We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

My 6 month plan....

PROLIANT

Posts: 6,396 Forumite

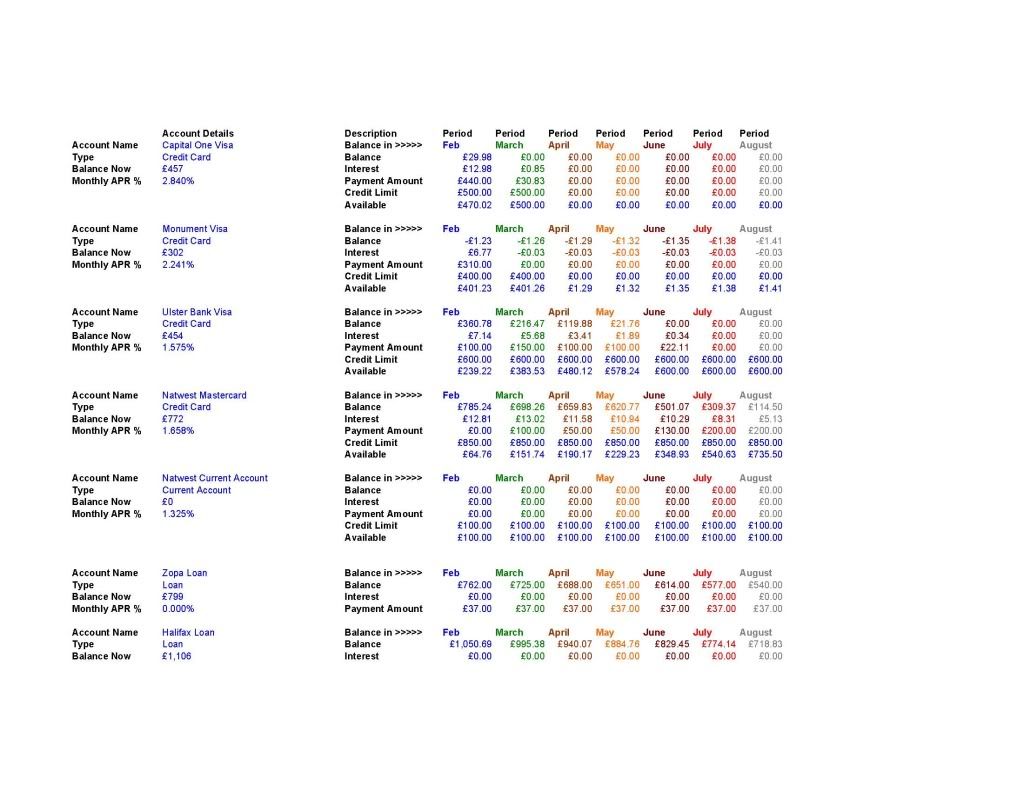

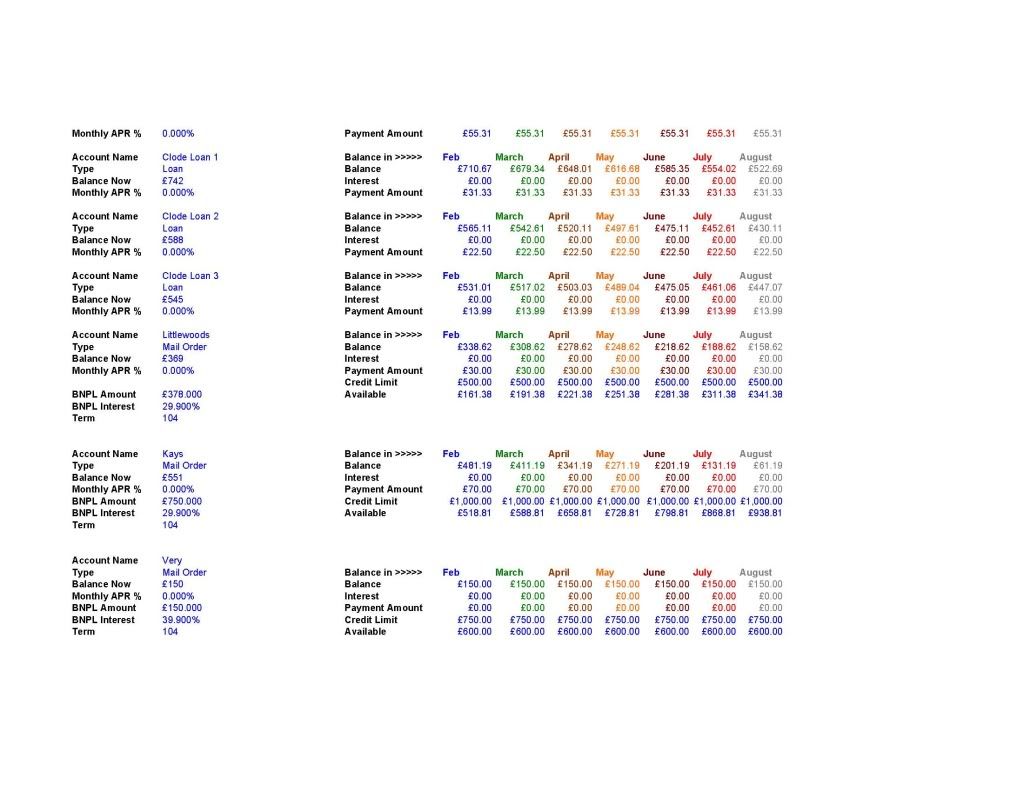

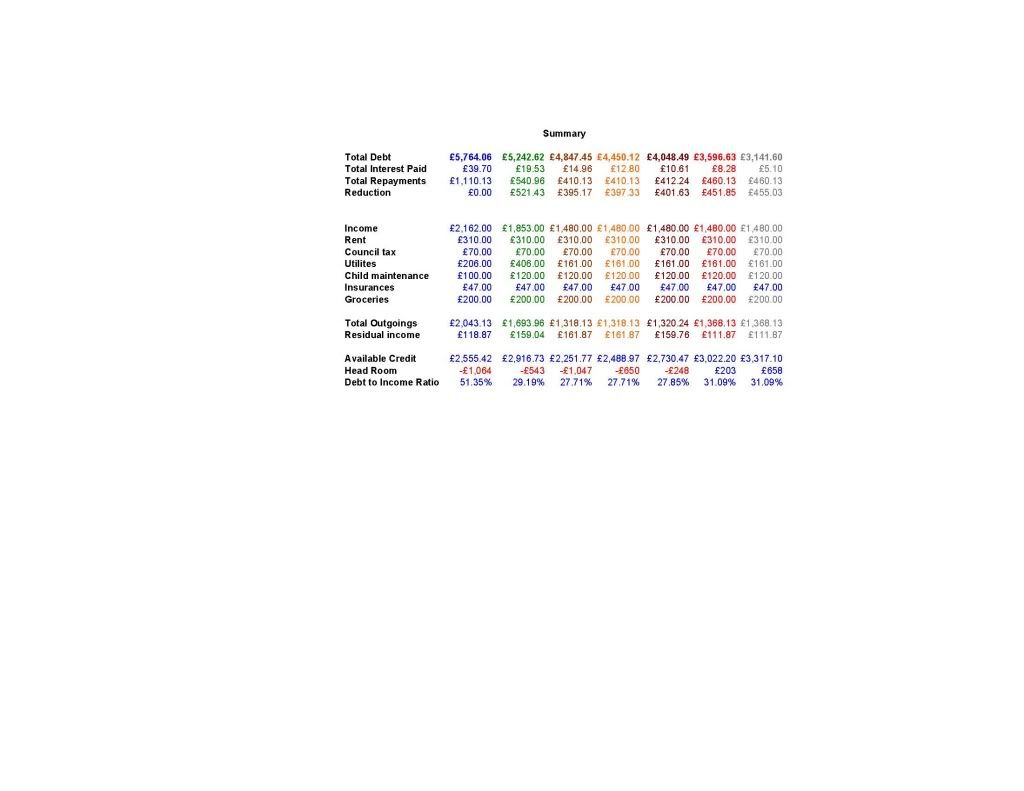

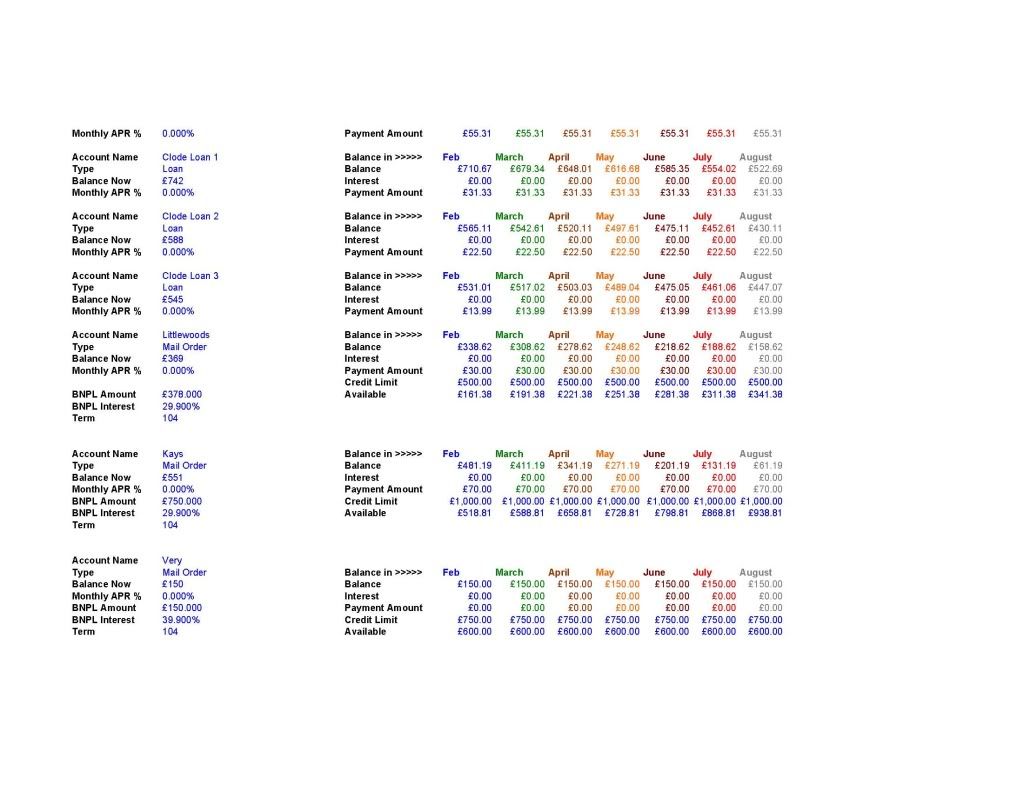

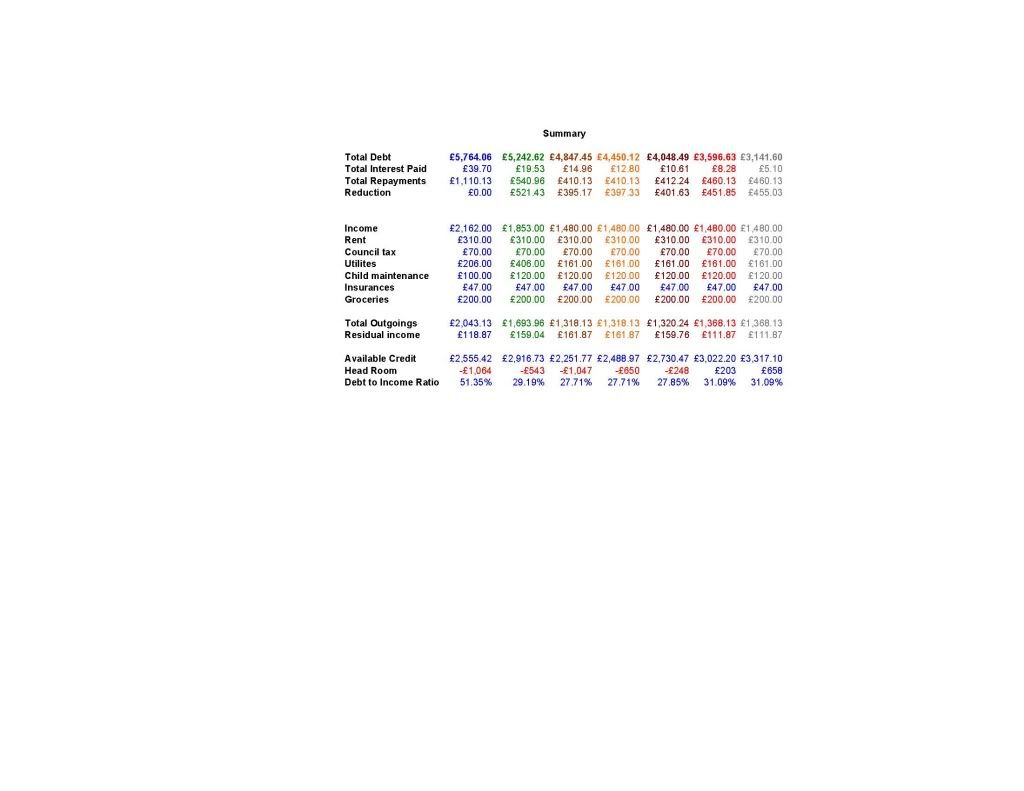

Ok, here is my plan; below is a summary from a spreadsheet I have designed for forecasting my financial situation over the next 6 months. The goal is to reduce my debt below the £5k mark by August which is when I will approach my bank for a consolidation loan which will free up circa £300 per month.

This means no more credit applications until August which is when I will begin shopping around for that loan, if any of you would like a copy of this template please PM me and I will email it to you.

This means no more credit applications until August which is when I will begin shopping around for that loan, if any of you would like a copy of this template please PM me and I will email it to you.

Since when has the world of computer software design been about what people want? This is a simple question of evolution. The day is quickly coming when every knee will bow down to a silicon fist, and you will all beg your binary gods for mercy.

0

Comments

-

thats kind of made my eyes funny i don't get the bit where the balance for the first one is £0.00 in the 2nd month but then u make a payment to clear the balance and i'm not to sure about the minus figures in the next one down but it all looks like u've sat down and done some homework. make sure u pay of the highest APR cards first is important and don't know about consilidating might be better to plug away and shift balances etc i consilidated and just ended up in 12k extra of debt - but thats just me u'll get lots of help/support here ;-)0

-

I have moved the Cap 1 and Monument to the Natwest card, the minus figures are just residual over payments. I have calculated the interest on a monthly basis and made an educated guess at the trailing interest on the Cap 1 and Monument cards so I know roughly how much it will cost when I close them.thats kind of made my eyes funny i don't get the bit where the balance for the first one is £0.00 in the 2nd month but then u make a payment to clear the balance and i'm not to sure about the minus figures in the next one down but it all looks like u've sat down and done some homework. make sure u pay of the highest APR cards first is important and don't know about consilidating might be better to plug away and shift balances etc i consilidated and just ended up in 12k extra of debt - but thats just me u'll get lots of help/support here ;-)Since when has the world of computer software design been about what people want? This is a simple question of evolution. The day is quickly coming when every knee will bow down to a silicon fist, and you will all beg your binary gods for mercy.0 -

it is good you are trying to budget, ive tried it in the snowball calculator. http://www.whatsthecost.com/snowball.aspx

Im sure some info you provided is a little off thou It will take you 8 months to pay off these debts if you snowball correctly. During that time, you'll pay £65.00 in interest.

It will take you 8 months to pay off these debts if you snowball correctly. During that time, you'll pay £65.00 in interest.

If you paid the same amount per month, but changed the order in which you paid your debts so you weren't paying the highest interest rates first, it would cost you an additional £337.00 in interest.

See the chart below for a breakdown of your monthly payments. Any months in red mean that the amount you entered as the amount you want to spend per month servicing you debt isn't enough to cover your minimum payments. In the "payments" column, any value shown in blue indicates that you're paying more than the minimum

It's important to note that while, financially, snowballing in interest order will cost you less, sometimes, emotionally, it makes more sense to pay off some the smaller debts first. That can be a great incentive when starting to deal with your debt.

What if I consolidated?

General reasons why consolidation is not always a good idea

First things first, I am not a financial expert, nor do I intend this site to give any kind of finance advice. I just give you and easy way of seeing the figures.

That said though, in my opinion, consolidation generally a bad idea. If you're in debt, it's because you spend more than you earn, and it's all too easy to get a consolidation loan, pay off your current debts, and because your monthly outlay is less, you feel you have more spending power and run up new, extra debts.

Consolidating debts into your mortgage, or another secured loan is (again, in my personal option) an even worse idea. Secured debt means that if you default on payments you'll lose your home. Not only that, but your mortgage will generally be on a much longer term, so although the interest rate may be less, in the long run you'll be paying far more.

For example, according to the figures you've just entered, you currently owe £7,963.00. If you consolidated that into your mortgage at, say 5.5% over 25 years, you'd end up paying £6,706.94 in interest. By snowballing correctly, you'd pay £65.00

Although no trees were harmed during the creation of this post, a large number of electrons were greatly inconvenienced.

Although no trees were harmed during the creation of this post, a large number of electrons were greatly inconvenienced.

There are two ways of constructing a software design: One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies0 -

that snowballing is awesome! 8 months and clear def the way ahead!0

-

Some debts have 0% interest from the sheet, i took your payments as max payments available and set all minimums at £5, so it maybe a bit more than 8 months,

Although no trees were harmed during the creation of this post, a large number of electrons were greatly inconvenienced.

Although no trees were harmed during the creation of this post, a large number of electrons were greatly inconvenienced.

There are two ways of constructing a software design: One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies0 -

Thanks for the input, I am having a toy around with this tool now. :beer:Since when has the world of computer software design been about what people want? This is a simple question of evolution. The day is quickly coming when every knee will bow down to a silicon fist, and you will all beg your binary gods for mercy.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards