We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Mortgage Approvals Up 2% in April.....

HAMISH_MCTAVISH

Posts: 28,592 Forumite

The number of mortgages approved for house purchases increased to 49,871 in April from 49,008 in March, a rise of 2%, the Bank's figures showed.

Despite the pre-election jitters.....:rotfl:

And in more good news, debt continues to reduce.

Meanwhile, UK consumers paid back more than they borrowed in April, with the net level of unsecured credit falling by £136m.

:beer:

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

0

Comments

-

HAMISH_MCTAVISH wrote: »And in more good news, debt continues to reduce.Meanwhile, UK consumers paid back more than they borrowed in April, with the net level of unsecured credit falling by £136m.

Be careful what you wish for...0 -

I thought mortgage approvals used to be over 100,000 per month or something like that? So 49,000 really isn't any good.0

-

HAMISH_MCTAVISH wrote: »Despite the pre-election jitters.....:rotfl:

And in more good news, debt continues to reduce.

:

Mortgage approvals for April: 49,871 in April, up from 49,008 in March.

wow I can see why they call it a spring bounce.0 -

Dirk_Rambo wrote: »I thought mortgage approvals used to be over 100,000 per month or something like that? So 49,000 really isn't any good.

http://www.housepricecrash.co.uk/graphs-mortgage-approvals.php:cool:

0 -

what's the amount that has been lent Hamish?HAMISH_MCTAVISH wrote: »Despite the pre-election jitters.....:rotfl:

And in more good news, debt continues to reduce.

the approval numbers increasing doesn't tell us too much... except that it get's the frothers all excited and out in force trying to trash your thread 0

0 -

it don't matter 100,000 plus approvals a month can still give you house price drops.Dirk_Rambo wrote: »I thought mortgage approvals used to be over 100,000 per month or something like that? So 49,000 really isn't any good.

49,000 can still give you house price increases as it is doing...

the neutral point of mortgage approvals gives you what HPI should be - that can be anything over 40,000 to 100,000 approvals a month.0 -

863 more approved in a month where a real bounce was meant to take place?0

-

That's a shockingly low figure for April. Must be lots of cash buyers out there snapping up all the 'bargin' properties.

More evidence the house Market has come to complete halt.Debt Is Slavery.0 -

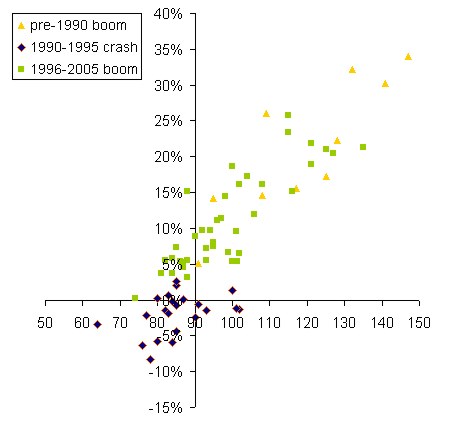

Dirk_Rambo wrote: »I thought mortgage approvals used to be over 100,000 per month or something like that? So 49,000 really isn't any good.

You're trying to compare apples and oranges. Totally different points in the housing cycle.

Mortgage approvals were as low as 69,000 at the start of the last cycle around 1995, but even that doesn't tell the whole story, as mortgage approvals in those days did not include cancellations whereas todays figures are reported net of cancellations.

Cancellations used to account for about 20% of approvals.

So at the same point in the last cycle the equivalent figure to today was around 55,000 to 60,000. Versus almost 50,000 today.

It's lower, but not all that much lower given the credit crunch and mortgage rationing.:cool:

And up significantly from the 27,000 we saw in late 2008, when prices were falling.;)“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Henry_P_Chester wrote: »That's a shockingly low figure for April. Must be lots of cash buyers out there snapping up all the 'bargin' properties.

More evidence the house Market has come to complete halt.863 more approved in a month where a real bounce was meant to take place?

you fail to understand... 49,871 approvals actually means HPI....Mortgage approvals for April: 49,871 in April, up from 49,008 in March.

wow I can see why they call it a spring bounce.

Nationwide for April plus 1.0%

Land Registry for April plus 0.2%

Halifax for April minus 0.1%

it means that it only needs 49,871 approvals ion April for house prices to increase for yet another month.

i'm sure i'll be labelled a bull for correcting and stating the facts... :eek:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards