We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

'How high should interest rates be?' poll discussion

Comments

-

dots_thots wrote: »Certainly :rotfl:... Interest rates are the price of money. Like any item the price is brought into balance via supply and demand. For interest rates to drop more people have to save in order to be able to lend it to someone else. With a fixed supply of money, changes in demand will cause mild inflation or deflation of certain goods depending on what the money chases or flees.

However, when there is no surplus of saving (like the indebted times we live in), interest rates are lowered by increasing the supply of money artificially - central bank open market operations - buying bonds, quantitative easing etc. When the central bank buys something the money deposited in the sellers account springs into existence. Essentially the more supply of money there is, the lower the rate of interest. Conversely when the bank wants to raise interest rates, it sells something (usually a government bond) and the money it receives is destroyed to lower the supply of money.

The problem is that the newly increased supply of money is now chasing the same amount of goods and services that existed before. This causes price inflation. The banks have essentially picked the pocket of all holders of money. It's important to note that inflation is defined as an expansion in the money stock. CPI is price inflation - the banks want you to focus on prices and not values. They can massage the CPI and RPI etc. via substitution and hedonic adjustments so it's important for them to get you focused on prices. They're hoping to gradually inflate without people noticing the cost of living rising slowly - if people have their inflationary expectations raised they will demand more wages and the velocity of money will increase (ie. people don't wish to hold money). A lot of the new money has been funnelled into derivatives - if the money ever landed on real goods and services even the CPI would go off the chart.

The effects of monetary inflation/deflation are not even right across the board. It all depends on what the money is chasing and that depends a lot on public sentiment. When a central bank adds new money to the system as reserves, commericial banks can expand the supply even further via the magic of fractional reserve banking. With a reserve ratio of 10%, if the banks choose to be "fully loaned up", they can expand the supply of new money 10 fold!! When Alan Greenspan lowered interest rates to 1% and banks were allowed to leverage to extraordinary levels, the new money went into housing because the commericial banks were lending like mad - hence the housing bubble. The lending institutions were emboldened by moral hazard because governments had shown they weren't going to let large corporations fail (eg. long term capital management blowing up and being rescued)

However, this is why there are busts. If reserves or savings are withdrawn or loans are defaulted on the situation starts to unwind. Banks have to shrink the loan books enormously which causes a huge decrease in the money supply. In normal circumstances this would cause interest rates to rise. Because this time around most mortgages are variable, people would start defaulting on them. The increased supply of homes and lack of demand cause house prices to reduce, more people walk away from mortgages and the situation could snowball. Which is why central banks step into the breach to fill the liquidity gap and to attempt to prop the prices up. That's all well and good but the effect is you destroy your currency in the process and that is disastrous for everybody.

Also, in terms of the "exit strategy" we keep hearing about the problem is like a hippo in a swimming pool. If the hippo gets out, modern economists would diagnose the problem as a lack of water and proceed to fill up the pool. When the hippo gets back in the pool (aka. the banks start lending again) what do you think will happen?

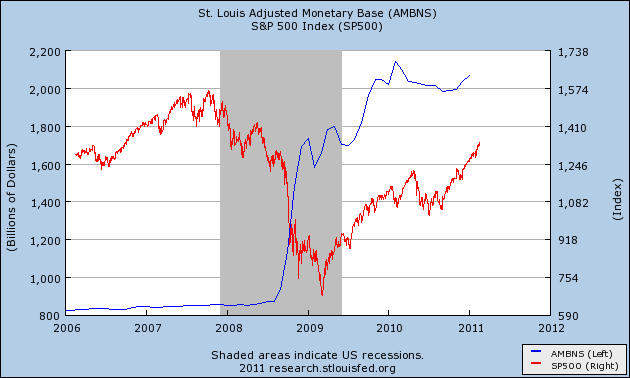

Recently the quantitative easing is flowing into stocks which the following chart simply screams at you...

What will happen if the central banks stop creating money?

As Milton Friedman said...

"Inflation is always and everywhere a monetary phenomenon."

That's how interest rates and inflation are related... it's when the supply of money has to be increased to push interest rates lower than the market wishes them to be - causing inflation, or lowering the supply of money to raise interest rates further than the market wishes them to be - causing deflation. This latter situation almost never happens - central banks since 1971 have held interest rates at levels much lower than free market rates would probably allow (with the exception of Paul Volcker in the 80s). This enormous expansion of money has gotten us into this terrible mess. They have two choices - default honestly, unwind they credit bubble and hurt debtors or steal from everyone and default disingenuously through a currency collapse of some sort. Oh, and just to make it worse, they bailed out the private bankers so it's you and me on the hook either way... Thanks! They're just praying we'll not notice or other events will give them something to blame instead. Well, I've noticed and I'm telling everyone I can! :mad:

In my opinion, there's nothing more important as understanding this fraud. It is the source of so many of our problems and we need to learn from history - it's happened so many times before. As the former Governer of the BofE Sir Josiah Stamp said...

"Banking was conceived in iniquity and was born in sin. The Bankers own the earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen they will create enough deposits to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of Bankers and pay the cost of your own slavery, let them continue to create deposits."

Excellent post above!0 -

Good reference above about the bankers. Also, I'd like to reply to the likes of icklepeach (and I'll TRY not to be too long winded!)

Don't attack pensioners for being 'baby boomers'. We didn't ask to be born during WW2 or whenever it's supposed to have been. We didn't set the levels of Nat. Insurance we payed throughout our working lives. We don't set the level of pension we now receive.

If you have grandparents or other family members who are pensioners, do you have a go at THEM for happening to be born in this 'baby boomers' era?

Should we all go out and spend our life savings (as suggested by one BoE commitee member)? I wonder where the economy would be then. Or maybe euthanasia for us all at 70 (two years time in my case) would be the answer.

I did read the Guardian link and, if those facts are right, who is ACTUALLY to blame? The Guardian article suggests it's all our fault, but we certainly won't be around having 'Saga holidays' in 2030-40.

The lunchtime BBC news yesterday stated that the BIGGEST LOSERS today are the PENSIONERS (and the most well off - but who gives a toss about the most well off? Oh, boohoo and violins).

If you re-read my original post you'll see that my attack was NOT on younger people - like my own daughter with her 8 and 3 year old girls - but that it's the BANKS who I blame. My reference to 'the least responsible' was to the bankers and their big fat bonuses, all those billions would be a great asset to the economy.

We'll never agree on interest rates, but I suggest us old-uns and young-uns stop fighting each other and join forces against the real cause of all these economic problems - the 'FAT CAT BANKERS'!0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards