We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

whats a captal and intrest mortgage

jamesey

Posts: 144 Forumite

ive been paying £415 a month for the last year and now we have our state ment i thought i would have seen roughly 5k wiped off our mortgage we have only got £2400 or so wiped of in a year,

it says on our statement 3.99%fixed repayment type capital and intrest

its was for a £56500 mortgage , its fixed for another 4 years with royal b of scotland , should i stay with this or try and move are there any better deals out there , i thought it was a full repayment , i was wrong obviously:mad:

it says on our statement 3.99%fixed repayment type capital and intrest

its was for a £56500 mortgage , its fixed for another 4 years with royal b of scotland , should i stay with this or try and move are there any better deals out there , i thought it was a full repayment , i was wrong obviously:mad:

0

Comments

-

It is a capital and interest morgage, assuming its a 25 year morgage, your calcs mean you pay it off in under 12 years ?

For most of the early years of a morgage you are only paying off interest from what i can remember its only in the last few years you pay the capital back.

If you look to change morgage lenders as its a fixed rate you will have to pay a "early release" fee which is you have another 4 years to go can add up.

If your unsure how the % of both work give your lender a call they can explain it better than i can.

Hope that helps:j mseswgwa:j0 -

You pay both interest and repayment - however in the early days you pay more interest than repayment as you have found out. £415 a month is just about £5k a year but this won't all come off your mortgage - you have to pay interest too! Over the next few years the interest you pay will reduce and you will notice your outstanding mortgage balance go down. Check out your KFI and your mortgage offer as that will outline how much you pay off each year. You have a good fixed rate but if you redeem your mortgage early you will have to pay redemption fees and then pay fees to take out a new mortgage.0

-

we have 14 yrs to run on it , like i said its a 5 yr fixed at 3.99 , ive got 4 yrs to run i thought i would have seen more paid off than that0

-

cheers , do you think i should stick at it then.:beer:You pay both interest and repayment - however in the early days you pay more interest than repayment as you have found out. £415 a month is just about £5k a year but this won't all come off your mortgage - you have to pay interest too! Over the next few years the interest you pay will reduce and you will notice your outstanding mortgage balance go down. Check out your KFI and your mortgage offer as that will outline how much you pay off each year. You have a good fixed rate but if you redeem your mortgage early you will have to pay redemption fees and then pay fees to take out a new mortgage.0 -

Try this link.

£56,500 at 3.99% over 15 years = £417.64 as a payment. This more or less matches what you have posted.

It also says that the balance at 12 months will be £53,691.67 and tells you month by month how the debt should fall after that.

So my numbers expect a £2,800 fall. You're saying there's a £2,400 fall. Did you add any fees/insurances on to the loan? Are only 11 payments showing on the statement?0 -

At £415 per month you have paid a total of £4,980 over the year - to reduce your capital owing by about £5k you would have to have an interest free mortgage. 3.99% of £56,500 is £2254 (to the nearest £)...so your interest element would be a bit below this, leaving something less than £3k to reduce your capital.

Using one of Excel's finance functions assuming debt of 56,500 an interest rate of 3.99% fixed over 15 yrs suggests montlhy repayments of about £418 per month, which ties in with what you pay.0 -

5 year fixed at 3.99% a year ago?

I have never seen a 5 year fixed at 3.99% (in the UK) until a week ago.0 -

If you dont like paying interest even at 3.99% which is cheap then overpay the mortgage every month and save yourself thousands of pounds in interest !

Check with your lender what if any overpayment limits you have with your deal and get overpaying0 -

just an update , im owing £52732 and ive just rung them and they said i can overpay 10% from july to july £5385 , ive tried the link in the previous posts above but it doesnt work , i need to know how much i can save in the long run on intreast and they also said if i for instance pay off the £5385 today they would re calculate and reduce my monthy payments i thought if it was a fixed c&i mortgage it would stay at the £416 or so a month??

ive got £15000 saved up in isas uk index type and ive got a pesonel isa aswell , the uk index has got £11600 and the personel has around 4k in it so it just over , im told i cant repay over the £5385k or ill get charged

can anyone get the link back

should i overpay and take it out of my uk index isa , as i could go down again with this goverment in , lol:mad:0 -

Hi

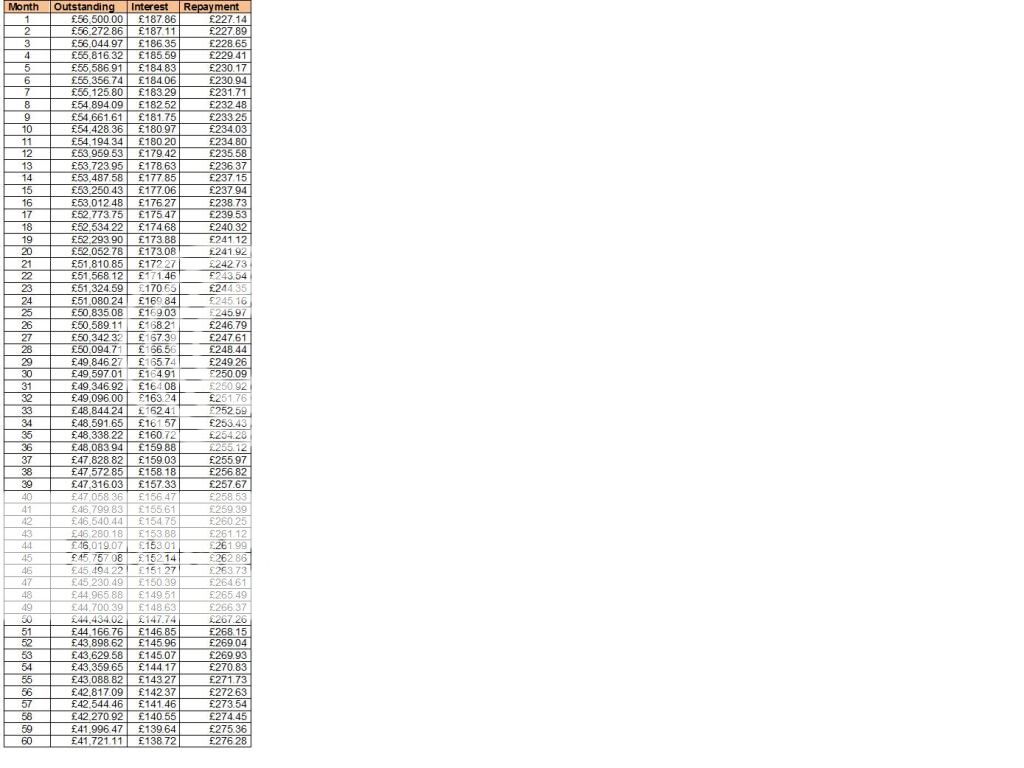

This table details the Interest/Repayment split for the five years that are fixed. It's a cracking deal and probably unbeatable. To change would cost early repayment charges. (Based on your £56,500 mortgage and £415 per month repayment, I make it 15 years and 2 months. You would need to pay £440 to make it 14 years).

Hope this helps.

GGThere are 10 types of people in this world. Those who understand binary and those that don't.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards