We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The bear case

macaque_2

Posts: 2,439 Forumite

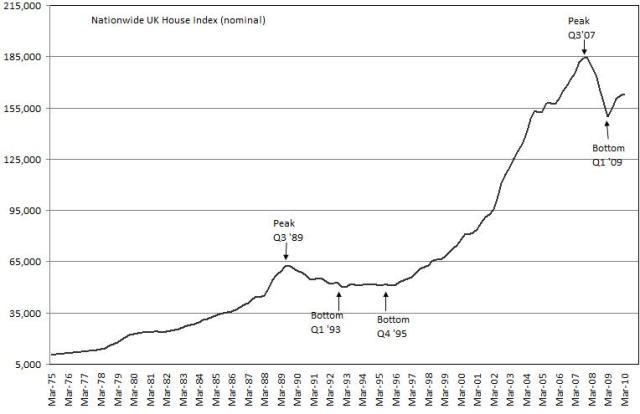

The credibility of Bears has been severely tested as predictions of sharp corrections have consistently failed to materialise. Year after year the bulls have congratulated themselves on calling the market right.

Why did the bears predict a correction? The answer is simple. An average house price of circa £200k cannot be sustained when the average salary is less than £30k. How can the UK compete in a global economy when up to 50% of young people's salaries are being siphoned off by lenders or landlords. Extrordinaly high housing costs in the UK are one aspect of our dysfunctional economy and, not surprisingly, large companies like GSK, Pfizer, Clariant, Astra Zeneca are moving many of their operations the other side of the English channel and further afield.

Why have the bulls been proved right so far? The answer is simple. The UK government has manipulated the housing market and used every lever possible to sustain bubble prices. They have opened the doors to mass immigration, turned a blind eye to reckless lending, set generous CGT terms (compared to income tax) and used hundreds of billions to create unproductive jobs in the public and private sector. We now have the highest population density in Europe and are one of the most indebted nations in the world.

In 2008 the government played its last card in the pack. They flooded the economy with tax payer's money and set lending rates to historica lows. The house price rise that came out of that is just not sustainable.

Some bulls believe in the fantasy that house prices can rise for ever. Other have accused the bears, of being stopped clocks. For their part, the bears have assumed that the economy would be run responsibly. New Labour however wilfully chose to buck the market and in doing so wrecked the economy. If the bears had got their way, house prices would have been corrected 10 years ago and we would not now have a nation mired debt, 8 million people 'economically inactive' and drastically depleted industry.

Several months ago I observed that the second leg of the crash was moving into gear. The fundamentals support this and there will be no bail out this time. As the departing governement told us, 'there is no money left'. The magnitude of this crash will be all the bigger for the delay and manipulation that has gone on over 12 years.

Why did the bears predict a correction? The answer is simple. An average house price of circa £200k cannot be sustained when the average salary is less than £30k. How can the UK compete in a global economy when up to 50% of young people's salaries are being siphoned off by lenders or landlords. Extrordinaly high housing costs in the UK are one aspect of our dysfunctional economy and, not surprisingly, large companies like GSK, Pfizer, Clariant, Astra Zeneca are moving many of their operations the other side of the English channel and further afield.

Why have the bulls been proved right so far? The answer is simple. The UK government has manipulated the housing market and used every lever possible to sustain bubble prices. They have opened the doors to mass immigration, turned a blind eye to reckless lending, set generous CGT terms (compared to income tax) and used hundreds of billions to create unproductive jobs in the public and private sector. We now have the highest population density in Europe and are one of the most indebted nations in the world.

In 2008 the government played its last card in the pack. They flooded the economy with tax payer's money and set lending rates to historica lows. The house price rise that came out of that is just not sustainable.

"The past year's house price gains lacked any solid economic foundation and the market remains overvalued. We expect values to fall back in the second half of this year as confidence fades. They will fall throughout 2011 as the impact of the fiscal policy tightening kicks in."

http://business.scotsman.com/business/Homebuyers-face-new-loans-crunch.6399211.jp?articlepage=2

Some bulls believe in the fantasy that house prices can rise for ever. Other have accused the bears, of being stopped clocks. For their part, the bears have assumed that the economy would be run responsibly. New Labour however wilfully chose to buck the market and in doing so wrecked the economy. If the bears had got their way, house prices would have been corrected 10 years ago and we would not now have a nation mired debt, 8 million people 'economically inactive' and drastically depleted industry.

Several months ago I observed that the second leg of the crash was moving into gear. The fundamentals support this and there will be no bail out this time. As the departing governement told us, 'there is no money left'. The magnitude of this crash will be all the bigger for the delay and manipulation that has gone on over 12 years.

0

Comments

-

what is this bear and bull stuff? sounds like a zooMartin has asked me to tell you I'm about to cut the cheese, pull my finger.0

-

dave4545454 wrote: »what is this bear and bull stuff? sounds like a zoo

Especially when you throw in the monkey I am sure Mr Ed will along soon. 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

I am sure Mr Ed will along soon. 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

..................................0

-

Especially when you throw in the monkey

I am sure Mr Ed will along soon.

I am sure Mr Ed will along soon.

Nah, The White Horse is usually sleeping at this time of day.;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

As a bit of a bear....

I always thought the 'bear' argument was that the differential between building and land value (ie planning rights) was to large and needed to be lowered?

Ie the only issue we have with the 'market' is the monopoly of planning.0 -

The credibility of Bears has been severely tested as predictions of sharp corrections have consistently failed to materialise. Year after year the bulls have congratulated themselves on calling the market right

As soon as someone starts to label themselves as a Bull or a Bear, and then starts to congratulate themselves whenever their attempt at predicting the unpredictable appears to be correct, one immediately has to question their credibility !!!'In nature, there are neither rewards nor punishments - there are Consequences.'0 -

A man wakes up one morning in Alaska to find a bear on his roof. So he looks in the yellow pages and sure enough, there's an ad for 'Bear Removers.' He calls the number, and the bear remover says he'll be over in 30 minutes.

The bear remover arrives, and gets out of his van. He's got a ladder, a baseball bat, a shotgun and a mean old pit bull.

'What are you going to do,' the homeowner asks?

'I'm going to put this ladder up against the roof, and then I'm going to go up there and knock the bear off the roof with this baseball bat. When the bear falls off, the pit bull is trained to grab his testicles and not let go. The bear will then be subdued enough for me to put him in the cage in the back of the van.'

He hands the shotgun to the homeowner.

'What's the shotgun for?' asks the homeowner.

'If the bear knocks me off the roof, shoot the dog.'0 -

Macaque, I like this thread. I've even thanked it.

Not because you're right, as I'll now explain, but because at least it's a step beyond the usual crashaholic level of non-debate as described here.....

http://www.propertyinvestmentproject.co.uk/blog/house-price-crash-hpc-website-mentality/The credibility of Bears has been severely tested as predictions of sharp corrections have consistently failed to materialise. Year after year the bulls have congratulated themselves on calling the market right.

Very true.

The credibility level of the bears is at an all time low, and the bulls have mostly called the market right.Why did the bears predict a correction? The answer is simple. An average house price of circa £200k cannot be sustained when the average salary is less than £30k.

And this is where it all starts falling apart for you......

This is a classic case of taking two reasonably accurate facts, and then extrapolating a completely illogical conclusion from them.

The average house price is around £168K. The average salary of actual house buyers (as opposed to all people) is more like £42K.

Now that is an income to price ratio of 4:1.

Now not even the most ardent crashaholic can claim purchasing a house at 4 times salary, which in todays market means taking on a mortgage of between 3 and 3.5 times salary, is an unreasonable thing to do.

And yet the facts show that is exactly what is happening. The CML figures show that the average FTB mortgage never crossed 3.5 times income even at peak. And average 2TB mortgages are below 3 times income.

The market fundamentals simply do not support a crash. Prices are well within the reach of actual or likely house buyers.

So what about those that are not on such a high income? Well, average FTB's do earn less than £42K a year, in fact the average FTB income is right around £30K a year. But the average FTB property is also far cheaper than the average house price. More like £120K instead of £170K. So again the ratio remains the same, and within the traditional affordability standards.How can the UK compete in a global economy when up to 50% of young people's salaries are being siphoned off by lenders or landlords. Extrordinaly high housing costs in the UK are one aspect of our dysfunctional economy and, not surprisingly, large companies like GSK, Pfizer, Clariant, Astra Zeneca are moving many of their operations the other side of the English channel and further afield.

Another 2 + 2 = 5 statement there I'm afraid.....

Companies move into and out of the UK all the time, and the cost of housing has almost nothing to do with it. Corporate tax regimes and income tax rates are the culprit with that one.

But lets examine this line of thought further..... If the bear case was correct, then the areas with the lowest housing costs should be absolute magnets for corporations and business people.

After all, if companies are willing to move to Europe, or even further afield, in search of cheaper costs for their employees, then they should certainly be willing to move a couple of hundred miles within the UK. And yet we see that the opposite is consistently the case.

The North of England has many areas where houses can be bought for 30K to 50K. And yet the exodus of business from these areas has been dramatic and overwhelming, and the unemployment in those areas has skyrocketed.

And the same thing holds true elsewhere as well. Detroit has houses available for just $10, and yet it has the lowest business occupancy rate and highest unemployment in the entire USA.Why have the bulls been proved right so far? The answer is simple. The UK government has manipulated the housing market and used every lever possible to sustain bubble prices. They have opened the doors to mass immigration, turned a blind eye to reckless lending, set generous CGT terms (compared to income tax) and used hundreds of billions to create unproductive jobs in the public and private sector. We now have the highest population density in Europe and are one of the most indebted nations in the world.

Wow...... Conflation of epic proportions.

Suffice it to say that whilst some of those things certainly help with HPI, it's not true that the government has done those things in an almighty secret conspiracy to create HPI.

House prices are where they are because of supply and demand, it is that simple and there is nothing else.

Some of the things you mention do have an impact on supply and demand, but the situation is clear...... We have a huge housing shortage, a growing population, and not enough houses.

Anything the current government does will be little more than tinkering around the edges.

Population is growing by 400,000 people a year, new households are being formed at the rate of 250,000 a year. And we are building around 100,000 houses a year.

The country is growing at the fastest pace on record. An extra million people in the last 3 years alone. And housebuilding is at the lowest level since 1924.

That, Macaque, is why the bulls have been proved right so far, and why they will continue to be proved right in the future.In 2008 the government played its last card in the pack. They flooded the economy with tax payer's money and set lending rates to historica lows. The house price rise that came out of that is just not sustainable.

To save the wider economy and the financial system..... Rising house prices are just a fringe benefit.

But more importantly, other countries did exactly the same thing, and yet their house prices fell far further and far faster, and have not recovered.

The reason for that is also clear.

UK housing vacancy rates are just 3.8%. The USA's are 11%, Spains are 16%, and Irelands a whopping 17%.

If you remove 70% of the mortgage funding from any market, prices will crash. And despite ZIRP, QE, govt interventions, happening everywhere, only the UK market with it's massive housing shortage, has recovered.

It is always all about supply and demand. There is nothing else.Some bulls believe in the fantasy that house prices can rise for ever.

We live in an inflationary monetary system.

House prices will rise as long as we continue to do so. Sure, there will be minor fluctuations with the house price cycle, but over the medium to long term prices always rise.

And of course, as long as we continue to build just one third of the houses we need, then only the top earning third of households need to be able to afford them for prices to rise.

So real terms increases are inevitable as well.Other have accused the bears, of being stopped clocks. For their part, the bears have assumed that the economy would be run responsibly. New Labour however wilfully chose to buck the market and in doing so wrecked the economy. If the bears had got their way, house prices would have been corrected 10 years ago and we would not now have a nation mired debt, 8 million people 'economically inactive' and drastically depleted industry.

Several months ago I observed that the second leg of the crash was moving into gear. The fundamentals support this and there will be no bail out this time. As the departing governement told us, 'there is no money left'. The magnitude of this crash will be all the bigger for the delay and manipulation that has gone on over 12 years.

And this is just more of the same bear delusion......

The crashaholics have got their hopes up, and assumed a crash simply must happen because it did once in the past.

They ignore the fundamentals of supply and demand, and assume that because they can't afford a house, nobody else can either.

The facts, and the markets, have destroyed that delusion, and yet a few desperate bears cling on.

Sorry, but the only bubble that will be bursting is that of the bears hopes and dreams of an almighty crash.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

I don't know why I am bothering to reply - have a moment to fill that's all. It's about other things as well Hamish - affordability, speculation, austerity being a few.HAMISH_MCTAVISH wrote: »It is always all about supply and demand. There is nothing else.

You accuse the bears of being blinkered, but seem to have your own single minded nonsense in reverse. Could the crash continue (it never stopped in some areas)? Of course it could. Might prices stay the same? Yes they might. Can they continue to outpace inflation? Hmmm.

But you have no doubt in your certainty - do you Hamish?

Good luck with that.

fwiw I think the post bubble crash was postponed - until about now would be my guess. But I won't pour out a torrent of postings expressing my certainty on a subject which is conjecture at best and nonsense at worst.

As the saying goes - check your local area.0 -

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards