We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Who's next? Spain? Italy?

Comments

-

Rochdale_Pioneers wrote: »You're believing the spin rather than the facts I see. Lets demolish a few shall we? America exited its recession earlier than we did. It also entered 6 months earlier than we did. And have you compared Britain's borrowing to that of Germany France and America? According to the OECD their debt to GDP is HIGHER than ours. But I'm sure you are right and the OECD are wrong....

OK so how much would this have changed our debt position? Lets say he didn't inflate GDP by the extra couple of percent post 05 as Labour did. So we'd be on 69% debt not 71% - happy? No? Remember that most of the deficit and the 25% of borrowing added to the total has been caused by the crash and our reaction to it. You do know that American, French and German debt increased by a similar amount due to their own response don't you? That the ECB and the Fed printed more money in their own QE programmes than we did?

But I think its your last line that is most telling. Lets assume that Howard had cut public spending. We'd have hit recession earlier (in line with Europe most likely) and with higher unemployment than we did. We wouldn't be exiting recession with substantially lower unemployment than Europe as we are now. You appear to be spinning the line that spending less in the crash was the right thing to do. Well we'll add you to that side of the argument alongside CamerOsborne, still massively outnumbered by the rest of the world. When the head of the IMF told Cameron in Davos that cutting spending would trigger a double dip recession were you listening? He was, hence the abrupt reversal in policy.

So basically your position is that the more a government spends, the better off the country is. Are you Gordon Brown?0 -

Rochdale_Pioneers wrote: »You're believing the spin rather than the facts I see. Lets demolish a few shall we? America exited its recession earlier than we did. It also entered 6 months earlier than we did. And have you compared Britain's borrowing to that of Germany France and America? According to the OECD their debt to GDP is HIGHER than ours. But I'm sure you are right and the OECD are wrong....

OK so how much would this have changed our debt position? Lets say he didn't inflate GDP by the extra couple of percent post 05 as Labour did. So we'd be on 69% debt not 71% - happy? No? Remember that most of the deficit and the 25% of borrowing added to the total has been caused by the crash and our reaction to it. You do know that American, French and German debt increased by a similar amount due to their own response don't you? That the ECB and the Fed printed more money in their own QE programmes than we did?

But I think its your last line that is most telling. Lets assume that Howard had cut public spending. We'd have hit recession earlier (in line with Europe most likely) and with higher unemployment than we did. We wouldn't be exiting recession with substantially lower unemployment than Europe as we are now. You appear to be spinning the line that spending less in the crash was the right thing to do. Well we'll add you to that side of the argument alongside CamerOsborne, still massively outnumbered by the rest of the world. When the head of the IMF told Cameron in Davos that cutting spending would trigger a double dip recession were you listening? He was, hence the abrupt reversal in policy.

I understand that 1) We along with Japan are the most indebted nation per person. 2) Our QE program per person is bigger than anything Japan did in the 80's or the US or Euro zone are doing now. 3) Growth for the 4th Quarter of 2009 was 10x higher in the US than it is here.

Its fine to borrow lots of money to keep having fun if somewhere down the line you can afford to pay it back. The problem is there is little evidence that the growth is likely to be in line with GB & AD's forecasts especially for 2011 and 2012.

So the question is how are we going to pay back all this debt that Mr B wants to keep borrowing?0 -

No more boom and bust - Economic cycles are a fact and can be caused by an external event i.e America sneezes the rest of the world catches a cold. The LAbour party thought that they had abolished boom and bust whilst borrowing loads of money during boom economic times. The Chinese avioded boom and bust because they had a trillion bucks in the piggy bank and they unleashed thier savings to help in the hard times. We had to print money to survive and had a very small fiscal stimulus a VAT cut.

The depth of the recession in he UK is Labours fault, just like the depth of the recession in America is Bush's fault. Australia never ever had a recession. France, Germany America were all out of recession earlier and faster than the UKbecause they did not borrow as much as Gordon during the good times so could aford a larger fiscal stimulus when the bad times came. German polititians are taking about tax cuts now we are facing large tax rises!

Germanys recssion was deeper than ours because we had a large financial sector and they have a large high value manufacturing sector. People still pay loans off in recessions but they do not buy Mercs.

All of the countries you mention as going bust have one thing in common large debts and big borrowings to maintain large public sector employment, wges and pensions. We are next. Browns fault.

Would it be different under Howard, yes because he would not have borrowed so much and cut back public sector spending.

Brown is and economic disaster - The worst chancellor this country has ever had.

Great post

the only thing i would say is that its a bit unfair to compare us with such a resource rich country such as Australia - we cannot compete - its impossible0 -

Rochdale_Pioneers wrote: »You're believing the spin rather than the facts I see. Lets demolish a few shall we? America exited its recession earlier than we did. It also entered 6 months earlier than we did. And have you compared Britain's borrowing to that of Germany France and America? According to the OECD their debt to GDP is HIGHER than ours. But I'm sure you are right and the OECD are wrong....

If you are going to demolish my argument you need to get your basic facts right. Germany entered recession first. Then the UK, America, France, Japan all entered at the same time. It is reported here.

http://www.thisislondon.co.uk/standard-business/article-23586250-shockwaves-as-germany-goes-into-recession.doRochdale_Pioneers wrote: »OK so how much would this have changed our debt position? Lets say he didn't inflate GDP by the extra couple of percent post 05 as Labour did. So we'd be on 69% debt not 71% - happy? No? Remember that most of the deficit and the 25% of borrowing added to the total has been caused by the crash and our reaction to it. You do know that American, French and German debt increased by a similar amount due to their own response don't you? That the ECB and the Fed printed more money in their own QE programmes than we did?

But I think its your last line that is most telling. Lets assume that Howard had cut public spending. We'd have hit recession earlier (in line with Europe most likely) and with higher unemployment than we did. We wouldn't be exiting recession with substantially lower unemployment than Europe as we are now. You appear to be spinning the line that spending less in the crash was the right thing to do. Well we'll add you to that side of the argument alongside CamerOsborne, still massively outnumbered by the rest of the world. When the head of the IMF told Cameron in Davos that cutting spending would trigger a double dip recession were you listening? He was, hence the abrupt reversal in policy.

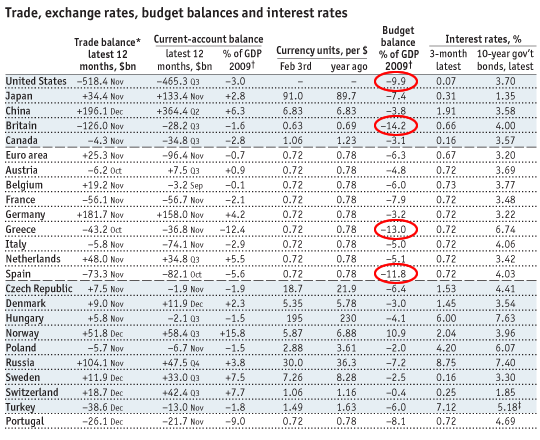

This is the scary chart the public sector deficeit is the amount of money that the respective govt has to borrow every year. As you can see Germany is abut 3.5% of GDP and they exited recession with that amount, France is 7.5%. Even though the USA is close to Gordo at 10% at least Obama got 5.7% growth. Our economic genius borrowed as a %tage, per year, more than any other country, wasted it and got .1% maybe.

Why because our annual borrowing was far too high before we even got to recession, the above countries borrowed more to stimulate thier economies we borrowed to pay public sector wages.

This is the IMF chart on discressionary fiscal stimulus to fight the recession i.e vat cuts, scrappage schemes, etc, not automatic stabalisers like social security.

http://www.imf.org/external/np/fad/2009/042609_table2.pdf

As you can see Germany total over the 3 years 3.6% of GDP, USA 4.9% and the UK 1.3% and we are the only country to withdraw fiscal stimulus to get us out of recession in 2010!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

To highlight this Germany has a strucutural deficit as a percentage of GDP is 3.5% but in 2009 1.6% of that was fiscal stimulus, so Germany is borrowing 1.9% to run the country. Gordo is borrowing 12.5% of GDP of which 1.4% is fical stimulus. Gordo is borrowing 11.1% of GDP to run the country, this is the problem. Germany is fiancially sound and can afford thier fiscal stimulus we can not we are in the basket case of financial management at a country level.

Tax revenues have decreased by abut 80billion from the boom (and I stress boom) times. This country would still be borrowing 100billion a year in normal economic times because Gordo lost control of spending before the recession hit. You say we have less unemployment during this recession because we have borrowed so much money. Gordo has only delayed unemplyment to try to get reelected.

All this talk of we had lower debt than Germany or France is missing the point. Our debt is growing at a rate that is far to high and it is not being used to stimulate the ecomomy. Gordo had lost control of this countries finances before this recession even hit and he is just making worse and worse.0 -

Forget what Brown says about not making cuts and being the party of 'investment' - as aelitaman shows, we're running out of credibility with bond investors. Who on earth will keep buying UK debt within a year or so? If Greece wasn't in the eurozone, the market would have completely ripped it to shreds by now just like Iceland.

The UK could easily be next. To restore an iota of sanity to the public finances, we must use primarily public spending cuts, not huge across the board tax increases like the insane 'tax on jobs' that Clown's proposing with his NI hikes.0 -

I like your Ring Of Fire chart. Can we conclude from it that we would now be better off if the Vikings had done a more thorough job of raiding and pillaging us and had fully imposed their civilised Scandinavian lifestyle on the f.eckless, spendaholic Dark Age Britons?They are an EYESORES!!!!0

-

RochdalePioneers will be along in a minute to assure us that there really is nothing to be concerned about.0

-

-

Rochdale_Pioneers wrote: »Hardly. Where have i said there is nothing to worry about?

Well there was this from last June.Rochdale_Pioneers wrote: »There is nothing to worry about0 -

Rochdale_Pioneers wrote: »Hardly. Where have i said there is nothing to worry about?

Sorry if I've misunderstood you. So you do actually agree that we have a major debt crisis on our hands?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245K Work, Benefits & Business

- 600.6K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards