We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Bank of England must get it right soon

Housebear51

Posts: 143 Forumite

In 2007 the Bank proclaimed that: "this is not an international financial crisis". Ouch. In August 2008 it said its "central projection" was for "broadly flat GDP over the next year or so". In fact, the economy soon shrank over 6%.

Since then, the forecasts for the recovery have consistently been too bullish. On top, the Bank said in August 2009 that inflation was "more likely to be below target in the medium term than above". Yet the cost of living has been over the 2% target in 42 out of the last 51 months.

That may be the past, but it's also crucial for the future. Our government still has to sell a shedload of its bonds – gilts – to fund the budget deficit

http://www.moneyweek.com/news-and-charts/economics/money-morning-bank-of-england-inflation-economy-03210.aspx

Since then, the forecasts for the recovery have consistently been too bullish. On top, the Bank said in August 2009 that inflation was "more likely to be below target in the medium term than above". Yet the cost of living has been over the 2% target in 42 out of the last 51 months.

That may be the past, but it's also crucial for the future. Our government still has to sell a shedload of its bonds – gilts – to fund the budget deficit

http://www.moneyweek.com/news-and-charts/economics/money-morning-bank-of-england-inflation-economy-03210.aspx

0

Comments

-

given their history, its best to ignore anything published by moneyweek0

-

it would be more apt if the article headline was

Moneyweek must get it right soon0 -

I was mildly interested until I saw it was written by funnyweek.0

-

It may be MoneyWeek but can anyone dispute this? Im not sure if its true or not. Maybe someone can say differentlyIn 2007 the Bank proclaimed that: "this is not an international financial crisis". Ouch. In August 2008 it said its "central projection" was for "broadly flat GDP over the next year or so". In fact, the economy soon shrank over 6%.

Since then, the forecasts for the recovery have consistently been too bullish. On top, the Bank said in August 2009 that inflation was "more likely to be below target in the medium term than above". Yet the cost of living has been over the 2% target in 42 out of the last 51 months0 -

Housebear51 wrote: »......

Since then, the forecasts for the recovery have consistently been too bullish. On top, the Bank said in August 2009 that inflation was "more likely to be below target in the medium term than above". Yet the cost of living has been over the 2% target in 42 out of the last 51 months.

...

Err now is only 12 months from August 2009.

We are hardly in "the medium term" yet

The headline increase, being an annual change, is as much dependent on what happened a year ago as it is on what's happening now.0 -

i really love the quality of Moneyweeks quotes...

looking through the author of this article past articles i found this peach...

By Associate Editor David Stevenson Feb 05, 2009Amazing! Just when you’ve got it into your head that this country’s property prices are still in freefall, what happens? Out comes today’s Halifax survey telling us that prices actually rose 1.9% last month compared with December 2008.

So is the great UK housing slump now over?

I don’t think so.

wrong....And this New Year bounce isn’t likely to last.

wrong again....But the real trouble for the housing market is only just beginning – soaring job losses.

The UK unemployment rate may already have been climbing for eight months, and have flipped up to 6.1%, the highest for a decade, but we’ve seen nothing yet.

From the current 1.9m, the number of jobless could easily double if history is any guide

i really love their analysis - always so detached from realityCapital Economics even sees a further 20% decline in British home values in 2009 alone.

The message is clear: don’t be fooled by today’s Halifax figures. House prices still have a long way to fall.0 -

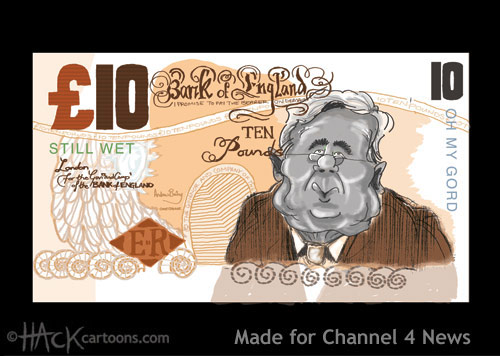

Wrong again Mervyn? Oh dear.

What's that Mervyn? You think we need divine intervention?

Choppy? Best throw more money onto the fire to tide use over then.

Nice work. Keep one for yourself Merv. Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0

Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

i really love the quality of Moneyweeks quotes...

looking through the author of this article past articles i found this peach...

By Associate Editor David Stevenson Feb 05, 2009

wrong....

wrong again....

i really love their analysis - always so detached from reality

You gotta laugh, but I do feel a tad sorry for some of the bears that were actually fooled by these publications.0 -

You gotta laugh, but I do feel a tad sorry for some of the bears that were actually fooled by these publications.

Fooled?

Ok, a few months out here and there.

But it's happening now. The tide is turning, unless anyone wants to disagree?

Anyway, the actual stuff about the BOE was interesting. Shame the focus has been taken off that and on to money week.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards