We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

new updated SOA, please check? BR 31st March!!!

horseypony

Posts: 45 Forumite

Statement of Affairs and Personal Balance Sheet

Monthly Income Details

Monthly income after tax................ 1214

Partners monthly income after tax....... 0

Benefits................................ 1116

Other income............................ 398

Total monthly income.................... 2728

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 650

Management charge (leasehold property).. 0

Council tax............................. 160

Electricity............................. 100

Gas..................................... 90

Oil..................................... 0

Water rates............................. 40

Telephone (land line)................... 78

Mobile phone............................ 0

TV Licence.............................. 12

Satellite/Cable TV...................... 0

Internet Services....................... 20

Groceries etc. ......................... 600

Clothing................................ 150

Petrol/diesel........................... 150

Road tax................................ 20

Car Insurance........................... 35

Car maintenance (including MOT)......... 45

Car parking............................. 10

Other travel............................ 0

Childcare/nursery....................... 100

Other child related expenses............ 145

Medical (prescriptions, dentist etc).... 33

Pet insurance/vet bills................. 30

Buildings insurance..................... 0

Contents insurance...................... 27

Life assurance ......................... 36

Other insurance......................... 0

Presents (birthday, christmas etc)...... 0

Haircuts................................ 30

Entertainment........................... 0

Holiday................................. 80

Emergency fund.......................... 0

Total monthly expenses.................. 2641

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 0

Other assets............................ 0

Total Assets............................ 0

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

Total unsecured debts..........0.........0.........-

Monthly Budget Summary

Total monthly income.................... 2,728

Expenses (including HP & secured debts). 2,641

Available for debt repayments........... 87

Monthly UNsecured debt repayments....... 0

Amount left after debt repayments....... 87

Personal Balance Sheet Summary

Total assets (things you own)........... 0

Total HP & Secured debt................. -0

Total Unsecured debt.................... -0

Net Assets.............................. 0

Monthly Income Details

Monthly income after tax................ 1214

Partners monthly income after tax....... 0

Benefits................................ 1116

Other income............................ 398

Total monthly income.................... 2728

Monthly Expense Details

Mortgage................................ 0

Secured/HP loan repayments.............. 0

Rent.................................... 650

Management charge (leasehold property).. 0

Council tax............................. 160

Electricity............................. 100

Gas..................................... 90

Oil..................................... 0

Water rates............................. 40

Telephone (land line)................... 78

Mobile phone............................ 0

TV Licence.............................. 12

Satellite/Cable TV...................... 0

Internet Services....................... 20

Groceries etc. ......................... 600

Clothing................................ 150

Petrol/diesel........................... 150

Road tax................................ 20

Car Insurance........................... 35

Car maintenance (including MOT)......... 45

Car parking............................. 10

Other travel............................ 0

Childcare/nursery....................... 100

Other child related expenses............ 145

Medical (prescriptions, dentist etc).... 33

Pet insurance/vet bills................. 30

Buildings insurance..................... 0

Contents insurance...................... 27

Life assurance ......................... 36

Other insurance......................... 0

Presents (birthday, christmas etc)...... 0

Haircuts................................ 30

Entertainment........................... 0

Holiday................................. 80

Emergency fund.......................... 0

Total monthly expenses.................. 2641

Assets

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 0

Other assets............................ 0

Total Assets............................ 0

No Secured nor Hire Purchase Debts

Unsecured Debts

Description....................Debt......Monthly...APR

Total unsecured debts..........0.........0.........-

Monthly Budget Summary

Total monthly income.................... 2,728

Expenses (including HP & secured debts). 2,641

Available for debt repayments........... 87

Monthly UNsecured debt repayments....... 0

Amount left after debt repayments....... 87

Personal Balance Sheet Summary

Total assets (things you own)........... 0

Total HP & Secured debt................. -0

Total Unsecured debt.................... -0

Net Assets.............................. 0

0

Comments

-

looks ok to me, the OR might cut it a bit for instance the life assurance, but as i say you dont get if you dont askHi, im Debtinfo, i am an ex insolvency examiner and over the years have personally dealt with thousands of bankruptcy cases.

Please note that any views i put forth are not those of my former employer The Insolvency Service and do not constitute professional advice, you should always seek professional advice before entering insolvency proceedings.0 -

The Groceries etc. bit jumps out to me as bit high, but you have not included how many it is for, depending on that telephone and holidays may be in question, but witout knowing the family unit makeup, its hard for me or anyone else to comment, unless you have said elswhere and i missed it, which by debts reply i guess you may haveThats it, i am done, Blind-as-a-Bat has left the forum, for good this time, there is no way I can recover this account, as the password was random, and not recorded, and the email used no longer exits, nor can be recovered to recover the account, goodbye all ………….

0

0 -

Its difficult without seeing how many in the household. Home phone at 70 with extra internet a further 20 seems high...is it required for work ? Also extra child related expenses at a further 145 plus childcare at 100 could seem excessive maybe..

Could do with an overview of the situation to put it all in context. (sorry if I missed it in previous threads.)

Angiexx0 -

sorry 2 adults, 2 children0

-

Then the other factor is where you live DONT ANSWER THAT:eek::p

The average for Groceries etc. is £100 less, but varies to where you live, both up and down, so is only a guide, likewise for the other things mentioned.

but as debt seems happy to leave them, do so and see what happens;)Thats it, i am done, Blind-as-a-Bat has left the forum, for good this time, there is no way I can recover this account, as the password was random, and not recorded, and the email used no longer exits, nor can be recovered to recover the account, goodbye all …………. 0

0 -

I read back & guess that you have added mobiles in your main phone amount.

i`m sure the guidelines have altered recently for groceries so not sure about that figure. The extra child related expenses will likely get questioned though I think.0 -

So_Sad_Angel wrote: »I read back & guess that you have added mobiles in your main phone amount.

i`m sure the guidelines have altered recently for groceries so not sure about that figure. The extra child related expenses will likely get questioned though I think.

The link to old and new is here http://www.bankruptcyandlivingwithit.co.uk/balwifrm/viewtopic.php?f=30&t=77 but i must stress they are just guidlines, as you say, so should not be seen as a target to fit in with, every case is differant on so many factors

And a agree the 'child other' seems high, but as they now count child benefit in the IPA calculations, on the whole they seem to be allowing more, though that exceeds CB for two i think, so yo may be rightThats it, i am done, Blind-as-a-Bat has left the forum, for good this time, there is no way I can recover this account, as the password was random, and not recorded, and the email used no longer exits, nor can be recovered to recover the account, goodbye all …………. 0

0 -

blind-as-a-bat wrote: »The link to old and new is here http://www.bankruptcyandlivingwithit.co.uk/balwifrm/viewtopic.php?f=30&t=77 but i must stress they are just guidlines, as you say, so should not be seen as a target to fit in with, every case is differant on so many factors

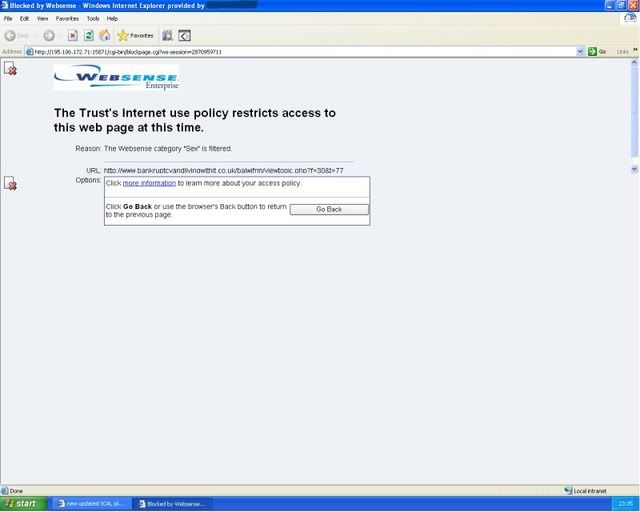

Just tried to click that link and we have websense filter in work and this is what came up!!!

What are you talking about on that forum?? :eek::rotfl::AWhatever it is - I didn't do it!:A0 -

That's spooky jaxb, worked the last twice for me:eek:!!"If wishes were horses, then beggars would ride"

0 -

Just tried to click that link and we have websense filter in work and this is what came up!!!

What are you talking about on that forum?? :eek::rotfl: I dont think anything is that bad, though i may know why, and it has nothing to do with the link, its a shared server, so who knows what the others sharing it may host:o

I dont think anything is that bad, though i may know why, and it has nothing to do with the link, its a shared server, so who knows what the others sharing it may host:o

Will have to look into it though, as thats not good, unless you find average income and expenditure as sexyThats it, i am done, Blind-as-a-Bat has left the forum, for good this time, there is no way I can recover this account, as the password was random, and not recorded, and the email used no longer exits, nor can be recovered to recover the account, goodbye all …………. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards