We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

What Happens When Greece Defaults?

Comments

-

Because a large part of the assets of the Greek Banks are held in Greek Government bonds for example Alpha Bank, which is apparently the best capitalised Greek bank, holds somewhere between 80-100% of reserves in Greek Government bonds. If the Greek Government decides to reduce the face value of its debt by half which is what the market is pricing in, the Greek banks are insolvent as they lose such a large proportion of their reserves.

I'm not explaining my question well.

If there's no currency risk mismatch between liabilites and assets. Would converting to the drachma result in insolvency?

If post Greek currency swap, liabilities are in other currencies to a larger extent than assets (or reserves). I can understand why Greek banks become insolvent.0 -

Because a large part of the assets of the Greek Banks are held in Greek Government bonds for example Alpha Bank, which is apparently the best capitalised Greek bank, holds somewhere between 80-100% of reserves in Greek Government bonds. If the Greek Government decides to reduce the face value of its debt by half which is what the market is pricing in, the Greek banks are insolvent as they lose such a large proportion of their reserves.

It seems likely. That doesn't mean it will happen though.

I didn't write the piece and I don't necessarily agree with it but it is food for thought. For example, some sort of deal could be done prior to default where the Greek banks enter into a swap deal to swap their bonds for cash with the ECB taking part of the hit on the fall in the value of the debt.

There are many ways to mitigate the impact of default on Greece although it doesn't mean they will happen. I suspect that the voters of the rest of the Eurozone will be quite happy to leave Greece to her own fate. That certainly seems to be the way the wind is blowing in Europe these days.

The funny thing is that the ECB only has around 9-10bn Euro of capital, they hold 50bn of Greek bonds, under any restructuring or default they would be technically insolvent. Of course member states would end up recapitalizing the ECB to avoid market chaos.0 -

Are there any examples of a single currency area with internal capital controls? Can't imagine it would work.

On a national, rather than international level, there's the county councils.

The government exerts a form of capital control, however it's influence is helped from being a big contributor to council's income.Limits on council spending

The Government exerts pressures on local councils to invest in and improve their public services, and also to limit their spending so that budgets do not increase in an unreasonable manner.

The Government requires local councils to provide services to national standards. If it considers that standards are not being achieved then the local council needs to invest in that service, paid for by reducing other services or by additional council tax.

The Government has previously held wide-ranging powers to limit or ‘cap' increases in council tax. It is now planning legislation to hand over these powers and to instead require local authorities to hold a local referendum if they seek to set, in its view, an excessive council tax increase.

eastsussex.gov.uk/yourcouncil/finance/guide/default.htm0 -

I'm not explaining my question well.

If there's no currency risk mismatch between liabilites and assets. Would converting to the drachma would result in insolvency?

If post Greek currency swap, liabilities are in other currencies to a larger extent than assets (or reserves). I can understand why Greek banks become insolvent.

Oh I see. It's been a long week!

Assuming no currency risk then all you're doing is changing the unit of account. It would be like changing from pounds to pence in the accounts so it wouldn't cause insolvency. The problem is from a decline in the value of the assets wiping out the reserves of the bank.

There would be some currency impact as some of the Greek banks have spread their wings. EFG for example last time I spoke to them (a few years back now admittedly) was setting themselves up as a regional bank for the south Med, pushing into North Africa.0 -

On a national, rather than international level, there's the county councils.

The government exerts a form of capital control, however it's influence is helped from being a big contributor to council's income.

No, that is not an example of capital control in the sense I mean it. A capital control is a system whereby the government can regulate the flow of money into or outside of an economy.

So, in the sense I mean, a capital control would mean you couldn't move your euro's from greece to spain, say, without paying a tax on it.

The implication is that the euro would be subject to different interest rates in different countries within the euro zone, so implicitly, 1 euro would be worth more in one country than another.

Do you see why I think it would not work? There would be an arbitrage between the same currency in different countries, which you could only restrain by controlling movement and trade.

In essence, I don't even imagine this could work in China because it becomes hugely profitable to find a way around the rules.

(I'm not sure this is a very clear post. Maybe Generali could explain? He is better at these things than me)“The ideas of debtor and creditor as to what constitutes a good time never coincide.”

― P.G. Wodehouse, Love Among the Chickens0 -

No, that is not an example of capital control in the sense I mean it. A capital control is a system whereby the government can regulate the flow of money into or outside of an economy.

So, in the sense I mean, a capital control would mean you couldn't move your euro's from greece to spain, say, without paying a tax on it.

The implication is that the euro would be subject to different interest rates in different countries within the euro zone, so implicitly, 1 euro would be worth more in one country than another.

Do you see why I think it would not work? There would be an arbitrage between the same currency in different countries, which you could only restrain by controlling movement and trade.

In essence, I don't even imagine this could work in China because it becomes hugely profitable to find a way around the rules.

(I'm not sure this is a very clear post. Maybe Generali could explain? He is better at these things than me)

Oh, I understand now. I'd thought the question involved finding a single currency system without fiscal union (as i read capital control) which works.

I'd thought the question involved finding a single currency system without fiscal union (as i read capital control) which works.

Like you've already said above, I see differential interest rates as unpragmatic and difficult to police. I feel individuals would smuggle notes across borders or money launder it through intermediaries.0 -

Oh, I understand now.

I'd thought the question involved finding a single currency system without fiscal union (as i read capital control) which works.

I'd thought the question involved finding a single currency system without fiscal union (as i read capital control) which works.

Like you've already said above, I see differential interest rates as unpragmatic and difficult to police. I feel individuals would smuggle notes across borders or money launder it through intermediaries.

You could simply buy a second hand car and drive it across the border. There are plenty of assets out there that you can move easily.0 -

In the 1970's when there were capital controls between the UK and foreign countries, business people used to have to count their Rolex in and out of the country.“The ideas of debtor and creditor as to what constitutes a good time never coincide.”

― P.G. Wodehouse, Love Among the Chickens0 -

At the heart of the issue in Spain, and Greece, is rising unemployment. Indeed data released last week in Greece revealed a jump to yet another new high in the Unemployment Rate, as seen in the chart. The Unemployment Rate jumped to 15.9% in February (data lagged by one-month), up from 15.1% in January, and up from 12.1% in Feb-2010. Worse yet, the Number of Unemployed has now spiked higher by +30.1% versus last February, and is up by a mind-numbing +99.9% versus February of 2008.

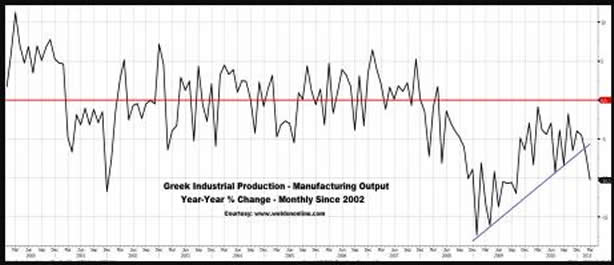

We also shine the spotlight on data released by the Greek National Statistics Service two weeks ago revealing that Industrial Production contracted by (-) 8.0% year-over-year during the month of March, plummeting deeper into negative territory versus the decline of (-) 4.8% yr-yr posted in February ...

... LED by a double-digit decline in the year-year rate of Manufacturing Output, which plunged by (-) 10.3% during March, sliding from a (-) 6.8% yr-yr contraction in February, and the (-) 4.5% yr-yr decline seen in January. Evidence the chart on display below, which speaks for itself.

Further, we note today's report on the Greek Budget, revealing that DESPITE austerity measures undertaken as part of the EU-IMF directed program, the Deficit WORSENED during the month of April. Indeed, the government reported a deficit of (-) EUR 7.246 billion in the four-month YTD 2011, an 'increase' of +13.7% versus the same period 2010.

Worse yet ... Revenue FELL, while Spending ROSE ... with Revenue falling by (-) 9.1% in the YTD-yr-yr, and Spending rising by +3.6%.

Problematic for SURE ... as a rise of +14.4% in Outlays linked directly to Interest Payments on the debt, which accounted for a MIND-BLOWING 52.7% of the TOTAL DEFICIT in the year-to-date, pegged at (-) 3.819 billion EUR.

Unfortunately, Greek bond yields continue to SOAR, reaching a new ALL-TIME HIGH TODAY, as evidenced in the chart below, wherein the 2-Year Bond yield now exceeds 25%.

http://www.marketoracle.co.uk/Article28317.html

Good article that goes wider than Greece, with numbers like those it's just a question of whether it will be a hard outright default or soft restructuring default.0 -

to refinance the lot would cost 40% of GDP each year just to service the debts.

The 'simple' solution is to cut spending far below tax revenues. That is austerity where as now they label it the same while still increasing borrowing

Seems to me without a larger nation buying Greece in some way they have hit a hard wall in terms of what they can do. This is when leadership is needed which is the best form of politics, they are still using appeasement which can only fail

Dont worry about Greece anyhow though I hope their people find a way.

Really worry about USA they are going to the same unyielding wall and their leaders have a backbone of jelly, who can help them they wont know how to help themselves either?

Printing is fine but it will have similar consequences spread over time, they will have to cut budgets in half

USA is our largest trading partner, that is the anchor that could sink us0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards