We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

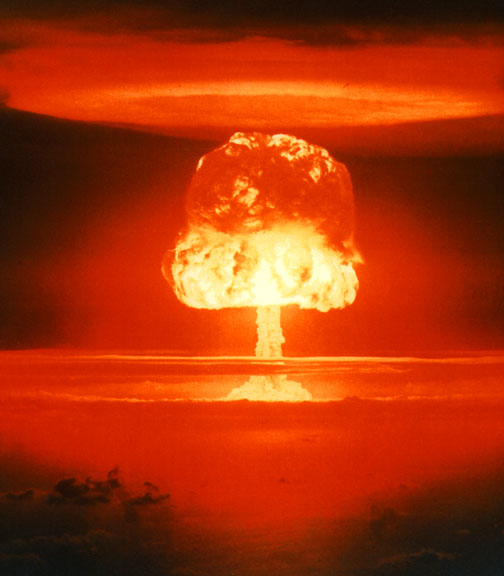

Britain facing another financial crisis !

Comments

-

It it a big stimulus because the government is so massive in the money market and it is lending money out at a lower cost then it costs to acquire it.low interest rates are a background stimulus, one small aspect of (hopefully) many to 'help the cause'. There seems to be a few posters that think that lowering interest rates has create a sizemic shift in the economic and cultural landscape.

When the opposite happens and the government requires more money then it deserves the effects will be felt by all taxpayers, till then its a tailwind in the money supply I think

I think my guess of low rates working would be if it were similar to a paymaster gaving an extra third to his employees pay packet for the first six months of the year. Second half of the year he instead deducts one third from the pay plus interest taken as well.

The difference between the two becomes massive and the jolt is a problem in itself

In theory the employee should be rich still from the first half but in practice the retraction in their cashflow might well bankrupt them as most will spend whatever they had spare0 -

It sounds very similar to the plan Lehman Brothers had to sell toxic assets to a spin off company ("Spinco"). Didn't really work for them. http://www.bloomberg.com/apps/news?pid=20601087&sid=aQjsXBJ4uN1Y0

-

How much longer can we keep on borrowing and spending other nations money?

Until they stop lending it to us.

That'll be when they no longer need us to provide jobs for their populace and buy the cr*p that they produce.'In nature, there are neither rewards nor punishments - there are Consequences.'0 -

Must be all those ALT-A reset thingys

tICK tICK tICK...........'In nature, there are neither rewards nor punishments - there are Consequences.'0 -

Then what?Until they stop lending it to us.

That'll be when they no longer need us to provide jobs for their populace and buy the cr*p that they produce.

Do they own us by then, does China take over the financial world? Does China fall into a massive recession as no one is buying the stuff they make anymore, do they have enough money to buy their own stuff (I don't think they will in large enough quantities, they have more sense than us).

Do we rise again... what as, not as a manufacturing base, what then? Financial wizz kids centre of the world.

I really don't see what is going to happen.Freedom is not worth having if it does not include the freedom to make mistakes.0 -

Can you give any links to examples of all the things that the banks are yet to declare?

I always thought that low interest rates are a background stimulus, one small aspect of (hopefully) many to 'help the cause'. There seems to be a few posters that think that lowering interest rates has create a sizemic shift in the economic and cultural landscape. I don't really see this. I understand that in a vague way it encourages public borrowing and spending, but I don't see it having a huge impact. I also understand that lowering interest rates increases assets such as shares and houses to some extent, but I think the recent rise in equities is as much down to a number of other factors as it is to low interest rates.

Lastly, and this is just an observation, it's interesting how some can see lowering interest rates as an important step to stablising and increasing economic output in the country, whilst others see it as just a delaying tactic before everything comes crashing down. I see it as the former.

Not something for the banks to declare as such, but my feeling is (& this is obviously affected by what I see in my work) is that the personal debt issue has to hit home yet. My feeling is it has been delayed by a few issues. Many who lost jobs will be covered by insurance for a year (12 month delay), political pressure on lenders to repossess as a last resort only, half baked schemes to stave off mortgage repossessions (will not work - so few people qualify).

Simply, too many individuals owe an unsustainable debt gained through easy access to credit. Up to 12 months ago it was "serviced" by accessing other credit sources, balance transfers etc. That's gonna have to stop now as credit is more expensive. In addition, people have borrowed above & beyond their income, so can't afford their current debts.

The majority of the population are really stretched, what with fuel prices, transport costs and all their other essential expenditure.

IR will remain low IMO to support both the government clearing their debt, but also to allow joe public to clear their debt. If IR's rise, the bankruptcy figures will rise dramatically.

My worry is that over the next 12 months, with increasing unemployment, PPI plans ending, household costs rising, then the personal debt issue will become a pressure on the finance industry.

It won't be on the scale of last year, and may not be as dramatic. However it will significantly affect thousands of people in the country, for the worse.

IF, we're recovering, the above may severely limit the speed of the recovery.It's getting harder & harder to keep the government in the manner to which they have become accustomed.0 -

Rather gloomy outlook.UK banks yet to face £130bn in credit crisis losses

With already severely battered balance sheets, UK financial institutions have billions more to face in losses in connection with the credit crisis and global economic downturn.

This is the claim made by Moody’s Investor Services in its latest Banking System Outlook on the UK.

The credit rating agency is predicting that losses will reach £240 billion in the next 12 to 18 months, more than double the £110 billion written down by the end of 2008.

The additional £130 billion will result from a weak UK economy feeding through to “higher loan arrears with ensuing pressure on profitability and capital”.

In such a scenario, the impact on the UK property market would be severe, with Moody’s anticipating a 40% peak-to-trough fall in house prices and a 60% drop in commercial property values.

The agency says the Bank Financial Strength Rating of UK banks now stands at C-, having slipped from B over the past 12 months.

The firm concludes that UK banks will continue to face many challenges over the next couple of years, as they work their way through the problems on their balance sheets.

http://www.bankingtimes.co.uk/15092009-uk-banks-yet-to-face-130bn-in-credit-crisis-losses/DOW JONES NEWSWIRES

Moody's Investors Service said its fundamental credit outlook for the U.K. banking system remains negative because of the weak economy and its likely effect on banks' financial performance.

The outlook represents the rating agency's view of credit conditions in the sector during the next 12 to 18 months, not whether ratings will be upgraded or downgraded. In fact, Moody's said it does not expect a large number of downgrades in the next 12 to 18 months.

One reason for ratings stability in the sector has been support from the government, which has provided large capital injections, credit guarantees and support for depositors, said analyst Elisabeth Rudman.

If European Union requirements lead to significant changes in the franchises of large banks that have received state aid, Moody's said it would change ratings of individual banks.

The credit rater expects U.K. banks to see higher loan defaults, which would require bigger loan loss provisions and more capital.

Rudman estimated that U.K. banks have lost about GBP110 billion ($183 billion) on loans and securities since the start of the global financial crisis in 2007 and had raised or arranged for about GBP120 in new capital by the middle of this year. Moody's estimates the sector will lose another GBP130 billion from loans and securities portfolios.

http://online.wsj.com/article/BT-CO-20090914-702381.html0 -

Thrugelmir wrote: »Rather gloomy outlook.

Are these the same guys who triple A rated the offending financial instruments:eek:'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

It's the elephant in the room.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards