We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Better to buy than rent!!

Comments

-

Can you explain how you expect to get 60k into an ISA in 6 years, at 5100 per annum, with CPI growth per annum added to your allowance per annum...

Yes, use your stocks & stocks ISA allowance. It's not a guaranteed return but it's reasonable to expect you might get an average of 2.5%/year over a period as long as 25 years.The 111k your 60k earns is a hell of a lot less than the expected doubling (reasonable 25 year estimate in price of the corresponding property of which the mortgage for said property is the same as the rent in year 1 for the same property, of which rent will almost certainly go up each year... so thats 200k asset, plus 200k growth.... compared to 60k turning into 111k as well as wasting over 300k on rent for no good reason.

I though you were saying no HPI and no rent inflation for the purpose of the example. I don't dispute it's very artificial.

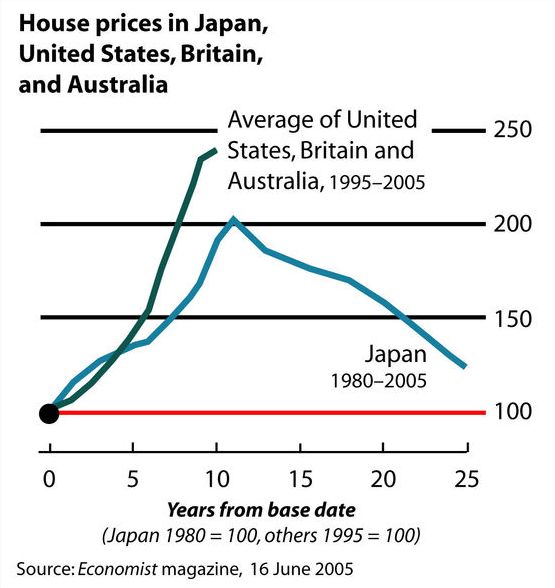

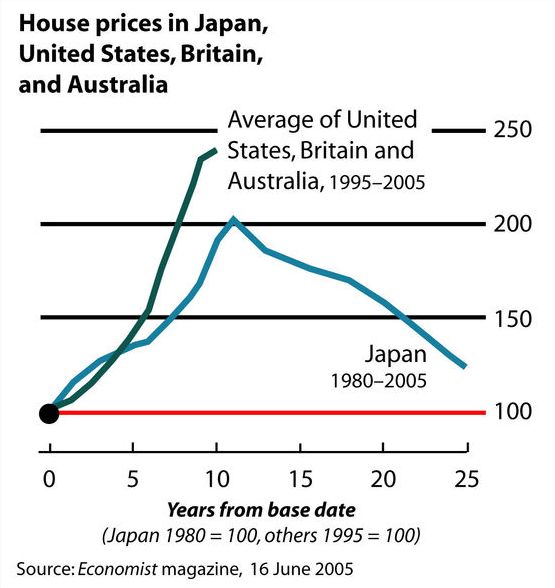

UK property might double in price over the next 25 years but it's possible to have very long bear markets in real estate after periods of credit expansion, for example Japan. Very unlikely it will happen in the UK – more favourable demographics, very strong tradition of homeownership, but I don't think steady HPI is as guaranteed as people think. 0

0 -

I doubt it.

Never changed boiler? If not then you are probably throwing away 200-300 quid a year etc etc.

Never changed the kitchen? Same cooker as 25 years ago?

>25 year old carpets.

Sounds like a lovely home.

New boiler recently £2.8k.

2 new kitchens did myself £5k.

New bathroom did myself £2k

Double glassing £4k.

New gutter and fascia boards £1.5k

New Garage roof £1.5k

allow £5k for carpets etc.

Total £21.8k

The house cost £60k but is now worth £275k obviously the later items would have cost less if there had been no inflation. .0 -

Thrugelmir wrote: »Banks have restricted funds to lend. So can afford to reduce risk by lending on sensible terms at profitable rates. Nothing exceptional in this, merely a return to the sensible lending of a couple of decades ago. However this will constrain the housing market until such time as the correction is complete and equilbrium restored.

BOE are pressing for repayment of the £185 billion advanced under the SLS by the end of 2011. So no respite in sight for shrinking mortgage lending at the moment.

Thanks for the summary. However mortgage lending contraction is irrrelevant and so is mortgage availability. Just because there are some that cannot get a mortgage it doesnt mean, they just turn off the tap one day, its hard, yea, but thats life. In the past they were generous with terms and money markets whole sale funding wise made it easy to offload onto institutional investors and insurance companies. Get on with it, and improve your own chances and (nothing personal, being general here) circumstances.

My argument initially was assuming HPI is stagnant for 25 years... this compared with NIL inflation on the rent netting off initial cost of house at the end and the fact after 25 years you have nothing while renting.Plan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0 -

Yes, use your stocks & stocks ISA allowance. It's not a guaranteed return but it's reasonable to expect you might get an average of 2.5%/year over a period as long as 25 years.

I though you were saying no HPI and no rent inflation for the purpose of the example. I don't dispute it's very artificial.

UK property might double in price over the next 25 years but it's possible to have very long bear markets in real estate after periods of credit expansion, for example Japan. Very unlikely it will happen in the UK – more favourable demographics, very strong tradition of homeownership, but I don't think steady HPI is as guaranteed as people think.

I invested in stocks and shares ISA and it Halved in value over 2 years... SO i sold up! used money in deposit on house. Not too fussed wasnt that material but... but... if I did invest more I would have lost more, I dont think 25 years was worth riding out to make back the losses. So materiality of all was just luck rather than judgement. I wouldnt make the same mistakes again but thats another story. The fact is, CASH ISA is the only 2.5% you can safely assume. That has a limit.

Investing in Stocks ISA is like asking how long a peice of string is!

I dont understand the correlation between us and japan.

Japan has no inflation, and over the same period japans property prices fell, ours increased more than 2 fold. Can you imagine property being only worth 50% of 1995's prices today... do you think that anyone couldnt actually buy a house with just raw cash?? you talking about 30k for a 3 bed house... my god ... ill have 3 please!! lolPlan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0 -

its not really fair to compare my calculation of No HPI and No CPI on rent and you to assume compounding interest over 25 years is it... im disregarding major fluctuations and fundamentals and your comparing to compounding at 2.5% which is still 0.7% below current CPI and is likely to stay that way in the short / medium term anyway!Y

I though you were saying no HPI and no rent inflation for the purpose of the example. I don't dispute it's very artificial.

Just can't win these arguments on these boards... lol

Sorry. but, its not worth my efforts, my thoughts just dont mean anything to anyone.

Just to summarise, I need to regather my roots, else I feel like im just wasting my breath!:-

who actually thinks that

1) HPI will not increase between now and 25 years time?

2) CPI will not increase between now and 25 years time?

3) ISAs will keep pace with inflation between now and 25 years time? (Just about)

To clarify, my personal opinions.

1) of course House values will be higher in 25 years time

2) of course inflation will make your £ worth less in the future than it is worth now, and means you will need annual wage increases to keep pace

3) ISA's will just about keep pace with inflation, especially with low long term interest rates and higher inflation expected.Plan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0 -

I invested in stocks and shares ISA and it Halved in value over 2 years...SO i sold up! used money in deposit on house. Not too fussed wasnt that material but... but... if I did invest more I would have lost more, I dont think 25 years was worth riding out to make back the losses.

This is an artificial example. In this example you do have 25 years to make back your losses, like a pension.IThe fact is, CASH ISA is the only 2.5% you can safely assume. That has a limit.

Not really. If you invested in fixed rate bonds of 3 year plus duration you could get 2.5% after tax. Even easier if you have a spouse that doesn't pay higher rate.I dont understand the correlation between us and japan.

Japan has no inflation, and over the same period japans property prices fell, ours increased more than 2 fold.

I thought you said in your example there was no inflation for 25 years...Can you imagine property being only worth 50% of 1995's prices today... do you think that anyone couldnt actually buy a house with just raw cash?? you talking about 30k for a 3 bed house... my god ... ill have 3 please!! lol

I doubt many Japanese home owners could imagine property dropping in value by 50% either. I didn't say the same thing will happen here, but it's a reminder that "housing prices always go up" is not necessarily true. Japan has a much larger population and is much more overcrowded than the UK. The big difference is that our population will go up a lot in the long term, theirs will go down.its not really fair to compare my calculation of No HPI and No CPI on rent and you to assume compounding interest over 25 years is it..

In Japan they've had two decades of reverse HPI and virtually no consumer price inflation and they still have compound interest...Very low interest rates yes, but they still have compound interest.

I'm not saying you're wrong that ownership is a better bet in the long term, but there are certainly a lot of variables. Obviously interest rates is the main one.0 -

If you get a 0.1% return on your savings and investments you're an idiot.

Let's assume for the purposes of the example interest rates stay the same for 25 years. You get 2.5% after tax, which is doable, especially considering you could fill your ISAs in six years.

After 25 years, you would have made £51,236.65 in interest/capital growth on your £60,000, giving you £111,236.65.

I'm sure buying is almost always better than renting in the long term, but the effects of compound interest is hardly insignificant, is it?

You need to deduct maintenance/insurance too in the buying example too – say 0.5% of the property value each year? That's £25,000.

Hang on im saying for example... no HPI for 25 years... and now your saying but there is maintenance... and even if it was 25k over 25 years, seriously do you not expect this to be peanuts in comparison to the HPI than is really achieved and the fact there is NO further payments for the rest of your life following mortgage completion, or the fact the rent will double over the same period and continue to do so to eternity (compounding the cost up continuosly)?

If you acknowledge the above two points, ill acknowledge the maintenance costs ... even thou, IMO, they are immaterial! :cool:

... even thou, IMO, they are immaterial! :cool:

I would say, some paint, a new boiler and maybe a new flat roof, along with 5k worth of flooring. IMO most of them will be done out of choice, rather than necessity.Plan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0 -

Hang on im saying for example... no HPI for 25 years... and now your saying but there is maintenance... and even if it was 25k over 25 years, seriously do you not expect this to be peanuts in comparison to the HPI than is really achieved and the fact there is NO further payments for the rest of your life following mortgage completion, or the fact the rent will double over the same period and continue to do so to eternity (compounding the cost up continuosly)?

Maybe you need to do the example again with HPI...:D

You always have to pay maintenance for a house, even when it's not going up in value, believe it or not!0 -

This is an artificial example. In this example you do have 25 years to make back your losses, like a pension.

Not really. If you invested in fixed rate bonds of 3 year plus duration you could get 2.5% after tax.

I thought you said in your example there was no inflation for 25 years...

I doubt many Japanese home owners could imagine property dropping in value by 50% either. I didn't say the same thing will happen here, but it's a reminder that "housing prices always go up" is not necessarily true. Remember Japan is much more overcrowded than the UK.

In Japan they've had two decades of reverse HPI and virtually no consumer price inflation and they still have compound interest...Very low interest rates yes, but they still have compound interest.

Pensions are locked in... and are very long term investments and carry a large degree of risk, so too do both corporate and government bonds.

I chose to ignore inflation... your 2.5% return doesnt ignore inflation, or are you assuming a 2.5% return above inflation... as CASH ISA's are not achieving anything like that... and to average out the CASH and Share isa, you would need 7.5% above inflation return on the 50% of shares /bonds or whatever... boy, you should be a fund manager, if you can achieve this, your in the wrong trade?

Granted, over the last 100 years, shares have average 7-9& growth above inflation. But you could also lose your initial investment. Plus during this time you'd still have to rent/ or buy a house

Over the last "many years" property prices have increased 3.2% I believe long term avarage, but you have to price in the fact, you dont have to rent either.

Property prices in JAPAN went wild, WILD, on a much larger scale than in the UK, and they ran out of land completely! lol The reality hit... interest rates in japan over the same period have been "nearly zero" so for the last 15 years, no interest rate shocks, if the UK goes down this road.. then straight like for like, buying v renting will still be a no brainer, although banks will continue to realign there margins to compensate further still no doubt.Plan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0 -

This is an artificial example. In this example you do have 25 years to make back your losses, like a pension.

Not really. If you invested in fixed rate bonds of 3 year plus duration you could get 2.5% after tax. Even easier if you have a spouse that doesn't pay higher rate.

I thought you said in your example there was no inflation for 25 years...

I doubt many Japanese home owners could imagine property dropping in value by 50% either. I didn't say the same thing will happen here, but it's a reminder that "housing prices always go up" is not necessarily true. Japan has a much larger population and is much more overcrowded than the UK. The big difference is that our population will go up a lot in the long term, theirs will go down.

In Japan they've had two decades of reverse HPI and virtually no consumer price inflation and they still have compound interest...Very low interest rates yes, but they still have compound interest.

I'm not saying you're wrong that ownership is a better bet in the long term, but there are certainly a lot of variables. Obviously interest rates is the main one.Maybe you need to do the example again with HPI...:D

You always have to pay maintenance for a house, even when it's not going up in value, believe it or not!

I have been in enough houses to realise you dont need to maintain lol... especially the one i brought.

knock off 20% at the end, I mean whats 20% between friends when over the last 25 years there has been 100% HPI... lolPlan

1) Get most competitive Lifetime Mortgage (Done)

2) Make healthy savings, spend wisely (Doing)

3) Ensure healthy pension fund - (Doing)

4) Ensure house is nice, suitable, safe, and located - (Done)

5) Keep everyone happy, healthy and entertained (Done, Doing, Going to do)0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards