We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Old default question...

gembex

Posts: 31 Forumite

Hi everyone, I have a quick question if you don't mind.

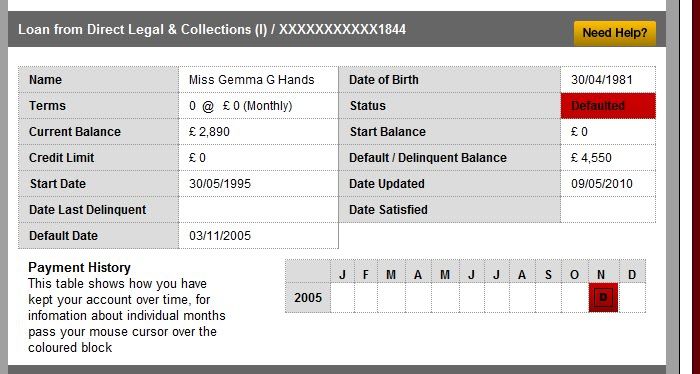

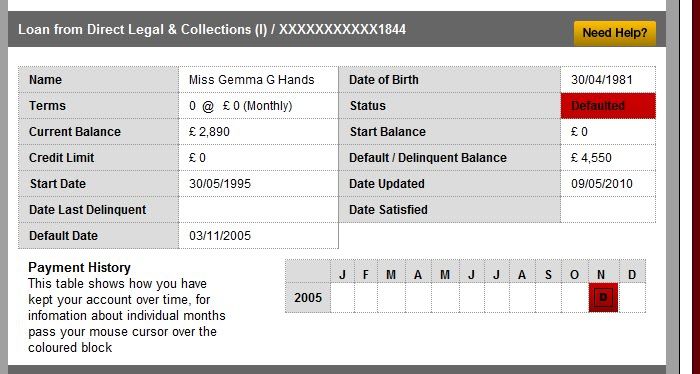

Below is a default from my credit file. This is a very old debt. According to this I was 14 when it started. I was born in 1981!! Anyway the company purchased the debt from HSBC and could not provide me with a copy of the original signed credit agreement, therefore I have not been making payments on the debt.

My question is, six years are up in three days according to the default date on this entry. Will this default be removed from my file, replaced on my file differently or stay right where it is?

Thanks

Gemma

Below is a default from my credit file. This is a very old debt. According to this I was 14 when it started. I was born in 1981!! Anyway the company purchased the debt from HSBC and could not provide me with a copy of the original signed credit agreement, therefore I have not been making payments on the debt.

My question is, six years are up in three days according to the default date on this entry. Will this default be removed from my file, replaced on my file differently or stay right where it is?

Thanks

Gemma

0

Comments

-

It will be removed entirely from your credit file (its actually 6years and 1 day for experian, and something like 6years and a week for equifax)A smile enriches those who receive without making poorer those who giveor "It costs nowt to be nice"0

-

Hurrah. I was a little worried that they would put it back on, or renew it or something as technically it shows that the balance is still outstanding.0

-

They absolutely shouldn't. Keep a copy of that credit report that shows the default date. In the unlikely event they (or another debt collector) sneekily put it back on with a later default date then having a copy of it as it is at the moment will make it easier to get it removed.

(Don't worry too much this doesn't happen often but occasionally it has been known).A smile enriches those who receive without making poorer those who giveor "It costs nowt to be nice"0 -

Thanks so much, I feel quite reassured now. I've spent YEARS cleaning up my credit record and this is the last little red spot. Everything else is green!0

-

PS - When it is removed, is there an instant jump in my credit rating or is it a progressive thing? I have several other credit accounts, all up to date with no missed payments so do you think my rating will be a good one?

Thanks 0

0 -

it should boost quite high, but agencys wont report as perfectDon't put your trust into an Experian score - it is not a number any bank will ever use & it is generally a waste of money to purchase it. They are also selling you insurance you dont need.0

-

Well I just hope it will be good enough to get a normal account, an overdraft to help with managing the bills and maybe even (god forbid) a credit card with a good rate. It would be nice to not feel like a second class citizen for the first time in years.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards