We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

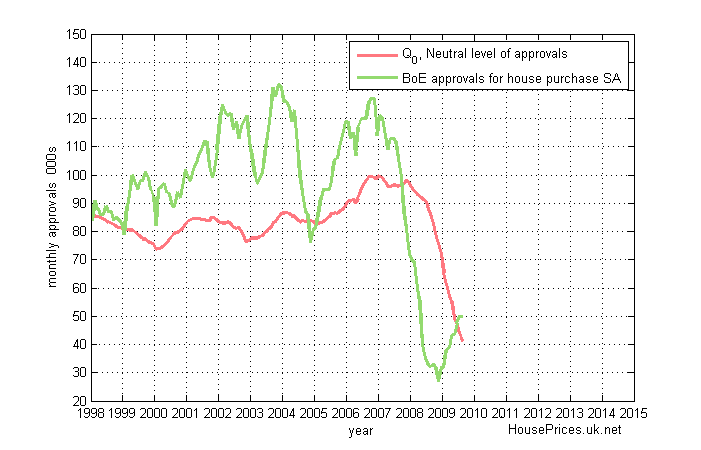

BBA mortgage approvals up to 38.2K from 35.2K

Comments

-

Thrugelmir wrote: »Fewer people have taken foreign holidays this summer. This could be giving the UK economy a boost while aiding savings.

Close friends are saving in general. Expectations of job losses, higher taxes etc are making people more wary. There is a real unkown haning over us all at the moment.

we can't deny that there is an unknown future but these fgures are positive (some may say unfortunately).

the number of new mortgages for house purchases is at it's highest point since Feb 2008.

the last few months have left a few bearish people in a bit of shock...

what will they be saying when it as high as 2007? :rolleyes:

until unsecured borrowing starts to increase peoples general lending appetite will not return... this will be reflected in the expectations of job losses, higher taxes etc starting to disappear...0 -

we can't deny that there is an unknown future but these fgures are positive (some may say unfortunately).

the number of new mortgages for house purchases is at it's highest point since Feb 2008.

the last few months have left a few bearish people in a bit of shock...

what will they be saying when it as high as 2007? :rolleyes:

until unsecured borrowing starts to increase peoples general lending appetite will not return... this will be reflected in the expectations of job losses, higher taxes etc starting to disappear...

Remember NR lent up until February 2008. Only as the main lenders such as HSBC, and more latterly NR itself, have made more money available has the approvals market picked up.

The main lenders still have money available. So approvals could pick up further. The real determing factor is confidence. It wouldn't take much to undermine the fragile confidence there is.

Most people only buy one house. So there is a demand factor that wil slowly come into play. FTB's were kept of the market in recent years. So are now buying but there will still be a price threshold for some.0 -

Thrugelmir wrote: »Remember NR lent up until February 2008. Only as the main lenders such as HSBC, and more latterly NR itself, have made more money available has the approvals market picked up.

NR at their peak (only) had 8% of the mortgage market, i doubt that the new lending they have taken out is remotely near this. Lloyds, HBOS and Natwest will soon have a bigger impact on the mortgage market. the government controlling state will force this to happen unless Lloyds look at the rights issue optionThrugelmir wrote: »The main lenders still have money available. So approvals could pick up further. The real determing factor is confidence. It wouldn't take much to undermine the fragile confidence there is.

Most people only buy one house. So there is a demand factor that wil slowly come into play. FTB's were kept of the market in recent years. So are now buying but there will still be a price threshold for some.

confidence is key for any improvement in mortgage lending and even house prices...

new mortgage approvals apparently make up 5% of house purchases, we're probably around the 3% level now...0 -

NR at their peak (only) had 8% of the mortgage market, i doubt that the new lending they have taken out is remotely near this. Lloyds, HBOS and Natwest will soon have a bigger impact on the mortgage market. the government controlling state will force this to happen unless Lloyds look at the rights issue option

confidence is key for any improvement in mortgage lending and even house prices...

new mortgage approvals apparently make up 5% of house purchases, we're probably around the 3% level now...

NR had 14.5% market share in the second half of 2006 and 18.9% in the first half of 2007.

http://news.bbc.co.uk/1/hi/business/6994099.stm

The impact of Northern Rocks lending policies on the mortgage market can't be underestimated.

I doubt that HBOS itself is in a good position to lend. Lloyds will use its dominance to rebalance the group mortgage book, and lend on sensible criteria.

The problem for both RBS and LloydsHBOS is the lack of wholesale funding. And I'm not talking about a couple of billion either. They both have massive holes in their balance sheets that need to filled by either more deposits, repayment of capital from existing borrowers or net reduction in lending.

Both RBS and Lloyds have issues to resolve with the EEC. Which may hurt those wishing to borrow. If the EEC decides that shareholders must share the pain further. This cost will be passed on.0 -

Thrugelmir wrote: »NR had 14.5% market share in the second half of 2006 and 18.9% in the first half of 2007.

http://news.bbc.co.uk/1/hi/business/6994099.stm

The impact of Northern Rocks lending policies on the mortgage market can't be underestimated.

it looks like that there mortgage share may vary... but if we're seeing HBOS as 20%, we have to take NR as the same way to show market share. we can't look at net lending :rolleyes:

Share of UK gross mortgage lending of 8.3%, with share of redemptions of 5.9% - generating a net market share of 13.4%. Closing share of stock of UK mortgages of 7.1%.

http://companyinfo.northernrock.co.uk/investorRelations/results/stockEx070124.asp

Northern Rock said that in the first 5 months of 2007 their share of UK gross mortgage lending was around 10%, up from 8.3% in the whole of 2006. However their share of net lending was a phenomenal 19%, compared with last year’s 13.4%, itself an excellent figure, bearing in mind that Northern Rock’s share of UK mortgage assets at the end of 2006 was 7.1%.

http://www.charcol.co.uk/knowledge-resources/ray-boulgers-blog/article/view/city-gets-northern-rock-wrong/509/0 -

it looks like that there mortgage share may vary... but if we're seeing HBOS as 20%, we have to take NR as the same way to show market share. we can't look at net lending :rolleyes:

http://companyinfo.northernrock.co.uk/investorRelations/results/stockEx070124.asp

http://www.charcol.co.uk/knowledge-resources/ray-boulgers-blog/article/view/city-gets-northern-rock-wrong/509/

What this shows is how much NR was driving for new business. Interest only mortgages bundled up and securitised through Granite.

The lenders that remain. Such as Lloyds , Barclays and HSBC. Lent on more traditional risk models. Capital repayment being one.

HBOS problems relate to its self certified income model. Which will take Lloyds a few years to unravel. Question marks must hang over the level of bad debt and fraud in their mortgage book.

The lack of securitisation is why net lending is now so low. The securitised i/o mortgage market has gone forever. We are heading back to pre 1999 days I suspect. A more normal credit rationed market. The NR securitised book stood at £127 billion after 8 years in 2007, and NR still now has £90 billion of assets on its books. So thats say £210 billion of debt still outstanding. This still over 16% of total outstanding mortgage debt.0 -

Testing. Just want to see if you babies have got me ppr'd yet?

edit: oh no. apparently not.0 -

Thrugelmir wrote: »With net lending at its lowest for 9 years. This bull market may be running out of steam.

Enjoy the news.

With rising unemployment you would not expect people to be paying of debts.

Consumers also continued to boost their savings levels, depositing £2.5bn in July, the second highest figure this year.

Pretty impressive for these economic times0 -

-

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards