We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

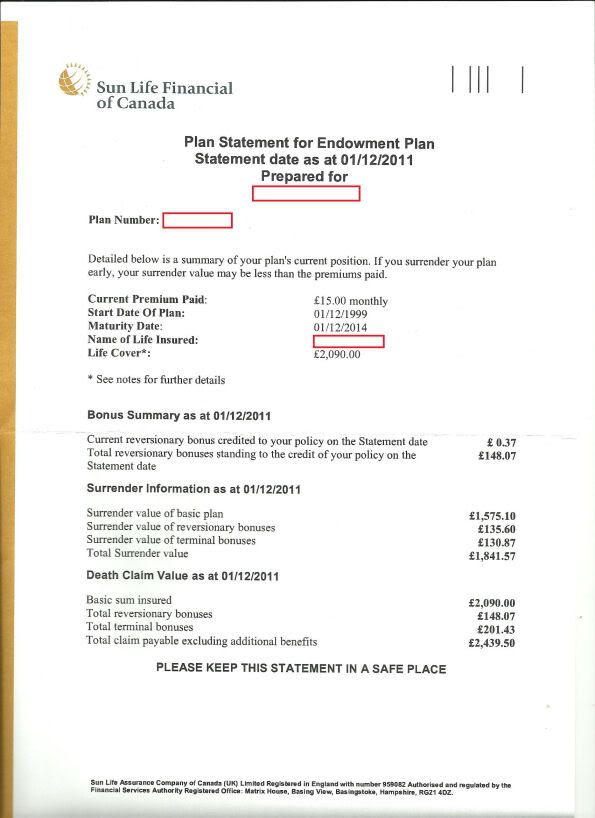

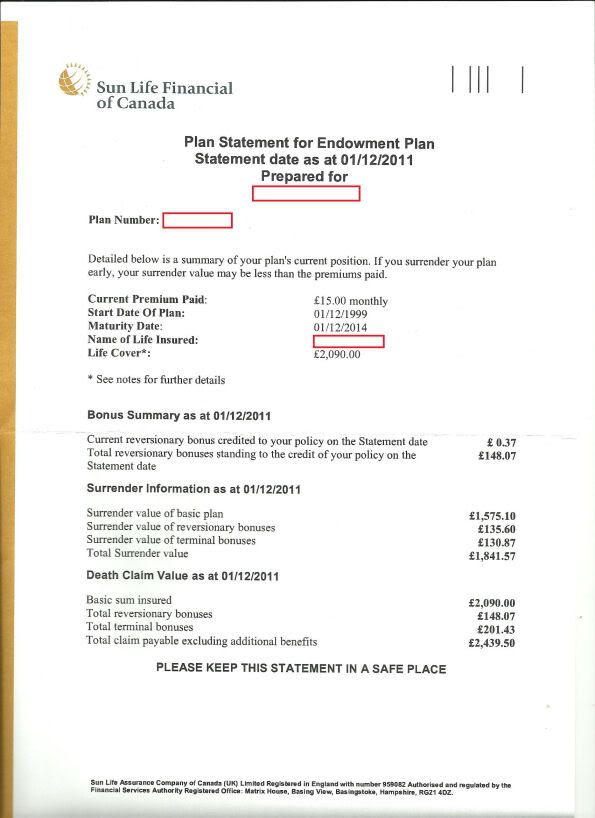

Is it worth cancelling this endowment plan & investing elsewhere?

Nine_Lives

Posts: 3,031 Forumite

My mum took out an endowment plan in '99. The interest it is receiving is abysmal.

Thing is, i don't fully understand all the terminology.

Here's what she received for her most recent statement:

Where it says current revisionary: £0.37, previous years have been as follows:

2009: £0.37

2008: £11.13

2007: £11.07

2005: £0.62

2004: £0.61

2003: £11.01

There's 2 missing i know.

There's penalties to be incurred by cancelling early, but would it be beneficial to cancel this & invest elsewhere (wherever else it may go, i THINK she will still pay £15.00 per month into, no more, no less).

Thing is, i don't fully understand all the terminology.

Here's what she received for her most recent statement:

Where it says current revisionary: £0.37, previous years have been as follows:

2009: £0.37

2008: £11.13

2007: £11.07

2005: £0.62

2004: £0.61

2003: £11.01

There's 2 missing i know.

There's penalties to be incurred by cancelling early, but would it be beneficial to cancel this & invest elsewhere (wherever else it may go, i THINK she will still pay £15.00 per month into, no more, no less).

0

Comments

-

Obviously if you can source a suitable investment vehicle, providing a guaranteed return higher than that achieved, which will also recoup the cancellation costs incurred,and includes life cover at the same amount and cost, then of course Mum may reason it would be better to seek another home for her £15.00 pm - as any comparision must be on a like for like basis to be a true reflection of benefit.

Financial advice re appropriate providers etc is not permissible, so Mum may want to have a chat with an IFA to have them evaluate her financial situation, requirements and ATR in order to source (if possible) a suitable and appropriate replacement to warrant cancellation of her current arrangement, without the risk of they be guilty of churning the policy.

Hope this helps

Holly0 -

Only 3 years to go, dont forget, whilst this policy is in place you mum has valuable life insurance and has had since the inception of the policy, handy if she has no other life insurance should the worst happen with no savings and no money to pay for a funeralmake the most of it, we are only here for the weekend.

and we will never, ever return.0 -

I >think< she has life insurance on another policy of a higher amount.

With the recent death of my dad, she has his savings which will be coming to her which is 20k+ i think.

She's also been talking about paying for her funeral NOW as she's been told it's possible to do this. Prices are only ever going to rise, so she was looking at paying for it now.

She said that once this matures, the funds are to be split between my brother & sister. I think that's all she took it out for - a 'savings' policy for them & when matured, they will get 50:50.0 -

I would not recommend purchasing a funeral package, unless there is financial protection in the event of the provider or group, ceasing trading, which I don't think is offered.

Better to deposit the monies into a savings vehicle/account - which will provide financial protection under FSCS regs in the event of the bank or b society falling into troubled waters.

Hope this helps

Holly0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards