We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much to buy a house in NI?

Comments

-

saverbuyer wrote: »

As for rental “trend” I wouldn’t really concern myself with this unless you are looking at it really long term confined to the Belfast city area. Rents have pretty much stayed inline with inflation with rents outside Belfast being at the same level (adjusting for inflation) for many years. The cost of renting is usually much lower that the cost of buying. Just look at the cost of renting a country mansion compared to buying. It could also be argues that with the housing benefit cuts renting will inevitable get cheaper as housing benefit provides a prop to the private rental sector.

With the current malaise, mortgage approvals are way down, and rightfully many are very cautious about buying. Quite a few simply cannot get mortgages (for whatever reason). In these circumstances I think the first sign of bottoming out will come in rental. I would keep an eye on it! The reason I say this is firstly, rental can potentially be more volatile than purchase, and secondly I have a few clients who are now buying to rent. If rents start to go up that trend will increase, and it could could have an effect on the low end of the market. Obviously be careful and do not jump in, but sooner or later the balance will shift and due to current levels of construction I would have serious medium term concerns on the supply side.

I would not be in a hurry to buy, as nothing is going to change markedly this year, but as we go through next year, inflation predicted to be going down, government cuts factored in, who knows! We could slide into another recession, if not I think we see very, very slow recovery. Much will depend on the health of the Banks and perceptions of currency values. Indeed it seems probably that some countries may default.

Personally I would have preferred to see high inflation and a weakening currency. That would flush the system a lot quicker than a long period of virtual stagnation, which seems to be where we are heading.

Right now it is very difficult to predict 18 month ahead, but few of the indicators are good. That could change.

Stay vigilant, acquire a sense of balance, an overview, and you may be one of the lucky people who buy at the bottom of the market.[STRIKE]Less is more.[/STRIKE] No less is Less.0 -

With the current malaise, mortgage approvals are way down, and rightfully many are very cautious about buying. Quite a few simply cannot get mortgages (for whatever reason). In these circumstances I think the first sign of bottoming out will come in rental. I would keep an eye on it! The reason I say this is firstly, rental can potentially be more volatile than purchase, and secondly I have a few clients who are now buying to rent. If rents start to go up that trend will increase, and it could could have an effect on the low end of the market. Obviously be careful and do not jump in, but sooner or later the balance will shift and due to current levels of construction I would have serious medium term concerns on the supply side.

I would not be in a hurry to buy, as nothing is going to change markedly this year, but as we go through next year, inflation predicted to be going down, government cuts factored in, who knows! We could slide into another recession, if not I think we see very, very slow recovery. Much will depend on the health of the Banks and perceptions of currency values. Indeed it seems probably that some countries may default.

Personally I would have preferred to see high inflation and a weakening currency. That would flush the system a lot quicker than a long period of virtual stagnation, which seems to be where we are heading.

Right now it is very difficult to predict 18 month ahead, but few of the indicators are good. That could change.

Stay vigilant, acquire a sense of balance, an overview, and you may be one of the lucky people who buy at the bottom of the market.

With inflation at 5%+, NI still in recession and the pound down 30%+ this is exactly what we are seeing. Personally I think it is very easy to see 18 months ahead. There’s increased talk of a double dip. Rates are at an all time low. Companies going bust left right and centre. The cuts are coming. Anyway you look at it there is zero possibility of a recovery in the housing market in the medium term 5-7 years. We are also unlikely to see house prices at 2007 levels for decades.

I think rent increases in the long term are highly unlikely. Where will they come from? Housing benefit? People with pay freezes? Rents have historically been low in NI for a reason. You think it will come from increased demand? Unlikely as there’s no shortage of rental properties or properties for sale. Where are all these homeless people? (not waiting lists actual homeless)

House prices are going nowhere but down in the short to medium term and if the market forces interest rate rises the will be going down rather fast.

I think the best advice is to sit tight, save as much of a deposit as possible. Let the speculators buy their rental properties if they must. But with the low housing benefit dependent yields they must be getting I’d rather put my money in a high interest account.

The Bank of England hasn’t got inflation right yet and I wouldn’t expect them to in the future. I would factor in the result of 7% interest rates on any potential mortgage.0 -

OP - what area are you looking at? You will be exempt from stamp duty btw.

I agree with those who say that the overall outlook is for house prices to keep falling. You are in a great position, just keep an eye out for the right house at the right price and keep saving! That's what we're doing - we are looking at the possibility of buying for cash if the downward trend continues. Prices have not bottomed out yet imho, and some sellers are frankly deluded in their asking prices.

Prices have not bottomed out yet imho, and some sellers are frankly deluded in their asking prices.  The right place will come along eventually.Are you a genuine FTB? I had a mortgage 10 years ago so wasn't classed as an FTB, ah well.

The right place will come along eventually.Are you a genuine FTB? I had a mortgage 10 years ago so wasn't classed as an FTB, ah well.

So... you're not a FTB then! :rotfl:Solicitors around £800

Arrangement fee with Bank or building society.

Moving furniture and belongings.

The dreaded survey that you pay for and which now tends to place a value lower than the agree price. In which case you may have problems. Perhaps you want a full structural survey?

You may also be required to make good any defects.

Decorating, painting.

Curtains.

What's the problem if it leads to the OP paying less for a house? Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.730 -

What's the problem if it leads to the OP paying less for a house?

Unfortunately it takes two to Tango. Survey fees seem immune to the recession and paying them several times. :eek:

I think we all agree don't rush in. Sooner or later this will bottom out, keep vigilant. A lot of people listen only to what they want to hear. It is a common mistake. I would still advise tracking rentals and also signs of year on year increases in mortgage approvals. UK figures are here http://www.bankofengland.co.uk/statistics/li/current/index.htm#tables

Locally - local press.

http://www.belfasttelegraph.co.uk/business/business-news/mortgage-approvals-rise-but-experts-doubt-market-recovery-16030461.html

It is sustained trends that are important, one month could well be blip from a very low base.

It all depends on. disposable incomes, ability to borrow, the amount of money in the market and the availability of property. If you can predict the market bottom then you have rare talent or rare luck.

When all is said and done a house is for living in. Hope you find one that suits.[STRIKE]Less is more.[/STRIKE] No less is Less.0 -

Unfortunately it takes two to Tango. Survey fees seem immune to the recession and paying them several times. :eek:

I think we all agree don't rush in. Sooner or later this will bottom out, keep vigilant. A lot of people listen only to what they want to hear. It is a common mistake. I would still advise tracking rentals and also signs of year on year increases in mortgage approvals. UK figures are here http://www.bankofengland.co.uk/statistics/li/current/index.htm#tables

Locally - local press.

http://www.belfasttelegraph.co.uk/business/business-news/mortgage-approvals-rise-but-experts-doubt-market-recovery-16030461.html

It is sustained trends that are important, one month could well be blip from a very low base.

It all depends on. disposable incomes, ability to borrow, the amount of money in the market and the availability of property. If you can predict the market bottom then you have rare talent or rare luck.

When all is said and done a house is for living in. Hope you find one that suits.

I’m much rather pay £250 a few times and save thousands on a house with a propery value. Do you not realise the survey is SAVING people money.

I wouldn’t bother looking at UK approval figures. What’s happening in England bears no relation to the NI market. We have had 50% drops so far.

Transaction levels here aren’t recovering really.

You talk about trend. This is down down down over years not months.

Again both articles relate to the UK market as a whole. Not NI specific. Besides the spring/summer season is when most house sales are completed. Historically transaction leavels are NOWHERE NEAR NORMAL.

A little bit of knowledge can be a very bad thing.

Every possible sign is pointing towards a continued downward trend. I think we will have another big drop and go the way of Japan with zero price increase for the next 15 years at least.

Only fools rush in.0 -

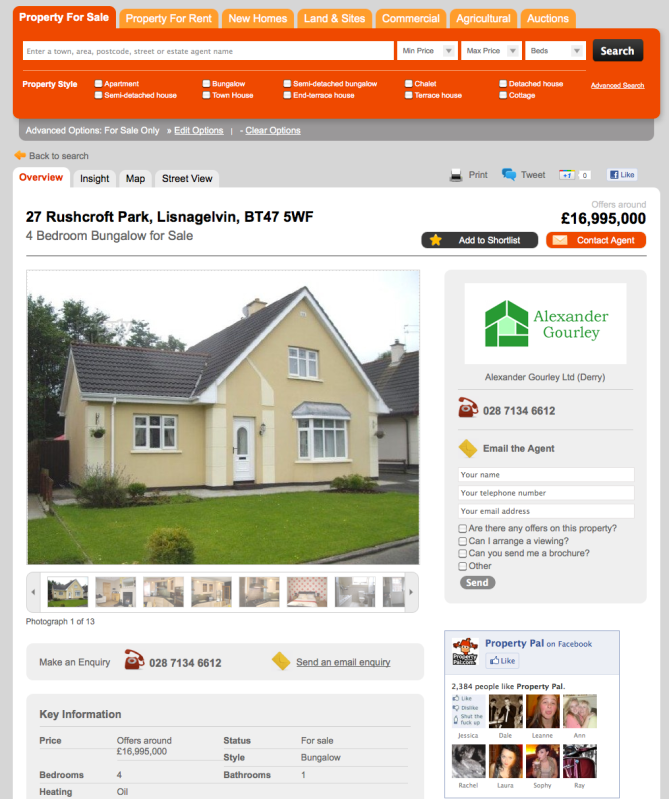

House prices are on the way up :eek:

A bargain for just under £17 mil:rotfl:I am trying, honest;) very trying according to my dear OH:rotfl:0 -

Thanks for the info its going to be 18-24 months away at the earliest so just wanted to know my target figure and to make sure I wasnt missing anything out.

:beer:0 -

House prices are defo continuing to fall, as a FTB this is music to my ears.

7 Feb 2012: 10st7lbs

7 Feb 2012: 10st7lbs 14 Feb: 10st4.5lbs

14 Feb: 10st4.5lbs  21 Feb: 10st4lbs * 1 March: 10st2.5lbs :j13 March: 10st3lbs (post-holiday)

21 Feb: 10st4lbs * 1 March: 10st2.5lbs :j13 March: 10st3lbs (post-holiday)  30 March: 10st1.5lbs

30 March: 10st1.5lbs  4 April: 10st0.75lbs * 6 April: 9st13.5 lbs

4 April: 10st0.75lbs * 6 April: 9st13.5 lbs  27 April 9st12.5lbs * 16 May 9st12lbs * 11 June 9st11lbs * 15 June 9st9.5lbs * 20 June 9st8.5lbs

27 April 9st12.5lbs * 16 May 9st12lbs * 11 June 9st11lbs * 15 June 9st9.5lbs * 20 June 9st8.5lbs  27 June 9st8lbs * 1 July 9st7lbs * 7 July 9st6.5lbs

27 June 9st8lbs * 1 July 9st7lbs * 7 July 9st6.5lbs  0

0 -

Not so much on house prices as Estate Agents... What the *eck are they paid for?? Both my wife & I work and are trying to view some houses in Belfast. a number of the houses we want to view are on with the same Estate Agent. Problem is apparently they QUOTE "Don't Do Weekend Viewings" !!!!

What the ****.... Don't Do Weekend Viewings!!!

If I was selling my house and the EA told me that they wouldn't be able to show a possible buyer round on a weekend I'd be finding another EA in a hurry!!! Any wonder no houses are selling in Northern Ireland!!

The lady on the phone actually had the cheak to suggest I "Getout of work early to come see the houses"

Is this normal for Northern Ireland Estate Agents... Certainly wasn't the case when I live in England!! Saturday was their bussiest day..0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards