We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

IFA - pay fees or commission?

Nine_Lives

Posts: 3,031 Forumite

I'm not too bad with bank accounts & chasing rates etc, but investments confuse me & i get lost in all the jargon.

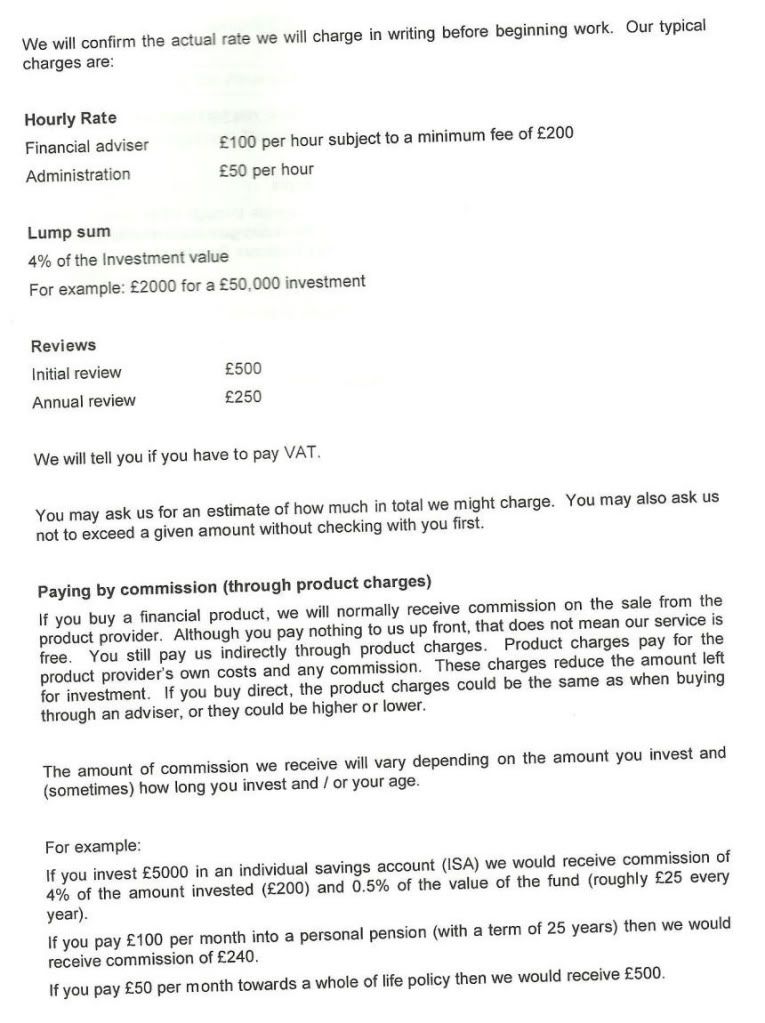

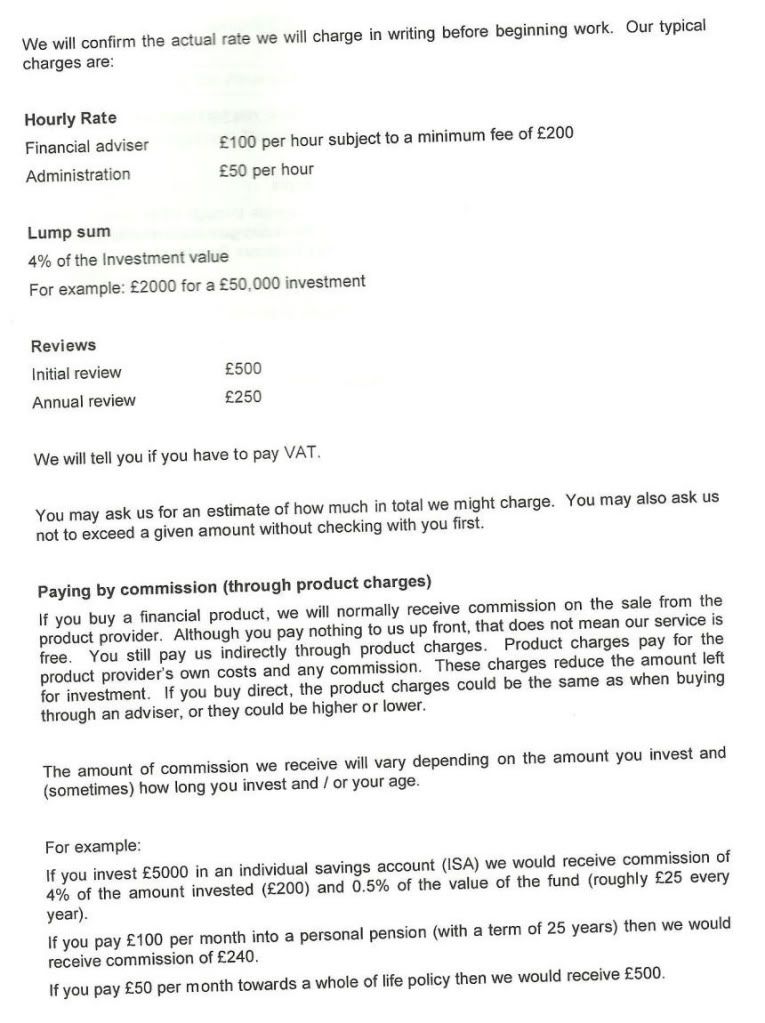

As a result, i thought it best to see an IFA. I have 2 options with which to pay. Fees or commission.

I was told most people opt for commission, but i can't get my head around what is best.

With my current situation, i'd be looking to pay in £100 per month to the pension.

Here is the paperwork from said IFA:

As i said, i can't get my head around it all, so i'm putting it out to the helpful guys of MSE to hopefully point me in the right direction.

to hopefully point me in the right direction.

As a result, i thought it best to see an IFA. I have 2 options with which to pay. Fees or commission.

I was told most people opt for commission, but i can't get my head around what is best.

With my current situation, i'd be looking to pay in £100 per month to the pension.

Here is the paperwork from said IFA:

As i said, i can't get my head around it all, so i'm putting it out to the helpful guys of MSE

0

Comments

-

I was told most people opt for commission, but i can't get my head around what is best.

Probably most did. However moving forward commission will be banned under RDR from 2013.With my current situation, i'd be looking to pay in £100 per month to the pension.

I would think in the long run fees would be the better option as it should reduce the amc.As i said, i can't get my head around it all, so i'm putting it out to the helpful guys of MSE to hopefully point me in the right direction.

to hopefully point me in the right direction.

Have you asked for an actual quote for your specific needs rather than just the generic typical charges?0 -

No, i haven't.

The first meeting is free. I've answered questions & the chap needs to go away & assess my risk, i think he said (my memory is awful! I couldn't get anyone available to go with me as i knew what my memory is like).

I know he's to go away & look at the investing & if we decide to go ahead with it, then i'll have checks ran on me (money laundering purposes). Once i pass those, THEN we can go ahead properly.

He gave an example of a previous case that cost X-amount via the fees route, but if it'd gone the commission route, it would've been cheaper (he gave figures, but i can't remember them exactly, other than commission was cheaper).

One thing that stood out was that commission was on the first 12 months. I found this very strange - as how are they getting paid after 12 months? Surely they wont manage my money forever & only get paid for the first year. I can only guess then that i've misunderstood this section of the explanation.

I know he said he could go away & it could take 5-6 hours of work (£100/hr) . Then the office girls make calls, write letters (£50/hr). I see this & it soon adds up.

Then is this the fee every year (i suspect it gets reviewed every 12 months or thereabouts)? It soon adds up.

I would've thought commission to be cheaper?

I should point out also, that i can stand a short term hit (i.e. fees) so this is ok. My only focus is = "cheapest in the LONG RUN".0 -

I was told most people opt for commission, but i can't get my head around what is best.

I find most opt for fees nowadays. It really depends on the firm.

In the case you highlight though they have actually set their percentage fee at 4% whereas the typical commission is 3%. That does not seem at all ethical and would no doubt be frowned upon if they had an FSA visit as the guidelines state that fees should not be set to mirror commission or put people off from using fee option.

I would suggest you look at another firm. However, your talk of £100pm into a pension will probably see a fee no higher than £600 and many IFAs will not be interested in offering terms or will price themselves high as a means of a passive blocker (rather than say no, they put the price up high and use that to put you off - although if you accept they will then do it)I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I think some posters here (who should know better, i suppose) are confusing the issue.

Fees or commission?

It's simple. You don't have a lump sum to invest, you are starting from scratch - paying £100 per month into a personal pension, right?

For Charges: You will HAVE to pay £500 for an initial review, by the sounds of things . You will also HAVE to pay £250 for an annual review.

In my opinion this is expensive. Most IFA's will not charge this for a new pension. This type of service also is 'here's your pension, that's it, don't come back unless you have more money'

For commission: Your pension provider will pay a commission each month from the funds you have in the pension, to the IFA.

They say £100 a month will cost you £240 over 25 years - i assume they mean on average it will be £240 a year.

So £240 a year in commission versus £250 for just an annual review - isn't it obvious?

Furthermore, i'm not sure what they figure their Trail (monthly) commission to be, but you shouldn't pay more than 0.5% and this should INCLUDE Annual Reviews and perhaps a quarterly performance statement or something.

With new regulations coming into force soon, IFA's need to be much more transparent about what they are being paid for. It seems an annual review isn't quite enough.

- commission gets a bad rep in my opinion, but the service should be worth it, if you are a client of a reputable IFA.0 -

Decide what level of service you require/want/need.

Get them to price up the job both ways (including any trail commission) and factoring in your chosen level of service.

Get a couple of like for like quotes from other IFA's it won't do any harm.

Make your mind up and set of into the sunset:)

Just my twopence worth but don't get tied up with esoteric arguments about remuneration in here it's straightforward enough if you work from first principles.0 -

I had a thought today which was worrying....

This IFA i spoke to said the first meeting is free. You pay from the second.

I read on another thread where an IFA invested a members money without any signatures or agreement, which put me into thinking...

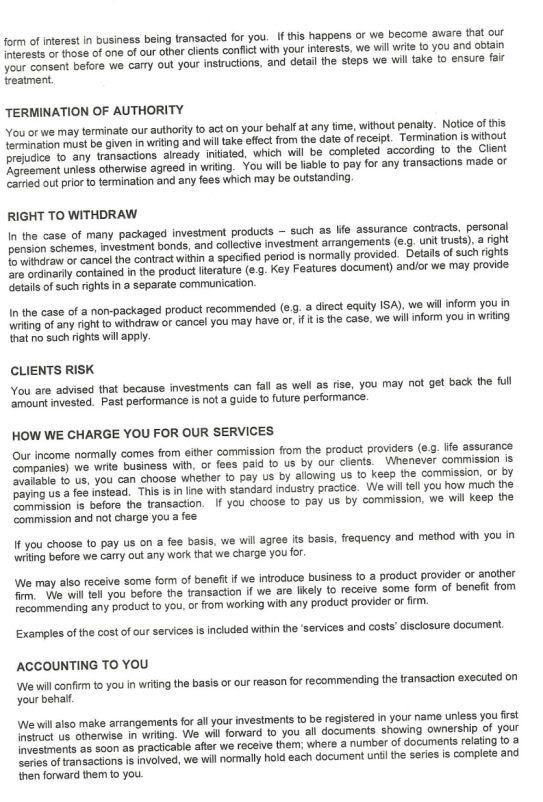

The minimum fee charge is £200. I'm wondering if (now that he's gone away to assess my risk - he says), i'm going to have to stump up this £200 whether i (at this very point) choose to go with them or not, or whether i only have to pay once he comes back & THEN i say yes ok let's go ahead.

Bit worrying!

Thanks to you all for your help.

One thing the chap said (as our meeting was actually about retirement planning & not exclusively pensions) was ISAs as an alternative (maxing them each year until retirement).

He listed of the pro's, but only listed 1 con really .... that when you retire, you'll have a great wad of cash rather than a 'drip feed' and too many people will be tempted to go silly & not manage their funds.

This may be true of many people, but certainly isn't true of myself (self confessed tightwad!). Slightly off topic, but i wonder whether that would be a better option. Just a thought i had. Reality is probably a mixture of the 2.

As said in the other thread there ... i'm seriously considering not going the IFA route. I wont know whether that's wise or not yet, but still.0 -

Sorry that we've, or rather i've, got 2 threads on the go at the moment, that are very closely related. This one is specifically payment orientated though.

My IFA has been in touch & wants to meet again for the 2nd meeting - the one that you (more to the point ...I) get charged for.

I'm guessing that even if i decide not to invest with/through an IFA, i'm going to have to stump up?0 -

-

He listed of the pro's, but only listed 1 con really .... that when you retire, you'll have a great wad of cash rather than a 'drip feed' and too many people will be tempted to go silly & not manage their funds.

With ISAs, you can take the money out at *any* time. Today, tomorrow, next week, next month. This is good. This is also bad.

Pensions have tax advantages but they also lock the money away until you're a wee bit older, and hopefully more focussed on what happens when you can't work any longer.

Use both ISAs and pensions is the best advice, and the proportions of each depend on circumstances.

If you can't decide on whether to DIY or IFA, or use pensions or ISAs, then push the meeting with that IFA back until you're CRYSTAL CLEAR regards your options.

This is a big step. Procrastinating is silly but researching is very sensible.I am not a financial adviser and neither do I play one on television. I might occasionally give bad advice but at least it's free.

Like all religions, the Faith of the Invisible Pink Unicorns is based upon both logic and faith. We have faith that they are pink; we logically know that they are invisible because we can't see them.0 -

Have you asked at what point you are committed and to how much?

If you are going down the commission route, what is the amc going to be? If the fee route what will be the amc?

No, i haven't.

Something like that sounds so basic & simple & probably is, but i honestly didn't think to ask. I was just absorbing (or trying to) what i was told & didn't think to ask about at which point i was locked in.

I've just this minute had to google what AMC stands for (for ANY abbreviation related to pensions, i'm going to have to look up), so i don't know the answer to this either.

I've found a section in the paperwork i was given which may or may not help, may or may not apply in this case: 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards