested?

That's my main concern. Then the ability to change monthly payments.

Your IFA will (rightly) base his charges on what he believes his advice is worth.

As you are investing only £100 a month, I think you may find the charges quite high at the beginning. I would be asking the IFA to make clear to me exactly what the charging structure is, and how I could expect it to change as the portfolio (hopefully) increased in size. The ratio of charges to what is actually invested can make a huge difference to your capital over time, and it is well worth doing a bit of research on it.

For what it's worth, I think you would be better putting your money into a cash ISA at the moment.

As you will be using your other savings to purchase a home, I think you should be building up an emergency cash cushion of around three months wages before you start building a portfolio of other investments.

Good luck whatever you decide.Nothing is foolproof, as fools are so ingenious! 0

0 -

tartanterra wrote: »As you are investing only £100 a month, I think you may find the charges quite high at the beginning.

I don't think their figures are particularly high tbh.

I didn't know what IFAs cost as such, so when the first chap said £100/hr, £50/admin fee with it likely taking around 5-6 hours, i just thought oh ok then.

If going via commission he was 4%.

This second IFA has already stated before the first meeting (first IFA refused to do this) that his charge is £100/hr & it will be £300 for my case. His admin charge is also £50. He SEEMED to be directing me towards fees rather than commission, but if i opt for commission then he's 3% - 1% lower than the first IFA.

If i accept his advice & go ahead with it all, then it's no extra charge - the £300 covers the implementation.

I may be wrong, but i think these prices are quite reasonable.

My savings at the moment are split. I have just over £17k in "old money" ISA & i have £5340 in this years ISA. This takes me to about £22.5k, so i have £7k-£8k in other savings accounts (Santander 5%, eSavers, First direct regular savers etc etc).For what it's worth, I think you would be better putting your money into a cash ISA at the moment.

As you will be using your other savings to purchase a home, I think you should be building up an emergency cash cushion of around three months wages before you start building a portfolio of other investments.

A 3 month buffer/emergency pot (based on my previous sickness history i'd probably opt for 6 months) for when i move out of home is something i've only recently thought of as it was brought to my attention by someone here on MSE. I wouldn't have thought about it, but it makes sense now.

Is that directed at me or someone else? If someone else then fine. If me then ... what? lol. SorryNo one doing what you just did bothers to look at income in additon to price rises- they just look up the index price. You are telling only half the story. Don't feel too bad, as hack journalists do this all the time lol.0 -

but if i opt for commission then he's 3% - 1% lower than the first IFA.

Commission is set by the provider. Fee is set by the adviser. So, whilst the commission figure is a guide, a difference is only applicable if they use different providers (if they use the same provider and the comm is 3%, then they both get 3%). There are some differences that can apply as economies of scale does occur on retail financial products as much as any other retail area.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Just be aware that any extra money you throw into the pension after December 2012 won't be commissionable, but if you add it into the contract after you've taken advice (rather than of your own accord and unadvised) you'll have to pay advice charges on top.0

-

Just be aware that any extra money you throw into the pension after December 2012 won't be commissionable, but if you add it into the contract after you've taken advice (rather than of your own accord and unadvised) you'll have to pay advice charges on top.

Its a good point because if the pension contract is old style, whilst there will be no commission generated, the charges will be the same as if there was. The provider gets to keep it.

Modern multi-charge plans that allow fees to be collected via the product should avoid that problem (as well as working out cheaper for most people). However, multi-charge plans tend to have higher minimum premiums (typically £100pm)I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I'm wondering if private pensions & IFAs is even for me after going on the Aviva website.

I googled Aviva stakeholder & the website sure makes pensions SEEM much simpler than it all has done to me for the past few weeks. Keyword there: SEEM.

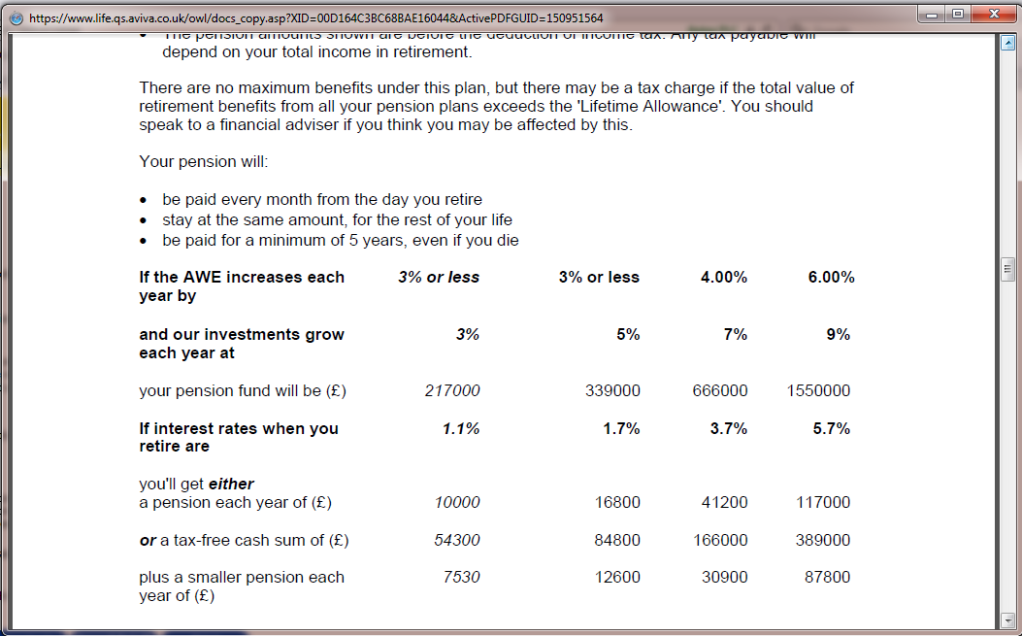

So i put in some stats for myself.

£100pm (or £125 with tax relief).

Increase of 3%per year.

Invested 100% in the aviva balanced fund (as stated earlier, i don't know how to select funds, so this was the only fund i felt comfortable selecting).

Churned out these results for me:

Seems to be more than what calculators have been saying so far.

I did the same figures for my brother, who's 19:

Again, higher than calculators HAD been quoting him so far.

Now, i'm not getting carried away with myself here. I know i'm missing some key thing here, i just don't understand enough to know WHAT.

But it certainly did seem to be better, especially with the charges not being as much as the IFA.

But when i read "stakeholders are dated" i must've missed something, as it can't be this good (i'm not saying the figures are brilliant, just better than what calculators HAD been saying).0 -

Again, higher than calculators HAD been quoting him so far.

The Aviva illustration is using monetary growth basis for it's examples (i.e. x% p.a. each year until maturity. Were the calculators you used doing it on SMPI basis (i.e. taking inflation into account and possibly)? Also, a number now have stochastic models which look at the investments you would utilise and project forward using average rates that are typical for the asset class.

Also, AWE indexation can often be an area you need to be careful with as it may be AWE subject to a minimum of x% and the assumptions used for AWE may not match.But it certainly did seem to be better, especially with the charges not being as much as the IFA.

An IFA can beat a stakeholder pension using comparable funds in a personal pension.But when i read "stakeholders are dated" i must've missed something, as it can't be this good (i'm not saying the figures are brilliant, just better than what calculators HAD been saying).

Only a handful of funds, mono charged may not be best method, not compliant with retail distribution review and NEST about to more or less replace it. Aimed at the bottom end of the market with small contributions.

Aviva's SHP is just about one of the best going and if you think an SHP is better than a PPP (Aviva's PPP is cheaper than the SHP) then fair enough.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

Once again, thanks dunstonh.

I have my meeting soon, so I'll need to condense my barrage of questions & try and just address points in the 30min time slot.

Unfortunately I have a tendency to waffle.

One query I do have for you is regarding NEST...

The ONLY way my current employer will contribute to anything (that doesn't make THEM) money is if they're forced to. They are leaving any movement until the day that they HAVE to make movement & they will only do the bare MINIMUM that they have to do.

So based on that...

From what I read of NEST, it doesn't sound all that great. The only thing that does is the free money from your employer.

I know I'm asking about something that won't happen for about 4-5yrs but is this NEST thing (in my case as stated above) going to be worthwhile?

For all I know, they could be pay into some real high risk investments or some real low risk or something else that wouldn't suit me.

If I go through an IFA this week & we agree to go ahead with a plan, would it be reasonable to ask my employer to pay their 3% into my private pension that I will have already set up .... Or does it not work like this??

If not, I assume I would have to choose between continuing my personal pension & opting out of NEST or stopping my personal pension & joining NEST (as I wouldn't be able to afford both on my pay).0 -

Unfortunately I have a tendency to waffle.

Hey, look at my post count, or dunstonh's !!!

Regards pensions being simple, then they are during the growth phase. You put money in tax free (subject to limits), some of this might get taken away as up-front fees, and the rest goes into various underlying assets. Then every year, your holdings either grow or shrink, but what is for sure is that there are more fees.

There is no perfect solution regards underlying asset portfolios, but there are lots of bad ones. Some are bad because of risk (lack of diversity or too much/little volatility for your age) and some because their fees don't justify their (highly debatable) higher return.

Keep fees low, ensure your assets are diversified, and that's the fundamentals.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

With my meeting tomorrow...

I'm drafting up my information for the IFA, what i expect from the IFA & also questions i have for the IFA.

I will be paying via fees, not commission (i think).

I've already done the first 2 sections (info & expectations) & think i've covered everything there.

I'm onto questions for the IFA but i've drawn a blank.

I've looked over my old/recent threads as i know points have been made about what i should find out, but i can't find them.

* I can remember that i should find out the annual management charge

Beyond this i can't remember any questions for the IFA. This is a problem of simply not knowing the field - i don't know what i should be asking. I've tried having a look but i can't find anything. Maybe i'm looking in the wrong threads or just missing the posts.

Any key questions i should be asking tomorrow?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.7K Banking & Borrowing

- 253.4K Reduce Debt & Boost Income

- 454K Spending & Discounts

- 244.7K Work, Benefits & Business

- 600.1K Mortgages, Homes & Bills

- 177.3K Life & Family

- 258.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards